Banking Crisis & Debt Ceiling Debate Ongoing

The banking crisis and debt ceiling discussions are expected to reach a climax in the next two months, presenting ambiguous risks.

Ever since the implosion of SVB (Silicon Valley Bank) back in early March, the net effect has been positive for BTC and Gold as safe havens.

However, a worsening banking crisis could harm BTC. Besides, the debt ceiling debate may generate negative headlines before a deal is inked, causing fluctuations and short-term panic in cryptos.

Other hurdles that may obstruct cryptocurrency growth include a prolonged pause at high positive real rates on sticky inflation, unyielding US employment, and the risk of a USD surge.

On the inflation front, the market still anticipates a sustained decline in US CPI, suggesting a minimal impact on the Fed policy and cryptocurrency trends. Crypto options pricing reflects muted volatility expectations.

Global liquidity is also set to contract among major central banks heading into H2, which may be a near-term headwind for the crypto sector.

Stagnant Price Action, Off-setting Push & Pull Forces

Over the past two months, the cryptocurrency market has been uncertain, with various factors listed above leading to a consolidation phase for both BTC and ETH values. This indecisiveness has significantly influenced crypto IV, with BTC’s DVol index nearing record lows.

The ongoing outflow of stablecoins from exchanges is worrisome and not helping. But that’s not all, we are going through an environment of stagnant funds in DEFI TVL, declining exchange volume, low DEX volume, reduced bridge volume, decreased on-chain volume, a drying up Ethereum NFT market, high gas fees, and falling numbers of active and new addresses.

The silver lining? The Bitcoin halving cycle could serve as a favourable market catalyst, particularly if the non-trivial risks gradually subside. It’s nonetheless encouraging to see Bitcoin and Ethereum’s resilience, combined with their low implied volatility levels. This supports cautious optimism. Moreover, weekly technical indicators persist in offering support, presenting a glimmer of hope.

