The lack of liquidity in the crypto market became more severe in June. Continued liquidity pressure, shifting narratives in risky asset markets, and declining uncertainty levels in the crypto market are the main reasons for the “drought” in the crypto market.

In the case that spot and perps trading is difficult to bring significant income expectations, investors’ preference for alternative strategies, especially those for selling volatility strategies, further depresses market volatility in the context of low liquidity.

The uncertainty of the June rate hike may bring some liquidity to the market. Still, the lack of liquidity in the crypto market will continue until the interest rate hike cycle officially ends.

There Is No Worst, Only Worse

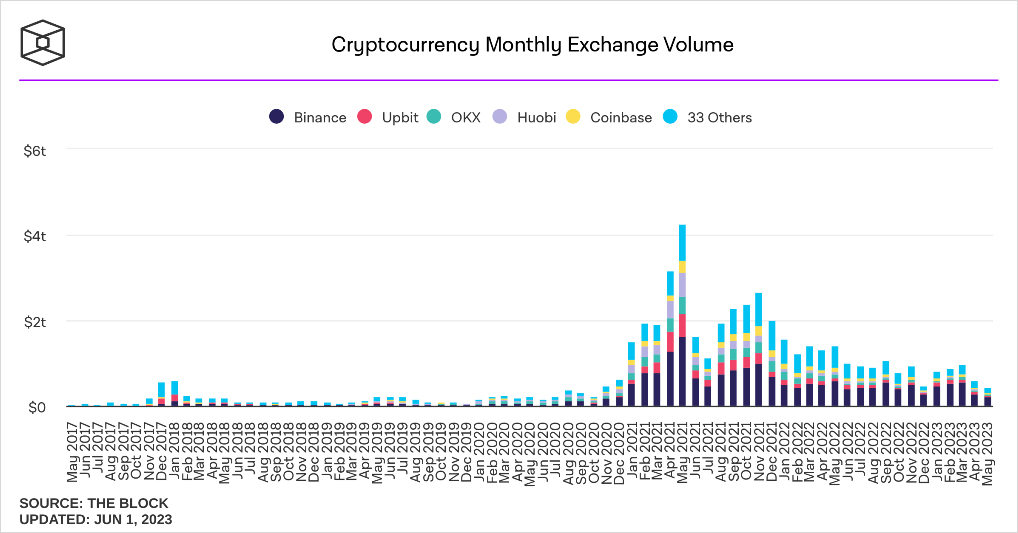

Entering June, although the hottest time of the year has yet to come, the crypto market has already suffered from the market liquidity shortage for a long time. The in-house spot trading volume in May hit a new low since Dec 2020, while the average daily in-house volume was even on par with the volume in Christmas and New Year holidays.

