On May 19th, 2021, we saw an extreme price drop in Bitcoin. The day posted a high of $43.5k and a low of $28.5k in the BTC perpetual contract. This is an extreme move, even for Bitcoin.

It’s hard, if not impossible, to know the fundamental catalyst for this drop ahead of time. In this case, Beijing banned banks and payment firms from providing services related to crypto-currency transactions. This was a dire headline coming off of an already difficult week, as Tesla reported no longer accepting Bitcoin payments, due to the electricity consumption of Bitcoin’s Proof-of-Work mining.

Although it’s nearly impossible to know how these events will unfold ahead of time, when dealing with social structures (such as markets), the wisdom of crowds ensures that almost always, someone knows something.

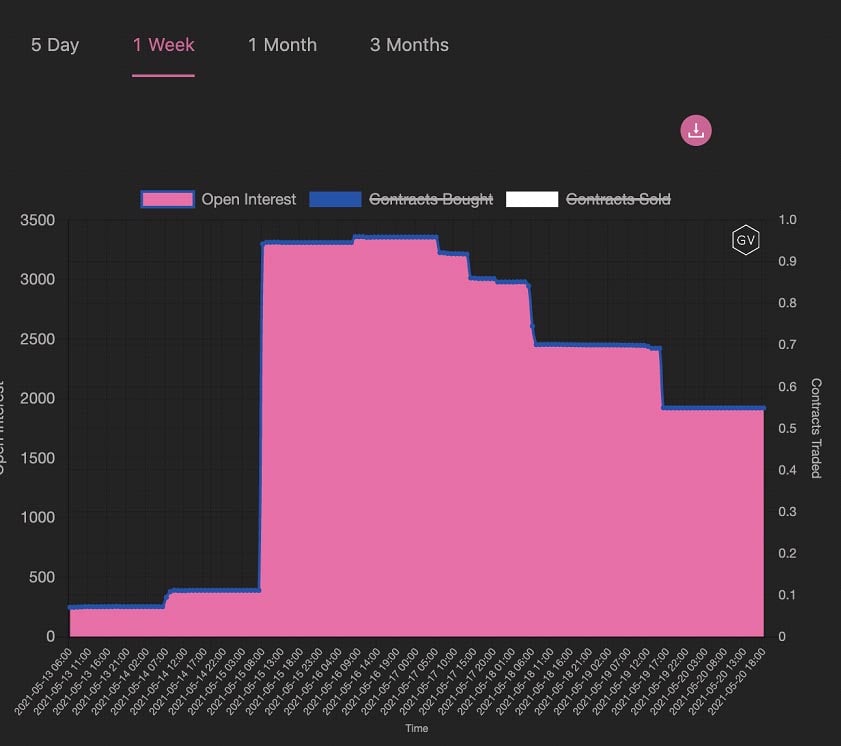

In this case, Bitcoin options and related derivatives did have some insights to provide. For example, on 5/14 a trader bought large amounts of short dated $46k puts on Bitcoin through block trades executed on Paradigm. These options expired on 5/21 and represented a near 800% increase in open interest for this instrument.

This type of bet requires perfect timing because these options are very short-lived.

Monday, May 17th, showed a couple more signs worth taking note of in the derivatives markets. Firstly, although Bitcoin did manage the drop more on Monday, reaching a low of $42k, the derivative markets saw outsized responses.

