Remarkable Calm In BTC and ETH

Since our last weekly update, the state of affairs remains largely unchanged. Bitcoin, over the past month, has showcased remarkable stability, recording its lowest 30-day annualized volatility at just over 15%. For a bit of perspective, last year this figure oscillated around 60%.

There’s been a noticeable decline in trading activity of late. Consequently, the price has scarcely moved. Prominent trading platforms, including the likes of Binance, OKX, and Coinbase, have reported significant drops in volume, hinting at a potential waning in traders’ interest.

Similarly, Ethereum is following suit. Interest in trading Ethereum is nearing its lowest point in the past year. It’s worth noting that despite heavyweights such as Coinbase and PayPal integrating new protocols and tokens on the layer 1 network, market reactions have been rather tepid.

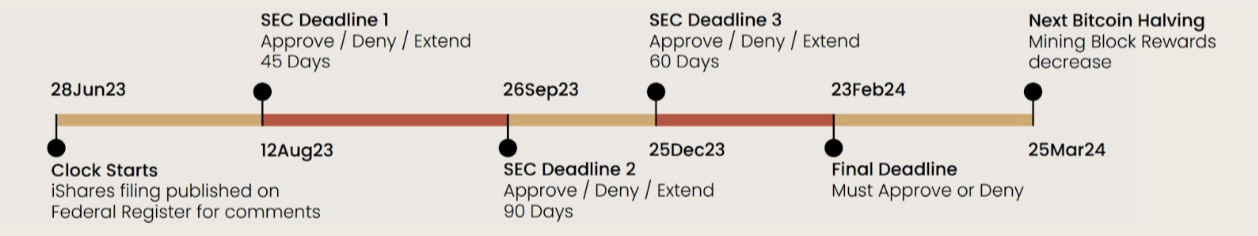

Turning our attention to spot ETF applications, the current market sentiment seems less optimistic. We’re all playing the waiting game, anticipating insights from the SEC later this year.

Elsewhere in the world of traditional finance, crypto remains largely insulated. Even with recent turbulence in the US stock market and a strengthening US dollar, the key cryptocurrencies have held their ground.

Barring any startling revelations, we can expect minor fluctuations in the major cryptocurrencies, but nothing too far from the norm. On a broader scale, our eyes this week are set on the forthcoming FOMC minutes report and the latest on US unemployment claims.

Continuing Downtrend In Realized Vol

We’re seeing a non-stopping downtrend in realised volatilities. As the trading ranges tighten and volumes wane, these vols are hitting new lows. Specifically, Ethereum’s 10-day realised has taken a sharp dive, going under 20%, with the 1,850 spot mark proving rather stubborn. Bitcoin’s realised fares slightly better, hovering close to 20.

There was a fleeting rise in implied vols last week, with Bitcoin’s spot making a run at 30,000. However, this momentum quickly faded as the breakout met another rejection – a pattern we’ve grown rather accustomed to.

Interestingly, volatility carry has bounced back to roughly 10 vols; this is because realised dropped at a quicker pace than implied vol. The summer’s tranquillity persists, and it’s becoming apparent that owning gamma at these historic low volatilities is a rapid route to getting rekt. Our gaze? Firmly set on the longer end of the curve.

