BTC and ETH Unfazed By External Events

Bitcoin (BTC) and Ethereum (ETH) have remained rather unfazed by major events like the recent notorious hacking in the Curve Finance system. Besides, the usual connection between these cryptocurrencies and traditional factors such as the US Dollar (USD) and equity market has nearly vanished. It means they are truly decoupled from external influences that once were there.

This is clearly translated in the long-term volatility of Bitcoin and Ethereum, which has reached multi- year lows, with 180-day volatility at 44% for BTC and 42.5% for ETH.

While on tradefi, things like the hype around AI or softer inflation have made a difference for equities. BTC and ETH are more focused on idiosyncratic aspects like the Blackrock spot ETF ruling, Bitcoin Halving, or the regulatory risks (for ETH). However, the hints we are getting from the options market seem to be optimistic, as there’s an expectation that there could be a big price rise, especially in BTC, by the end of the year, as shown by the steep volatility curve and consistent call skew.

However, we shouldn’t completely ignore the broader economic picture this week. Traders should keep an eye on Friday’s Non-Farm Payroll (NFP) number in the US, since the labour market is doing well, affirming the soft-landing rhetoric, and this could stir up some needed volatility in the market.

Lastly, do keep a watchful eye on the situation with the Curve hacking. If it worsens, it could have a significant short-term impact, especially concerning the $CRV token and platforms like Aave. BTC and ETH have been robust so far, but dramatic changes could affect them.

Volatility As Quiet As It Gets

Cryptocurrency volatility has continued to decrease, to the extreme of now being less volatile than several commodities and some equity markets, such as China.

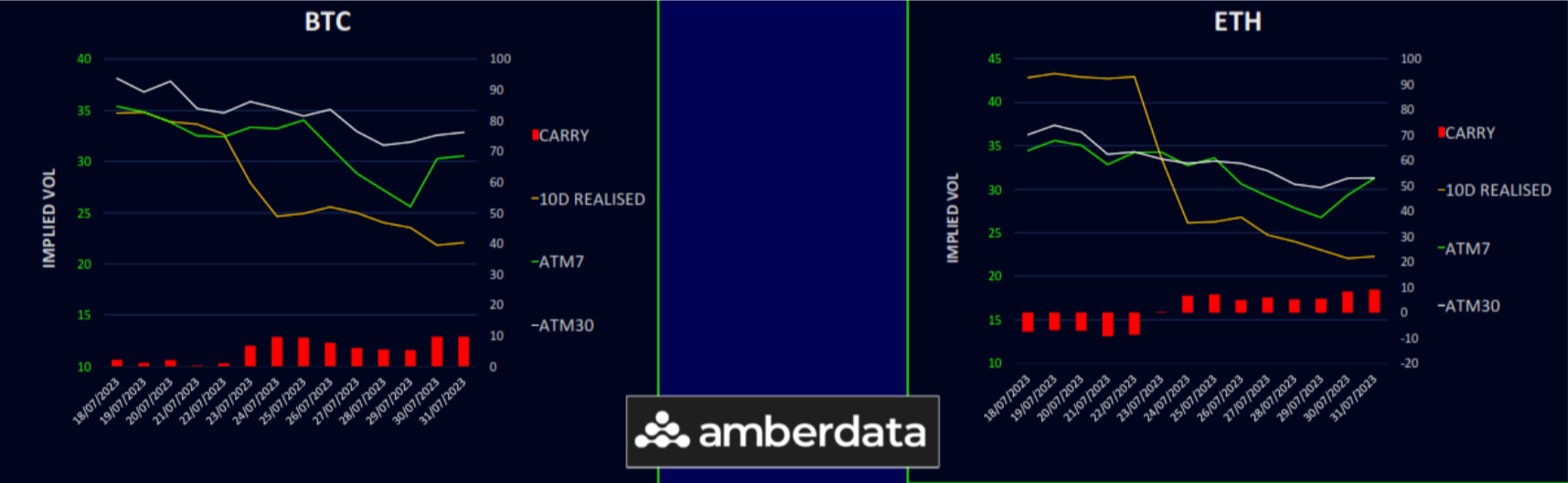

The implied volatility dipped into the weekend after July’s expiry but has rebounded following the CRV news. This increase has boosted volatility carry to around 10 vols, providing good potential for those who sell gamma to earn time decay, a strategy that has been very fruitful this year.

With the upcoming ISM and Non-Farm Payroll (NFP) reports this week, there might be more fluctuations in the US dollar, but the crypto markets seem to be indifferent to such macroeconomic changes right now. It would likely need a significant change in sentiment to really affect prices.

So, we could be looking at a calm summer in the crypto space until news regarding ETF approvals sparks interest again and potentially brings in the promised funds from big institutional investors.

Term Structure: Getting Steeper

BTC’s term structure (a way to look at volatility over different time periods) is moving lower. The worst hit has been in the August/September period around 3 vols, but it’s affecting the whole curve. Because the structure is so steep, if vols go down, the back-end can’t escape the pressure to sell.

The supply of vol continues to come in as the realised vols are close to the lowest they’ve ever been.

ETH’s term structure hasn’t been affected as much as Bitcoin’s. The front end of the curve has seen a sudden increase in value (an overnight bid), mostly due to worries about CRV liquidation affecting Alts. However, the back-end vols are still heavy, and that could mean long-term value.

Relative Value: ETH Vol Remains Historically Inexpensive

The volatility spread between Ethereum (ETH) and Bitcoin (BTC) is slightly increasing, mainly influenced by the front-end vols after the CRV news encouraged some bids for ETH gamma. Over the next 6-9 months, the market expects the bullish factors to primarily come from BTC, so long-term ETH volatility remains lower than BTC’s.

