Hype Around ETH Futures ETFs Fades

Last week, Bitcoin and Ethereum enjoyed gains overall, primarily fuelled by the forthcoming introduction of ETH futures on Monday. However, the subsequent ETF launch showed disappointingly low trade volumes, leading to a significant dip, especially for ETH.

These scanty volumes in ETH future ETFs have sparked concerns about the genuine interest in cryptocurrencies. They may even put into question the future importance of BTC spot ETF, given the current evidence. Such dynamics could well sway short-term speculative BTC movements.

For perspective, the BTC futures ETF ($BITO) launch in 2021 coincided with BTC’s pinnacle at 69k, all within the month of its SEC nod. A glimmer of hope for BTC bulls is its recent resilience, touching 28.5k prior to a 1k reversal. This is in spite of the USD’s pronounced rally and climbing real interest rates. Notably, even safe havens like gold haven’t been immune to these broad economic challenges.

For those dabbling in BTC, it is worth pointing out that historically, October has consistently been the most favourable month for BTC. However, its Q4 performance remains somewhat of a mixed picture.

On a broader economic note, this week heralds the release US NFP data. A lacklustre result could potentially ease the selling of bonds and offer some respite to the stock market.

Realized Vol Behaving Better In October

October has traditionally been a strong month for cryptos, and this one set off robustly as well. The realised volatility in BTC nudged up by 5 points, whilst ETH saw a loftier surge of approximately 10 points, energized initially by the hype surrounding a futures ETF.

Implied volatility notably rebounded from their previous lows last Friday, with weekly options, especially in ETH, experiencing a particular uptick as gamma began to work and influence pricing.

As we look towards the release of the Non-Farm Payroll (NFP) data this coming Friday, and with ETH carry in the vicinity of a negative 7 vols, it may lead to a pause by gamma sellers, waiting for some semblance of stability before reinitiating short positions.

Term Structures: 2024 Maturities Holding Up Better

The BTC term structure has exhibited a modest shift down from the 1-month mark and longer. Weekly expiry experienced a lift of 2 vols, as gamma found preference amidst the more substantial recent price swings. Despite the shifts, 2024 maturities are holding up better than 2023, as the halving event perpetuates a bid for long-dated upside.

Conversely, the ETH term structure has witnessed a better bid for weekly gamma, up by 5 vols. While September to December ’23 experienced a marginal downturn, as it persists as the main supply zone on the curve. March and June ’24 maturities have had a more favourable bid, up 0.5-1.5 vols.

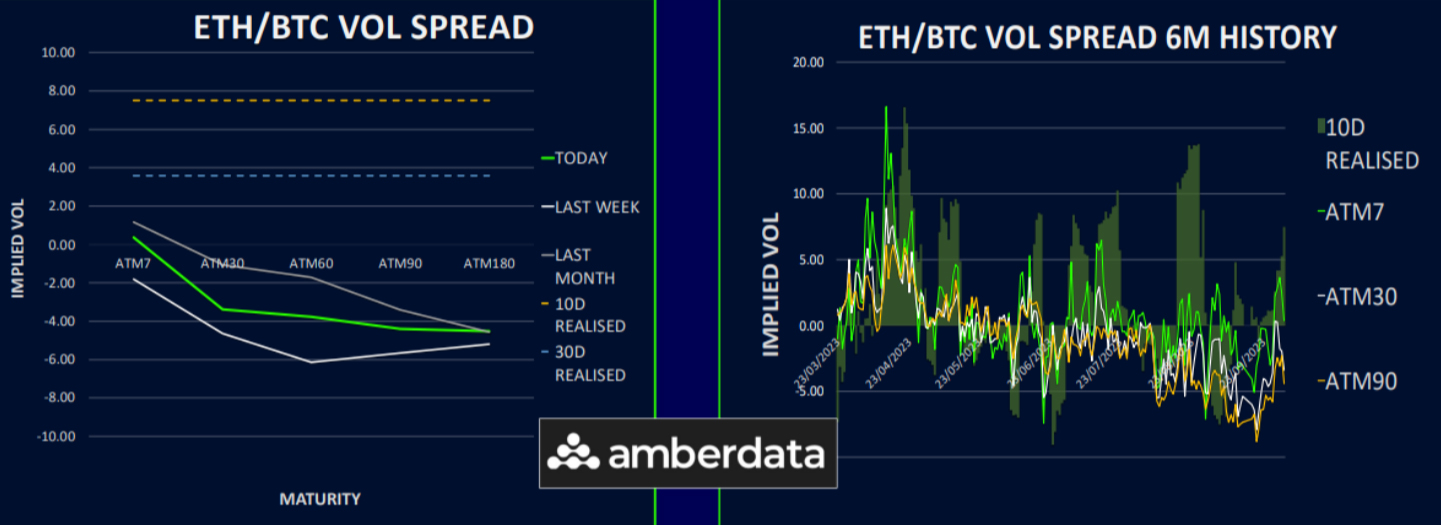

ETH/BTC Vol Spread On The Mend

The ETH/BTC volatility spread keeps recovering, with the realised more in favor of ETH, showing a 10-day realised spread at 7.5 vols, whilst BTC volatilities were more under pressure.