Cryptocurrency monthly in-house trading volume changes. Source: The Block

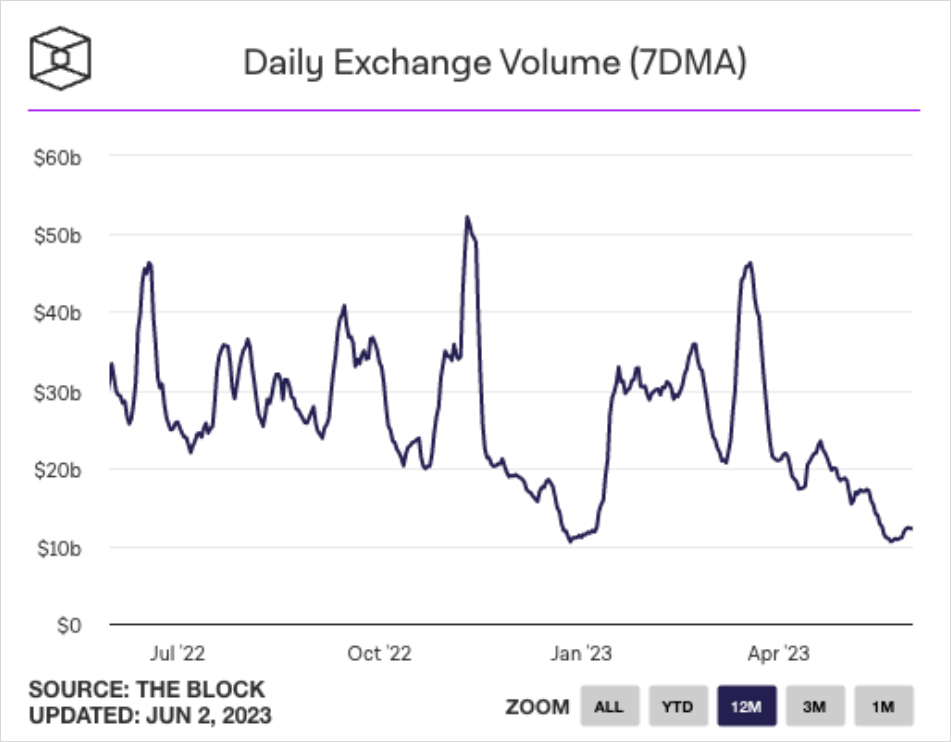

Daily in-house volume changes, as of Jun 2, 2023. Source: The Block

The sluggish trading volume has kept the realized volatility of mainstream crypto assets persistently low. Market volatility in May is usually higher than in April, as lots of macro data and major economic meetings’ decisions are typically released in May rather than April.

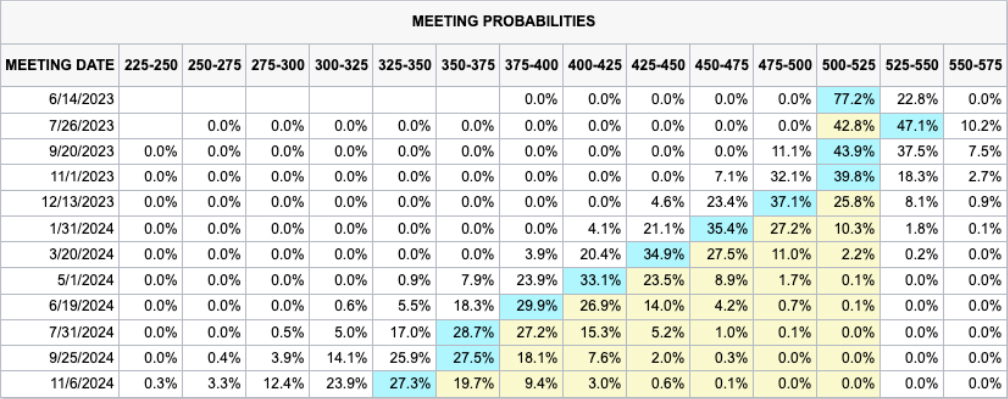

The law was broken in this year: the resolution of the debt ceiling and the arrival of interest rate peak were already priced in. Even though dovish speeches from Fed officials raised the probability of a pause in interest rates in June, traders’ expectations for interest rates have not changed significantly. No new expectations mean volatility is difficult to generate. Given how closely the crypto market is related to the macro economy, the current performance does not seem incomprehensible.

