BTC and ETH Stir Amid US Debt Ceiling Developments

After a spell of uneventful movements last week, the curtain for BTC and ETH has raised slightly, following the more than likely resolution of the US political drama on the principles of a 2y debt ceiling extension. Still, the House and Senate need to nod their heads in agreement.

While it remains to be seen, this political development has the potential to inject greater and more sustainable volatility. Bitcoin and Ethereum have been awakened by a surge in their realized volatility, bringing a pulse back to the market that had remained extremely flat for quite some time.

Interestingly, the digital assets don’t seem bothered by the strength of the USD as of late, a point that could be interpreted as a display of their inherent tenacity.

Technicals in BTC also show that after multiple failures to break below the local support at 26.5k, the price finally made a statement of intent by breaching a key resistance overhead at 27.5k, although it has slipped back below overnight.

Nonetheless, we must be mindful of the potential ripple effects of a US debt ceiling deal. If the US Congress agrees on the debt ceiling extension until 2025, the Treasury will need to hastily bolster its TGA cash reserves, possibly causing a liquidity shortage.

Recalling the debt ceiling deal of 2021, this situation has, in the past, put a damper on equities, even if the current stock market remains technically bullish and cryptos largely decoupled from tradefi.

This week, all eyes are on the resolution of the US debt ceiling issue, the start of the Treasury's efforts to refill the TGA, and key economic data releases (US ISM data and non-farm payrolls).

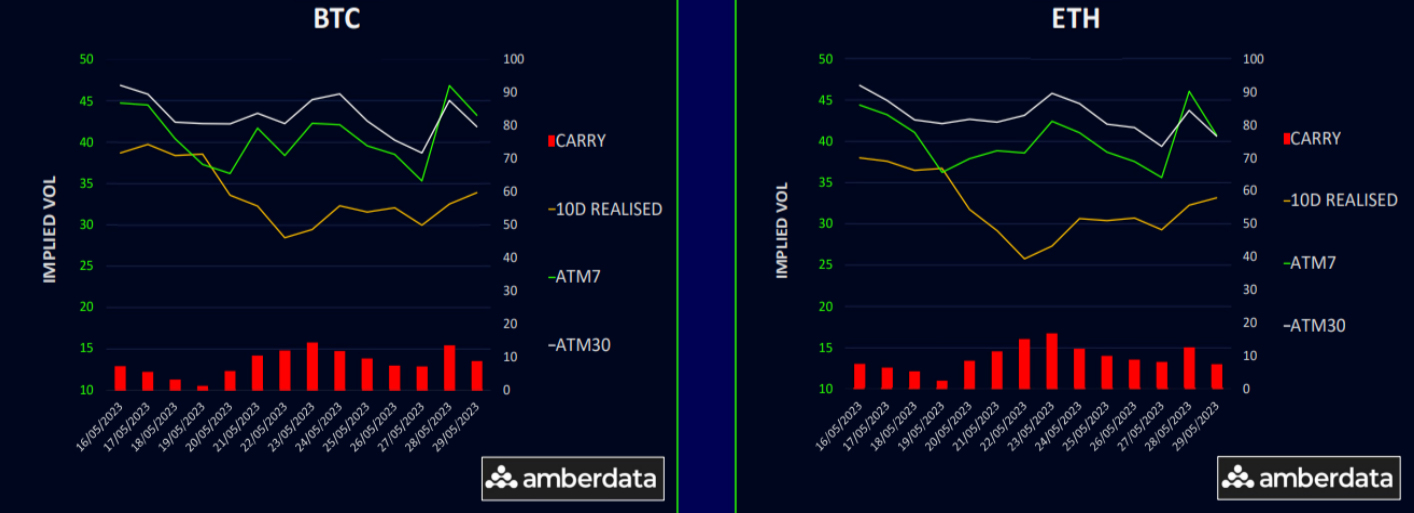

Short-Dated Implied Vols Gain Some Vitality

As realized volatility traded at its lowest for the year, a debt ceiling agreement over the weekend instigated a noteworthy increase of over 4% in the large caps, reigniting short-dated volatility.

Last week, implied volatilities carried a slight premium over realized ones, proving mildly advantageous for gamma sellers. The burst of activity on Saturday saw a 10 vol increase in the weekly implied vol. However, it’s already losing steam.