Volatility Subsides as Range Trading Persists

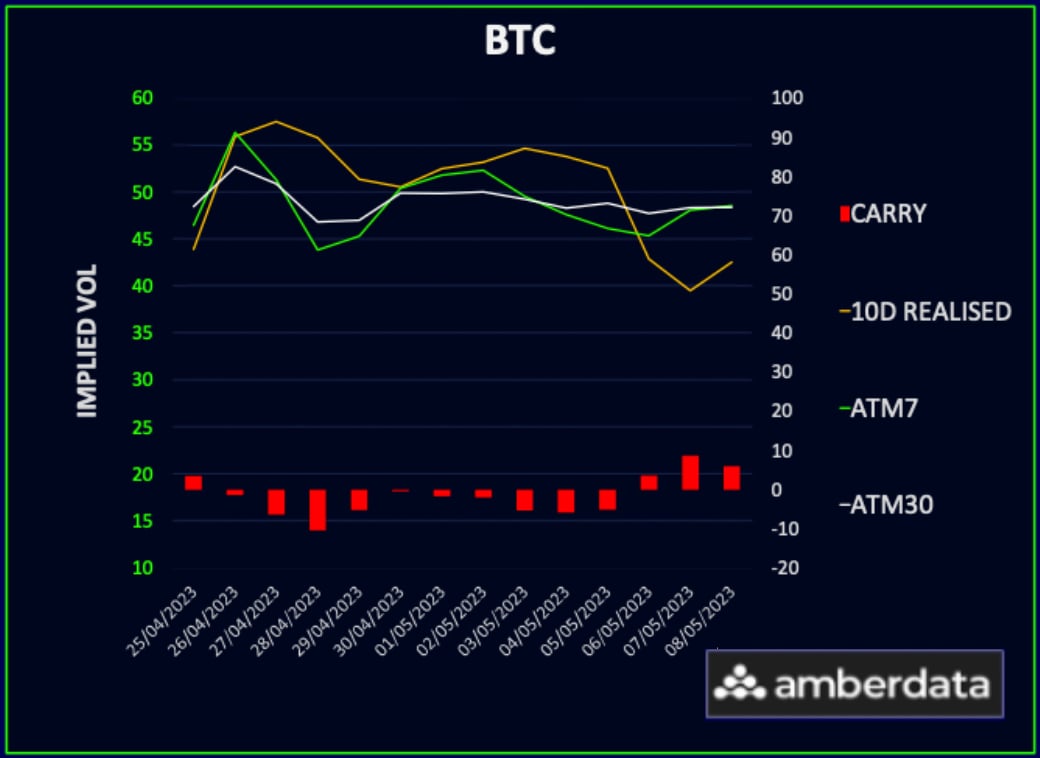

BTC realised vol shifted back down 10 points as spot remains rangebound between 27k-30k. Meanwhile, ETH 10d realised vol was again more stable around 50% on 10d timeframe.

The implied volatility experienced a decline last week as FOMC and NFP events transpired without much commotion. Over the weekend though, we observed a tepid increase in volatility as the market dropped back to the lower end of its range, ahead of the US CPI which came in slightly weaker and triggered a bounce in spot that took front-end vols back down.

Positive carry has re-emerged in BTC, enticing gamma sellers, although it remains below median levels. Meanwhile, ETH carry is still negative, suggesting that volatility is more desirable to own.

BTC’s Flat Term Structure vs. ETH’s Inversion

BTC’s term structure marginally declined yet remains rather flat, as the front end failed to enter into contango ahead of the US CPI data release.

On the other hand, ETH’s term structure maintains a slight inversion, as realized volatility demonstrated relative stability in the past week.

Both have started to move toward contango post event as you would expect.

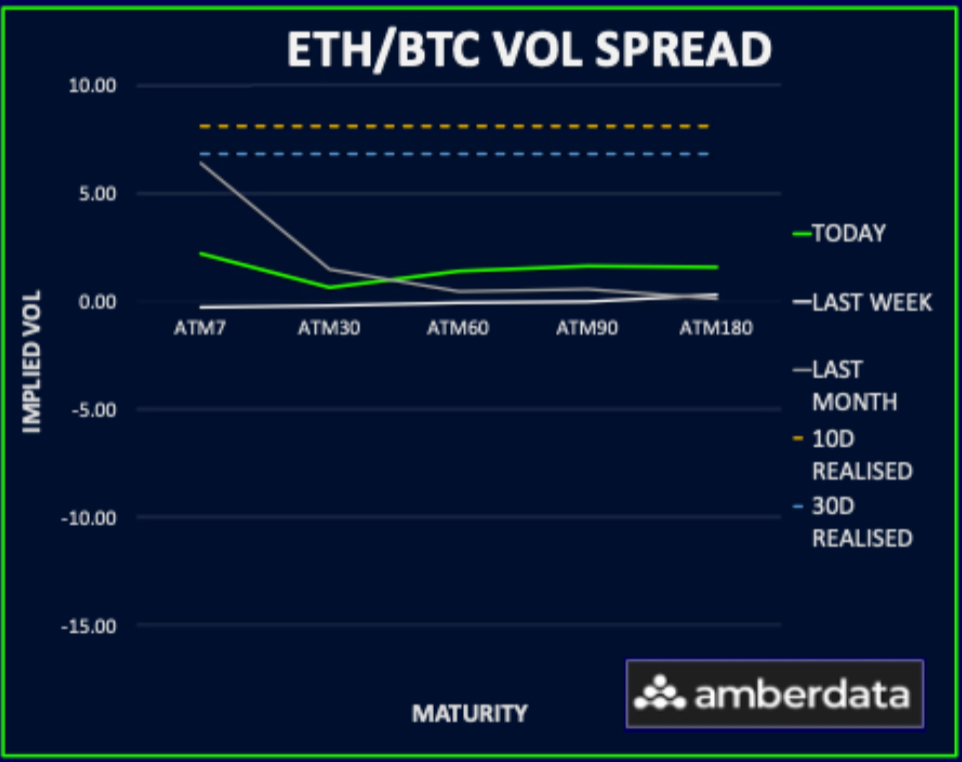

The ETH/BTC volatility spread experienced a modest rebound, along with improved realised volatility in ETH (6-8 vols higher). However, the market appears sceptical, given the restrained response in the implied spread. We believe a significant shift in ETH volatility will only occur if the downside support in the 1700/1800 range is breached, which has yet to happen.