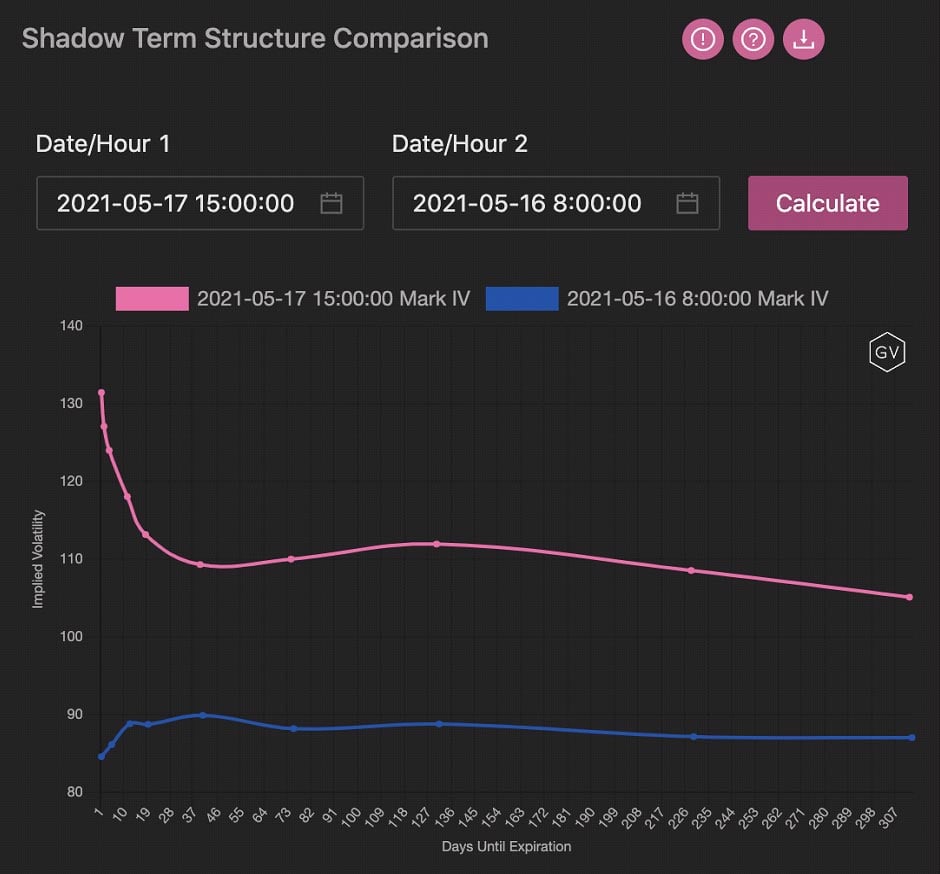

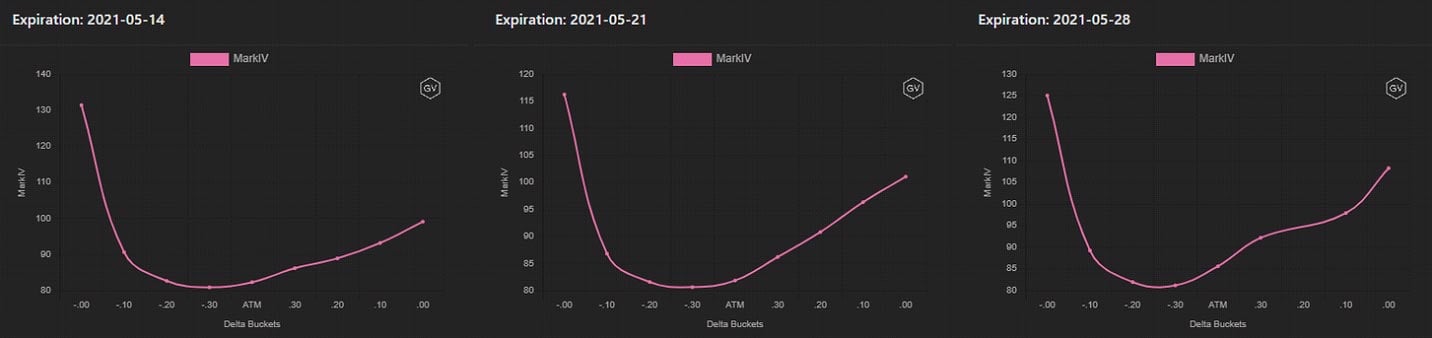

Options liquidations on Deribit were the highest seen all month. Notably, long-dated options were being puked, causing long-dated implied-volatility to move much higher.

This type of parallel shift higher in the implied-volatility curve is extremely rare. This is because implied-volatility will reflect the average volatility over the option’s lifespan. Having implied-volatility move so drastically higher from 5/16 to 5/17 for options that have over 300 days-until-expiration reflects a substantial change in the expectation of volatility over the next 300 days. This is almost unheard of.

Futures spreads are another derivative that’s been gaining a ton of traction. Professional traders have been using Paradigm to block-trade futures spreads and synthetic futures spreads, using options, as the futures cash-and-carry trade grows.

