BTC and ETH Trying To Weather the Alts Storm

US SEC’s focus on Binance and Coinbase, the two leading crypto exchanges, has ruffled feathers in the BTC and ETH markets. As well telegraphed over recent times, these exchanges have now been confirmed to be facing allegations of operating unregistered securities exchanges by the SEC.

However, the most significant impact to BTC and ETH price action came from pricing in an impending Alt liquidation event following SEC’s classification of some of these Alts as securities. Prominent VCs and Robinhood, have or are about to, liquidate significant Alts holdings.

That said, the continuous wave of negative news may eventually lose its market pull. After all, the industry is global, with plenty of alternatives and low entry barriers. Therefore, any outsized volatility in BTC and ETH should be seen within the context of a broad trading range to fade.

Also, notwithstanding short-term risks, Coinbase is expected to fight back legally, possibly dragging the matter on for years, even until a possible administration change. For Binance Global, the CEX with the most volume, any non-criminal penalties for past offenses will likely only result in fines.

Looking at the calendar, the week is packed with events that may move the needle once again. These events include a crypto hearing by the US Financial Committee, Treasury Secretary Yellen’s hearing, updates on the SEC vs Ripple legal case, and the SEC’s response to Coinbase’s lawsuit.

Simultaneously, in light of yet another softening of the US CPI on Tuesday, it adds to the case to make this Wednesday’s FOMC meeting their first pause in more than a year.

BTC and ETH, compared to Alts, have shown resilience, with losses capped at a modest 4-5% versus 15-25% in the broader Alt market. Since neither Bitcoin nor Ethereum are deemed ‘securities’ by the SEC, they are perceived as safer and more liquid bets, leading to stronger dip buying.