The market has regained some vitality, and with the hefty 27th May crypto options expiry behind us, there’s scope for more movement.

It’s worth noting that the relative resilience of crypto over the weekend might hearten the bulls in the short run. Nonetheless, we mustn’t overlook the potential liquidity drain that is likely on the horizon.

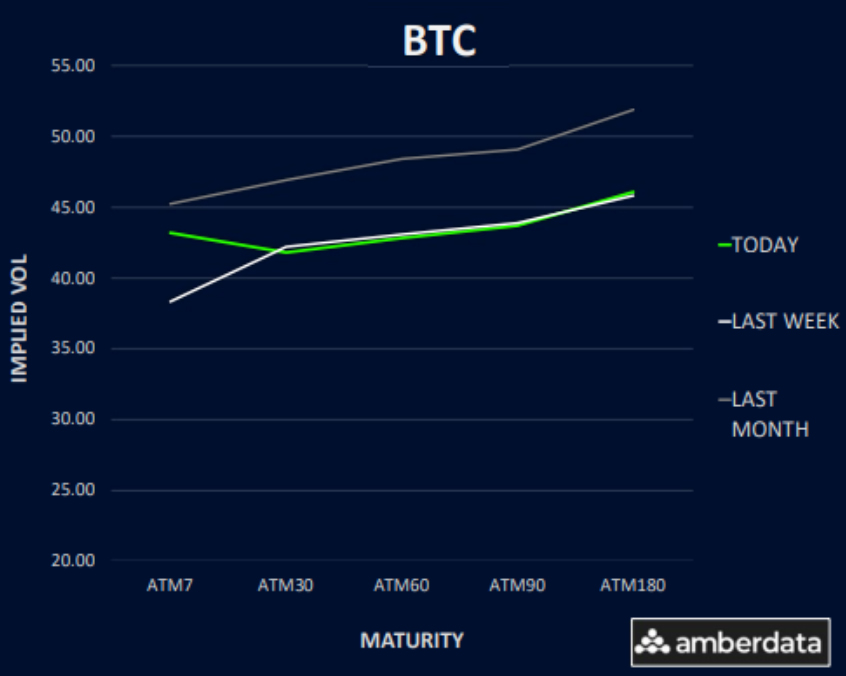

Term Structure Flattens In The Front End

Both Bitcoin (BTC) and Ethereum (ETH) reacted to the recent debt ceiling agreement by exhibiting a degree of flattening at the front end of their term structures.

Ethereum, under the weight of persistent selling pressure, saw its volatility spread over Bitcoin reduced by a good 2-3 vols. Although the Ethereum curve is steeper, traders appear to keep the intent on maintaining the spread above zero in the six-month and longer segments. However, the front end (gamma buckets) simply can’t substantiate this given the current realized volatility.

The removal of a considerable 1800 strike pin from the 27th May Ethereum expiry may provide the needed catalyst for realized volatilities to reach a normal state. Consequently, Ethereum could reclaim its position of heightened volatility. This is yet to be confirmed, but given the recent dulling of gold’s luster, perhaps Bitcoin’s dominance could also ease a bit.

Skew Shifts Towards Call Premium Territory

Bitcoin’s (BTC) skew took a brief turn back towards a call premium as markets perked up on Saturday. Since then, we’ve seen a retracement back towards put, particularly in the weekly skew, which remains highly sensitive to spot prices.

The Ethereum (ETH) skew, albeit remaining in put premium, had shrunk to approximately one vol as ETH rallied in unison with BTC, notching up a 4% increase. This has also faded back as spot gains prove difficult to hold on to.

This strong correlation between spot and skew points to a lack of conviction in the crypto markets. It appears there’s a dearth of structural hedging flows from institutions, and traders are attempting to exploit low delta wings to pursue potential range breakouts, which keep falling short.

We’re still of the belief that put switches, being Long on ETH and Short on BTC, could provide a savvy hedge against downside risk towards the end of Q3. If a flight-to-safety bid occurs, BTC may be shielded from a harsh sell-off in a genuine liquidity-driven risk-off move.