Skew Shows Structural Long-Term Optimism For BTC

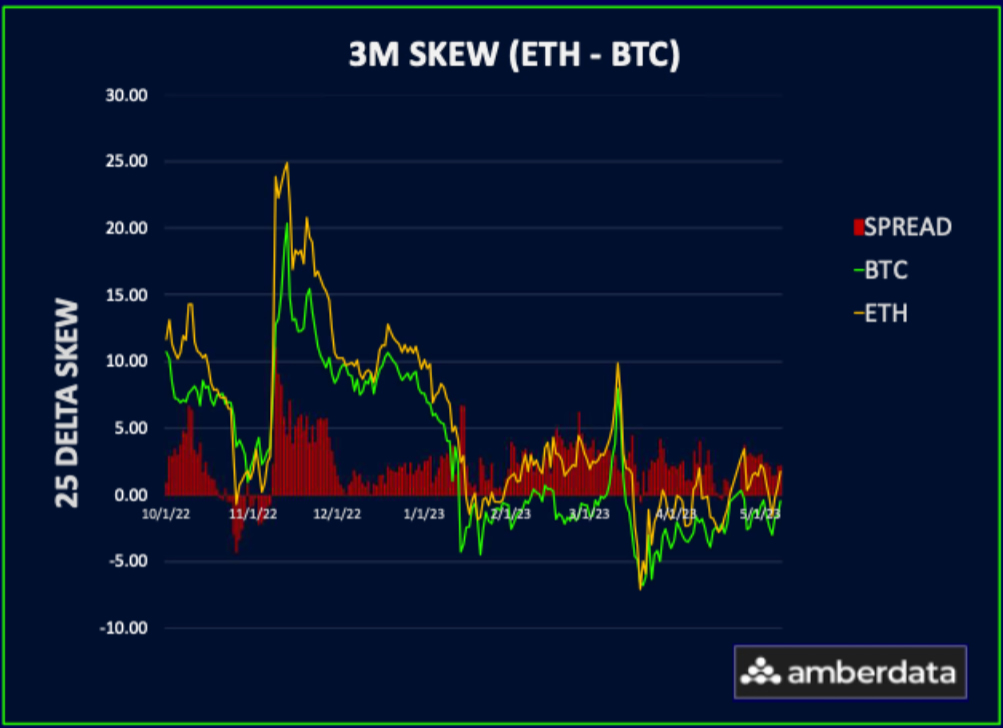

Following a brief venture into call premium while BTC tested the 30k mark, front-end skew reverted to its previous state of a modest put premium in the weekly expiry.

As one moves along the maturity curve, the skew transitions to neutral at the one-month mark and then into call premium for longer-dated tenors, with six-month calls 2 vols above.

Thus, the structural outlook for long-term optimism, influenced by the halving cycle narrative and a resurgence of easier monetary policy once the recession arrives, remains intact.

ETH skew briefly entered call premium territory as the 2000 level faced pressure but reverted to deeper put premium on the failed break. This shift reflects increased put hedging demand vs BTC.

The market continues to anticipate that if ETH volatility resurfaces, it will occur on the downside and in the near term. Conversely, in a medium-term bullish scenario for cryptocurrencies, BTC is expected to lead the charge, with its dominance continuing to grow.

Option Flows And Dealer Gamma Positioning

Options trading volumes have persistently declined alongside implied volatilities as markets seem confined to their current range. Directional upside has been pursued through various means, with primary transactions including 30k outright calls as well as some sizeable call spreads.

