The Bitcoin Landscape: ETF Narrative Still Underpins The Market

Blackrock’s filing for a Bitcoin ETF has been on the market’s plate for some time now. Furthermore, Ripple’s surprising favourable legal outcome provided a bit of a boost. However, Bitcoin’s struggle to solidify its stance above the 30k mark is rather noticeable.

Curiously, investors might be disregarding the value Bitcoin offers when compared to stellar stocks like Coinbase and Microstrategy, which have outperformed Bitcoin significantly over the recent weeks. This could imply that these stocks have soared too high or that traditional finance is simply seeking crypto exposure following the ETF filings, with stocks being the easiest route.

The SEC’s first deadline for a Bitcoin ETF, specifically the 21 Shares/ARK application, is fast approaching on August 13. As this date draws nearer, we could see a growing anticipation, even though this deadline doesn’t guarantee final approval.

From a psychological perspective, those who managed to get in below the 20k mark and hoped for a 30k exit have likely cashed in already. This suggests the majority who missed this window are waiting for a market dip to re-enter. The discomfort seems to persist and dips into the 30k region have been getting bought.

Looking at Bitcoin’s cycle, it appears to have bottomed below the 20k level, with a surge expected in the second half of the year. This is especially considering upcoming market drivers like spot ETF news and halving, with the Federal Reserve playing a less prominent role as the tightening cycle comes to a close.

Finally, in the larger economic picture, a weaker CPI report than expected last week paved the way for all risk assets to continue their upward trend.

The macroeconomic agenda remains rather calm until the next FOMC decision on July 27. Considering a 25bp rate hike has already been factored in, we don’t foresee any major economic events causing market shifts until at least mid-to-late August.

Realised Volatility in Crypto: A Week of Surprises

Last week, the crypto world saw an increase in realised volatility, particularly due to news about XRP, which sparked sharp increases, especially in Ethereum (ETH), up by 7% in a day. However, Ethereum handed back those gains the next day, serving as a reminder that Ethereum can indeed fluctuate significantly when circumstances dictate.

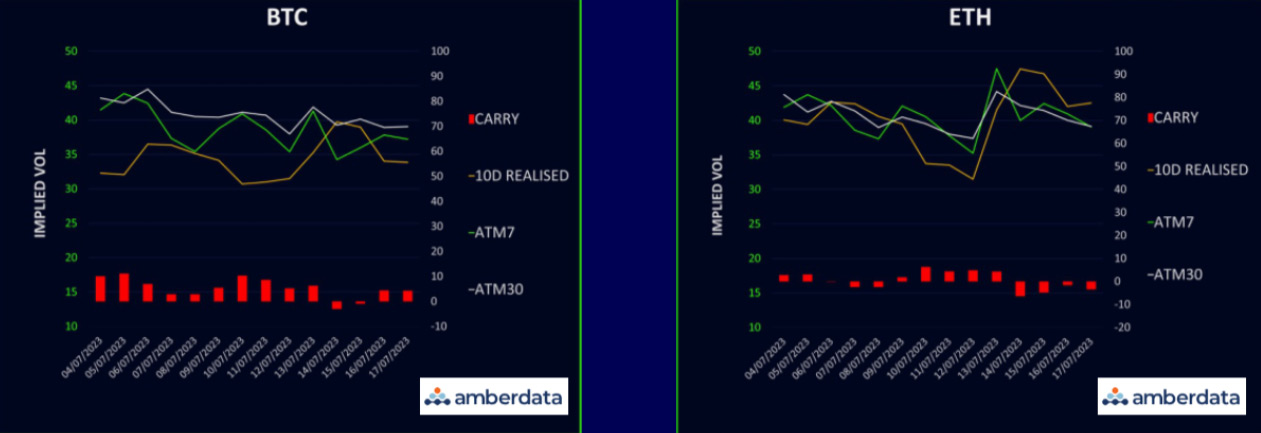

As expected, short-term implied volatilities experienced a spike, more so for Ethereum, but they have started to subside since. Currently, we’re seeing a positive carry of around 4 vols in Bitcoin, and a negative carry of about the same amount in Ethereum, with the 1-month implied trade level for both is hovering around 39 vol.

The crypto market’s performance has been rather underwhelming, given the positive news that has been circulating, which might cause investors to feel uneasy in the short term. Trading activity has largely been on the optimistic side, but if BTC dips below 30k support levels, it might inspire the purchase of puts due to the low volatility rates.

