Summary: Bitcoin is driven by four factors: SEC Bitcoin ETF decision, willingness to add to leverage by futures & options traders, fiat inflows into stablecoins, and the fee generated within the Bitcoin network. Selling strangles (selling calls and selling puts) could generate +7.1% into year-end as volatility is relatively high currently. Fiat inflows into stablecoins have averaged more than $100 million per day last month. The increase in fee generation for the Bitcoin network indicates that activity has increased, which is fundamentally important.

Analysis

Four factors drive the Bitcoin price at this point: 1) expectations that the SEC would approve a spot Bitcoin ETF, 2) increased demand for leveraged positions, 3) fiat inflows through stablecoins, and 4) improved fee generation through the Bitcoin network.

Let’s look at each point in detail:

The second deadline for most of the Bitcoin spot ETF applications passed in mid- October without any comments from the SEC. As Bitcoin has traded around the $35,000 level for nearly three weeks and the third deadline is mid-January 2024, we expect implied volatility to decline into year-end as any approval before Christmas appears less likely.

But, this does not mean that the price of Bitcoin will necessarily decline. Even as a decision by the SEC appears less likely this year, there is still plenty of demand from traders to take leveraged upside positions. So far, this has primarily manifested through the perpetual futures markets, where the funding premium was as high as +28% annualized on Monday, November 13, and has since declined to +11%. While still offering attractive arbitrage opportunities, the waning futures premium indicates that leveraged long positions are being unwound. This could become a short-term headwind for the price of Bitcoin.

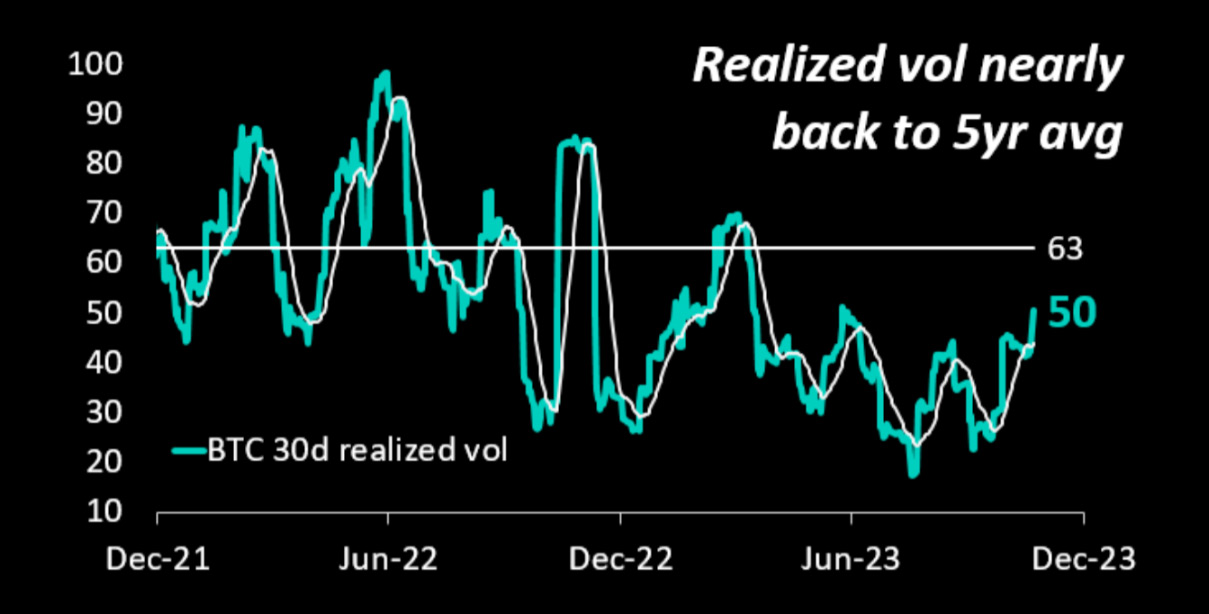

Another sign of excessive speculation is the repricing of implied volatility for options. Arguably, 30-day realized volatility is trading near its 5-year average of 63%, but at 50%, we think realized volatility will likely decline into year-end. As we wrote on November 14, selling strangles (selling calls and selling puts) could generate +7.1% into year-end as volatility is relatively high currently. We struggle to see how markets could materially shoot above the 40,000 level without an SEC Bitcoin spot ETF approval.

