Crypto Loses Momentum Post FOMC

The current environment for BTC is challenging, particularly in light of the outcomes from the recent FOMC meeting. Unexpectedly, the Fed’s dot plot indicated prolonged higher rates, which has led to a surge in Treasury yields and a downturn in the US equity market.

MicroStrategy’s acquisition of an additional 5,445 BTC no longer appears to be providing the market support it once did. Unless new buyers emerge, especially with the October spot BTC ETF decisions in sight, we might see further sell-side pressure, broadly speaking.

On a more optimistic note, the deadline for Mt. Gox to repay its creditors has been extended to October 2024. However, the commencement of repayments could potentially start by year-end. Nonetheless, this may alleviate some immediate selling pressure.

Furthermore, Ethereum (ETH) continues to underperform when compared to BTC. This can be attributed to BTC’s potential for a spot ETF, a catalyst that ETH currently does not possess.

On the macro front, this week’s macroeconomic calendar is less packed. Noteworthy events to watch include Powell’s address and GDP revisions on Thursday, with PCE data releasing on Friday.

The end of the month and quarter will inevitably influence broader market dynamics, and it’s crucial to note that September 29th marks a significant crypto options expiration date.

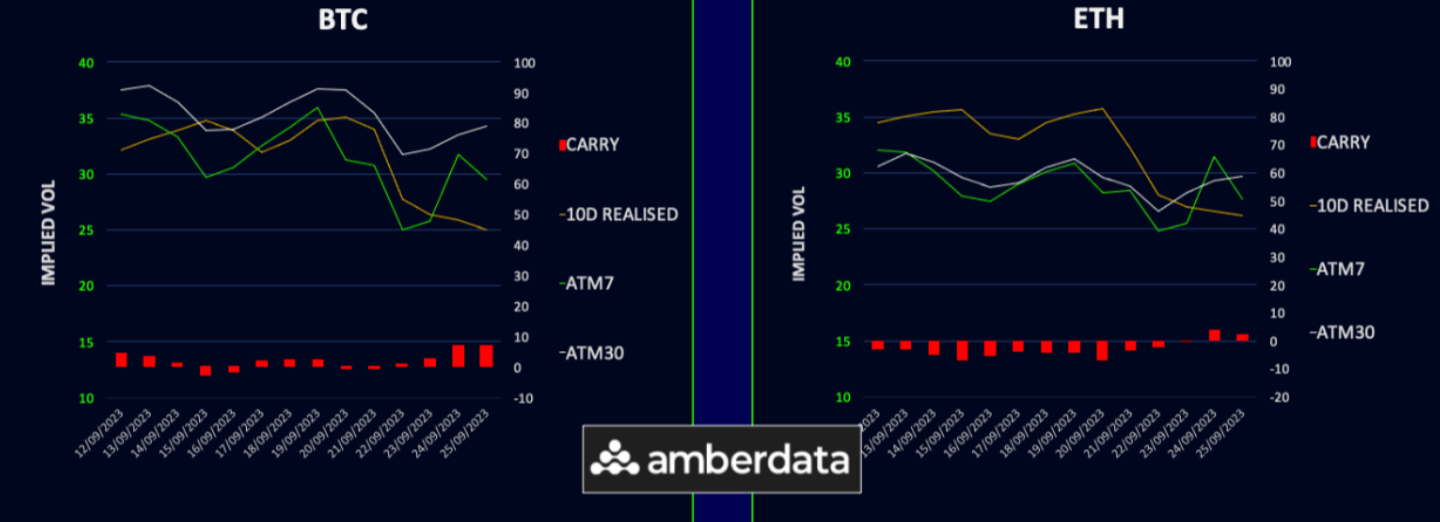

Realized Volatility Fades Back

Crypto realized volatilities have receded to the mid-20s, with spot prices experiencing a decline and failing to sustain their gains. While implied volatilities also decreased, they did so at a slower pace compared to realized volatilities. This shift has returned the volatility carry to a positive stance, favouring gamma sellers who have been capitalizing effectively throughout the year.

The upcoming week is relatively devoid of major macro triggers, suggesting that this subdued volatility environment may persist at least until the options expiration on Friday. However, it’s worth noting that forthcoming Bitcoin ETF decisions in mid-October could reintroduce heightened volatility. For the time being, time decay, or THETA, remains a predominant concern for options holders.

