Choppy Environment as ETH Fades Downside Break

The outlook for BTC and ETH remains choppy, with some spells of selling pressure that so far have failed to materialise in clean downside breaks. The recent dynamics we’ve experienced in price action have been characterised by modest surges; however, these gains were short-lived, receding within a day. On the downside, it is also getting harder to find further follow-through.

Despite the current sombre short-term view, the longer-term perspective remains optimistic, given the array of positive developments pointing towards increased adoption. Notably, Ripple’s triumph over the SEC, BlackRock’s foray into BTC spot ETFs – a move mirrored by several other entities – and Grayscale’s victory against the SEC are milestones. Furthermore, Paypal’s introduction of a stablecoin and other features, including ‘off-ramp’ crypto to USD conversions, is worth mentioning.

Conversely, we must remain cognizant of potential headwinds:

While the anticipated halving effect could act as a positive driver going forward, concerns linger due to the DOJ’s intensified scrutiny of Binance, potential liquidation threats from FTX assets, and the potential offloading of seized BTCs by the US government and Mt. Gox creditors.

From a macroeconomic perspective, the robust DXY is not aiding the cryptocurrency sector, maintaining its distinct bullish trajectory. This week, our attention is on the forthcoming CPI and PPI data, which could provide insights into potential Fed actions. Furthermore, the FOMC rate decision scheduled for 19th-20th September is anticipated to maintain the current stance on rate hikes.

Pop In Realized Volatility

The realized volatility for cryptocurrencies had returned to the mid-20s, even as the spot market showed fragility on the downside. With a 4% decline on Monday and then a similar recovery yesterday, ETH breached the 1600 support level, causing its realized volatility to surpass BTC, which remains slightly more stable.

Short-term implied volatilities experienced a slight uptick as the spot market retreated, ending the week marginally higher. There’s a shift back to positive volatility carry in both assets, a scenario likely to attract gamma sellers, more so if support levels are maintained approaching the weekend.

As forecasted last week, an uptick in volatility appears to be linked to a spot market decline. Additionally, Wednesday’s CPI data may instigate further market fluctuations.

Term Structure Firmer Across The Curve

The BTC term structure has moved higher across the curve. The surge in front-end volatilities is primarily driven by a concentration of protection buying stretching up to November 2023. Volatility for the extended term, into 2024, was well supported, increasing by over one vol point.

ETH’s term structure, in contrast to BTC, hasn’t received as robust a bid, notwithstanding its decline. The mid-curve is lagging behind. Long-end volatility for ETH remains resilient, primarily because it continues to trade at a substantial discount relative to BTC.

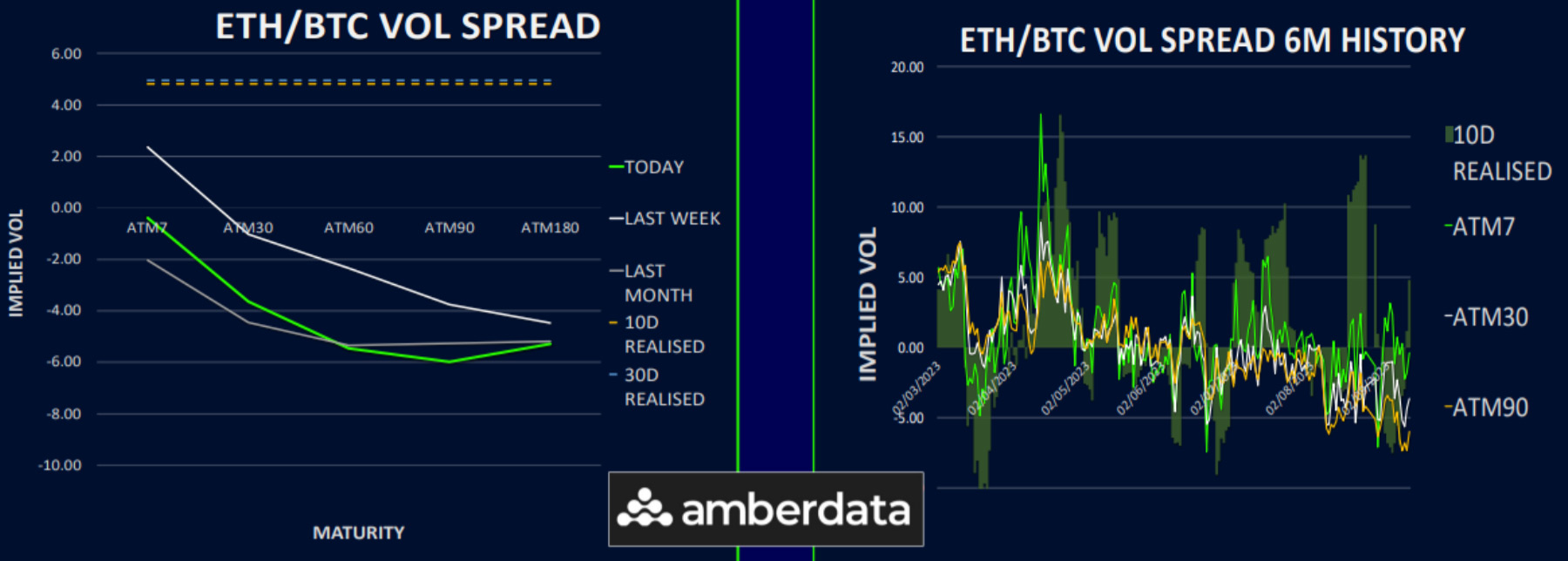

Vol Spread Shifts Down Across The Term Structure

The ETH/BTC volatility spread is displaying a consistent downward trajectory across its term structure, even as ETH shows some superior realised performance.

