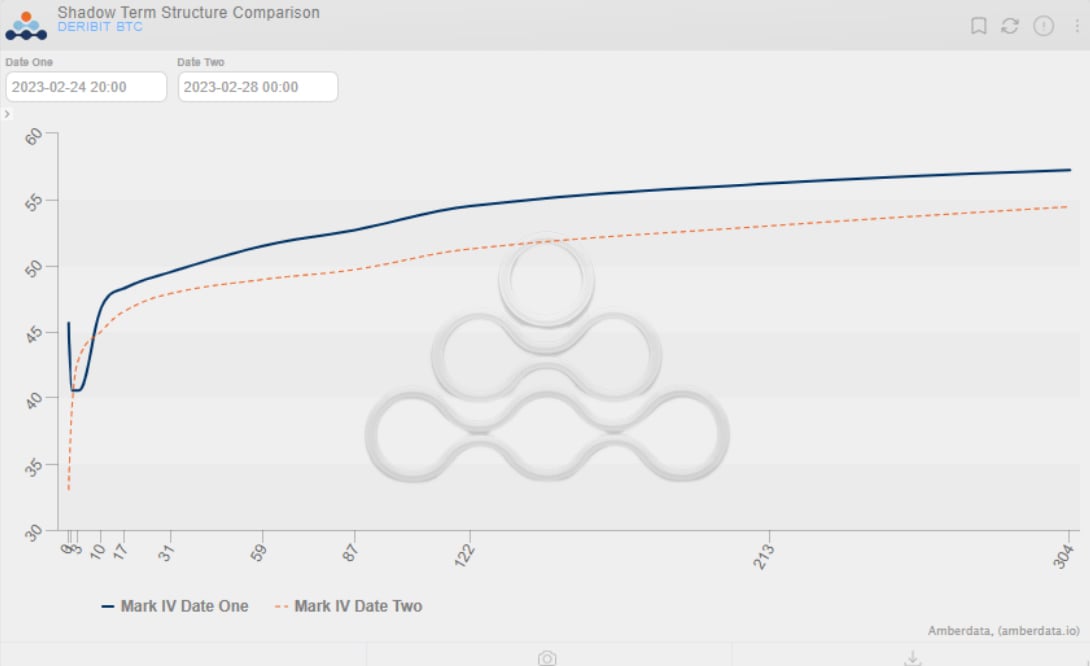

Although the beginning of the month started with some heavily bullish bets in both short and long dated tenors, flows coming in toward the end of the month have been mixed or slightly bearish. It looks like some of the longer-term bets on volatility and the demand for longer-term optionality are also starting to decline, as this weekend saw one of the more drastic shifts downward in term structure – surprisingly in the back-end of the term structure, which has stayed relatively firm over the past week.