Historically, it’s rare for ETH to be this inexpensive compared to BTC. Traders who expect things to return to normal (mean reversion players) see this as an attractive point to enter the market.

Volatility experts may be using this situation to trade in a sophisticated way. They’re able to be gamma neutral, but at the same time, they can use forward volatility spreads to own the VEGA spread further along the curve. Their goal is to capitalize on an eventual return to a volatility level of 10 or more without being exposed to large realised moves in the near-term that may favour BTC.

In simpler terms, there’s a rare change in the volatility relationship between ETH and BTC that’s creating opportunities for seasoned traders to position themselves for potential gains out into 2024.

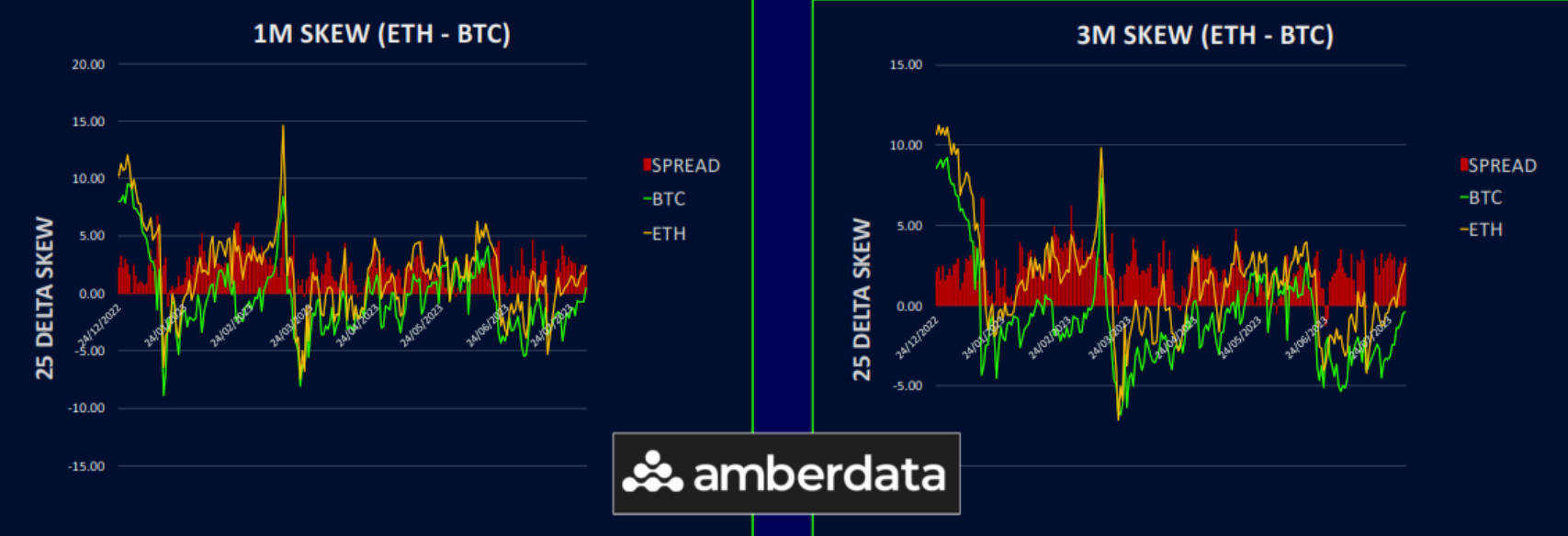

Skew: Optimism Fading Slightly

The Bitcoin (BTC) skew (difference in implied volatility between put and call options) is shifting more towards put premium, meaning that the market is seeing more value in options that bet on price declines. Even the 3-month part of the curve is trading close to flat, and the 6-month and longer portion, although still favouring call premium, has halved to a 2.5 vol call premium in the last week.

Ethereum’s (ETH) skew tells a similar story, with a strong 4.5 vol put premium at the front end, and even the back end slightly leaning towards puts.

The market has generally lost its optimism about rising prices, and the very low realised volatility is pulling down any volatility premiums that can be found even on the tails of the surface.

The situation can change quickly if the spot price goes up, but as of now, with BTC’s price capped at 29500, call options (which bet on price increases) are becoming less attractive.

In simple terms, the market is showing more interest in options that profit if prices fall, indicating a shift in sentiment away from bullish expectations at least in the short-term.

Option Flows And Dealer Gamma Positioning

Options trading for Bitcoin (BTC) has stabilised, with the lower volatility. Traders have been utilising the decline in spot price and increase in put skew to take long positions through bullish risk reversals set for 29th September. There were also outright calls bought in August and October.

Ethereum (ETH) options saw increased activity, with a focus on call options. Various strategies were executed, including the buying of bullish risk reversals and long-dated call spreads.

BTC dealer gamma has been very close to zero, meaning dealers’ hedging requirements have remained stable. However, there are some short upside positions that could flip if BTC rallies above 30k, although no significant gamma impact is expected at current spot levels near 29k.

ETH gamma positioning is not as strongly biased towards long after July’s expiry but is still net long. This is largely due to dealers being loaded up with call options up to a price of 2000, which may act as resistance in a rally.

Strategy Compass: Where Does The Opportunity Lie?

We think the bullish risk reversal strategies being employed to buy the dips are sensible, especially further out the curve around 3-month expiry. These structures can be risky if traded naked, but for investors who are underweight and waiting for dips, they can offer a nice way to participate in upside, should it come earlier than anticipated.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)