Cumberland is commenting on the recent volatility and potential opportunities to take advantage of it.

For further information about Cumberland, please visit Cumberland website here.

January 3

What are we seeing in the markets?

It’s hard to imagine that just 5 short weeks ago IV was sitting at 100+ compared to how quiet the market is currently despite the DCG overhang. Both realized and implied vol continue to remain depressed. Rolling 30D realized vol settled at 38 & 26 for ETH & BTC respectively, near all-time lows. 31 MAR 50D IV is at 64 & 54, as both trended down from the week before. Not surprisingly, skew has trended towards the call in this low vol environment, where the 25D RR is almost premium neutral. Volume has been down across venues and crypto has not reacted much to economic news while other markets such as rates continue to remain volatile.

Looking forward, the economic calendar is fairly light, with NFP on Jan 6th and CPI on the 12th. We are seeing some minor interest for the 13 Jan expiries as it covers the CPI release.

Potential trade

Long 31 MAR ETH straddle. Short 31 MAR BTC straddle.

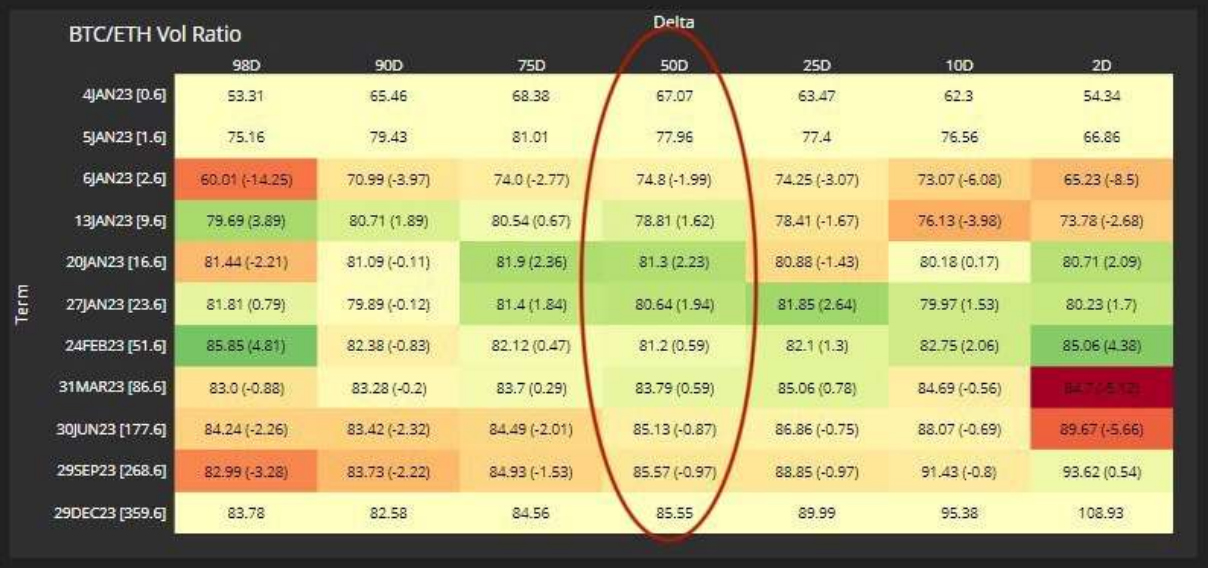

We continue like owning ETH vol against BTC vol. The 31 MAR BTC vol to ETH vol ratio sits at 84%, which is near the upper limit of the historical range of ~60% to 80%. As the historically higher beta asset, ETH could deliver higher realized vol off of any DCG related surprises. Otherwise, the ratio should decrease as the position rolls down the curve. For example, the same ratio for 90D realized vol is only 70%.

Disclaimer

The information (“Information”) provided by Cumberland DRW LLC and its affiliated or related companies (collectively, “Cumberland”), either in this document or otherwise, is for informational purposes only and is provided without charge. Cumberland is a principal trading firm; it is not and does not act as a fiduciary or adviser, or in any similar capacity, in providing the Information, and the Information may not be relied upon as investment, financial, legal, tax, regulatory, or any other type of advice. The Information has not been prepared or tailored to address, and may not be suitable or appropriate for the particular financial needs, circumstances, or requirements of any person, and it should not be the basis for making any investment or transaction decision. THE INFORMATION IS NOT A RECOMMENDATION TO ENGAGE IN ANY TRANSACTION.

If any person elects to enter into transactions with Cumberland, whether as a result of the Information or otherwise, Cumberland will enter into such transactions as principal only and will act solely in its own best interests, which may be adverse to the interests of such person. Before entering into any such transaction, you should conduct your own research and obtain your own advice as to whether the transaction is appropriate for your specific circumstances. In addition, any person wishing to enter into transactions with Cumberland must satisfy Cumberland’s eligibility requirements.

Cumberland may be subject to certain conflicts of interest in connection with the provision of the Information. For example, Cumberland may, but does not necessarily, hold or control positions in the cryptoasset(s) discussed in the Information, and transactions entered into by Cumberland could affect the relevant markets in ways that are adverse to a counterparty of Cumberland. Cumberland may engage in transactions in a manner inconsistent with the views expressed in the Information.

Cumberland makes no representations or warranties (express or implied) regarding, nor shall it have any responsibility or liability for the accuracy, adequacy, timeliness, or completeness of, the Information, and no representation is made or is to be implied that the Information will remain unchanged. Cumberland undertakes no duty to amend, correct, update, or otherwise supplement the Information.

The virtual currency industry is subject to a range of risks, including but not limited to: price volatility, limited liquidity, limited and incomplete information regarding certain instruments, products, or cryptoassets, and a still emerging and evolving regulatory environment. The past performance of any instruments, products, or cryptoassets addressed in the Information is not a guide to future performance, nor is it a reliable indicator of future results or performance. Investing in virtual currencies involves significant risks and is not appropriate for many investors, including those without significant investment experience and capacity to assume significant risks.

AUTHOR(S)