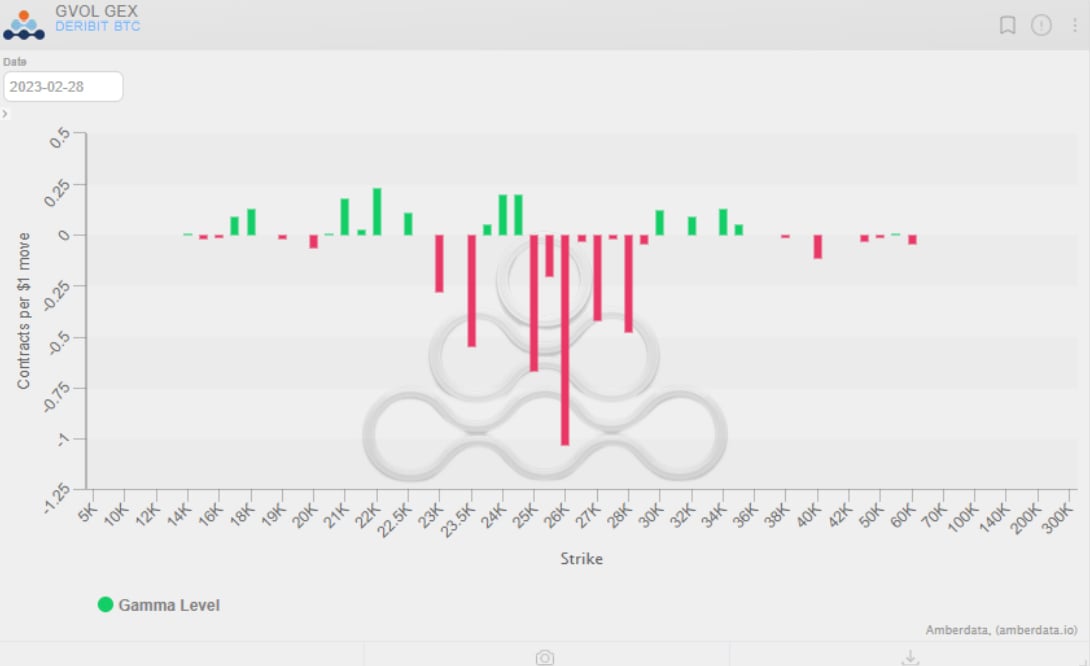

Regarding open interest, February had one of the larger option expiries across the majors, with around $1.8B in open interest expiring in BTC options alone. Short-term speculation toward the upside had occurred during the multiple tests of $25K. After multiple rejections, dealers are speculated to be net short gamma from the $25K-30K region.

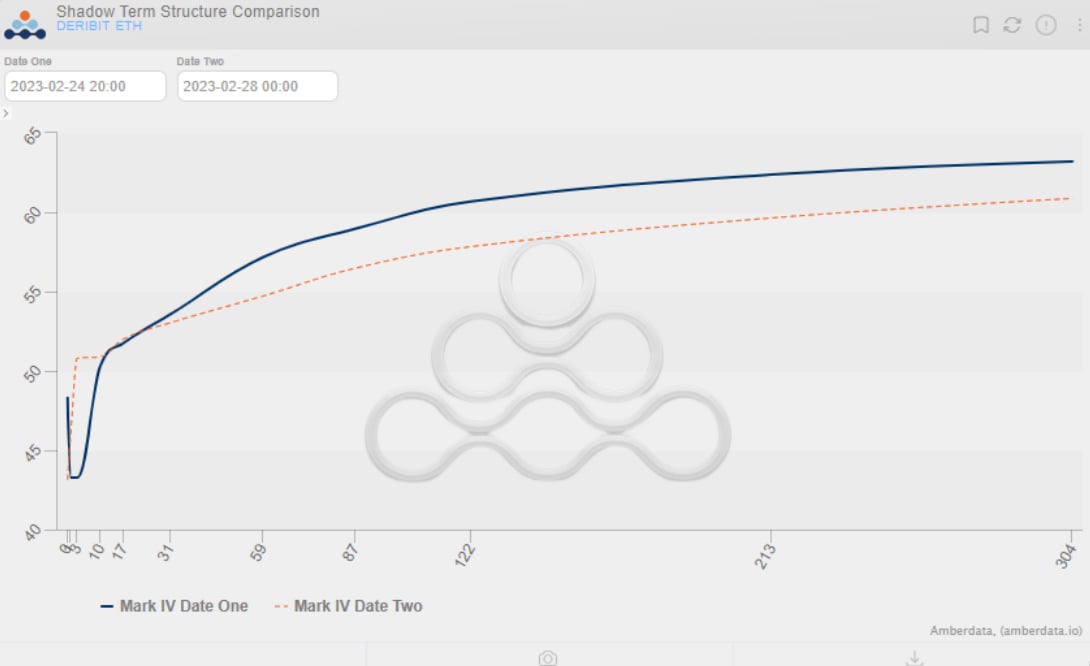

The ETH Shanghai narrative indeed continues to be of interest, but the options markets don’t seem to be pricing in the event in the same way the Merge was priced in. There are no noticeable kinks in term structure and not too many systematic or abnormal blocks coming in for the end of March expiry. Implied volatility across all tenors of options in BTC has steadily declined, with ATM IV trading at relative lows compared to the rest of the month. This decline in implied volatility has been consistent with range-bound price action.