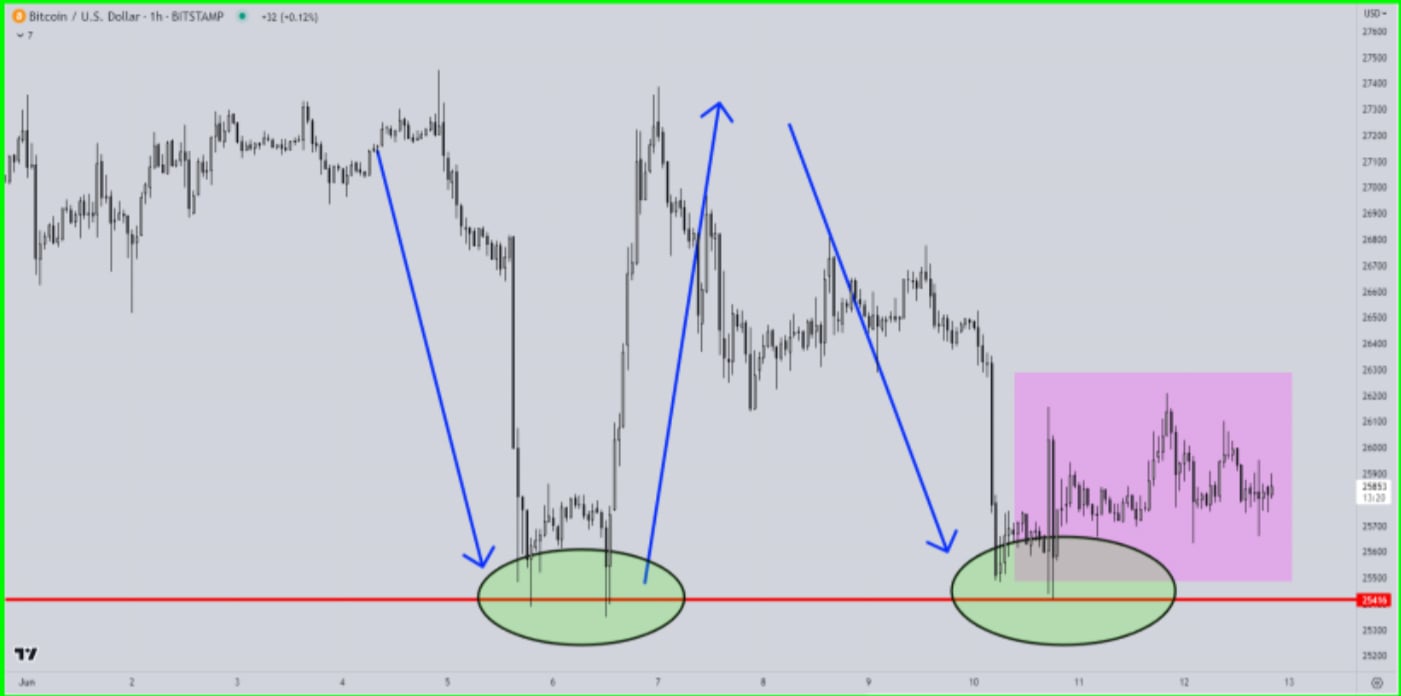

BTC buyers have drawn a line and defended it hard around the 25.5k weekly support (see red line below). If broken, we could see stops triggered and a dip towards 22k-23k.

Meanwhile, ETH seems to be under more pressure, as acceptance of lower price levels could breach the key support at 1.7k. This would open up risk of a slide towards the 1.5k mark.

Uptick In Implied Vols As Demand For Options Increases

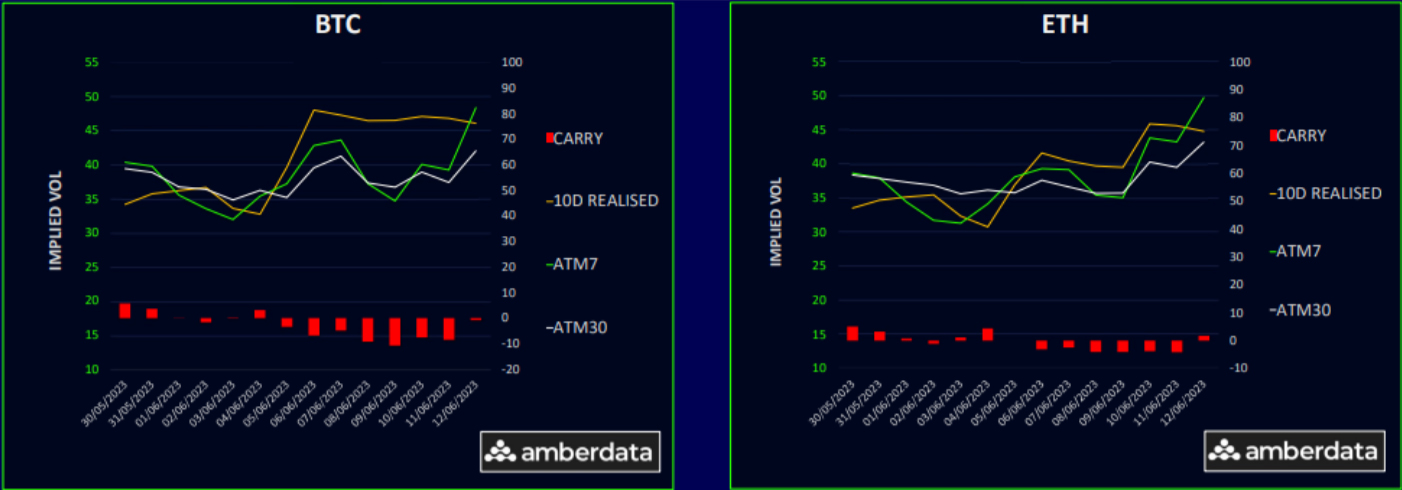

This week has seen a notable 10-15 points leap in realised vols, fueled by heightened volatility in the wake of recent SEC actions against Binance and Coinbase. These actions have set off a cascade of liquidations from Alt coins, now being categorised as unregulated securities.

