Cumberland is commenting on the recent volatility and potential opportunities to take advantage of it.

For further information about Cumberland, please visit Cumberland website here.

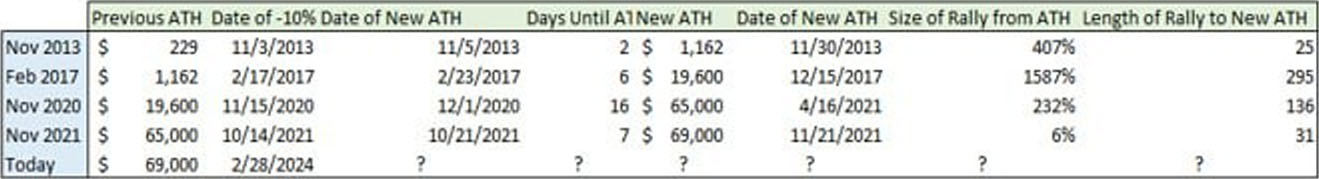

BTC is currently about 9% below its previous all-time high. Our research team looked at other instances where BTC came within 10% of the previous cycle’s ATH, and saw that in each of these cases, BTC moved through it to make new highs. In fact, in three out of the four examples of the past decade, it reached the previous ATH within a week of the 10% touch. (The exception was Nov 2020, where it took 16 days). In three out of four of those examples, BTC also went on a significant run following the new ATH; the only counterexample here was the “false” rally driven by high leverage in 2021.

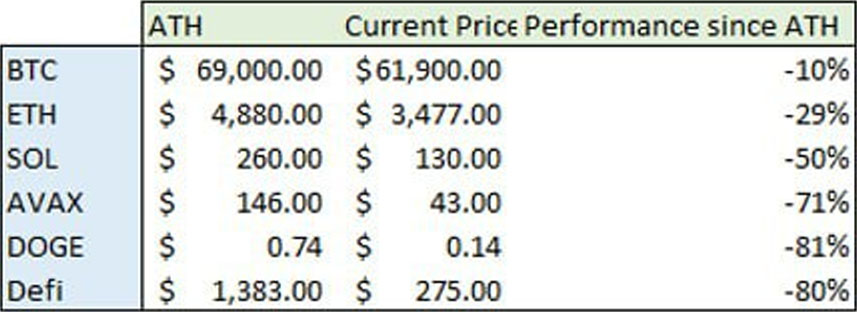

It’s not all of crypto that is near its ATH; in fact, outside of a few meme tokens (and we will get to them later), it’s just BTC. BTC is 9% below its ATH, but ETH is down 30% from its high, SOL is -50%, AVAX is -70%, the Defi index is -80%, and DOGE is -80%. Put simply; smaller market-cap assets have performed worse during the bear market. There are two conclusions you could take away from this. The first conclusion would be that a new BTC rally should give the most value to alts; if you think everything is going to make new highs, then alts provide a *lot* more value than BTC right now. On the other hand, if you think the previous levels in alts were driven purely by leverage, it might be that these previous highs are unattainable. And frankly, some alts are never going to make it back to their highs; many of the tokens, be they L1 or app or otherwise, don’t even have teams working on them anymore. The right strategy here, which is certainly easier-said-than-done, would be to identify the “strong” alts from the “weak”; my razor here is that companies which have been shipping during the bear should be considered “strong”, and projects that have gone silent should be avoided. (Note: some of those dead projects might have hellacious rallies anyway).

We’re definitely seeing the market scramble for beta right now, in advance of an expected push through previous highs. The sector which is the most on-fire right now is the one which, using the logic of the previous ATH, has the most room to run: the meme-token space. DOGE, the poster child for the sector, is up 80% over the past second days, but within the sector, it is a laggard. SHIB and BONK are each up over 100%, and WIF has more than 4x’ed in the past week. Interestingly enough, SHIB has now passed its older cousin, DOGE, in FDV, likely due to being more widely accessible, being an ERC20 token. SHIB actually trades above 5% of the FDV of ETH, while BONK plus WIF make up roughly the same share of SOL FDV.

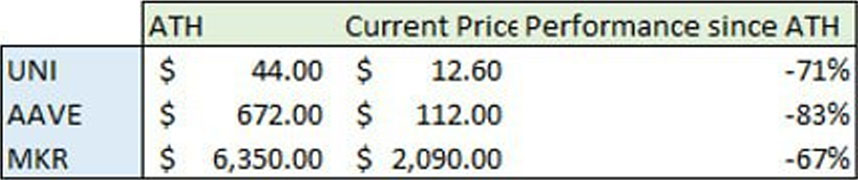

The rally in meme tokens make sense as a play for Beta, at a moment when Beta seems appealing, but the DeFi sector seems less emphasized, despite having strong fundamentals. We’re just a few weeks after UNI holders voted on the fee switch, and in an environment where regulators have lost multiple battles against the industry, and likely their appetite to chase losing battles as well. The DeFi sector seems like the one that has been most impacted by regulatory concerns, and therefore if regulators back off, it’s the sector which could have the best chance for a re-rating. UNI is down 71% from its ATH, MKR is down 67%, and AAVE is down 83%; most interestingly, these ATHs were made in May of 2021, not in Nov 2021, which was the period where leverage was the most rampant.

Disclaimer

The information (“Information”) provided by Cumberland DRW LLC and its affiliated or related companies (collectively, “Cumberland”), either in this document or otherwise, is for informational purposes only and is provided without charge. Cumberland is a principal trading firm; it is not and does not act as a fiduciary or adviser, or in any similar capacity, in providing the Information, and the Information may not be relied upon as investment, financial, legal, tax, regulatory, or any other type of advice. The Information has not been prepared or tailored to address, and may not be suitable or appropriate for the particular financial needs, circumstances, or requirements of any person, and it should not be the basis for making any investment or transaction decision. THE INFORMATION IS NOT A RECOMMENDATION TO ENGAGE IN ANY TRANSACTION.

If any person elects to enter into transactions with Cumberland, whether as a result of the Information or otherwise, Cumberland will enter into such transactions as principal only and will act solely in its own best interests, which may be adverse to the interests of such person. Before entering into any such transaction, you should conduct your own research and obtain your own advice as to whether the transaction is appropriate for your specific circumstances. In addition, any person wishing to enter into transactions with Cumberland must satisfy Cumberland’s eligibility requirements.

Cumberland may be subject to certain conflicts of interest in connection with the provision of the Information. For example, Cumberland may, but does not necessarily, hold or control positions in the cryptoasset(s) discussed in the Information, and transactions entered into by Cumberland could affect the relevant markets in ways that are adverse to a counterparty of Cumberland. Cumberland may engage in transactions in a manner inconsistent with the views expressed in the Information.

Cumberland makes no representations or warranties (express or implied) regarding, nor shall it have any responsibility or liability for the accuracy, adequacy, timeliness, or completeness of, the Information, and no representation is made or is to be implied that the Information will remain unchanged. Cumberland undertakes no duty to amend, correct, update, or otherwise supplement the Information.

The virtual currency industry is subject to a range of risks, including but not limited to: price volatility, limited liquidity, limited and incomplete information regarding certain instruments, products, or cryptoassets, and a still emerging and evolving regulatory environment. The past performance of any instruments, products, or cryptoassets addressed in the Information is not a guide to future performance, nor is it a reliable indicator of future results or performance. Investing in virtual currencies involves significant risks and is not appropriate for many investors, including those without significant investment experience and capacity to assume significant risks.

AUTHOR(S)