Crypto Recovers As Geopolitical Risk Fades

BTC’s recent halving has slashed its annual inflation to 0.85%. After this much-anticipated event, the spot price is back above $66k as fears of war in the Middle East escalating fade into the background.

Historically, after halvings, BTC prices tend to consolidate followed by surges within 2-3 months. The technicals keep supporting this view as the base case.

Potential risks going forward include fresh geopolitical tensions and macro dynamics. However, ongoing trends like increased ETF interest and broader adoption suggest a sustained upward trajectory for Bitcoin.

Realized Vol Rolling Over

Recently pumped realised vols are starting to rollover. BTC 10d realized is down to the mid-70s and ETH in the mid-80s. Short-dated implied vol has tapered off too with more reductions expected up to the 70k level. Once above, the price up/vol up correlation may kick in again. Both assets remain deeply in negative carry. Mega-cap tech earnings will be the main focus to determine risk sentiment.

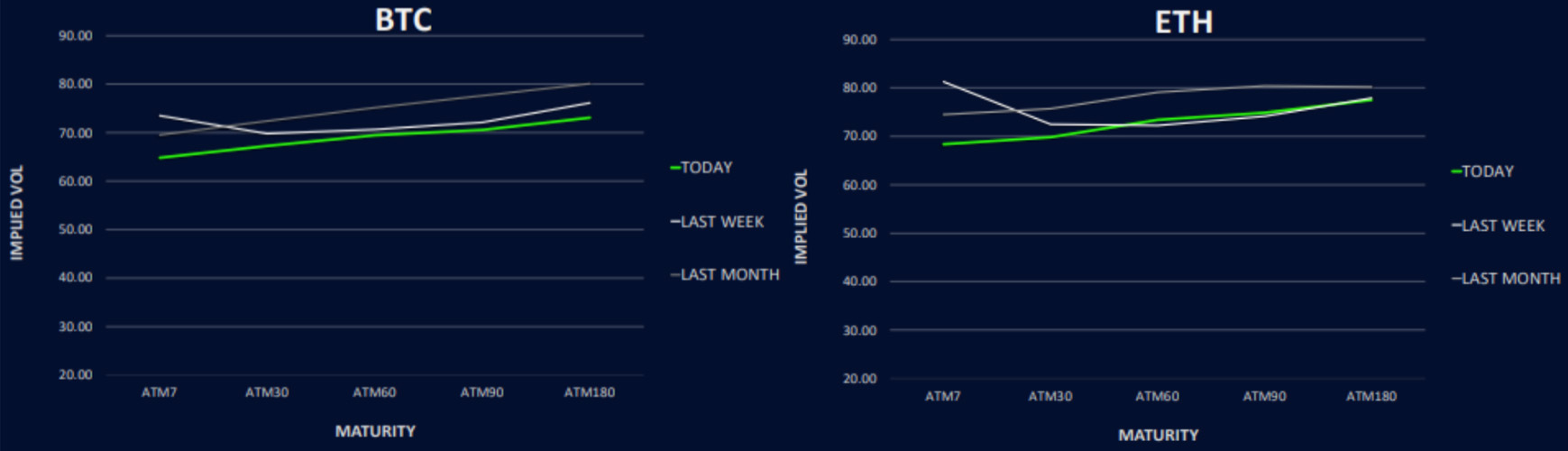

Term Structures Back to Contango

Both BTC and ETH term structures reverted to contango post halving, with front-end expiries notably declining as we anticipated. The shift in skew suggests a more balanced outlook. On ETH, long-end vol remains steady, with a slight put premium persisting in the front-end out to May 24, while long-end call premium still present.