The front end remains flat, with a pronounced dip of around -5/6 in the long end.

This movement further underscores our prior observations: for ETH to persuade options participants that its implied volatility deserves a premium over BTC, it must consistently showcase more sustained realised over an extended period.

Present imbalances between supply and demand pose a significant challenge for ETH’s volatility to overcome. Adjusting these dynamics will be a protracted process.

Long-Term Skew Stubbornly Bullish

As BTC’s spot market approached its weekly support threshold, there was notable demand for the put skew, especially within the weekly expiry reaching a maximum put premium of approximately 6.5 vols. The mid-curve skew has eased since our last update, yet the long end continues to hold a call premium near 4 vols.

The ETH skew predominantly leans towards a put premium across much of its curve, most pronounced in the weekly and 1-month durations, spanning between 2 and 4 vols. Progressing further along the curve, the skew begins to normalise, albeit at a more gradual pace compared to BTC.

Notably, the long end of the ETH curve has reverted to a call premium, a development of intrigue in light of the recent price drop.

The fact that the put skew has remained consistent during the latest downward move might be the options market’s indicator of waning bearish momentum.

Option Flows And Dealer Gamma Positioning

This week, volumes declined as the spot value edged downwards, nearing critical support levels. We observed a predominant trend of protection buying, particularly in September expiries, primarily puts and put spreads. Yet, a significant transaction occurred with the 29th December 20K outright puts.

For ETH, options trading volumes marginally decreased over the week. The biggest block traded was a protection buyer through the 29th December 1400 puts. A variety of puts, spanning from September to December maturities were also traded and call calendars were used to roll short call positions up and out by overwriters.

BTC dealer gamma continues to manifest a negative trend. Dealers predominantly hold short positions for this week, especially within the 24k-25.5k bracket. Should values surpass 26k, we anticipate a return to equilibrium with more neutral stances. It’s pertinent to note that options positions aren’t perceived as the primary driver at these levels.

Regarding ETH, dealer gamma remains relatively unchanged. The volume provided by put sellers has been sufficient, preventing dealers from sustaining short positions for extended durations. Locally, some short positions linger in the 1500-1600 range, yet it’s commonplace for dealers to possess ‘wing’ positions in ETH for September and October expiries.

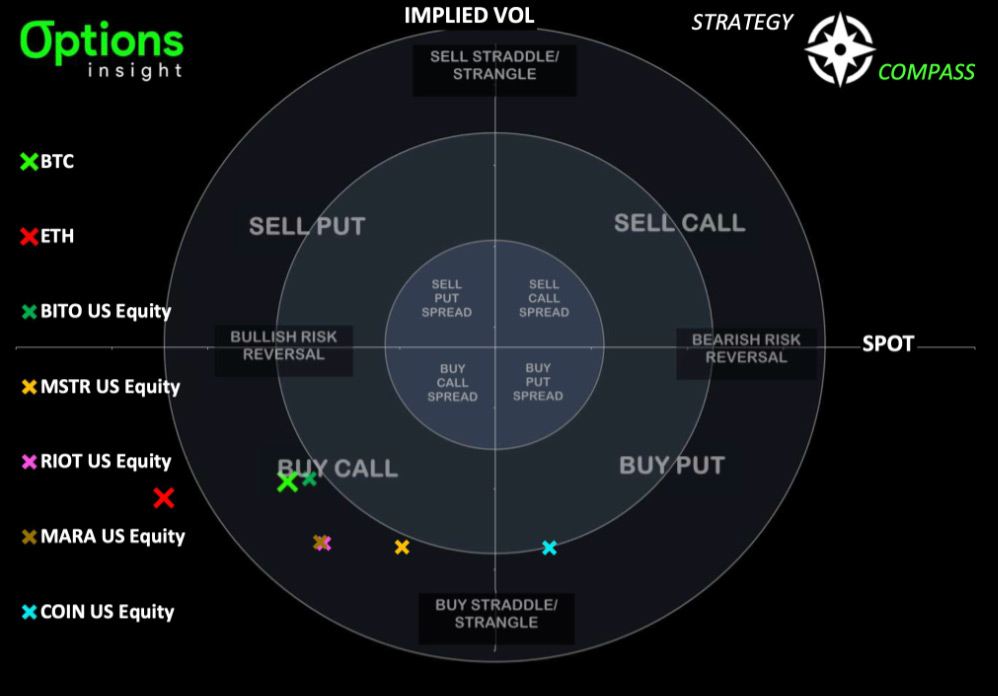

Strategy Compass: Where Does The Opportunity Lie?

Buying calls has been screening well for obvious reasons with low vol levels and spot near the bottom of the range. The issue is that if we get a downside break then the move could easily be another 15-20% lower as 20k on BTC becomes the next major support. We think using a lower DELTA structure like call butterfly on crypto stocks with high vol such as MARA may be an interesting way to get upside exposure and leverage to a rally without committing too much premium at this potential inflection point in markets.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)