Cumberland is commenting on the recent volatility and potential opportunities to take advantage of it.

For further information about Cumberland, please visit Cumberland website here.

What we are seeing in the markets

Last week was characterized by continued and at times explosive spot rallies, initiated by several altcoin narratives but supported by a general risk on rally in the broader markets as more and more participants take the view that inflation is truly on the way down. Here, we touch on some of the main narratives of the week, their implications on the crypto vol market and a trade idea that (a) takes into account these narratives and (b) suits the current perturbed nature of the vol surface.

1) Crypto has seen a very bright start to the year, in the last 7 days BTC is up 20% and ETH up 16.8%. One of the drivers of this has been liquid staking derivatives (LSDs). With the Ethereum Shanghai upgrade confirmed for March, stakers will soon be able to freely unstake their ETH, making those sizeable staking yields much more practical to attain and fundamentally shifting the supply/demand dynamics of ETH. The liquid staking derivative LDO, which is the governance token of the most popular ETH decentralized staking platform Lido, is up 127% from the start of the month. Other similar tokens have seen such gains as well.

Here we point out that whilst this narrative did contribute towards last weeks BTC/ETH/Altcoin rally, the main point to make is the longer term bullish signal this gives to ETH. With the ETH staking ratio hovering around the 14% mark (this metric captures the percentage of ETH in circulation that is being staked, and is much lower than for other proof of stake blockchains), a successful Shanghai upgrade could encourage more stakers hence disincentivize selling.

2) The option flows of last week can be summarized simply as a mass of call buying every day as spot moved higher and higher. 1 month ATM vol has spiked from 37%/49% to 66%/74% in BTC/ETH respectively. In addition, all the call buying has significantly shifted the volatility skew from the put to the call (BTC January 0.5 SD calls are 3.5 vols higher than the respective puts). We note that June atm vol is trading lower than the front of the term structure (61% and 70% in BTC and ETH respectively), and the skew is still higher in the puts than the calls.

