With CPI, FOMC meeting minutes, and ETH Shapella wrapping up, most event/narrative-based traders are left looking for the next opportunity. Although there were mixed reviews on the short-term outlook of Shapella, in most measured metrics, it is clear that ETH currently has more opportunity from both a volatility and directional standpoint. Regarding magnitude, the ETH/BTC ratio as of 08:00 UTC, Thursday, has yet to see a level change such as this since March 13th and January 24th, as the previous rallies were predominantly BTC-led.

Much of this move in ETH began around the LDN opening, and the continued momentum has led to a measurable amount of shorts liquidated in ETH, with liquidations over the past 24 hours in ETH outnumbering BTC. Regarding some of the mixed reviews on post-Shapella price action, given the delayed response of the bullish move, I’d lean to speculate that perhaps traders saw post-event that not much adverse price action came through the tape and that a delayed wave of buying came in after a while to digest the implications in both the short and long term.

Regarding the broader macro environment and price action around CPI, there was an initial spike upon the positive data, however a further rally never really materialized in either of the majors. Front-end vols post-CPI fell drastically, with ETH options holding a small bid as the Shapella upgrade became the predominant tradable event. Another supporting factor for this current outperformance in ETH related to Shapella can also be seen in the relative performance of some of the L2s built on ETH, with OP and ARB up 4 and 11 percent, respectively.

ARB in Orange, ETH in Yellow, BTC in Blue, and OP in Purple.

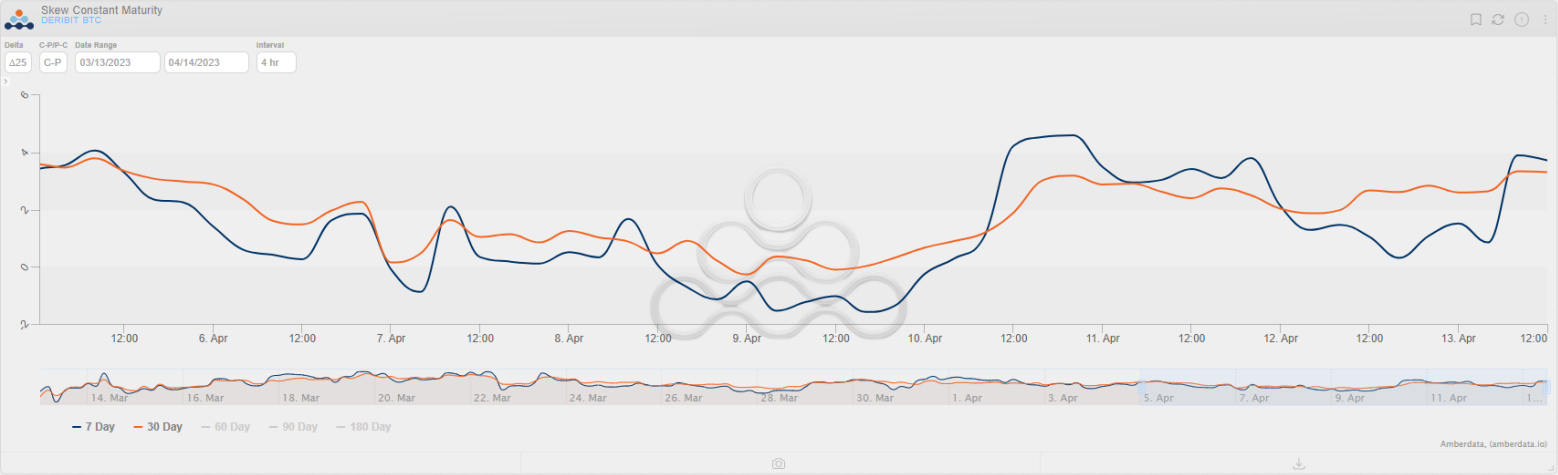

Post-Event Skew Analysis

In BTC, post-CPI saw the development of weekly put skew at a premium, which has since then reversed. The monthly skew has stayed relatively flat, with a mix of flows targeting the end of May and end of April expiries. Today, predominant flows in the European session show a preference for vega in both ETH and BTC with the uncertain events behind us and positive price action for the majors.

With ETH Shapella also being a predominant event that traders had positioned for, it’s no surprise how volatile some of the shorter-term skews from a magnitude perspective are a bit more volatile than BTC. Around Sunday 20:00 UTC, weekly skews were in the gutter with puts at almost a 6 IV premium to calls in the 25 delta range. The weekly skew shows calls now trading at a 6 IV premium. As measured by the 25D risk reversal, the short-term skew is up between 5 and 6 points in the 21APR23 and 28APR23 expiries.