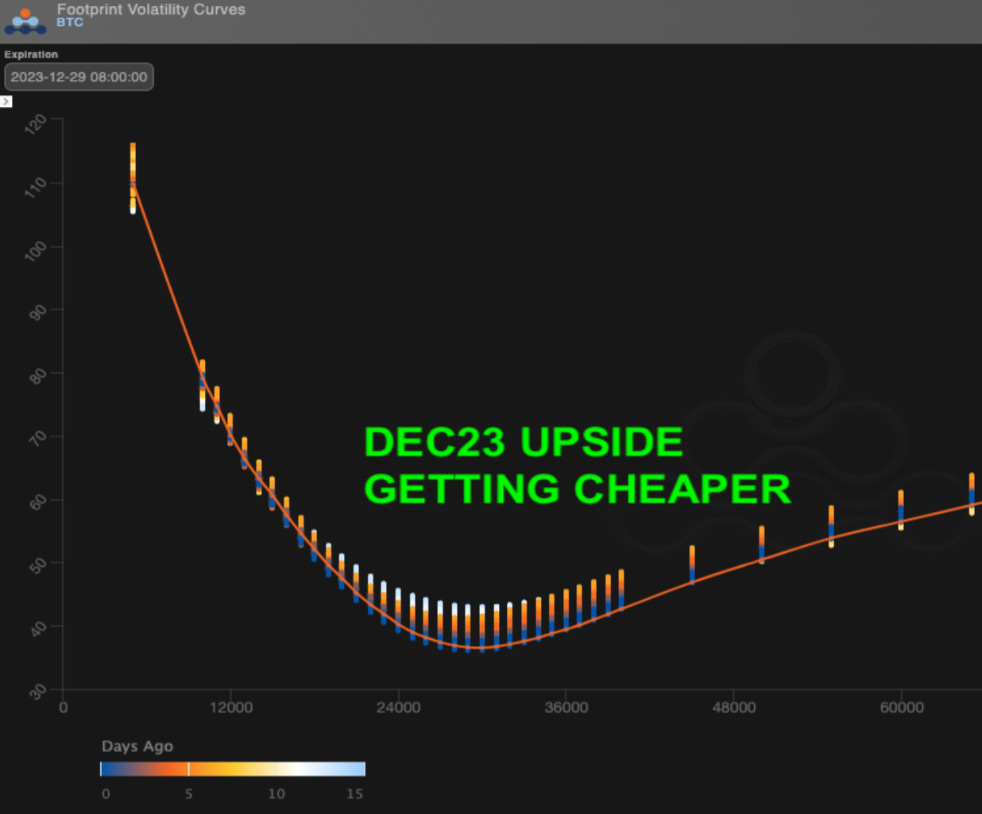

Traders Attack The Term Premium

Bitcoin’s term structure is feeling the heat once more, given its price remains in a rather static position. It’s the longer durations that are seeing more significant shifts. Traders seem to be challenging the term premium, finding the idea of selling gamma below a 30 volatility less interesting, although the systematic sellers will keep coming regardless of the level.

Although there’s still a keen interest in the longer durations for potential upside, the volatility for June 2024 has diminished by 3 points in just a week.

Ethereum’s term behaviour this week mirrors Bitcoin’s. The back end is down 3 vols, which, albeit significant, isn’t as dramatic as the 7-point dip we witnessed last week. With the front-end volatility sitting at 25, it’s beginning to resemble equity volatility. However, with realized hovering around 15, it seems gamma sellers are persistently being rewarded.