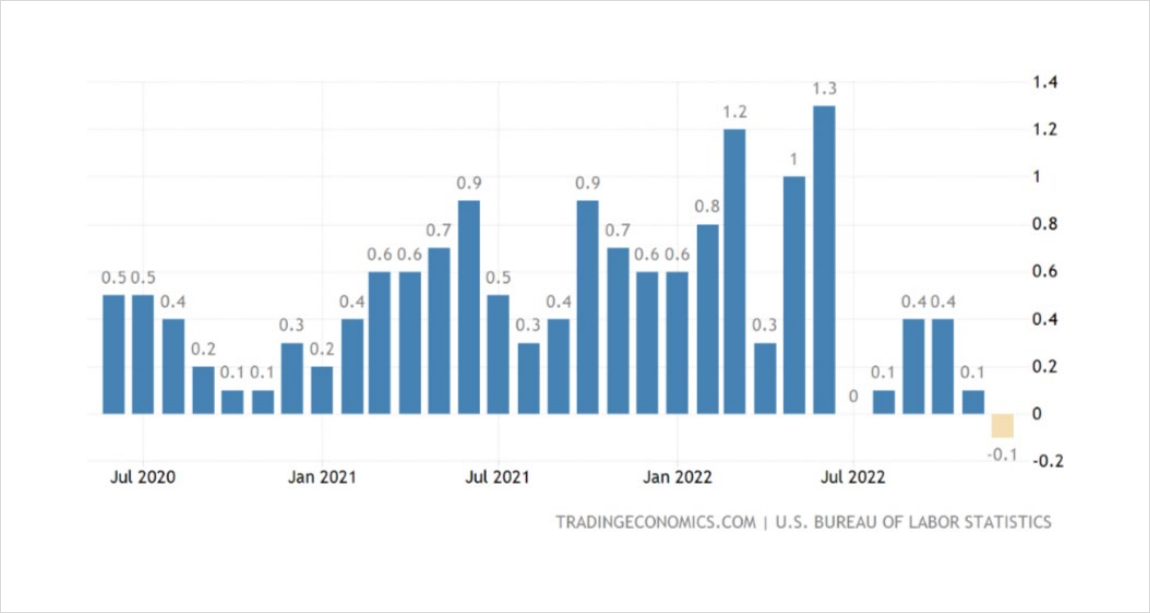

3) Last week also saw CPI hit expectations bang on, with the MOM figure at -0.1% (first negative reading since inflationary pressures began in June 2020, see figure below) and the YOY figure at +6.5% (down from the peak reading of +9.1% in June). Whilst the fight against inflation is certainly not over, the most recent readings are causing the market to start believing in a ‘pivot’, contrasting with the messaging being portrayed by the FED. The US rates markets are pricing a terminal rate of just below 5% and more than 50bps of rate cuts in the second half of the year. On the contrary, FED members have repeatedly suggested a terminal rate of just over 5%, and no cuts at all until 2024. If data releases continue in this manner, then a change in tone of the FED is on the cards, truly cementing the pivot narrative and having the potential for risk assets to rip. Given last week’s explosive rally in crypto, despite the lack of a big narrative shift, it is difficult to overestimate how much higher spot and call skew could rip when the FED do announce a pivot.

Potential trade

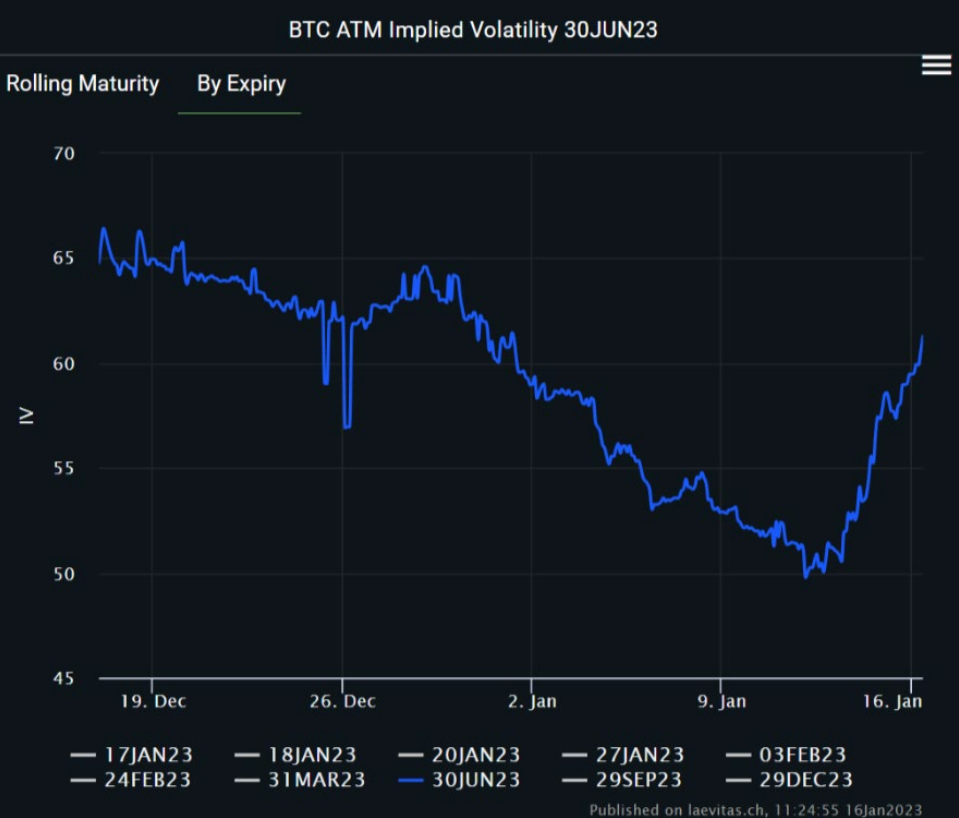

Before describing the trade that we think best captures the current market conditions, we reflect on the trade idea that we pitched on the 12th December 2022. Our suggestion of selling BTC June calls (when ATM vol was 65%) has paid dividends. ATM vol hit a low of 49% last week, which would have been the perfect time to take profit on this trade (see figure below). Note that BTC June ATM vol is now 61%, still lower than the 65% in December. The point of this reflection is to provide color for our next trade idea:

Buy ETH June 1800 Call, Sell ETH June 1300 Put, delta hedged.

A) The ETH supply side argument provided in (1), due to an increasing number of stakers post Shanghai upgrade, means June is an ideal time to make an ETH upside play.

