BTC Stands Out Against Its Peers

Bitcoin (BTC) is emerging as the asset to own with the most conviction judging by the recent price action, as the panic caused by the SEC’s recent actions quickly fades away.

Ethereum (ETH) and other altcoins took more of a hit from the SEC than BTC as of late. But even non-BTC assets are starting to show renewed signs of life following the commotion the SEC inflicted by labeling a bunch of Alts as securities and going hard after Coinbase and Binance’s businesses.

We continue to observe hint after hint that BTC might be about to do much better than the rest. We see this in the BTC price, the BTC dominance chart, and even in comparisons with ETH pricing.

Plus, we’ve got some confluent promising developments for BTC. Let’s name a few:

BTC stands out as it’s in the clear with the SEC and is viewed as a legit asset. Besides, the fact that Blackrock is applying for a BTC ETF adds another layer of validation and reason to stick with BTC.

There’s more to be hopeful about BTC. As the SEC looks closer at altcoins, BTC becomes a sort of safety net that market participants are defaulting to. ETH had its time to shine with idiosyncratic narratives, but BTC appears to have its moment again, especially with the 2024 halving nearing.

Technically, BTC keeps showing some unique characteristics of strength in what clearly constitutes a strong statement of intent by buyers. The price came into the 25k weekly support, and it’s been rejected meaningfully, so much so that it has left way behind the supply candle from June 14th (in magenta) and is now going after those offers stacked at 30k.

Looking at the broader macro, we had softer trends in US inflation and a pause in rate hikes by the Federal Reserve last week. Both didn’t really affect prices. This week, we’ll be tuning in to Fed Chair Powell’s testimony on monetary policy. Let’s see where the chips fall.

BTC Implied Vols Receive A Boost

Last week, we saw the realised volatility in Bitcoin (BTC) settling down to 30s. This happened as its support levels stood firm and the price went back up thanks to the news of Blackrock’s ETF.

BTC’s implied volatility had a bit of a boost over the weekend, after having dipped for most of the previous week. ETH’s, on the other hand, lagged a bit as its spot price didn’t rise as quickly. It is now kissing the $1,800.00, trying to piggyback the renewed bullish momentum in BTC.

In BTC, carry is now positive. This is because implied volatility shot up due to buying flow, as people responded to the promising shift in the narrative. But for ETH, carry is still negative. This is because sellers of implied volatility are still around, and ETH isn’t leading the upswing.

Our guess is that the recent upturn in BTC volatility and spot price could be short-lived. So, selling short-dated calls or call spreads could work well in the near term, even though the recent positive news could mean a long-term bullish trend for BTC. However, given the recent violent upside price action, it’s definitely a trade for the brave.

Term Structure Goes Into Contango

In the last 10 days, both Bitcoin and Ethereum futures have once again shown a ‘contango’ curve.

Interestingly, buyers of the longer-term options also known as the “Vega” part of the curve are making bets that the implied volatility will increase, especially on the upside.

Vega is a measure of an option’s sensitivity to changes in the implied volatility of the underlying asset, in this case, Bitcoin and Ethereum.

On the flip side, the prices of shorter-term options, the “gamma” part of the curve, have stayed fairly steady for Bitcoin, while Ethereum’s near-term options have softened, consistent with lower actual (realised) volatility.

The volatility spread between Ethereum and Bitcoin has narrowed, with Ethereum’s near-term volatility now less than Bitcoin’s. This is happening because excitement about a potential Bitcoin price rally is creating more demand for Bitcoin call options.

Ethereum’s price performance has been lagging behind, but if Bitcoin rallies further, it could pull Ethereum up to the $1800 mark, specifically for the options expiring on June 30.

Previously, we speculated that Ethereum’s volatility could increase if its price dropped. However, so far, the $1700 price level has proven to be a solid support, preventing a significant downward move.

BTC’s Skew Solidifies In Call Premium

The skew, or the difference in perceived risk between potential upsides and downsides, has moved back towards a lower level this week. This happened as key support levels held firm, and Bitcoin (BTC) initiated a bounce back.

Bitcoin’s skew is shifting towards calls, meaning more traders are betting on Bitcoin’s price to rise across all expiring contracts. This surge of optimism is driven by speculations about Blackrock launching a Bitcoin exchange-traded fund (ETF).