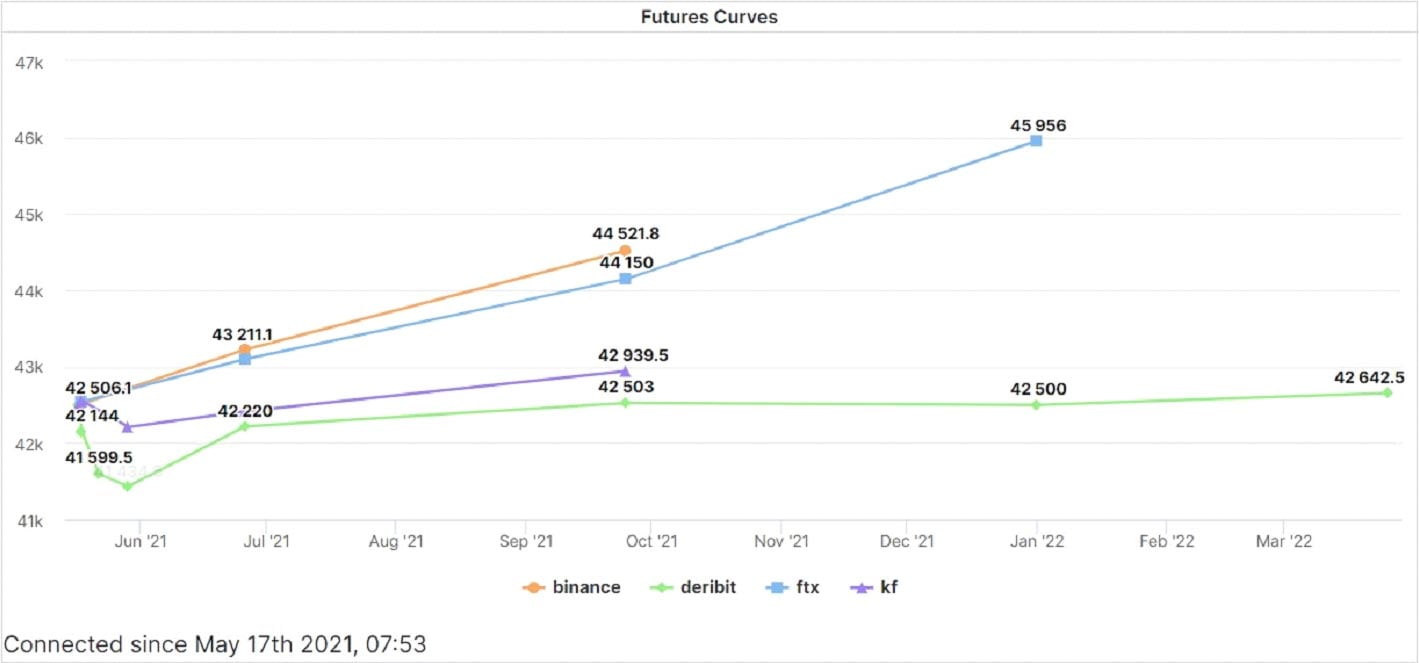

Julien Sterz of Orca traders (Twitter @JSterz) pointed out an interesting differential between futures prices being traded on Deribit versus other exchanges, such as Binance and FTX.

This type of differential exists on Deribit because Deribit is the largest crypto options exchange in the world, and traders are short gamma as crypto prices are dropping.

What this means in plain English, is that traders are hedging their options books by selling futures as the market drops, despite futures trading lower on Deribit than other venues; traders MUST hedge their books, they have no choice… Something bigger is brewing and traders aren’t going to stop hedging, despite the price discrepancies.

Those unwilling to keep a negative-gamma-position open could chose to buy back their options and close the position, simultaneously driving implied volatility higher. It’s no coincidence that on 5/17, Deribit’s DVol index hit the highest reading on record, nearly 160 for 30-day implied volatility.

In the end, someone knew something, or traders had a gut feeling that something was coming, because on 5/19, Bitcoin prices finally broke lower by a significant amount. Bitcoin dropped as low as $28.5k from around $43k the day before… That’s around a 35% drop.

This is an extremely big move, considering that Bitcoin is now (or was) a $1 trillion dollar asset. Volatility like this for assets with mega market caps is atypical to say the least. Many traders were liquidated and caught off guard and certain market responses are interesting to note.

