The first week of January started off relatively quiet with very little activity as buy-side takers and organic flow drifts back into the markets. New positions started to accumulate in longer dated tenors, and weekly demand for options started to flow back in after the major December 31st expiry to close the year out.

The holidays were characterized by little activity and scarcely traded volumes across the asset class, and 7-day realized volatility in BTC for the last two weeks of December averaging around the low 20s. BTC has traded in around a $600 range, and there have been few liquidations save for a few to start off the beginning of the year.

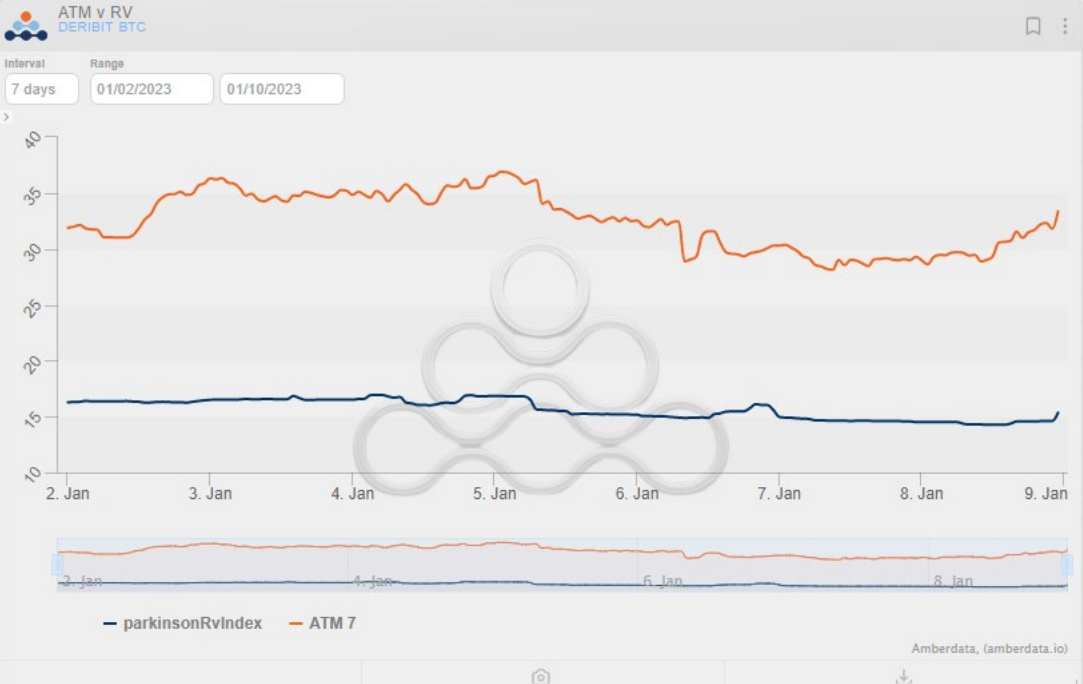

ATM vs RV for BTC and ETH

ATM vs realized vols in BTC started the year off in the mid-30s before peaking Thursday at around 37 and drifting lower into Friday expiry as the NFP event was a relatively low volatility event for the crypto markets.

ATM vs realized vols in ETH started the year off in the mid-40s before peaking Thursday as well, briefly touching 50 before drifting lower into Friday expiry. Both BTC and ETH realized vols are heavily suppressed compared to historical data.

Into the weekend we saw a new push above $17,000 for BTC with ETH aiming to test $1,300. A solid push into new trading territory above previous levels of resistance may lead to a new range of trading as the current $600 range in BTC has persisted for weeks.

