As price decreases even lower, their capital is on the brink of liquidation, and most don’t realize it.

If price continues its countertrend of decline in the coming weeks, we will witness an avalanche of liquidations on DeFi. It will provide the first lesson to new DeFi users of the risks associated with DeFi.

As of now, DeFi users are not fully aware of the risk and leverage used on their locked up capital. They are no longer simple hodl’ers. Instead, they need to manage an account like an open position on margin. It is a scenario much like a driver of an everyday passenger car asked to get behind the wheel of a Formula One race car. They are ill-equipped. The only difference is that DeFi users might not even be aware they are sitting behind the wheel of a race car.

This places significant sums of capital at risk of liquidation as price drops. Creating an environment for price action that is reminiscent of March 2020. For a hodl’er – somebody who doesn’t trade – this is suboptimal. For traders this creates opportunity.

The reality is, most crypto traders are not equipped to spot this market trend. DeFi is unique in that it is not on exchanges. There are no order books, and there is no long vs short ratio. The tools to better anticipate market corrections are just being developed. And since these developments are so new, the first wave of traders adopting these methods and techniques will reap the rewards. Which is also the aim of this article – to demonstrate you the opportunity at hand.

Let’s shine some light on the state of the market through the lens of DeFi, what it means to price action, and how traders can profit from this setup.

The Stage is Set

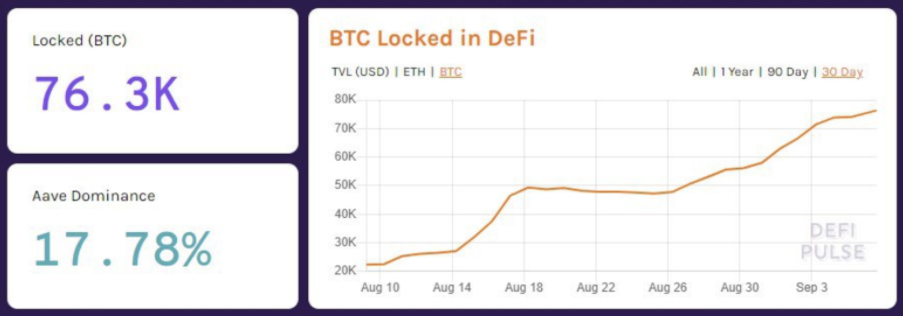

In the last thirty days, almost 2.5 million ETH and 50,000 BTC were added to DeFi. You can see this in DeFi Pulse’s charts below.

The first chart shows ETH locked in DeFi growing from just under 4.5m to almost 7m. At the time of writing, it is slightly above 6m ETH, potentially locked up in DeFi contracts.

The second chart shows the amount of BTC locked in DeFi. It is a similar trend. Nearly 50,000 BTC were added in the last 30 days.

It is a significant growth in a short span of time. And as this growth unfolded, the price reached yearly highs.

In fact, the average price of Ethereum in the last thirty days has been $402. The last time ETH was this high was July 2018. On the other hand, Bitcoin’s average price is around $11,500. The last time we were at these levels was over a year ago.

When it comes to DeFi, it’s important to understand that when it comes to earning yield, for the most part, assets are “locked up” in smart contracts so users can borrow against it. This opportunity allows borrowers to generate a yield higher than the borrowing rate or trade with the borrowed capital to earn more than the borrowing rate.

Collateralization is what makes this possible. Therefore, as long as the crypto locked up maintains a value higher than the amount borrowed, all is good. And this starting value of locked up collateral versus amount borrowed tends to start at around 200%. Meaning the assets locked up are valued at twice as much as the borrowed amount.

Put differently, it is the risk a user is taking on their locked up crypto. Because as their locked-up assets decrease in value – ETH price declining – their collateralization ratio drops with it. It’s where everything discussed in the intro comes into play and where things start to get exciting.

To make it easier to understand, let’s look at an example – if a user deposits 10ETH at $402 with 200% collateralization, he can borrow $2,010 against it.

Now, as ETH price drops from $402 to $300, this ratio is no longer 200%, but 149%. And when it gets to approximately 113% or roughly $2,275 in value, the 10 ETH in the DeFi contract can be liquidated.

Based on this math, it happens when ETH reaches $227. This means that an estimated sum of 2.5 million ETH will be sold on the market if the price reaches $227 per ETH.

It’s important to remember that:

Firstly, we just went from $490 to $310 in a matter of days. Secondly, liquidations do not start at $227. That’s merely where the “meat” of DeFi contracts will be. In fact, assets locked at a 200% collateralization ratio near the peak of $490 have not been touched. They won’t start until around $280.