Implied vols, too, have been pulled upwards due to significant market moves and the risk of breaking below crucial support levels, thereby renewing some demand for options.

Carry largely stayed in the red throughout the week but shifted to a more neutral stance as implied vols surged over the weekend. Given the high likelihood of more negative news and major macroeconomic triggers this week, we don’t foresee any significant changes in vols until Friday.

Systematic call selling flows have been capping short-dated vols for several months. However, should markets dive lower as they have in ALTs, we could transition into a different volatility environment.

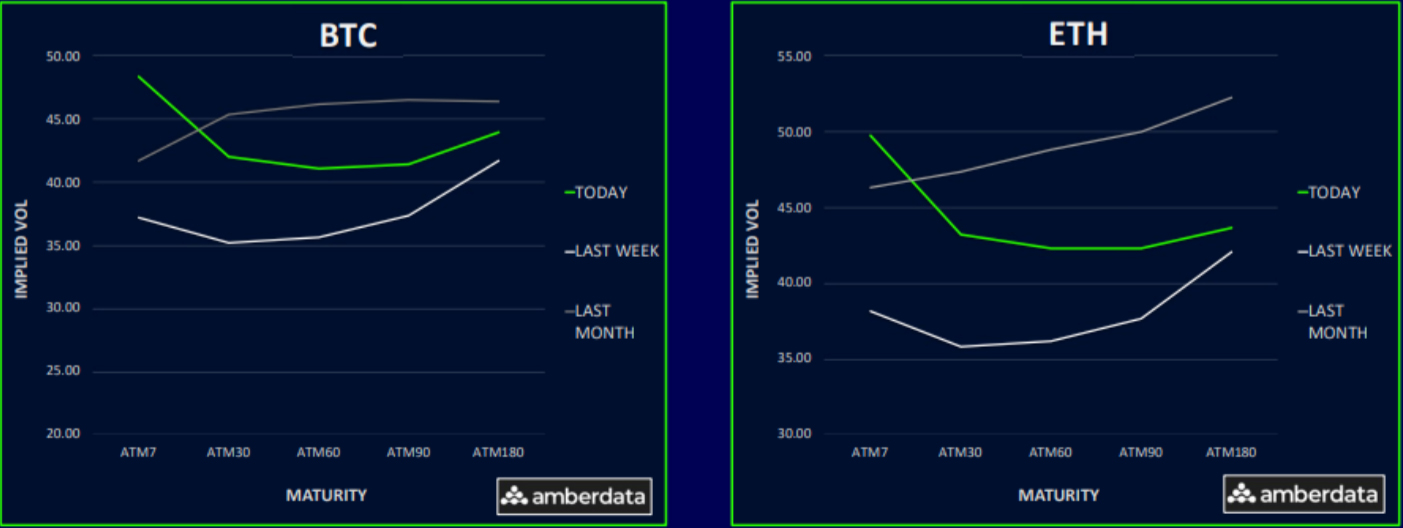

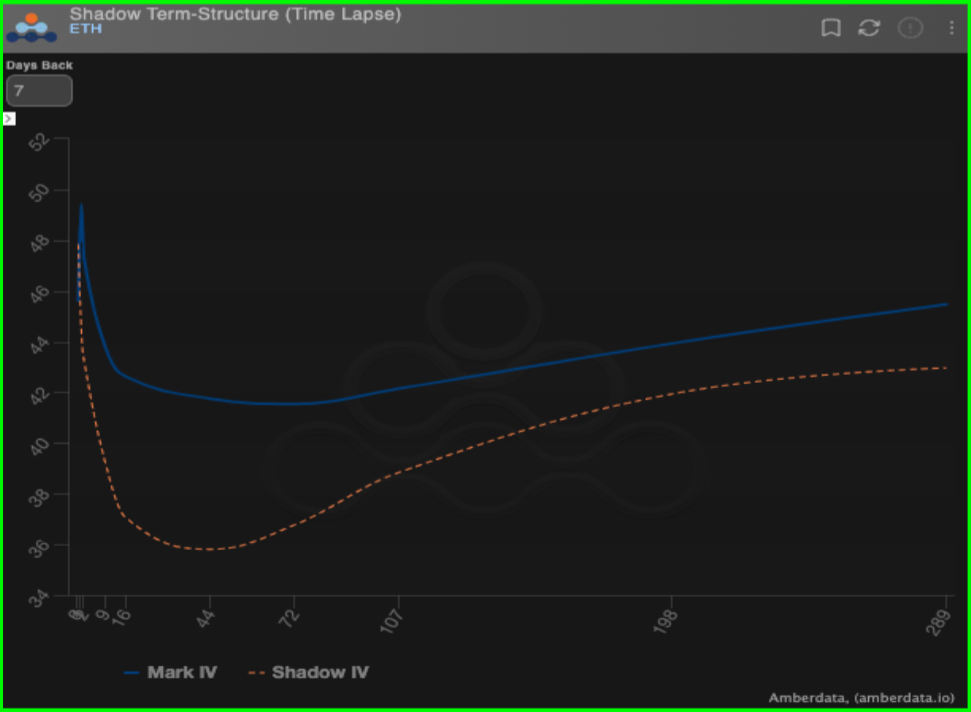

Term Structure Goes Into Inversion

The back-end vols remained relatively stagnant, with demand primarily focused on short-dated expiries, pushing the weekly vol close to a 50% mark.

The volatility spread between ETH and BTC stayed steady around one vol (ETH above), even as the realised trend continues to slightly favour BTC.

Given ETH spot’s more unstable appearance compared to BTC, it’s expected for ETH to hold a minor premium, even if it’s not being realised at present. However, should ETH spot break below 1700, this scenario could rapidly change, leaving traders on edge.

Skew Shifted Towards Put Premium

Crypto markets are feeling the pinch as weekly support levels for both BTC and ETH are under the microscope. As a result, the skew has been shifting more towards put premium across the spectrum.

For BTC, weekly skew has crept up to nearly 6 vols for puts, but this trend gradually dissipates as we go further along the curve, and we see a shift back to call premium in the 6-month bucket and beyond. Even with near-term price drops on the cards, the halving cycle premium doesn’t seem to be going anywhere.

In contrast to ETH vol, put skew commands a noticeable premium above BTC. The front end has seen highs of 9 vols for puts, and while it does fade as we consider longer durations, it remains in put premium territory throughout.