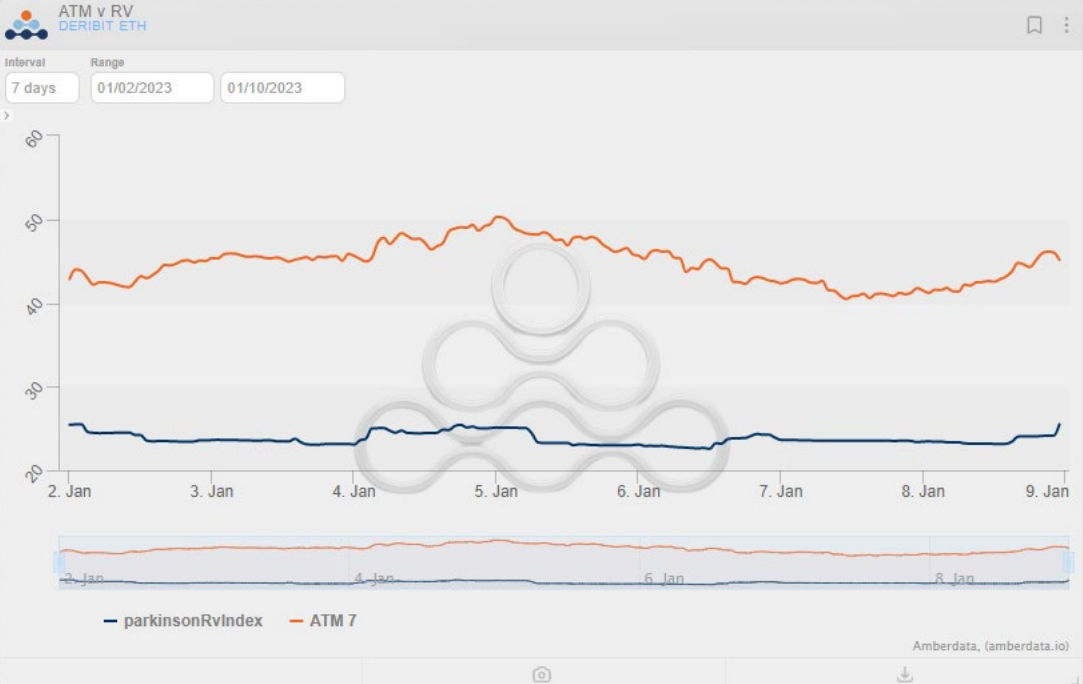

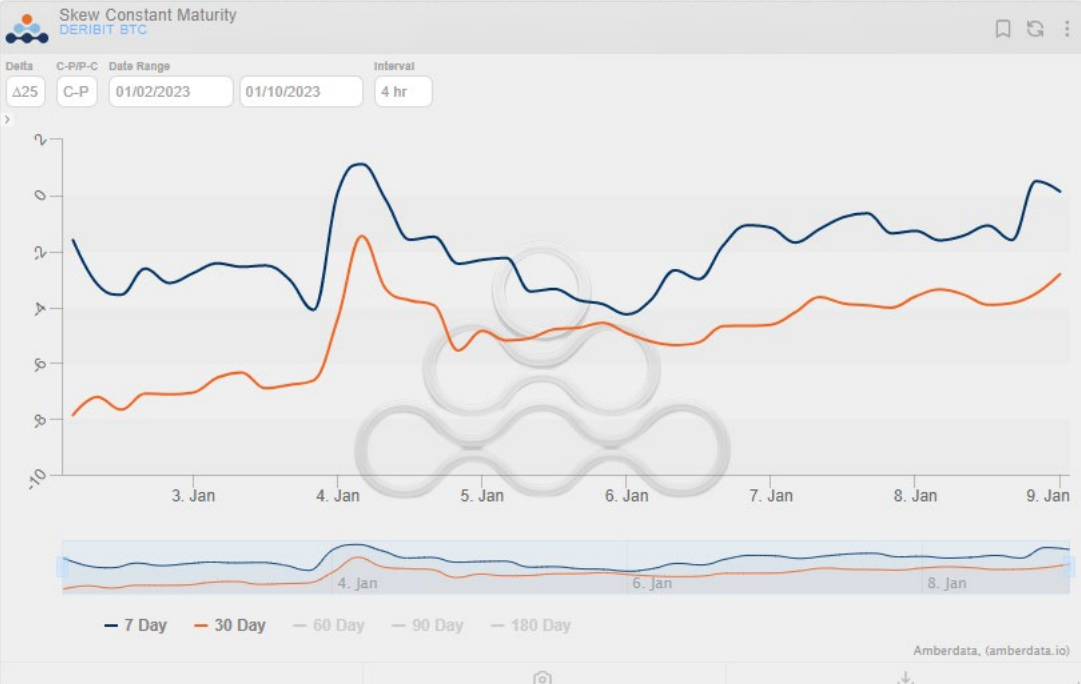

Skews for BTC and ETH

The 25-delta skew in BTC (measured call-put) kicked the year off with weekly skew suggesting puts trading around a 2 IV point premium and monthly skew suggesting an 8 IV point premium with that premium slowly fading into Wednesday’s event: the FOMC meeting. Weekly calls actually had traded at parity or a slight premium the night before the event. This richness in calls faded to close the week off with weekly 25 delta puts reverting to their slight premium before flipping back to a slight call premium once again as the weekend trading activity saw a breakout above $17,000.

In ETH, a similar pattern has emerged, although an interesting divergence seen in the chart above shows a cross-over between weekly and monthly skew with longer dated skew slightly favoring calls compared to weekly – albeit only temporarily.