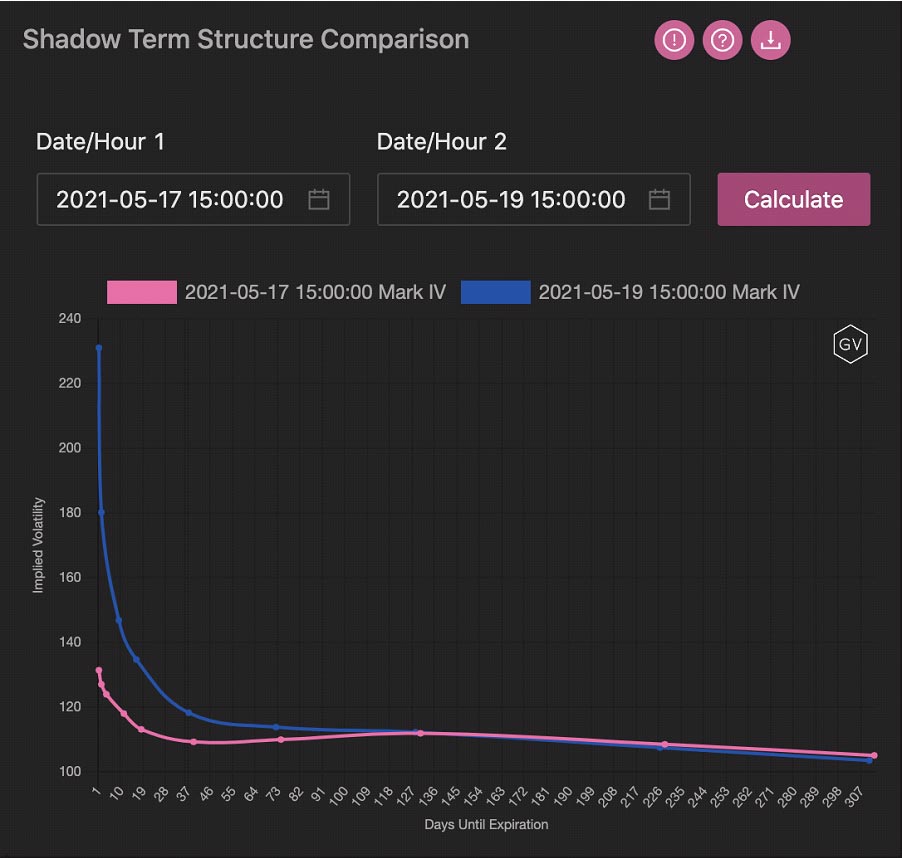

Note that looking at the shadow term structure found on G-Vol.io, the long-dated option volatility remains nearly identical on 5/19, versus 5/17.

The big 35% Bitcoin price drop had almost no effect on long dated volatility, only short-dated options saw any effect from the price drop.

This means that long-dated option volatility had already been priced-in on 5/19, two days before 5/19 occurred.

Interesting indeed!

Is it possible to predict the future? The short answer is no. It’s basically impossible to consistently do. But there are hidden tells in the market that can be observed to gauge market sentiment and there are also dynamics that sometimes provide asymmetric opportunities.

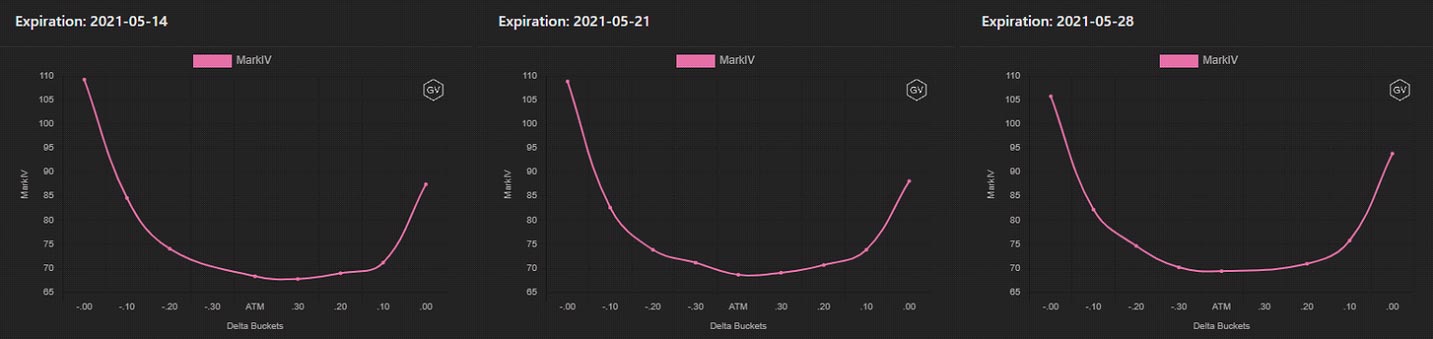

For example, in our recent weekly option newsletters, we noted that Bitcoin couldn’t shake the negative option skew for short-dated options despite Ethereum, a highly correlated asset, hitting new all-time highs and pricing very positive skew (calls are more expensive than similar delta puts).

Option traders had an insatiable appetite to buy Bitcoin puts, despite whatever else the crypto market was doing.