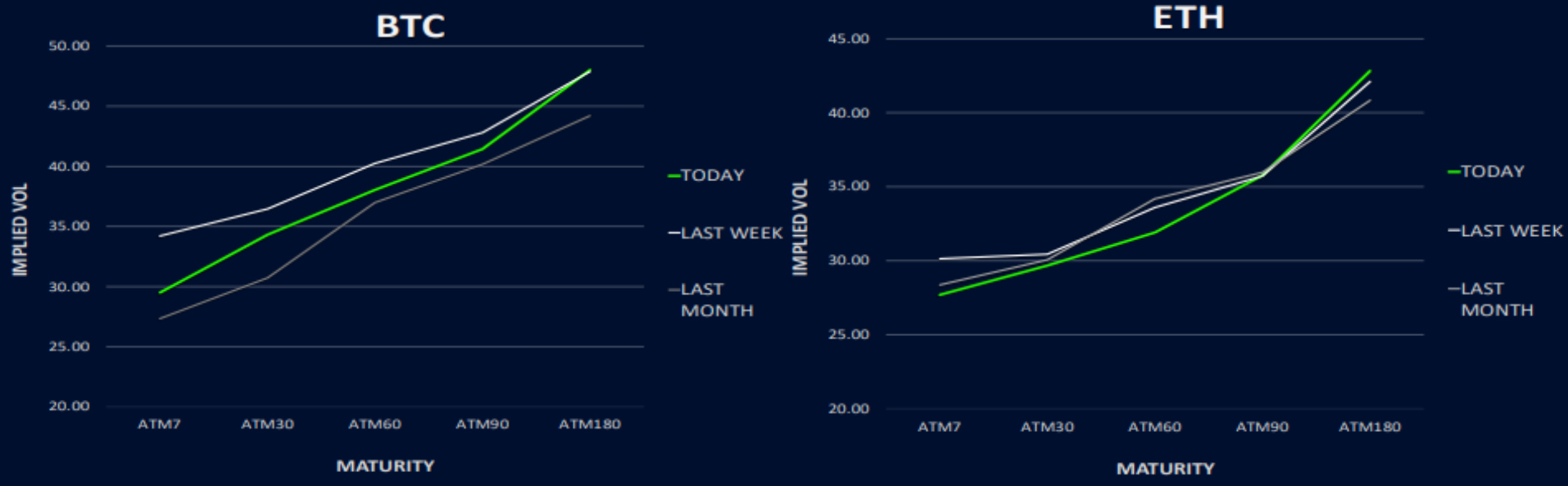

Steeper Term Structures

The term structure for Bitcoin is currently steepening, primarily driven by the front-end’s decline, which is influenced by the subdued realized volatility. Between September and November 2023, we observed a decrease in volatility by 2-3 points. Interestingly, the volatility for long-end maturities set for 2024 remained stable, underpinned by consistent VEGA demand. In such low volatility scenarios, there’s a discernible preference for VEGA over GAMMA, which aligns with typical market behaviour.

Similarly, Ethereum’s term structure is also steepening, with its front-end trending downwards. The volatility between September and October 2023 has reduced by 1-2 points, with November 2023 experiencing the most significant drop of 2.5 vols. However, for March and June 2024, there was a slight uptick in demand, resulting in a marginally increased volatility.

ETH/BTC Vol Spread Bounces

This week, the volatility spread between Ethereum and Bitcoin experienced a resurgence. BTC volatilities faced a more pronounced decline compared to ETH, which had already been significantly impacted by sustained selling pressures.

The front-end of the curve is trading at -2, with a deeper dip to -5/6 observed at the long end. Notably, the 60-day (set for Nov 2023) spread, positioned at -6 vols, appears to be the curve’s lowest point.

In terms of realized volatility, ETH holds a slight edge over BTC in shorter durations. However, the implied volatility spread continues to be negative. For a positive repricing of this spread, market participants would require a more consistent display of higher realized volatility. Given the prevailing market conditions, a shift in this dynamic is unlikely until decisions related to the BTC ETF are finalized, as that’s where the primary event risk is currently concentrated.

Skew Remains Volatile

The volatility of skew itself, remains elevated. This is primarily due to the market’s inability to generate positive momentum, which has reignited demand for puts, subsequently shifting the skew towards a put premium in the short-dated segment of the Bitcoin (BTC) curve.

Specifically, the 1-week skew for puts is notably high at 4 vols, while the 1-month stands at 1 vol. Beyond this timeframe, we begin to observe a resurgence of call premium, with the 6-month duration still favoring calls at 4.5 vols.

