In this week’s edition of Quant Analysis, Samneet is commenting on the last weeks opportunities post-ETH launch.

Despite ETH’s lackluster post-ETF launch performance last week, trading volatility itself offered a profitable opportunity for event-driven traders to capitalize on a surge in short-term ETH realized vol.

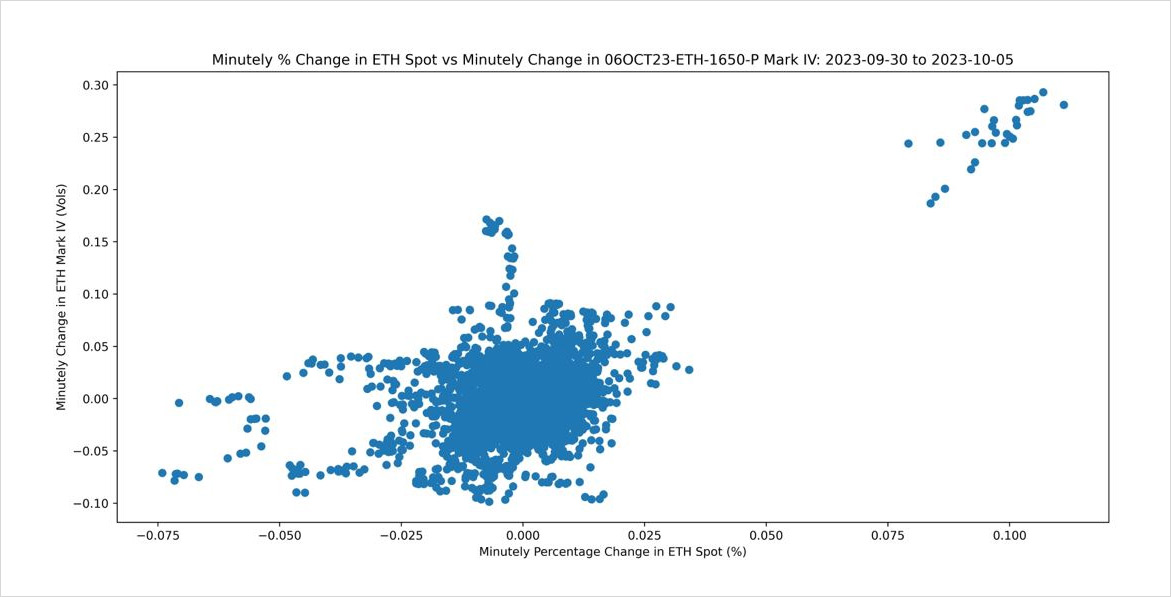

2) Here’s the PNL from systematically trading a $1650 ETH 06OCT23 straddle since September 30th into the ETF event on October 2nd morning while maintaining flat deltas hourly. Notice the PNL surging around the 6 PM EST CME futures opening on the evening of October 1st.

3) This highlights the lesson that, even though volatility may peak before a significant event, holding long-vol positions into these events can still be profitable despite the post-event dampening of volatility.

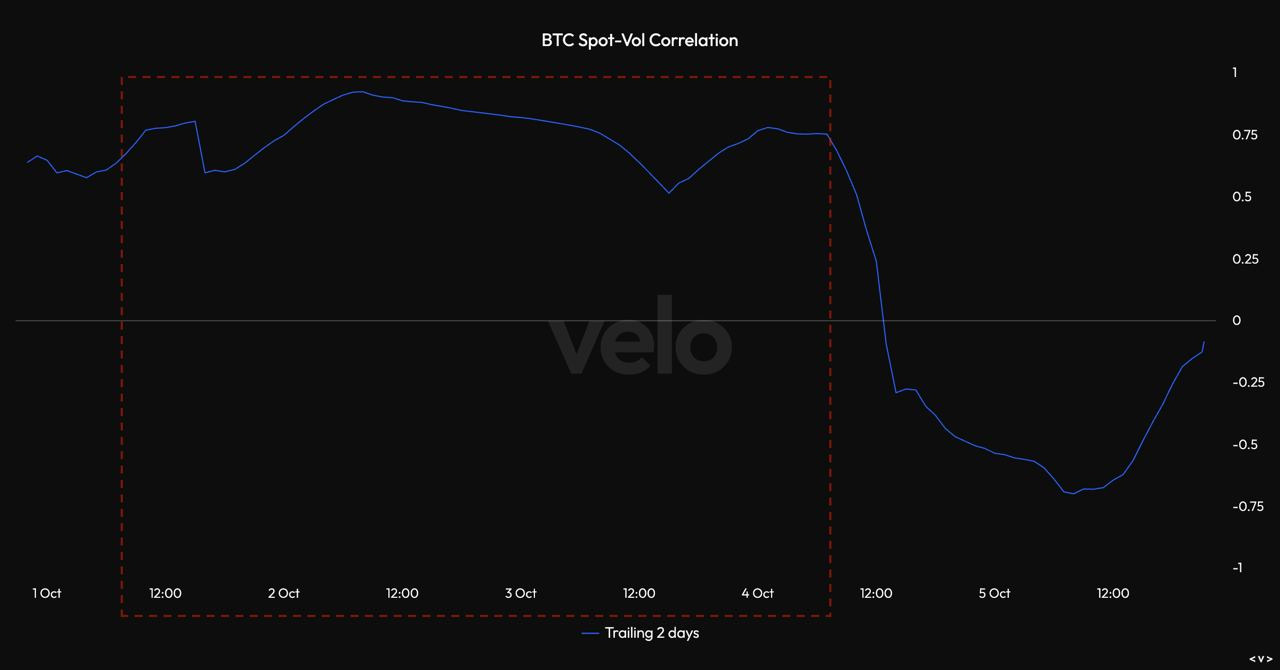

4) Furthermore, analyzing the spot-vol correlation over these days is insightful. It’s fascinating to observe a positive spot-vol relationship evolving: spot goes up / vol goes up <> spot goes down / vol goes down. This aligns with our findings on Velo Data.

View Twitter/X thread.

AUTHOR(S)