A combination of a steady stream of call selling flows on ETH and the perception that ETH could suffer more in an actual spot downturn, given that it wouldn’t benefit from any flight-to-safety moves, has kept ETH’s skew above BTC for some time.

The crypto options market is certainly ramping up the probability that the current support levels (25500 for BTC and 1700 for ETH) may not hold up this time around.

Option Flows And Dealer Gamma Positioning

BTC options experienced an increase in activity this week, spurred on by market vulnerabilities following the SEC headlines. The surge in short-term gamma sellers on 16th June’s 25.5k/27.5k strangles was readily absorbed as front-end vols surged.

ETH flows saw a more balanced action this week as realised vol rose. Calendar trades continued to lead the way, but with an unusual twist as we saw buying activity on the 30th June/28th July and 30th June/25th August 2000 call calendars.

Meanwhile, BTC dealer gamma has subtly transitioned into negative territory as gamma buyers have entered the market this week. This is due to improved realized vol and significant macro events.

As for ETH, gamma positioning continues to be long, primarily due to the dominating 30th June 1800 strike. However, as we have observed some buying on the downside, dealers have shorted below 1700. This could trigger a gamma flip if the spot price declines further.

Strategy Compass: Where Does The Opportunity Lie?

Long ETH upside call calendars look interesting here, give the pop in front end vols and the likelihood of a mean reversion in the curve is spot bounces after this week’s macro events. We would look for more delta neutral structures though as the risk of a break lower could make the short gamma painful and we would prefer to run away from our Greeks if markets sell off.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)