Ethereum’s skew mirrors this pattern for 1-week options, registering around a 5 vol put premium. However, the subsequent curve remains predominantly in favour of puts, with the 30-90 day maturities showcasing a 3-4 vol put premium. For longer durations, specifically 6 months and beyond, there’s a slight tilt towards a 1-2 vol call premium.

Such rapid shifts in short-term skew are indicative of options traders using front maturity puts as a protective measure against potential market downturns. Simultaneously, there’s a steady supply of upside calls in the front end, which allows traders to capitalize on time decay (theta) more efficiently.

Option Flows And Dealer Gamma Positioning

Bitcoin’s trading volumes have experienced a modest increase this week, especially as we near a significant quarterly expiration set for Friday. A notable activity includes the rolling of exposures, with significant transactions observed as 29Sep 24k puts transitioned to 13Oct.

Ethereum’s options volumes have risen, mirroring the trend seen with BTC. A significant buy was made for the 27Oct 1900 call as a closeout. However, this was offset by substantial on-screen sales of October 1600 and 1700 calls.

Dealer gamma for BTC has reverted to a neutral position, primarily influenced by the 29Sep 27k strike that seems to be a focal point in dealer portfolios. A downward shift could slightly tilt them into the negative, based on the options set for Friday.

On the other hand, ETH dealer gamma has recalibrated downwards as spot prices moved away from the 1700 mark, and there was an influx of put buyers for the 29Sep 1550 puts. This adjustment means there’s a reduced likelihood of a long position going into Friday, making a pin at 1700 increasingly improbable. Should ETH experience a downward break, the positioning might even turn short, potentially catalysing a more pronounced market movement.

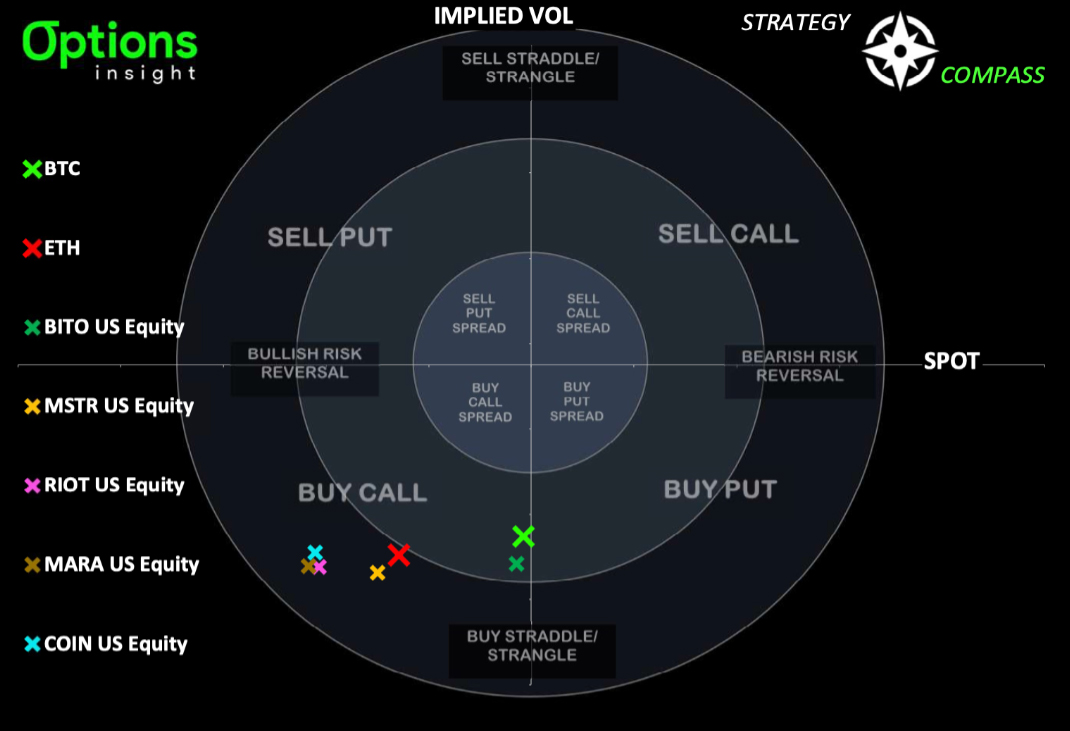

Strategy Compass: Where Does The Opportunity Lie?

Short Gamma and earning decay probably remains the correct posture here, and rolling any protection into longer maturities is a must to preserve premium.

Crypto related stocks have been getting hurt much more than the digital assets themselves and so our strategy compass is flagging some opportunities to buy calls. We prefer call spreads given the high absolute vol levels some of these names trade with.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)