Term Structure for BTC and ETH

Flows in some of the longer-dated tenors have become prevalent, with June straddle supply in BTC causing the recently sticky back end in BTC term structure to decouple, coming in 3-4 IVs in even the September/December tenors. As range-bound price action continues, February price in BTC looks to close out only around +1.2%, compared to the 40% increase in January. The bullish exuberance leading into the beginning of February certainly contributed to the elevated levels of implied volatility that slowly dwindled before reaching recent relative lows.

A similar picture in ETH looks to be painted, as vol selling across the board in ETH lines up with the similar sentiment established in BTC. Implieds have come in throughout the entirety of the curve, with the largest decline seen mainly in the June expiry.

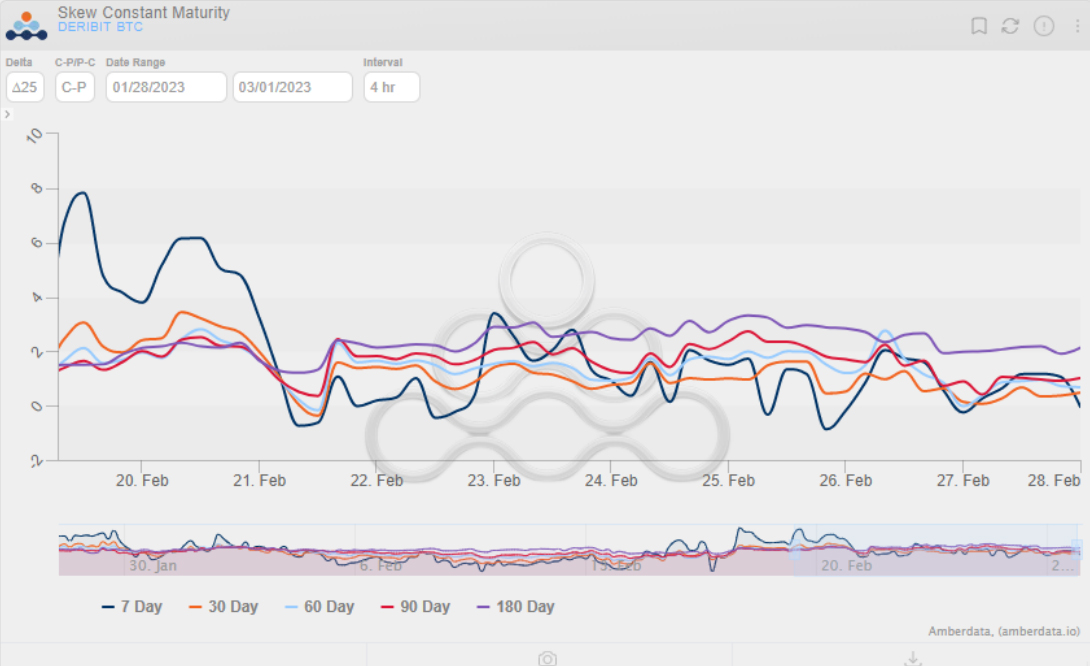

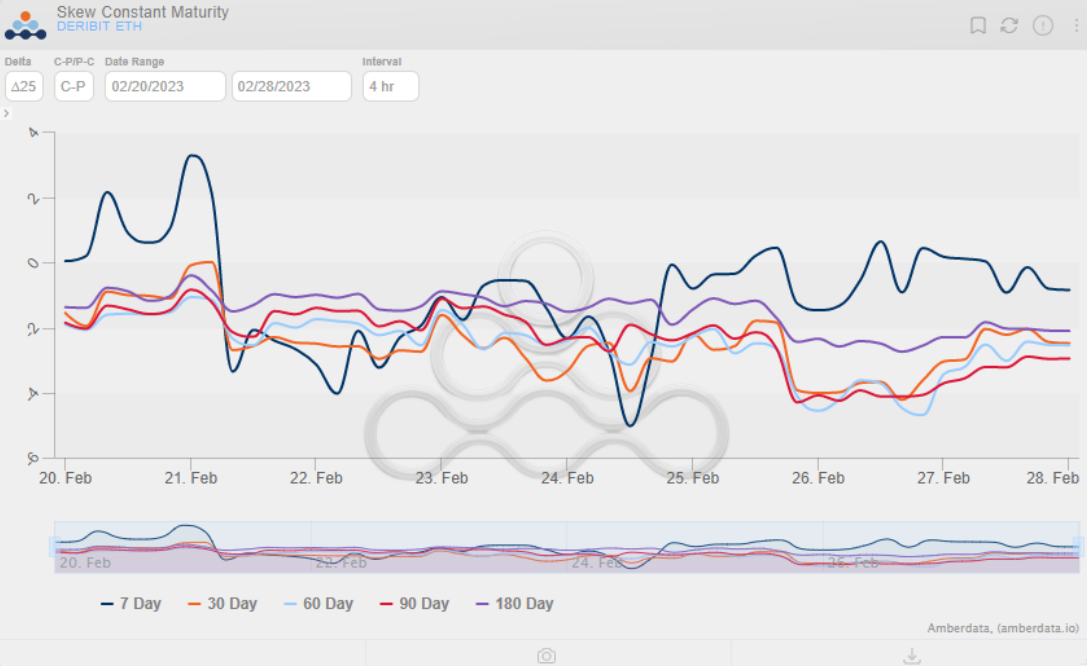

Skew for BTC and ETH

In BTC, the longer-dated skew has stayed relatively stable over the past week, while the front end of the curve (as represented by the 7 and 30 day timeframes) has steadily declined since the beginning of last week. To start the week, 25 delta calls in BTC had traded at almost an 8 IV point premium, now currently only trading at around 1 IV point premium. Noticeably, the skew in BTC across all tenors is still positive, and the market over the past few weeks has shown a slight preference toward calls.

In ETH, the same level of preference for calls has not been echoed as skew across all tenors trades in the negative levels – signaling the 25 delta put trading at a premium to the call. This trend has persisted over the past few weeks regarding a lingering preference toward puts.

Liquidations