The front end has reverted to a neutral position, attributed to the effective performance of ETH gamma, albeit followed by a stable decline back down towards -5 vols at the longer end of the curve.

Intriguingly, the spread momentarily went into positive territory with the 1-month expiry as ETH kept moving higher, only to retract as the anticipated breakout did not come to fruition. This move-up was the first inkling we’ve witnessed of ETH leading on the upside, on some ETH-specific ETF news.

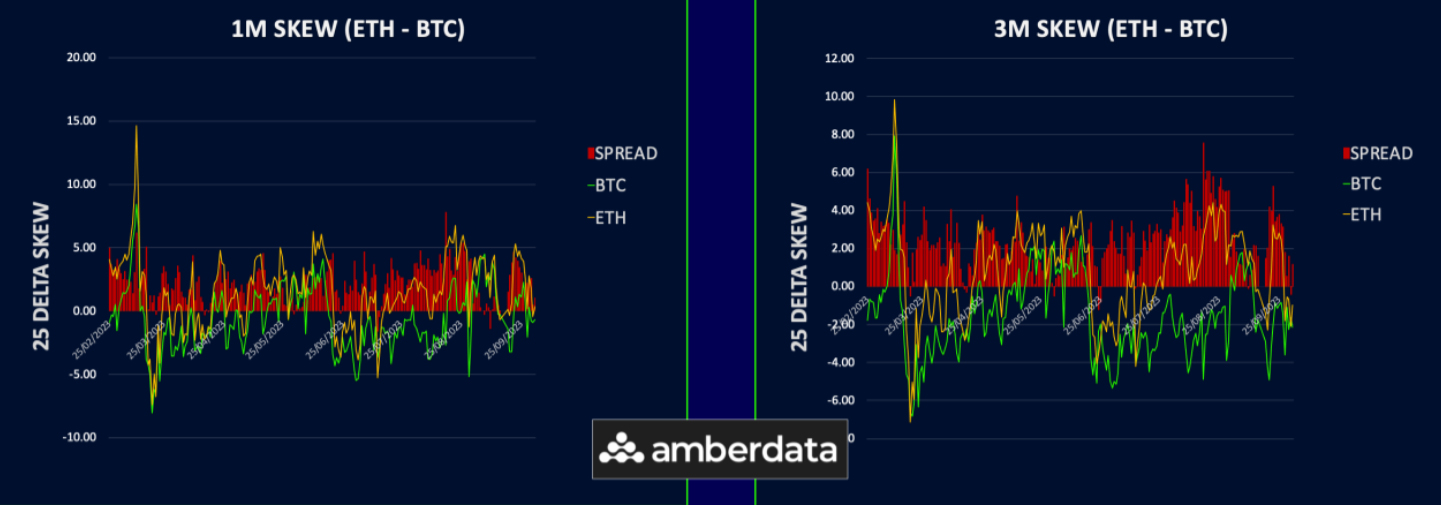

Big Shift In ETH Skew

The skew maintains its notable sensitivity to the spot once more. The month’s rally so far has led skew back in favour of call premium across the majority of the BTC curve. Albeit the weekly expiry maintains a marginal put premium around 1 vol, but then we see a steady increase into call premium, with the back end reaching levels as high as 5.5 vols.

ETH skew has undergone a significant shift. The persistent put premium around the mid of the curve has now dissipated, leading to a call premium from 60d and extending into longer maturities. While the front-end weekly skew firmly retains a 2.5 vol put premium, akin to BTC, a shift towards calls emerges the further along the curve we move. Even for ETH, the back end resides in a 4-vol call premium, which, I suspect, will exhibit more stability given that a more bullish longer-term outlook is forming for ETH around ETFs.

Option Flows And Dealer Gamma Positioning

BTC options have witnessed a 30% uptick in volumes as the significant quarterly expiry has rolled off. Predominantly, on-screen activities displayed typical 1-month call selling flows, whilst in block trade, we observed the rolling of October calls into those of November.

Concurrently, ETH options volumes experienced a surge of 60%, fuelled by ETF optimism, which sparked call activity. Abundant two-way flows were noticed with initial buying in Oct-Dec23 calls across the 1800-200 strike calls.

BTC dealer gamma positioning has reverted to near neutrality following Friday’s sizeable expiry roll- off. While positions are likely to be rebuilt as we edge towards the year-end, the current state sees dealer owning local strikes at 28-29k, versus being short on the upside above 30k.

In contrast, ETH dealer gamma dwindled post-expiry, with dealers holding long positions on the 27Oct 1700 strike against other shorts in shorter expiries. The ETF surge incited some short covering from clients, resulting in dealer books becoming more neutral.

Strategy Compass: Where Does The Opportunity Lie?

We think call calendar spreads, selling 2023 maturities to fund 2024 long call positions make sense, as crypto has been decorrelating from other assets but failed to gather any real momentum due to investors waiting for the green light on ETFs before driving inflows. Any time the front end vols pop, we think that provides the opportunity to get into these type of trades.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)