May 2nd Bitcoin Skews

May 2nd Ethereum Skews

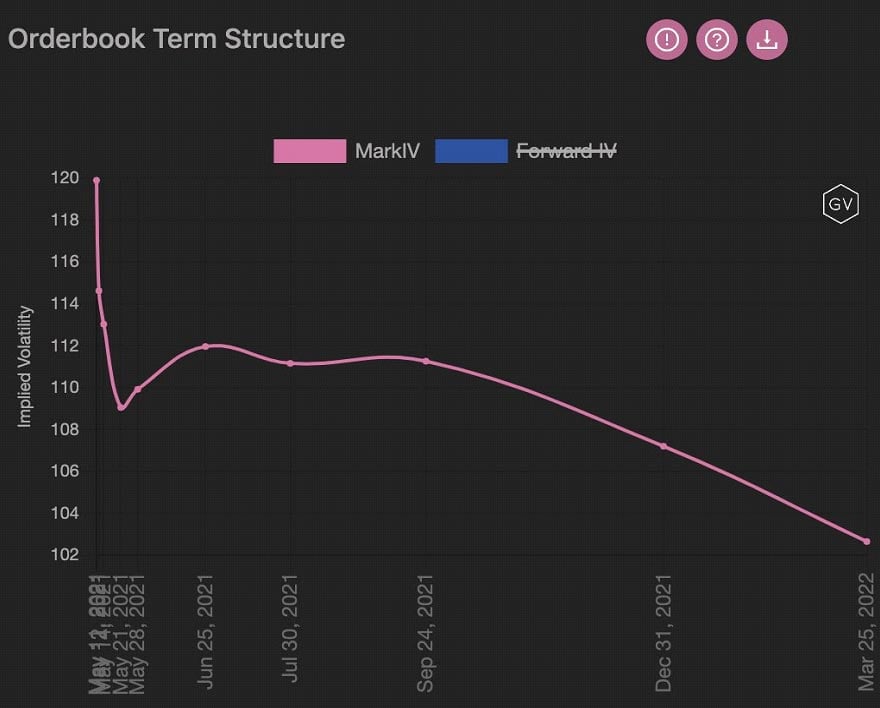

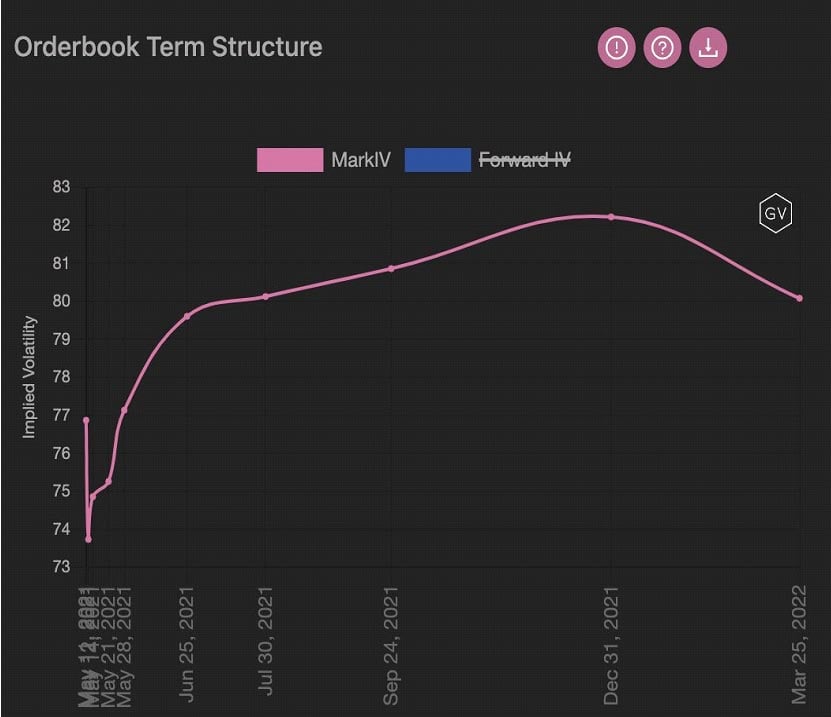

Another divergence, noted on our twitter (@genesisvol), was the BTC and ETH implied volatility Term structures on May 10th, 2021.

If prices kept rallying, this divergence made sense since ETH was hitting new all-time highs and BTC merely sat flat… But in the case of a sell-off, could BTC actually lead the move lower with high velocity? If so, traders could do a relative volatility trade by financing BTC put protection buying by selling ETH puts.