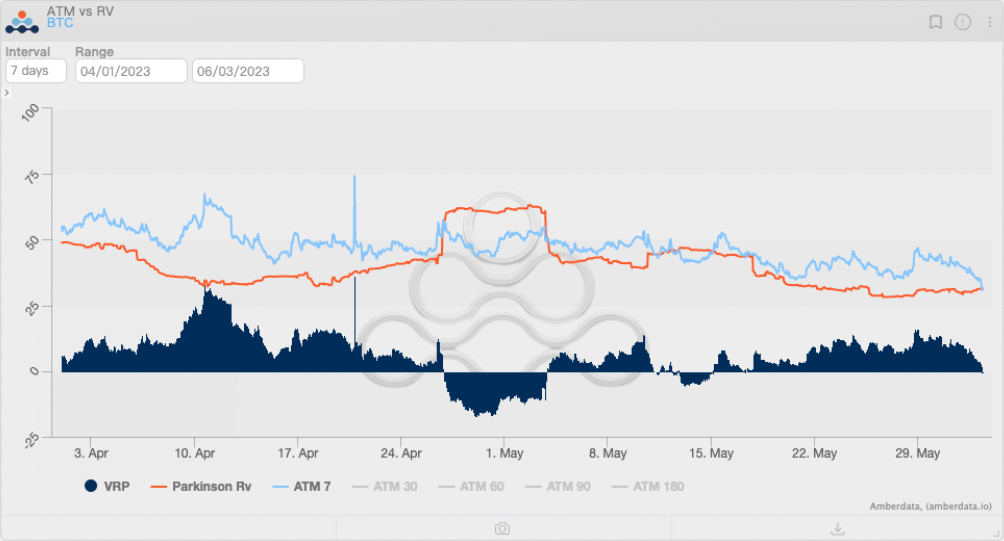

Comparison of 7-days realized volatility and implied volatility levels for BTC from April to date. Source: Amberdata Derivatives

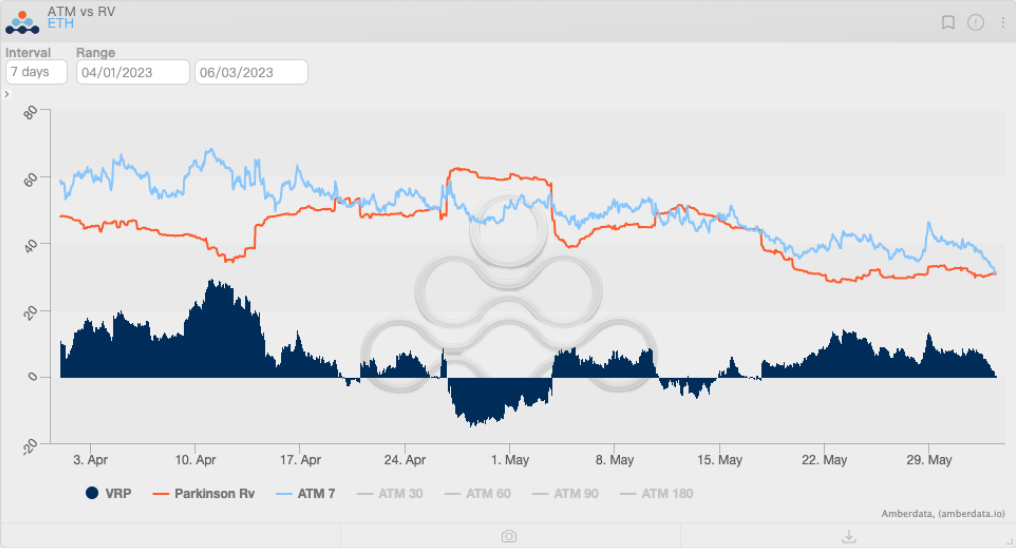

Comparison of 7-day realized volatility and implied volatility levels of ETH from April to date. Source: Amberdata Derivatives

The expectations of Fed interest rate changes. Source: CME Group

In addition, the rise of the concept of AI has made speculative liquidity more inclined to choose US stocks rather than the crypto market. As one of the macro trading tools, the macro fundamentals faced by BTC have not improved. In comparison, a bet on NVDA can allow them to obtain an absolute gain of more than 20% immediately when the financial report is released (regardless of leverage). In contrast, Bitcoin, “once a highly volatile asset,” was down more than 5% in May amid near-low volatility.