Term Structure Moves

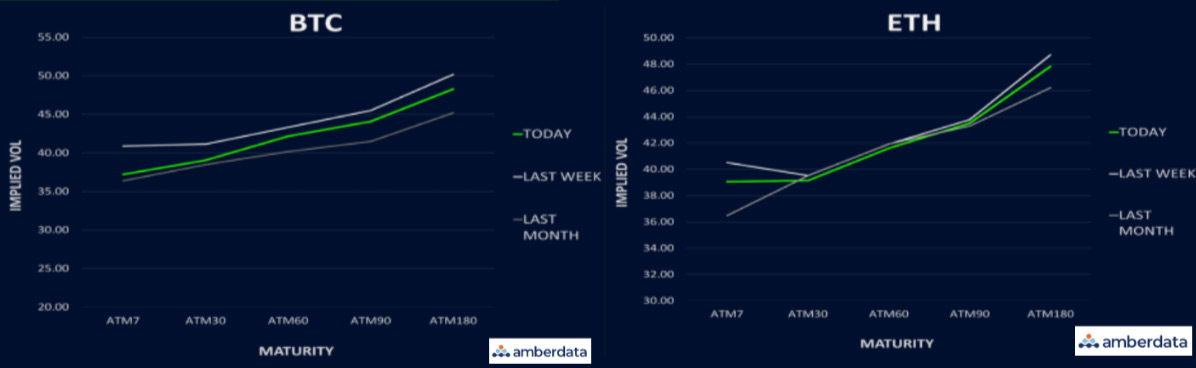

The term structure of Bitcoin (BTC) is tilting downwards, particularly at the front end, leading to a steeper contango condition. This shift is propelled by the low realised volatility pushing the front of the curve down, while purchasing of longer-term upside keeps the curve steep.

On the other hand, Ethereum's (ETH) term structure remains quite steady for August and longer expiries, only dropping by a minor 0.2-0.3 vols. The front-end (gamma dominant) is being offered at a discount by 2-3 vols as movements have been mean-reverting whilst the back end remains robust due to the influx of call buying.

Relative Value: Ethereum’s Possible Resurgence

The volatility spread between Ethereum (ETH) and Bitcoin (BTC) is on the rise, as realised volatility spiked to nearly 9 vols higher for Ethereum, pulling the front-end implied along with it. The spread exceeded 5 vols in the weeklies, but has since receded to around 2 vols.

The remainder of the curve continues to be relatively flat to mildly negative, reflecting the enduring influence of Bitcoin dominance, which will take a while to diminish. This week offered us a small peek at what a resurgence in Ethereum might look like, demonstrating how quickly the spread can adjust. It serves as a reminder that buying into the longer-term vega spread, which is predicated on Ethereum volatility, still makes sense.

