Emerging ETF-Led Narrative in Ethereum

The most recent standout event in cryptos has been ETH’s impressive performance, spurred by BlackRock, the largest asset manager globally, applying for a spot ETF with the SEC.

The preference for ETH over BTC has been evident in the ETH/BTC chart. At this juncture, the emerging narrative of a possible ETH spot ETF could significantly boost crypto prices into year’s end.

Technically, BTC is facing strong resistance at 38k following its steady climb, while ETH has also found it a struggle to overcome the hurdle at 2.1k.

While the latest soft US CPI has resulted in a major bid for risk-on assets, which has hurt the two largest assets in crypto, further retracements are likely well supported, primarily by expectations that the SEC might approve multiple spot BTC ETFs simultaneously.

Bloomberg Intelligence ETF analyst James Seyffart notes a deadline of Nov 17 for approving all 12 spot BTC ETF applications, with a 90% chance of at least one approval by Jan 10. This high probability is likely fuelling renewed institutional interest.

Remarkably, last week, CME surpassed Binance in Bitcoin futures open interest, and digital asset investment products recorded inflows of US$293m, bringing the seven-week total to over US$1bn.

BTC’s outlook is further bolstered by the fact that over 80% of Bitcoin addresses are currently profitable, as per Glassnode. This minimizes the likelihood of widespread selling on the first correction.

Additionally, the upcoming fourth halving event historically leads to substantial returns. Glassnode’s analysis indicates a low ‘available supply’ and a ‘supply storage’ rate that is 2.4 times higher than the current issuance rate, presenting a very optimistic scenario for the market.

Implied Vol Elevated As Moves Get Bigger

Bitcoin’s realized volatility rebounded into the 40% range as its spot price tested but failed to sustain the 38k level. Throughout the week, carry remained positive, with implied volatilities staying above 50%, as there was less enthusiasm from gamma sellers.

Ethereum experienced a significant increase in realized volatility, surging 12% in a single day following the news of BlackRock’s ETF filing, pushing its 10-day realized volatility towards 60%. Short-term implied volatility for Ethereum rose by 10 vol points, mirroring the heightened realized vol. The volatility carry is close to neutral, considering the substantial spot move in the realized volatility. If Ethereum breaks through the 2150 resistance level, it could trigger a much larger rally, potentially keeping gamma sellers cautious.

Call overwriting against core long positions in Ethereum during its first test of major resistance was an obvious choice, especially with the spike in volatility. With a reduction in systematic supply, future volatility levels are expected to more accurately reflect market movements, contrasting with Ethereum’s typically undervalued volatility for most of 2023.

A Rising ETH’s Term Structure

Bitcoin’s term structure showed flattening over the week. The front-end rose slightly due to increased GAMMA buying when testing the 38k resistance level. VEGA was more actively sold from December 2023, with January 2024 experiencing the most significant drop, around 3 vol points. The front-end might face challenges in maintaining these levels unless realized volatility increases again soon.

Ethereum’s term structure is rising, primarily driven by the front end. The November 2023 expiries saw a 7 vol point increase, correlating with a spike in realized volatility on a 12% upswing day. The rest of the curve also ascended in a time-weighted manner, with the back-end rising by 2 points. Ethereum’s volatility is becoming more prominent as the ETF narrative shifts the focus.

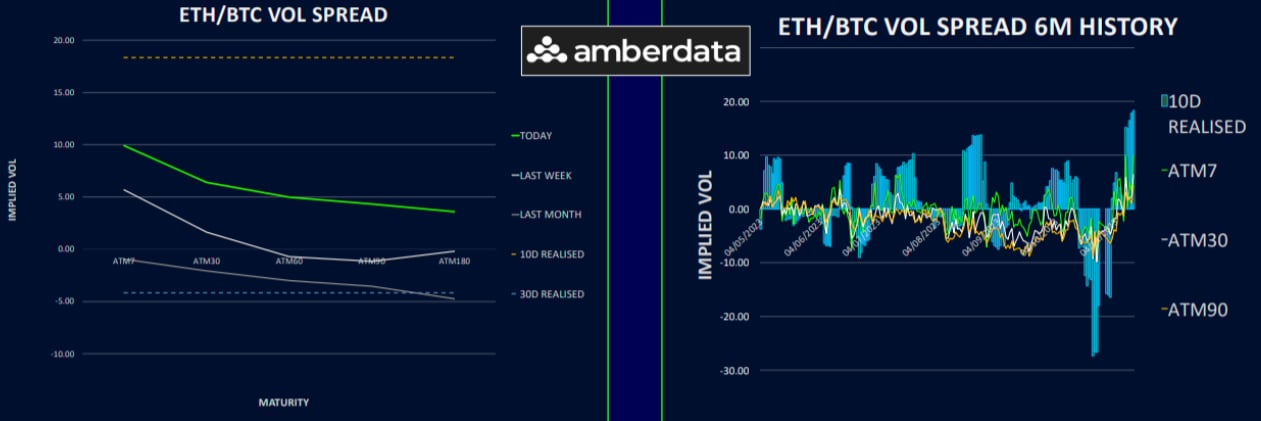

ETH/BTC Vol Spread Shifting Higher

The volatility spread between ETH and BTC is increasing again, driven by a surge in ETH’s realized volatility due to ETF-related news.