Comparison of price changes between BTC and NVDA in the past month. Source: Tradingview

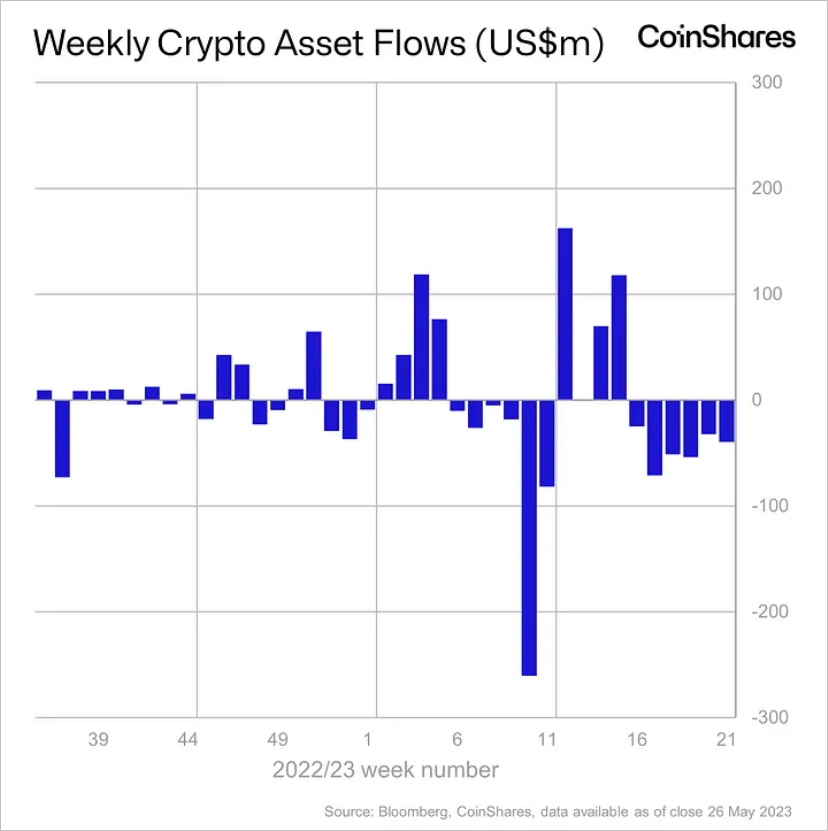

Liquidity providers are rational: Many institutions and high-net-worth investors have begun to cut their positions in the crypto market in the face of difficulty in obtaining excess returns. According to Coinshares, the crypto market has experienced six consecutive weeks of outflows since May, and crypto fund managers have lost nearly 1% of their AUMs under management in a month or so.

Weekly inflows/outflows from crypto funds, as of June 2023. Source: Coinshares

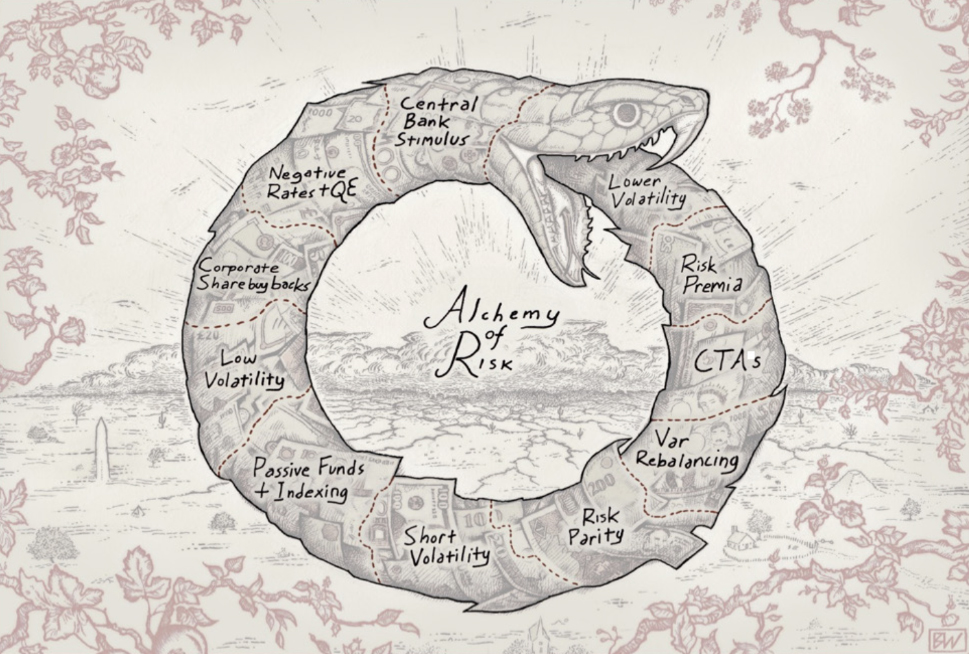

Ouroboros

Schematic of the financial market “Ouroboros Cycle.” Source: Artemis Capital Management