Skew: BTC Call Premium Across The Curve Intact

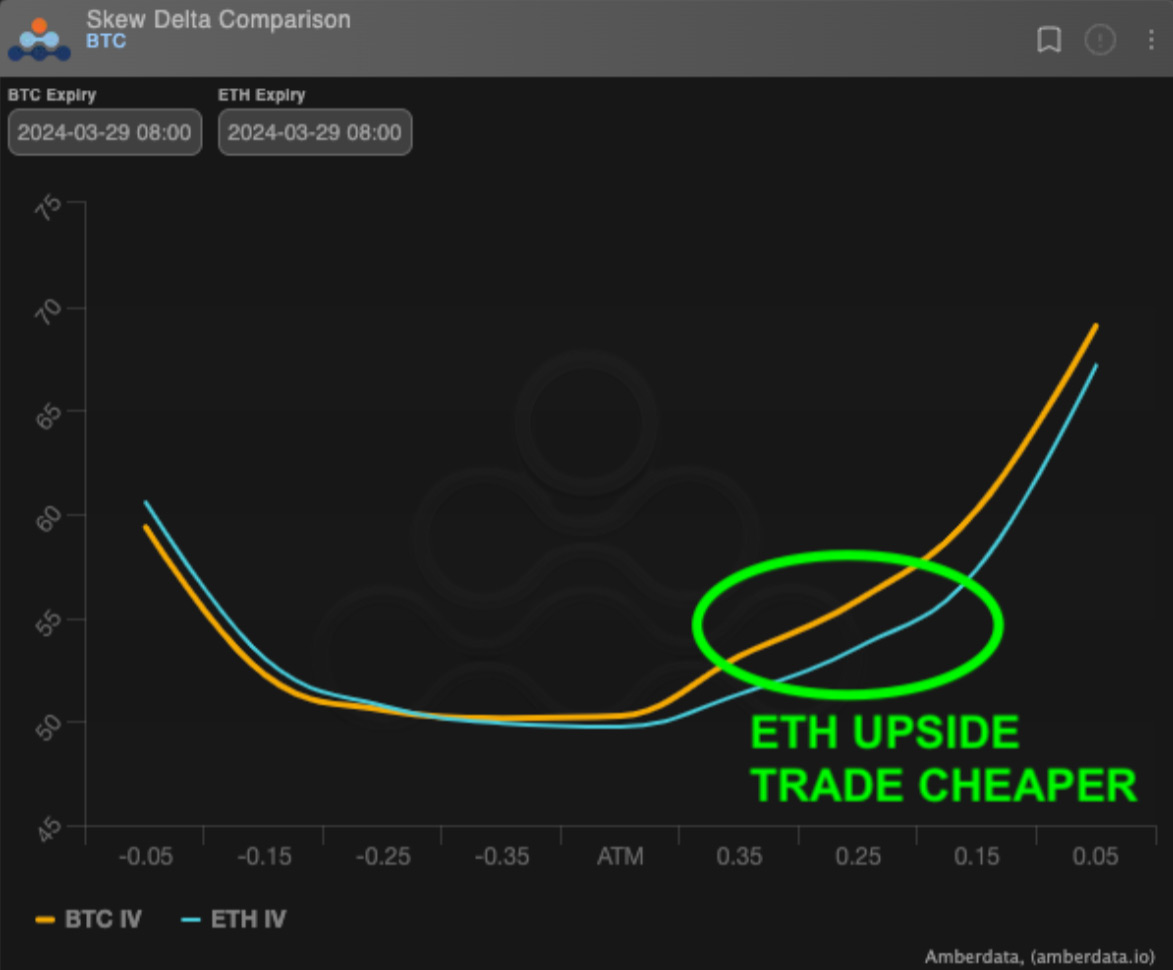

Bitcoin’s (BTC) skew maintains a call premium across the curve, increasing with the length of maturity. The weekly skew sits at 1 vol, compared to the 6-month skew at 4 vols for calls. Following last week’s spot price spike, the curve was briefly flat at around 4 vols, but the front-end quickly dropped as the spot price retraced its gains.

On the other hand, Ethereum’s (ETH) skew exhibited quite a bit of fluctuation last week. Initial surges triggered by XRP news pushed the weekly ETH skew to 7.5 vols for calls, with the back-end similar to Bitcoin at around a 4 vol call premium. However, once the spot movement mean-reverted, the call skew took a nosedive. Now, the curve is level out to 3 months and only in a 2 vol call premium for the 6-month and longer periods.

If Ethereum’s spot price doesn’t remain stagnant and lag behind Bitcoin’s rallies, we might witness the longer-dated skew gradually rise to align with Bitcoin.

Option Flows And Dealer Gamma Positioning

Bitcoin options volumes found a steady footing last week. Bullish risk reversals were purchased for both July and September as the skew neared neutrality with Bitcoin’s approach to the 30k mark. Call buyers were consistently active at the 32k strike for all maturities extending to September.

Meanwhile, Ethereum options volume witnessed a significant surge (up by 50%) as the Ripple court ruling initiated a short squeeze, causing liquidations of short call positions. During the rally, it seems overwriters were caught out, covering approximately $300k worth of vega.

Bitcoin dealer gamma positioning is gradually rising as the spot price moves towards the 30k mark, moving away from the significant short strike at 31k. There could still be a forceful upward movement through 31k if a suitable catalyst presents itself by the end of the month. Dealers appear to be locally long at 30k.

As for Ethereum, its gamma positioning ended the week balanced after a couple of instances in negative territory when we experienced a spike up to 2000 on spot. There’s a decent amount of gamma accumulating at 1900 in July and September, and it’ll be interesting to observe if this has the potential to pin or stabilise the market. So far, it hasn’t demonstrated the strength to hold the market, as we’ve seen better realised volatility since the June expiry rolled off.

Strategy Compass: Where Does The Opportunity Lie?

With the theme of BTC dominance subsiding there may be scope for some ETH outperformance, especially as traders take advantage of the cheaper long term vols on the upside. Bullish risk reversals in 6-month or longer maturities look attractive relative to BTC still, especially for those who might be underweight ETH due to the poor price action earlier this year.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)