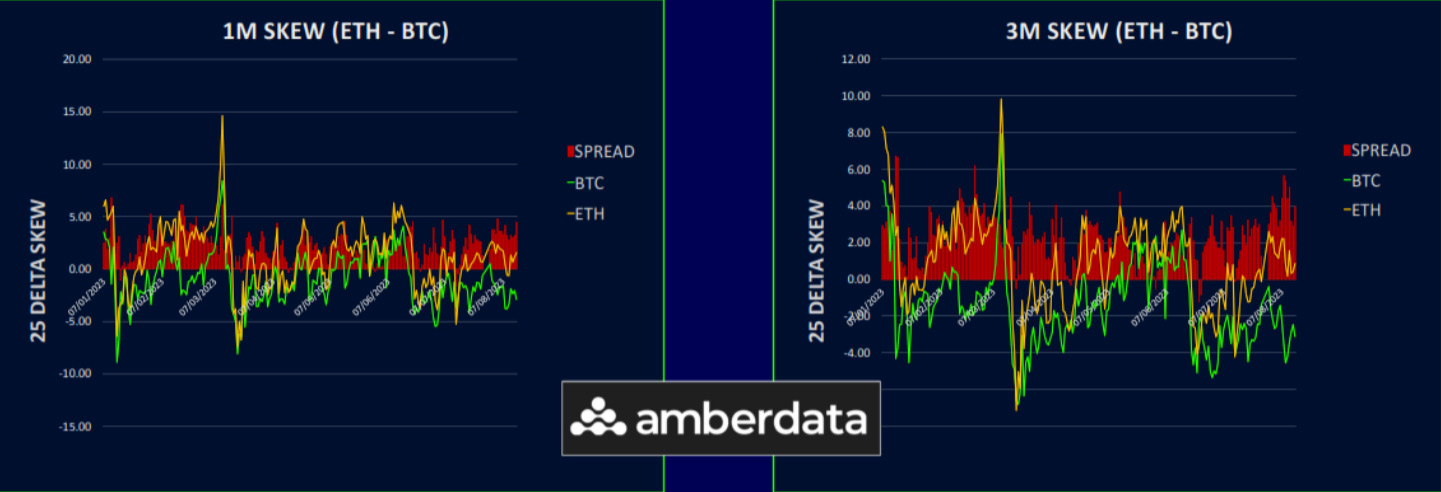

ETH/BTC Vol Spread Term Structure Smoothing Out

The volatility spread between Ethereum and Bitcoin remains under pressure, with the short-term difference at -3 and the longer-term at -5. Despite this lack of demand for ETH vol right now, our stance remains firm: there’s immense value to be found here in the long run.

Presently, long-term Ethereum volatility is trading 5 points below Bitcoin’s. The market sentiment suggests a stronger bullish trend for Bitcoin in the forthcoming 6 to 9 months. It’s worth noting that such disparities in the spread, especially at lengthier durations, are rather rare.

Those with an eye for value ought to consider long-term Ethereum volatility, especially on the upside, as the current bias leans towards put options, in stark contrast to Bitcoin.

Call Skew In BTC Unshakable

The volatility skew for Bitcoin has remained remarkably steady over the week, lingering around a 3-4 vol call premium across the spectrum. Ethereum’s skew, on the other hand, has experienced a resurgence in demand for its upside, which has balanced out its 1-week and 6-month tenors.

The centre of this curve, however, still carries a put premium. This is primarily because the calls are being predominantly sold within the September to December 2023 maturities.

The pronounced disparity in skew between Bitcoin and Ethereum paints a picture of a markedly enhanced sentiment towards Bitcoin. Yet, this sentiment hasn’t been echoed by a tangible underperformance from Ethereum’s end. If we were to gauge merely by its price movements, Ethereum’s resilience and inability to break below support, against Bitcoin’s prevailing bullish narrative, might very well hint at bullish signs.

Option Flows And Dealer Gamma Positioning

BTC options trading volumes remained stable this week, but there was a noticeable dominance of call buyers, particularly in block trades. This demand didn’t not lead to rise in implied vol as paying decay has been a losing battle lately, so market makers were happy to offload options to any fresh buyers.

There’s evident interest in 18-25 August calls, particularly for the 30k-32k strikes, likely in anticipation of a favourable outcome for Greyscale in their litigation against the SEC. Additionally, for the months of October, December, and March 2024, there’s discernible call buying activity as well.

Switching our attention to Ethereum, the option volumes were lower following last week’s substantial calendar roll volume spike. The bullish inclination remains steadfast, with considerable buying volumes seen for the 27 October 2000 and 2300 calls. Furthermore, outright calls have also been acquired in longer maturities such as 29Dec23 and 29Mar24.

As per Bitcoin’s dealer gamma, it briefly dipped into the negative during the 30k test. However, it soon rebounded, primarily due to the prevailing local long strikes for 18 August being at 29000 and 29500.

As for Ethereum’s gamma positioning, it’s consistently on the ascent. Dealer-long strikes at 1900 and 2000 are presently setting the tone. With expirations extending to 29 September, a significant piece of news would be required to nudge Ethereum from its status quo.

Strategy Compass: Where Does The Opportunity Lie?

To express a bullish bias on crypto we can’t help think that the longer part of the curve is best way to do it and owning Dec23 BTC calls or Mar24 ETH calls is setting up as a decent value bet in our opinion. We think using the current weakness in vol to average into this type of exposure makes sense for those wanting some leverage to a crypto rally later this year.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)