The entire curve now favors ETH premium, reminiscent of earlier times (pre-2023), with a 10 vol premium in the front expiry, decreasing to around 3 vols towards the back end.

The 10-day realized volatility spread is nearing 20 vols, and if ETH surpasses the 2150 mark, it’s expected that this spread could remain above 10 vols for some time.

While the focus had been on the BTC ETF, the market is now shifting towards ETH, though this transition seems to be in its early stages.

The absence of systematic call sellers in ETH means this factor won’t be pushing ETH volatility down rapidly. For the volatility spread to revert to favouring BTC, realized volatility would need to shift in BTC’s favour, which appears unlikely given the current narrative and market positioning.

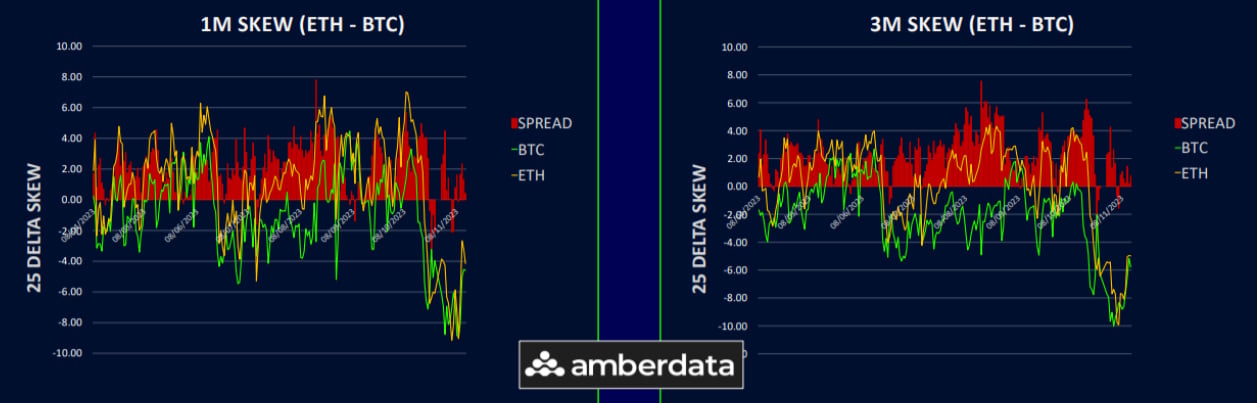

Call Premiums Come Down From Extremes

This week, the skew for both BTC and ETH realigned as call options (weekly expiry) initially soared above 10 vols during the upward movement, before settling back to around 5-6 vols across most of the curve. However, in the longer part of the curve, both assets are nearing a 10 vols call premium.

Previously, ETH’s call skew was slightly higher than BTC’s, despite ETH/BTC underperforming. As predicted, this indicated the options market’s anticipation of an ETH upswing, which the Blackrock ETF filing triggered.

Following such a significant short-term rise, some profit-taking and consolidation are expected. While ETH still holds the potential for sharp increases, predicting the timing remains challenging.

Regardless, owning call in ETH versus BTC seems to be a sound strategy. This is because the potential impact of the BTC ETF is largely factored into prices, and it’s unlikely to push BTC past 40k significantly, in our view.

Option Flows And Dealer Gamma Positioning

Trading volumes in BTC options increased by 35% to nearly $8 billion as the spot price rose again. The main activity involved rolling up calls in the 24 Nov and 29 Dec expiries, moving from the 37-38k range to the 40-45k region.

ETH volumes also rose by about 30%, though they didn’t surpass BTC volumes. Buys in the 24 Nov 2000-2100 strikes were made to cover short positions and establish new long gamma positions.

BTC dealer gamma positioning remained short as the upside from 37-40k has been bought in 24 Nov. This short positioning keeps implied volatility high, even as BTC’s realized volatility remains relatively steady.

ETH dealer gamma turned negative last week and has stayed that way as the spot price rose following the ETF filing news. Dealers seem to be short across all local strikes from 1900-2200, which is likely to sustain firm volatility and enhance the likelihood of gamma performing well.

Strategy Compass: Where Does The Opportunity Lie?

With the variance risk premium in BTC elevated, we think leaning short GAMMA is making more sense. As front-end expiries found a bid this week, using long calendar structures look interesting to earn THETA.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)