Weak Phase as ETF Narrative Dies Down

The market is currently weak, with both majors (BTC and ETH), and the broader altcoin bleeding. The break below BTC’s 40k support, a crucial level during the ETF run-up, signals a potential decline to 38k or even 35k from a technical standpoint.

The lacklustre combined inflows into spot BTC ETFs, despite high trading volumes, have dampened BTC sentiment since the ETF launches. This is partly due to a shift from older crypto products and stocks into new ETFs. Actions by Grayscale’s long-term holders and FTX’s significant sale of Grayscale’s Bitcoin ETF have impacted spot BTC ETF inflows.

However, with FTX’s sales likely to be concluded, selling pressure might lessen. We anticipate gradual increased institutional adoption through ETFs, though Greyscale currently pressures BTC.

In the medium term, ETH is expected to outperform BTC, driven by potential ETH Spot ETF approvals, the EIP4844 upgrade, and restaking opportunities. Additionally, the upcoming Bitcoin halving in April, reducing miner supply, should positively impact Bitcoin’s long-term value.

Vols Have the Typical Reset

Last week, the excitement around the BTC ETF cooled, causing a significant drop in crypto volatility, with BTC and ETH returning to the 40 vols range. As BTC and ETH break through key levels of 40k and 2,400, respectively, volatility is slightly increasing.

Implied volatilities had the ETF reset but have continued to decrease steadily in BTC, while ETH experienced a larger decline due to substantial sales of upside calls.

Volatility carry is modestly positive, aligning with typical options market behaviour as implied vol led on the way down. Given the critical 40k level for BTC and dealer positions, selling BTC gamma currently seems unappealing, especially with the month-end expiry approaching.

Term Structures Shifting Lower

The BTC term structure is lowering slightly but remains backwardated at the front end. Weekly volatility is stable due to demand for 26Jan puts. The mid-curve is more affected, with a 5 vol decrease, while the long end dropped by about 2.5 points. There’s no significant ‘kink’ in the April expiry due to the BTC halving as it’s not a one-day shock ‘event’.

ETH’s term structure is experiencing similar but more pronounced changes than BTC. The 26Jan gamma bucket remained stable despite ETH falling below 2,400, with significant call selling impacting mid-curve volatility by around 10 vols. Long-term volatility premium in ETH is less severe compared to last week.

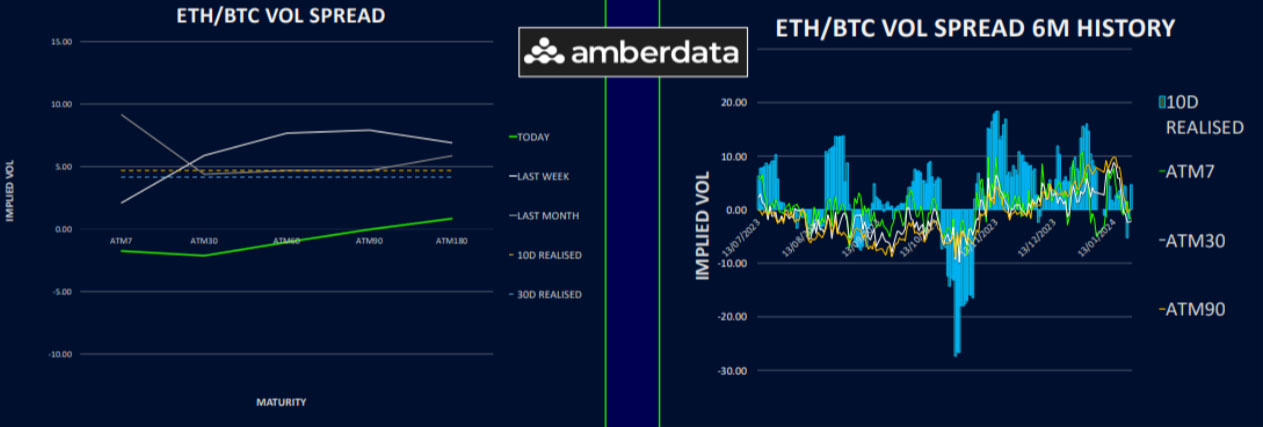

ETH/BTC Vol Spread Collapses

This week saw a significant narrowing of the ETH/BTC volatility spread, returning to nearly flat across the curve. This is primarily due to excessive ETH overwriting flows that the market couldn’t fully absorb. ETH continues to maintain a 5 vol advantage in realized volatility, making volatility spread investments attractive at current levels.

The ETH/BTC spot spread has begun correcting from its recent high but remains above pre-ETF approval support levels. Although this spread is worth considering for medium-term investments, it may experience volatility. For those seeking ETH exposure, call switches are advisable, especially longer-dated and far out-of-the-money options, to minimize exposure to short-term fluctuations.

Sudden Rush for ETH Skew

This week, the BTC skew term structure remained stable, with a continued presence of put premium in the front end and call premium in the long end.

ETH skew, however, saw more dramatic movements. The weekly skew for ETH expanded to a 10 vol put premium, extending put bias to April. Call premiums still persist in the long end though.

The sudden increase in ETH skew reflects the influence of call selling flows and the break of key technical support at 2400, pushing prices towards 2200.

A critical level for ETH is 2150; breaching this could lead to further declines. Recent market movements suggest a cautious short-term outlook for ETH, with increasing demand for hedges.

Option Flows And Dealer Gamma Positioning

BTC options volumes decreased by 60% as excitement around the ETF waned and spot prices fell below 40k. This led to the selling of long calls and increased buying of protective puts. Following the volatility reset, interest in 23Feb 44k straddles increased in anticipation of more volatility if downside supports were broken.

ETH saw a 20% reduction in volumes, with significant overwriting flows and selling of VEGA in March and April on 2900 calls. Despite expectations of ETH ETF approvals, there was also selling in the 28Jun24 strangles.

BTC dealer gamma positioning remained negative, indicating dynamic market activity, especially with the upcoming 26Jan expiry. ETH dealer gamma varied but closed higher due to a mix of overwriting and weekly gamma selling, balancing out some buying of January 2600 calls. In a rally, dealers are expected to be short gamma but long VEGA.

Strategy Compass: Where Does The Opportunity Lie?

We think picking up longer dated ETH upside looks attractive here for fresh long exposure and this could be financed by selling BTC upside. We struggle to see how BTC outperforms ETH if crypto markets rally in response to the end of the rates cycle and more abundant global liquidity.

We still maintain some hedges on BTC, which will enable us to add risk, should we be lucky enough to see levels near 36k on a positioning flush out.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)