There have certainly been some noticeable liquidations throughout the month of February, with the price action on February 8th leading to the largest amount of long liquidations over the past few months as we dipped back below $22,000 – leading to a flush of leverage. This weekend, however, was relatively quiet, with relatively modest price action and very few liquidations occurring on either end.

Noticeable Flows Throughout the Week

Friday saw vol sellers entering the ecosystem, coinciding with quite a bit of a decline in vol across all tenors. Longer-dated vol selling materializing in the form of June straddles were blocked, and outright upside demand in the wings began to transpire. Friday also saw a similar supply of vol traded in ETH as many puts in the May and June expiries flooded the markets before the weekend.

Given the strikes, I can’t imagine this outright buying of the $45K strikes being a hedge for any short BTC positions. Several traders were undoubtedly betting on a break above $25K and expecting a combination of a directional move in their favor and a repricing of risk in some of the tails to drive profits on these positions.

Check out Paradigm’s most recent Twitter thread for insight into last week’s flows and macro insights.

A Look Ahead

With a supply of vol flooding the markets on Friday, the continued range-bound price action, and a dearth of short-term catalysts, the options markets have been relatively sleepy as term structure across the board in both BTC and ETH has broadly come in – even in some of the stickier longer-dated tenors.

Speculated dealer gamma positioning continues to pop up on Twitter threads. Still, barring any catalysts in the near term, pushing current prices into those more volatile negative gamma pockets will be challenging. The catalysts I watch out for in this environment are unexpected liquidations driven by the supply and demand dynamics of the perpetual futures markets and outsized spot trading.

AUTHOR(S)