This type of trade could provide asymmetric opportunity.

All these data points represent past opportunities, so let me leave you with this last sentiment reading, for something hopefully coming in the future.

The relationship of BTC versus ETH.

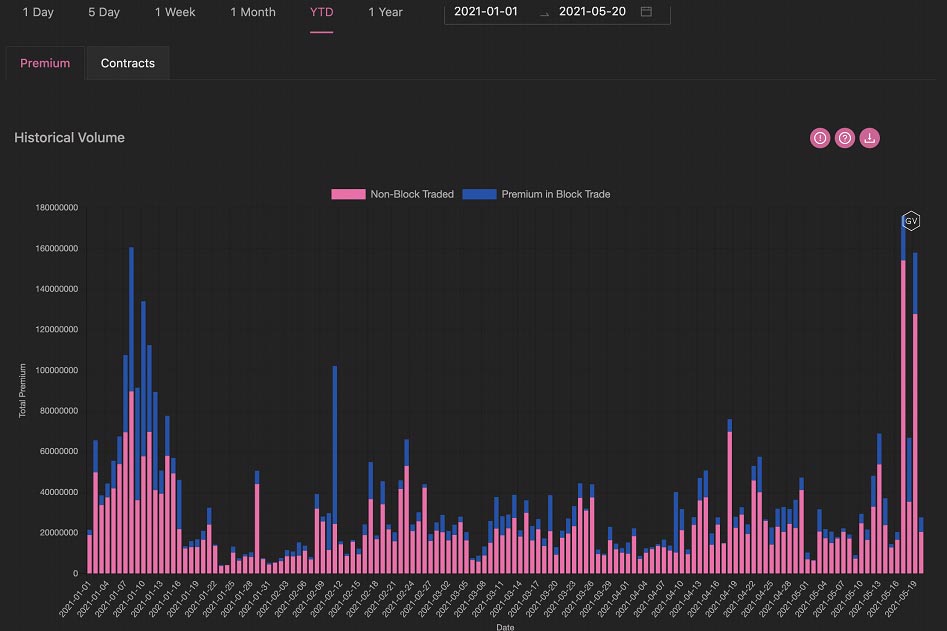

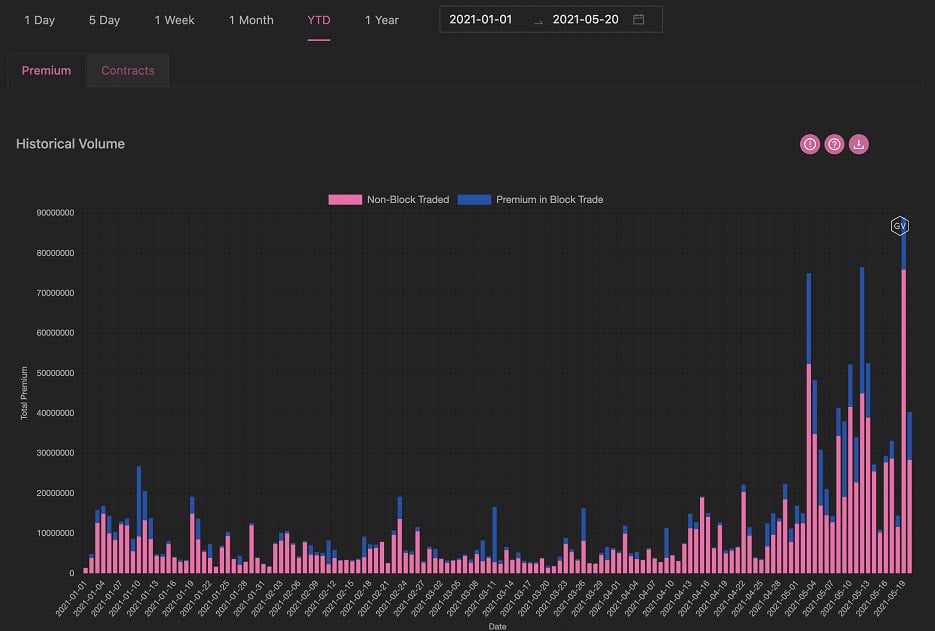

Look at the growth in option premiums traded YTD between the two assets…

BTC Option Premiums Traded YTD

ETH Option Premiums Traded YTD

Could monitoring the growth rates of derivative instruments provide context for overall sentiment between the two assets? We will soon find out.

AUTHOR(S)