B) This structure is net long vega, which gives good exposure to an increase in June ATM vol:

- Vol here is still low relative to the nearer expiry months as described in (2), which should revert as the market settles down and the term structure changes back to being more normal looking. This morning we have already seen smart funds start to position for this, through trading March-June call calendars (they buy June, sell March). More generally, we are seeing early interest in long dated upside, and dealer inventory is on the verge of shifting.

- We may also see the big vol sellers from December decide to take profit, giving June vol a further uplift.

- Last week saw a fundamental regime shift from the very low realized vol levels of the past month. 70% ETH 6 month implied vol is below the lows of past regimes.

- It is always useful to recall that an implied vol of 70% in ETH approximately implies a 3.7% daily move, which is $55 when ETH is trading at $1500 and $166 when trading at $4500. In other words, a $166 day move would be the norm at an ETH = $4500, IV = 70% scenario, but would imply a much larger IV when ETH = $1500.

- The path of volatility is now clearly to the upside. If crypto stabilizes here or drifts lower, distributions will shrink again. This is why we suggest delta hedging and also selling the put rather than buying the call outright.

C) As described in (2), ETH June calls are still cheaper than puts:

- The 1800 call has IV = 69.5%, whilst the 1300 put has IV = 72.5%. In fact, the backend is the only place where risk reversals are still somewhat significantly towards the put. This relative cheapness, plus the upside move phenomena described in (1) and (3), make June a great place to make such a trade. This morning, someone sold June 1x3s (selling the 1 leg and buying the further out 3 legs, taking advantage of call skew being low).

- One could argue that this trade would not materialize if the narrative turns sour again and we see a large downside move. However, factors such as FTX announcing the recovery of $5 billion worth of liquid assets to return to creditors, and the crypto market being much less leveraged than it was a year ago, make the case for a natural floor developing in the prices of BTC and ETH.

Disclaimer

The information (“Information”) provided by Cumberland DRW LLC and its affiliated or related companies (collectively, “Cumberland”), either in this document or otherwise, is for informational purposes only and is provided without charge. Cumberland is a principal trading firm; it is not and does not act as a fiduciary or adviser, or in any similar capacity, in providing the Information, and the Information may not be relied upon as investment, financial, legal, tax, regulatory, or any other type of advice. The Information has not been prepared or tailored to address, and may not be suitable or appropriate for the particular financial needs, circumstances, or requirements of any person, and it should not be the basis for making any investment or transaction decision. THE INFORMATION IS NOT A RECOMMENDATION TO ENGAGE IN ANY TRANSACTION.

If any person elects to enter into transactions with Cumberland, whether as a result of the Information or otherwise, Cumberland will enter into such transactions as principal only and will act solely in its own best interests, which may be adverse to the interests of such person. Before entering into any such transaction, you should conduct your own research and obtain your own advice as to whether the transaction is appropriate for your specific circumstances. In addition, any person wishing to enter into transactions with Cumberland must satisfy Cumberland’s eligibility requirements.

Cumberland may be subject to certain conflicts of interest in connection with the provision of the Information. For example, Cumberland may, but does not necessarily, hold or control positions in the cryptoasset(s) discussed in the Information, and transactions entered into by Cumberland could affect the relevant markets in ways that are adverse to a counterparty of Cumberland. Cumberland may engage in transactions in a manner inconsistent with the views expressed in the Information.

Cumberland makes no representations or warranties (express or implied) regarding, nor shall it have any responsibility or liability for the accuracy, adequacy, timeliness, or completeness of, the Information, and no representation is made or is to be implied that the Information will remain unchanged. Cumberland undertakes no duty to amend, correct, update, or otherwise supplement the Information.

The virtual currency industry is subject to a range of risks, including but not limited to: price volatility, limited liquidity, limited and incomplete information regarding certain instruments, products, or cryptoassets, and a still emerging and evolving regulatory environment. The past performance of any instruments, products, or cryptoassets addressed in the Information is not a guide to future performance, nor is it a reliable indicator of future results or performance. Investing in virtual currencies involves significant risks and is not appropriate for many investors, including those without significant investment experience and capacity to assume significant risks.

AUTHOR(S)