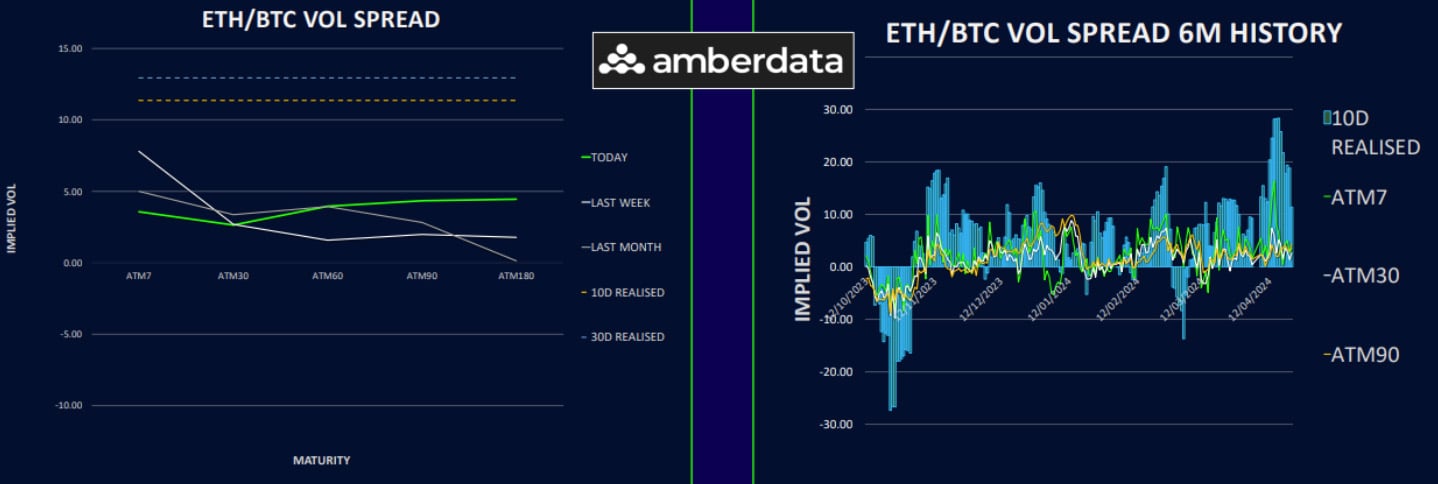

Owning Mid-Term ETH Vs BTC Favoured

ETH/BTC volatility spreads widen for medium-term expiries but retract in the short term due to decreased realized volatility. Medium-term ETH positions offer better value, especially in May-Jun24 expiries. The outlook anticipates a narrowing spread in the short term on BTC’s outperformance. We are still waiting for lower levels in the spread to get long ETH calls for later this year.

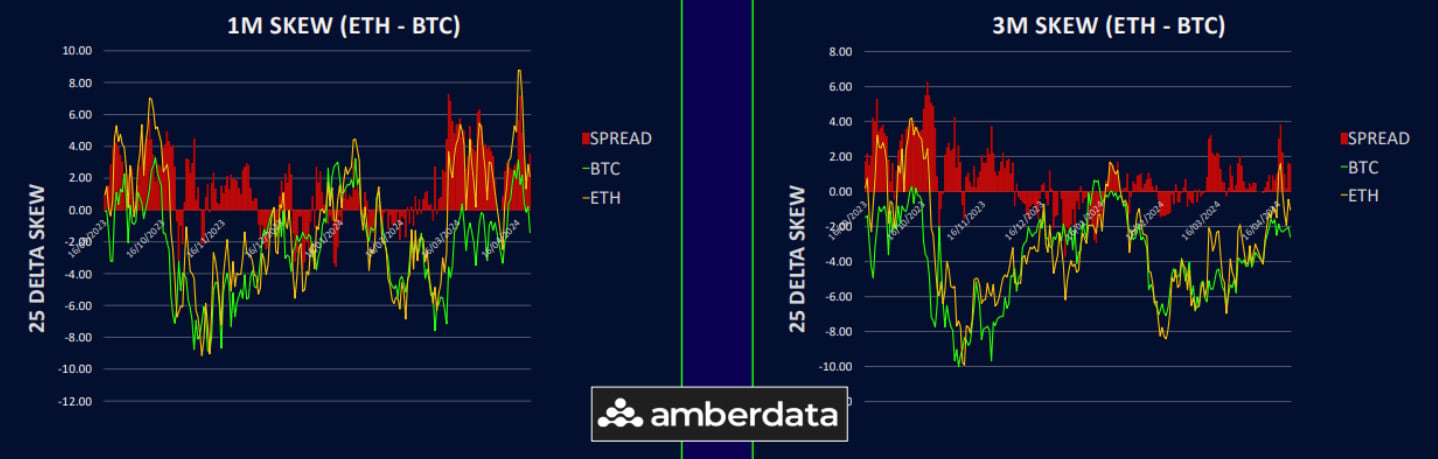

More Neutral Skew

Recent market rebounds neutralised put skew in BTC and ETH expiries in the front-end. Persistent long-dated call skew signals continued bullish sentiment for both assets. Call ratios were an effective approach amid declining implied vol, which is proving to be the case so far.

Option Flows And Dealer Gamma Positioning

BTC option volumes rose slightly, with active put protection buying in the 60k-55k zone as well as April and May calls up to 70k being bought to play post-halving upside. ETH volumes remained steady. BTC dealer gamma gets shorter, potentially setting the stage for a gamma squeeze, while ETH dealer gamma remains stable with slight long positions. Market dynamics could shift based on upcoming catalysts, especially on the downside where ETH positioning would get shorter around 3000.

Strategy Compass: Where Does The Opportunity Lie?

Despite volatility carry showing negative, which suggests owning gamma, we think that with the market in the middle of the range (60k-72k on BTC) it is better not to bleed too much time decay by being long options. Short volatility structures such as ratio spreads and ladder continue to be the better way to express directional views right now. This may change if we break the range, but macro will go a little quiet into month-end and vol could overshoot on the downside while we wait for a break in either direction. Iron condors to play the continuation of the range also can make some sense, although be quick to cut them on a break.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)