Yet, we are already seeing liquidations starting.

Here you can view historical and real-time liquidations on the MakerDAO platform: Here. You will notice there are several pages of liquidations on September 5th, when the price reached its most recent lows.

This serves as only a glimmer into what may happen if we get another drive lower. If the price goes into sub $280 price levels, traders can expect an avalanche of forced selling as DeFi contracts are liquidated on the open market.

And while the entire 2.5 million ETH nor the 50,000 BTC are not necessarily locked up into MakerDAO smart contracts, the majority is. In fact, yETH, one of the most popular Yearn.finance vaults, is on the top 10 list in terms of largest pools of capital sitting on MakerDAO. The thing is, most users aren’t aware of this risk.

Which is why this avalanche of selling is a real risk and sets the stage of aggressive price moments in the days and weeks to come.

What to Do

The crypto landscape is shifting. New DeFi products are introduced every day, attracting a wave of former crypto hodlers. In effect, these products are creating a market where users are no longer just exposed to spot-like leverage, but instead are leveraging their assets.

Meaning the market itself is undergoing a shift where more crypto is being leveraged. And as you may or may not know, with more leverage comes more volatility.

A simplified comparison is a car engine. As you increase the horsepower and start adding modifications, it will go faster from point A to point B. But at the same time, faster speeds introduce more risk. With greater speeds, small bumps on the road or wet pavement can result in deadly crashes. And in a market that’s generating more returns per one dollar change in ETH and BTC, the risk of these deadly like crashes becomes greater.

A one day bump in price is no longer just a bad day, it can mean a permanent loss of capital. Which is why safety must be considered.

Therefore, what can traders do to get ahead of this changing landscape? Or how do you increase the safety of your trading while supercharging your returns in DeFi?

First – Expand Your Toolbox

The metrics most traders have grown accustomed to will no longer be as reliable. The volume and transaction activity on DeFi platforms are growing by the day. Liquidation levels, leveraged positions, and returns are not merely contained to the largest centralized exchanges.

This also means that the flow of crypto to and from exchanges no longer give a holistic picture of the buying or selling pressure of an asset. Therefore, traders need to embrace tools that look at DEX volume, yield on various assets, liquidation levels of various DeFi smart contracts, and even the network’s mempool – this last one is unique in that rising unconfirmed transactions or network congestion might lead to more severe price corrections.

Second – Embrace Derivatives

With increased volatility comes new opportunities. It’s a trader’s dream. Because, if the price goes higher and lower more often, there are more chances to profit. The flipside is that the increase in price fluctuations means that the chance the trader loses his position on a good entry increases. It’s a frustrating experience when it happens.

It’s why many traders leverage options. They allow traders to harness this volatility while ensuring they aren’t knocked out of the position on a good entry. It’s a simple way to improve the odds of a successful trade.

Additionally, options aren’t unique to traders. DeFi users need to embrace them as they explore DeFi opportunities. It’s a way to hedge losses.

For example, if a new project is promising 200%+ yield on ETH, the user can “buy insurance” on their capital through a put contract. This lets the DeFi user make up the potential loss they may suffer from a liquidation event. And sure, it might shave a few percentage points off the yield, but it allows DeFi yield farmers to explore riskier projects and safely allocate more capital to DeFi.

An example:

If a DeFi user expects a 13% loss of capital when putting 100 ETH into a 200% collateralized vault at $402, the individual can buy put contracts. For every contract purchased at $402, they stand to gain at least $102 of value if price moves to the liquidation mark near $300. This in turn allows them to purchase approximately 0.33 ETH for every contract.

Put contracts near “at the money” when volatility is low (as measured by IV – implied volatility) cost approximately 0.1 ETH with expirations two months out. This represents 0.23 ETH of profit for each put contract.

For an individual potentially losing out on 13 ETH on their 100 ETH capital, they can hedge against this loss. If they purchased 5 ETH worth of put contracts at 0.1 ETH a contract and price drops from $402 to $300, their put contracts can intrinsically be worth 0.23 ETH each. And with 5 ETH worth of contracts, this equates to 50 contracts or potentially 11.5 ETH of profit. Which is close to offsetting the loss from the DeFi liquidation.

This little scenario highlights the importance of risk management in DeFi and how you can hedge yourself when yield farming.

It’s something that can’t be stated enough. Options hedge the risk associated with DeFi. So do your homework and learn more about options before the next March selloff happens.

AUTHOR(S)