As for Ethereum (ETH), although its skew has decreased from its peak, it’s still leaning more towards puts. This means traders are protecting more against a price drop. Unlike Bitcoin, Ethereum didn’t have a strong positive news event and its spot performance, or its current market price, has been relatively weaker.

There’s a noticeable impact from the substantial selling of Ethereum call options. This not only reduces the demand for options that would increase the volatility (vol bid), but it also hampers Ethereum’s ability to rally in sync with Bitcoin.

With the current market positioning, it’s difficult to see how Ethereum could rise significantly above $1800 by June 30th unless there’s a catalyst specifically favorable for Ethereum.

Option Flows And Dealer Gamma Positioning

In the Bitcoin (BTC) options market, the flow of transactions remained steady last week, with a total value of about $3.5 billion. Following the news of Blackrock’s potential ETF, there has been a surge in buyers of call options, or bets on the price rising.

The average retail investors focused on near-term call options (23-30th June), close to the current price, while larger investors targeted call options expiring between July and December.

As for Ethereum (ETH), the options flow has decreased somewhat, mainly due to fewer overwriting transactions (selling call options against a held asset). However, the biggest transaction was the purchase of 50k call options with a strike price of $2200, expiring on 29th September.

The market position for Bitcoin, measured by dealer gamma (a measure of the rate of change of an option’s delta), has remained negative as the price moved away from long strikes (25K and below) and back towards short strikes (up to 29-30K) on the upside.

On the Ethereum side, the gamma position is still positive. As long as the Ethereum price stays near $1800 by the end of the month, the attraction of the $1800 call option expiring on 30th June will grow stronger, making it difficult for Ethereum to rise significantly above this level.

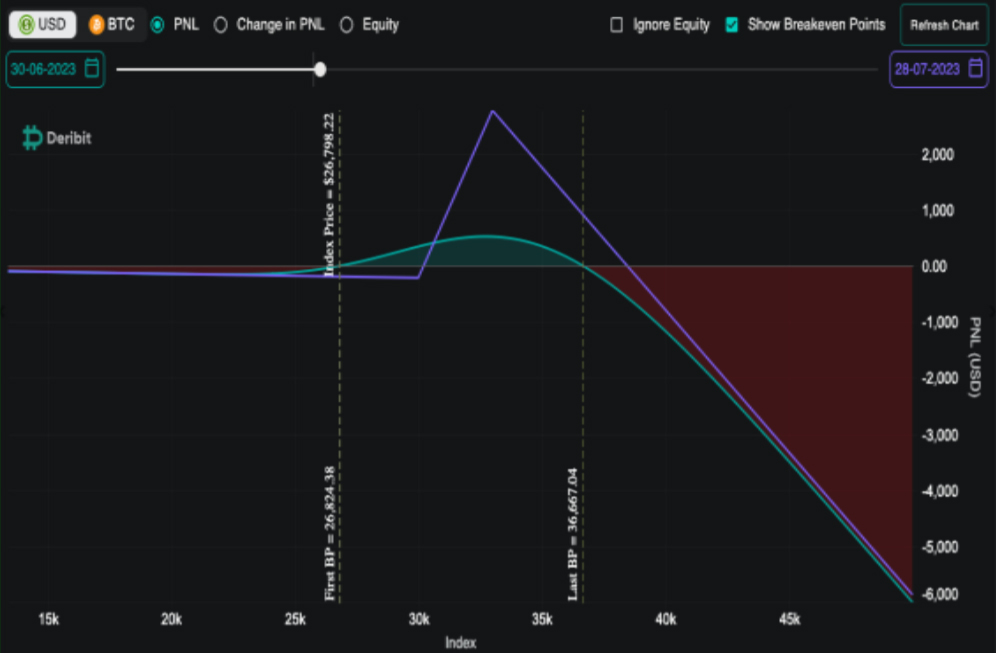

Strategy Compass: Where Does The Opportunity Lie?

We have been rolling BTC upside exposure out from June to July expiry as the curve was still quite flat and we see resistance near 30K as likely to hold until month end. In general, we continue to use ETH put protection vs our BTC long holdings (and ETH holdings) as we see more downside risk there and the vol is cheaper. Lastly, we like call ratio structures (1 by 1.5) to participate in moderate upside in the near term and take advantage of the call skew becoming more elevated through call demand.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)