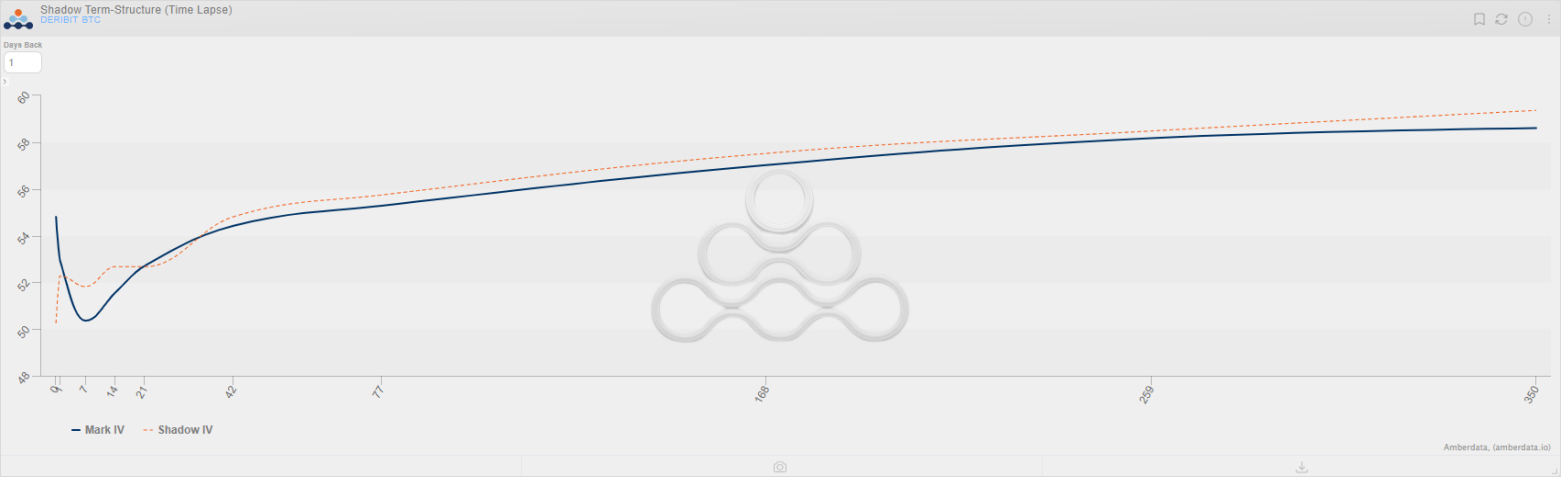

Post-Event Term Structure Analysis

Although realized volatilities have been low, implieds have stayed elevated with this week’s events at the forefront. Compared to a day ago, the BTC term structure in the longer-dated end of the curve has drifted down a few points, while the opposite has been seen in ETH. The ETH term structure shows a strong backwardation, mainly driven by favorable price uncertainty toward the upside on this break above $2,000.

BTC Term Structure 1 Day Ago.

ETH Term Structure 1 Day Ago.

Flows

Heavy demand for upside wings and rolling of strikes have been the predominant flows recently, with small blocks of 29DEC23 upside bought during the European session and strong demand for similar OTM calls in ETH.

For more information and analysis on block flows, check out Paradigm Edge on Telegram.

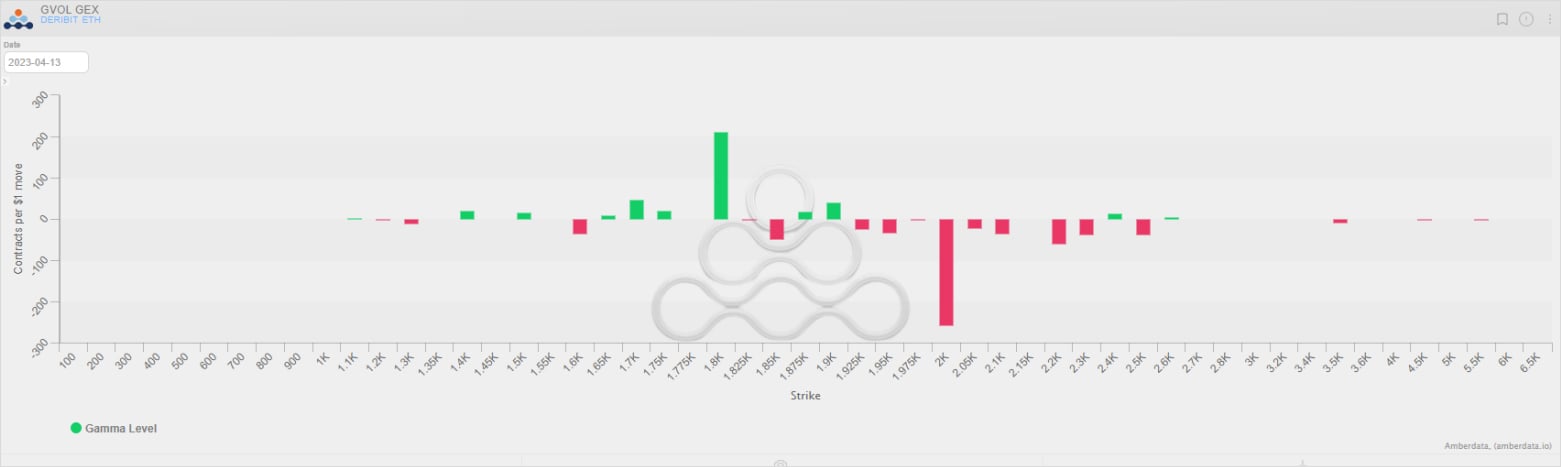

Bonus Chart

A strong bid for near-ATM upside has left dealers short gamma around the $2,000 strike. Although there has undoubtedly been heavy demand across OTC desks that might not be represented, staying cognizant of high-level speculated dealer gamma positioning would suggest that dealer hedging around these levels would be a net volatility add to price action here in ETH. BTC, however, does not show a similar profile. With spot liquidity drying up over the past week, TWAPs execution and outright blocking delta hedges can undoubtedly impact price – especially if we push into liquidation ranges.

ETH Dealer GEX as measured by AmberData.

AUTHOR(S)