Option Flows And Dealer Gamma Positioning

We’ve seen a modest rise in options volumes as a sizeable May expiry is dealt with, and call activity continues to hold sway. Initially, as spot prices weakened, calls and call spreads were sold. However, we also observed some downside selling near spot lows through 30 June 24k puts.

Ethereum (ETH) flows remain influenced by call sellers, exerting pressure on implied volatility. A substantial portion of call calendars was sold yet again, this time at the 30 June/28 July 2100 line. On the directional side, we’ve seen buyers of 30 June 2000 and 2200 calls.

Interestingly, the steady supply of ETH seems oblivious to the vol levels. This hints at structural long players boosting yield on their holdings, which are likely also being staked. If ETH begins to realise, we suspect the vol overhang will persist, keeping implied vol on the cheap side.

As per Bitcoin dealer gamma, it has slipped back into negative territory as spot prices exceed 27k, catching dealers short on June expiries. Thus, the potential for an upside squeeze is back on the table from an options positioning perspective if a suitable catalyst emerges.

Ethereum’s gamma positioning looks much more balanced after becoming rather long into expiry, as the May 1800 pin had suppressed realised vol. Now, the market seems to have embraced a risk reversal where they remain long on the 1800 strike but short above 2000. This also leaves the market more susceptible to a squeeze than before.

Strategy Compass: Where Does The Opportunity Lie?

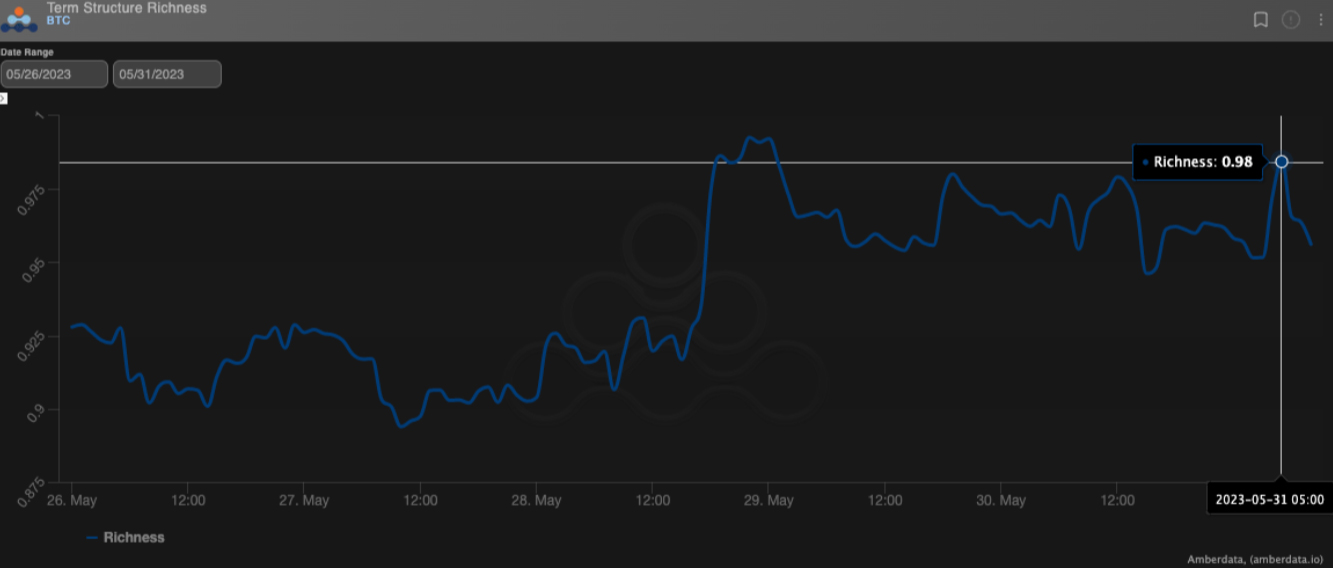

We like BTC Vega neutral call calendar structures to play mean reversion post NFP. This structure looks to capitalize on the recent uptick in front-end volatilities. Term structure richness doesn’t tend to stay near 1.00 for very long without good reason. These trades allow us to anticipate a return to contango and to accrue theta, should the market maintain its tranquillity.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)