As we pointed out last week, the market capitalization increase in Tether’s USDT signals that new fiat money is being moved into crypto. This inflow has reached $3.8 billion during the last 30 days—more than $100 million daily. After five months of almost zero inflows, those flows have materially picked up and, we would argue, had a pronounced impact of trickling down to the altcoins, where people became more comfortable taking riskier bets. While crypto equity-linked notes (ETNs) have also seen nine weeks of consecutive inflows of $1bn, the stablecoin inflows are more significant and show institutional demand.

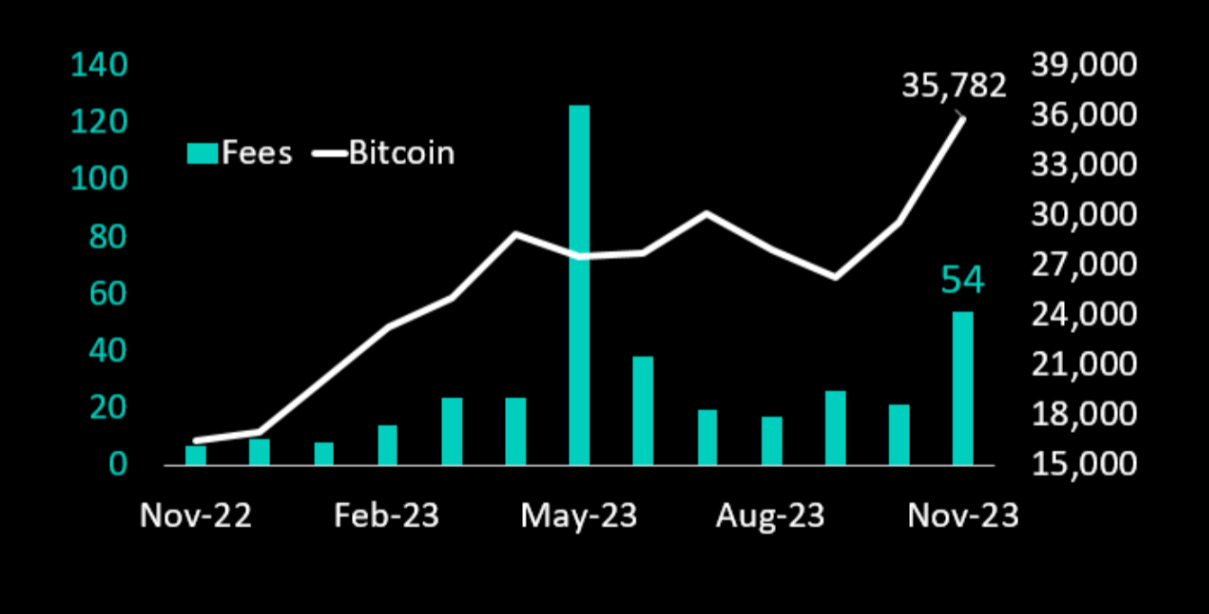

The Bitcoin network currently generates $54 million in fees, and while we are only halfway through November, this month already turns out to be the second strongest. Ordinals have made a comeback as Binance rolled out support for ORDI, the original BRC-20 token. UniSat and Magic Eden dominate the Ordinals space regarding the number of users. Still, OKX appears to have gained a 73% market share recently – however, this number does not include the volume from Binance.

Nevertheless, the increase in fee generation for the Bitcoin network indicates that activity has increased and this is fundamentally important. Even if the SEC is pushing out any decision around a Bitcoin ETF into January and leveraged futures traders are unwinding some of their bullish perpetual while others also take off some of their leverage upside call positions, Bitcoin could still rally due to solid fiat inflows and a healthy, fee-generating Bitcoin network.

However, in the absence of the former two drivers (SEC ETF approval + decline in leveraged long positions), Bitcoin might not run away and trade materially above 40,000. We still view our trading idea that recommends selling puts and calls as viable in the current environment. Since our latest report, the December 29 expiry call with the 40,000 strike price has declined from $1,844 to $1,660 while the 32,000 put premium has remained around $800. This is understandable as we have not yet seen a material decline in implied volatility.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)