For investors who have the flexibility to deploy their funds as needed, they can deploy their funds to invest in other markets when the crypto market is hard to earn. However, many traders rooted in the crypto market, such as portfolio managers of crypto funds, must “find a path from the dead zone”; liquidity providers want them to earn in the crypto market rather than in other markets.

In the absence of price movement, portfolio managers must consider flexibility. Because markets are stable, selling tail risk at a profit seems reasonable: according to “simple probability logic,” a “Black Swan” event in which prices move significantly beyond expectations does not happen for months, a year, or even years. Options provide investors with a tool to trade tail risk. For buyers, their portfolios receive tail protection; for sellers, stable cash flow returns allow them to be accountable in their client’s eyes.

As a result, trading based on selling volatility has become one of the essential sources of income for crypto investors in 2023, and this selling volatility operation forms a suppression cycle for volatility:

- The significant increase in option sellers has led to a relative imbalance between supply and demand. Option sellers are willing to accept relatively low bids to speed up trading.

- As the seller’s ask prices decrease, the buyer also begins to lower the bid, and the implied volatility declines. At the same time, crypto whales have also gradually accepted relatively low buyer bids, driving implied volatility further downward.

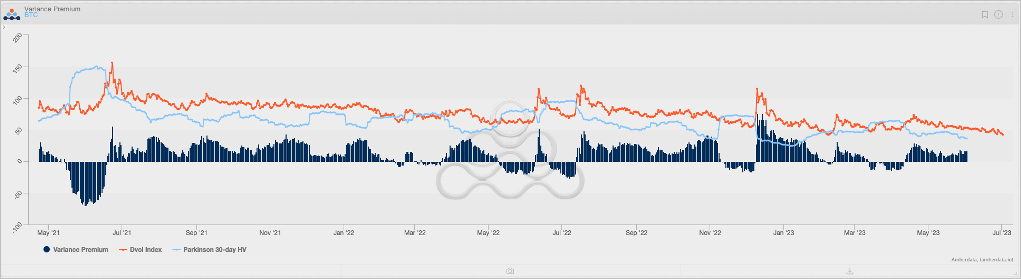

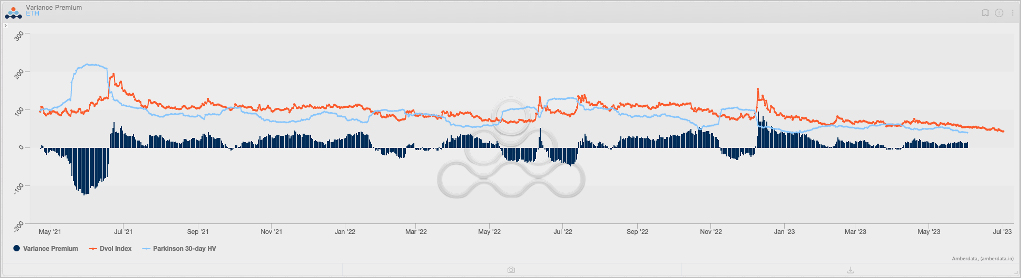

The impact of selling volatility can be seen directly in the variance premium (the difference between the realized and implied volatility). The variance premium is significantly higher in both 2021 and 2022 compared to 2023, which means a significant reduction in the profitability of selling volatility.

Changes in the variance premium between BTC and ETH from May 2021. Source: Amberdata Derivatives

In addition, since investors mainly sell volatility, option market makers have gradually transformed into relative volatility buyers (holding positive gamma). When hedging, volatility buyers usually tend to “buy low and sell high,” that is, by buying the underlying assets at a low level and selling at a high level to hedge the risk of price changes.

