For those new at trading, trading bots might still be an undiscovered topic. The term “using a trading bot” refers to utilizing a program or system with certain parameters set by the user to trade on an online exchange.

All you really have to do is create an algorithm with fixed conditions for the bot that can be applied to its trading strategy. When these conditions are met, the bot will automatically execute the trade for you. In the article, we will be referring to this as algorithmic trading or Algo Trading.

Current cryptocurrency markets pair up very well with the algorithmic trading style, as the state of these markets tends to be quite advantageous for algorithmic traders. There are a few reasons for this, the first one being volatility. Unlike traditional markets, cryptocurrency markets tend to have bigger swings in prices, thus creating more opportunities for traders. Secondly, your trading time is not limited, as cryptocurrency markets are open and accessible at all times. Moreover, compared to traditional markets, cryptocurrency markets have smaller total market capitalization. Another big factor is the age of cryptocurrency markets. While traditional markets are more or less controlled by large funds reaching billions of dollars, cryptocurrency markets are quite young compared to traditional ones. As a result, crypto markets are much less saturated with enormous funds, thus requiring less capital to begin profiting off your trading.

The previously mentioned high volatility on the sleepless crypto market also contributes to the creation of the ideal setting for speculations, such as pump and dump strategies, which is quite important to bear in mind when deciding whether to trade on cryptocurrency markets.

Going back to trading bots, a well-programmed one can take into account the momentum, technical indicators, and fundamentals when engaging in a trade. Alternatively, you could create a more effective trading bot algorithm to handle orders more aptly and efficiently, depending on your needs, examples of which include automating Iceberg orders or dividing a single large order into smaller ones, and taking advantage of arbitrage or routing an order across different exchanges or markets when trading.

Most popular crypto trading strategies

The most popular crypto trading strategies are Market Making, Arbitrage, and Trend Following Strategies.

Market Making Strategy

This strategy employs the tactic of continuously buying and selling an asset in order to reveal and profit from the spread between both the buy and the sell prices. This can be achieved by placing limit orders on both sides of the order book. This strategy does have its downsides, as its use cases are limited in a low liquidity environment or during the previous extreme competition.

Arbitrage Strategy

Arbitrage trading is the practice of buying and selling an asset across different exchanges to take advantage of the difference in the asset’s price. Profiting from this strategy is pretty straightforward, as all you really have to do is buy an asset on one market and sell it on another.

Trend Following Strategy

As the name implies, the main idea behind this strategy is to identify the trend of an asset and to subsequently follow it when executing trades. The strategy is used to analyze the direction in which the asset is moving, as well as the course or momentum of said asset. Trend Following requires you to take a long position when the asset experiences an upward trend and to sell the position when it trends downwards in order to profit from it.

When it comes to which tools to use, that mainly depends on the trading algorithm’s difficulty level, as well as your own technical skills and prowess. Bot building can be split into 3 difficulty levels: beginner, intermediary, and advanced. We will explain each level in detail and additionally recommend tools that can be useful when creating your own trading algorithm in another article.

Example of a crypto trading bot using TradingView

Let’s look at one of the ways you could build a trading bot using TradingView. The first thing you’ll do is to create a strategy script, as it can be backtested, with TradingView providing comprehensive results of the strategy.

Below is an example of the bot’s code utilizing the EMA or Exponential Moving Average strategy where both the entry and the exit occur at the intersection of the fast and slow EMA. The code can be copied and pasted into TradingView’s Pine Editor.

Trading strategy example:

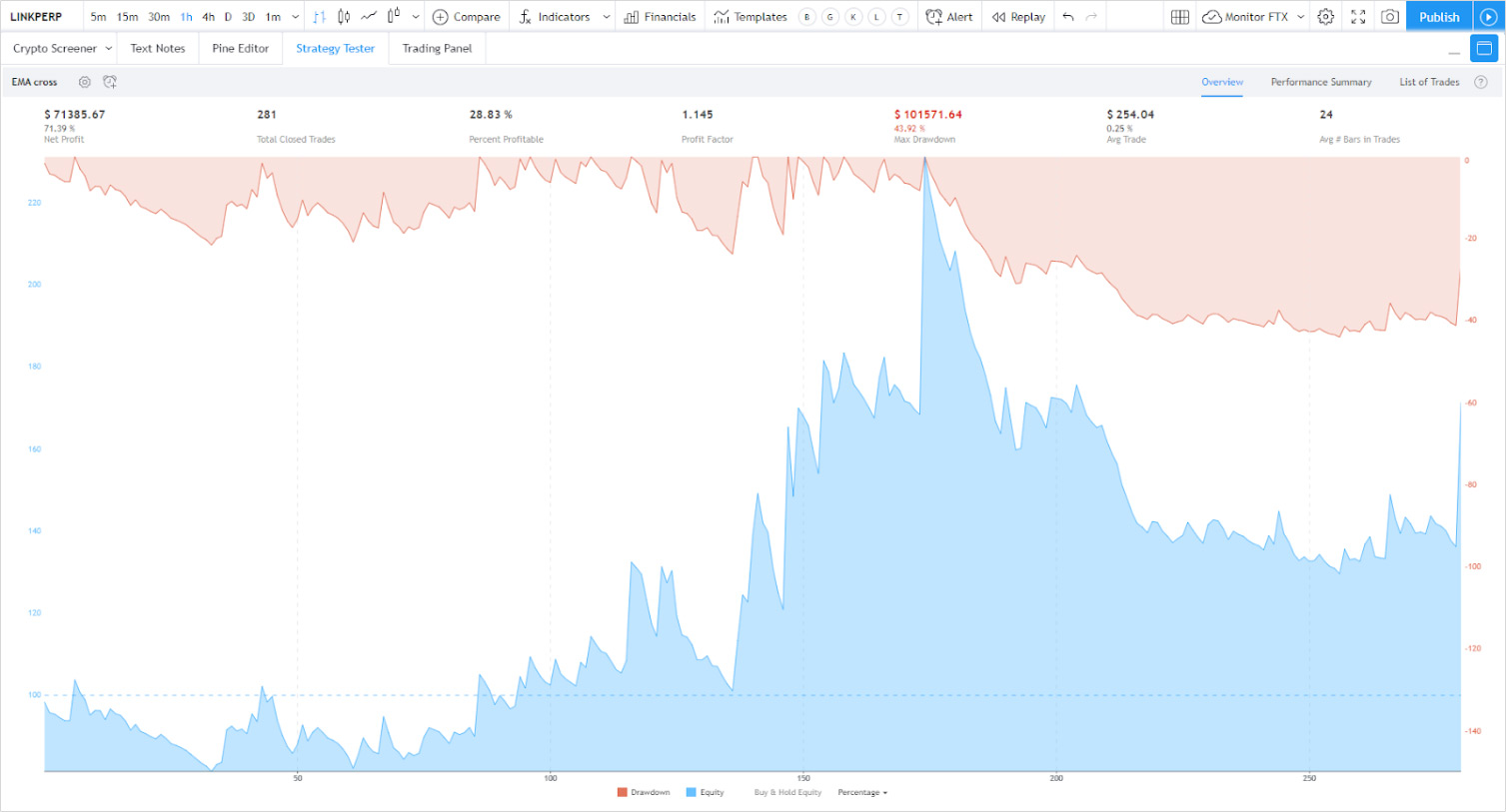

TradingView strategy result screen:

You can adjust the strategy as well by adding additional input variables, for example, stochastic indicators and volume, or commands like take profit with stop-loss targets.

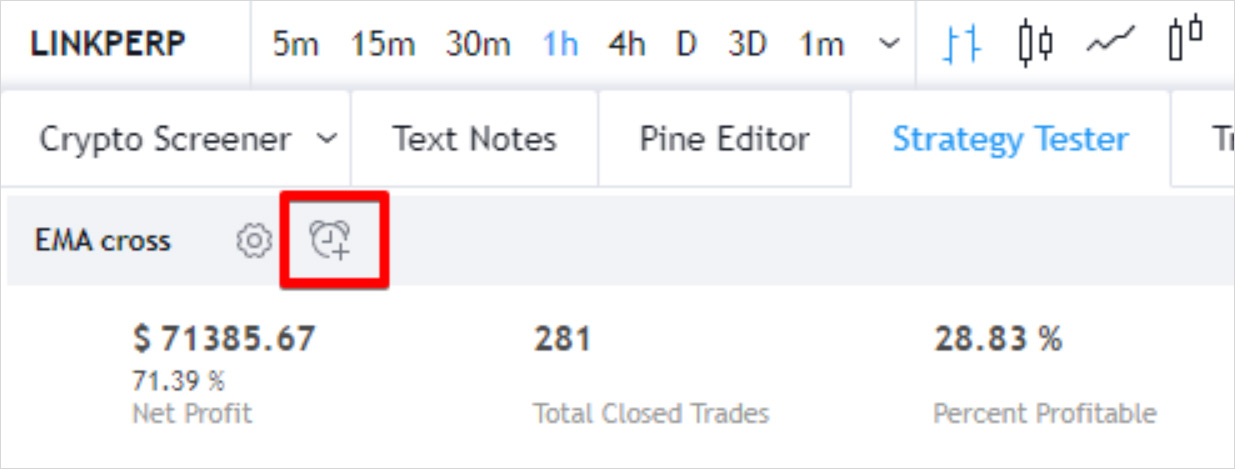

After you’ve finished making and testing the strategy, it is possible to create alerts so that you don’t end up missing your trading setups. Create an alert in the “strategy tester” screen by pressing the alarm button.

Now, each time that your strategy will enter or exit the position you would be notified in TradingView and you would be able to act on this alert.

Nevertheless, there may be cases where you simply do not have the ability to execute your strategy after receiving an alert. In this case, it is possible to actually automate TradingView strategies using a third-party service provider. Wunderbit Trading is one of such providers. Using a service like this, will make your bot able to execute operations on an exchange automatically. You can program a bot to enter or exit your strategy based on the strategy alerts from TradingView.

AUTHOR(S)

THANKS TO

Names here..