ETH flows shifted to a more bearish tone this week following the ETH foundation’s $30m sale, raising concerns of a near-term peak. Significant Vega sales were observed, while Sep/Dec straddles and calls were sold. Directional buyers concentrated on 2000 and 2200 calls a few months out.

BTC dealer gamma seems rather sensitive to spot fluctuations at the moment, as dealers appear to hold a substantial 27k/28k risk reversal position.

In contrast, ETH positioning remained positive throughout the week, despite spot prices fluctuating within a 200-point range. The sizeable long positions at the 1800 strike seem to be constraining the spot range and suppressing implied volatility.

Strategy Compass: Where The Opportunity Lies?

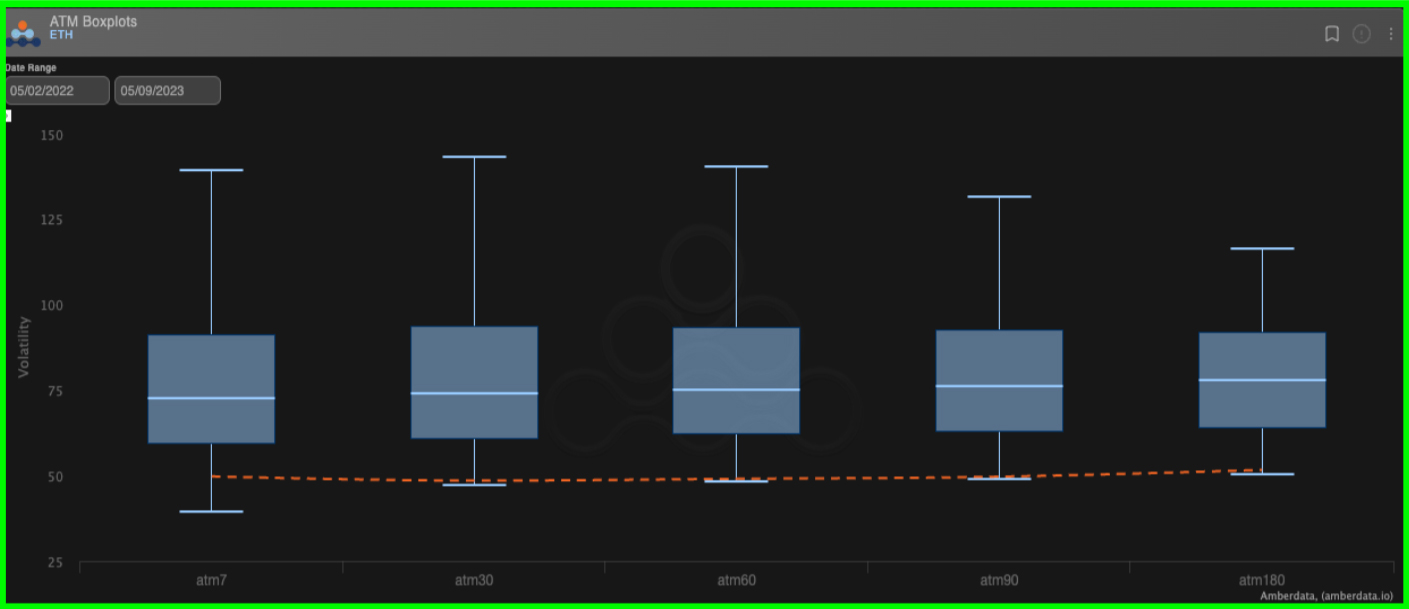

We lowered our hedge ratio with cryptos back at the lower end of its range by buying back our 30Jun23 short upside which was part of a risk reversal hedge entered a few months ago. We would look to resell calls at top of range around 30K on BTC. We still think ETH vols look the cheapest and prefer to lean long Vega in September, which as the boxplot shows is at 12-month lows.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)