When liquidity is abundant, option market makers have a limited impact on prices; when liquidity is scarce, option market makers, one of the few “active players” in the crypto market, significantly impact the market and further reduce market volatility.

Showers

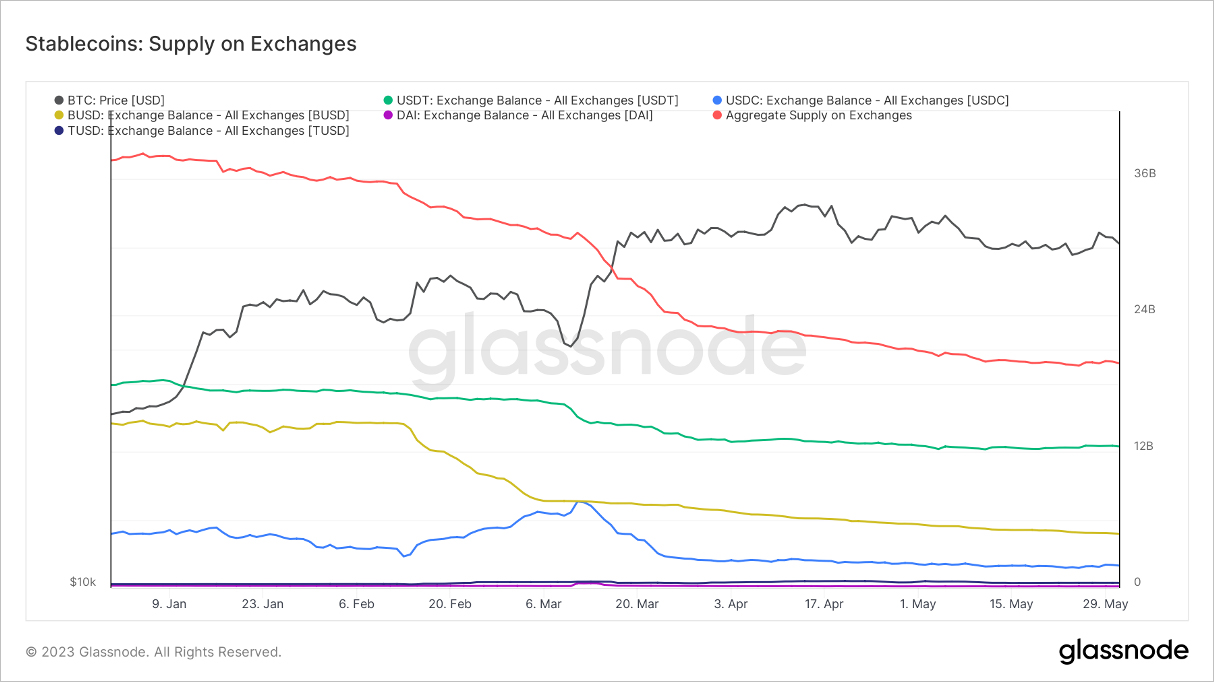

How long will the drought in the crypto market last? It’s hard to tell. Affected by the poor macro environment, it is certain that liquidity in the crypto market will still be challenging to recover before the end of 2023. In fact, liquidity has not stopped leaving the crypto market; compared to April, the in-house stablecoin supply has fallen again, meaning a deterioration in cash liquidity.

YTD changes in the level of in-house cash liquidity, source: glassnode

Fortunately, macro uncertainty can still bring some liquidity to the crypto market. Due to the Fed’s emphasis on “making final decisions based on data,” a series of macro data in June and July will also become the essential basis for investors in the crypto market to trade, especially the CPI data, while the June and July Fed meetings may also bring some good trading opportunities.

However, on the whole, the liquidity accumulation brought about by macro events is like a “shower” and does not play a role in alleviating liquidity pressure. In the absence of new expectations, investors’ enthusiasm for trading has decreased significantly, and investors tend to wait and see. A small amount of liquidity will not relieve the “drought” in the crypto market before the end of the interest rate hike cycle; we still have to wait.

AUTHOR(S)