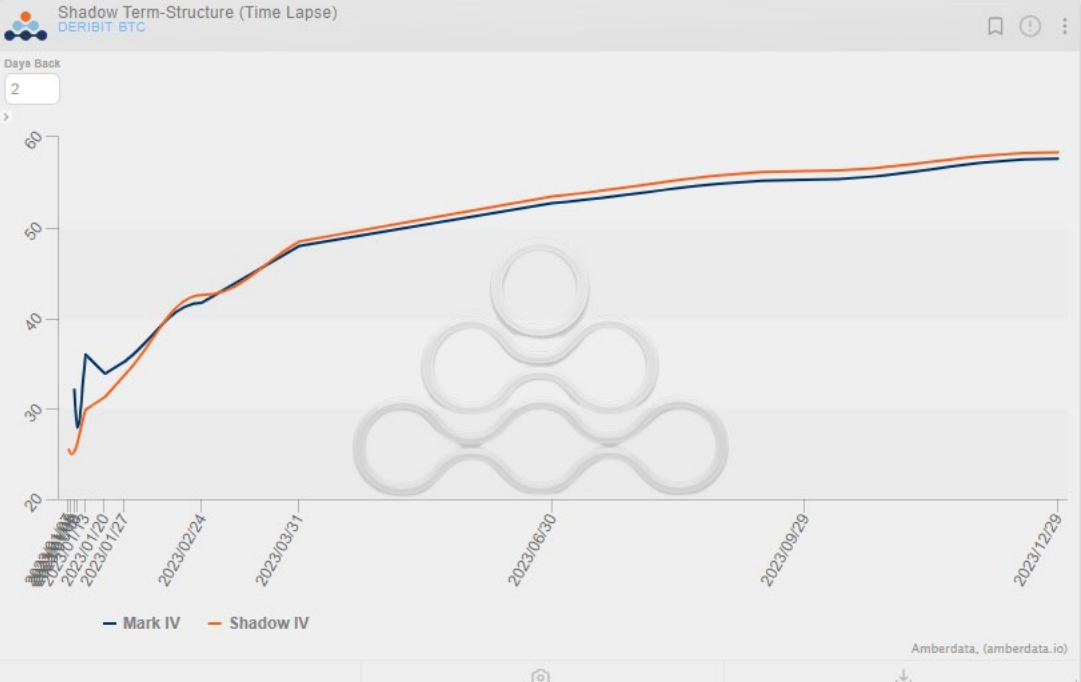

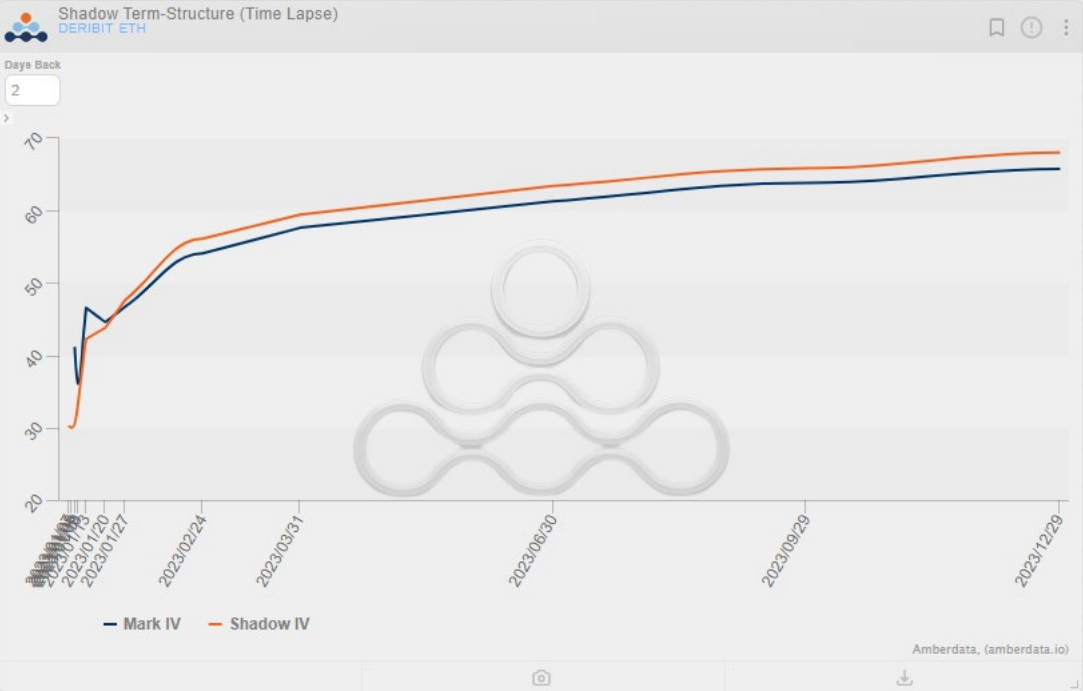

Term Structure for BTC and ETH

Looking specifically at the weekend, term structure in BTC had a discernable elevation in the front part of the curve with weekly ATM contracts trading 6 IVs higher than yesterday as BTC made a push above the range we’ve traded in for a few weeks. Longer dated tenors have only been pushed up slightly with some expiries shifting less than a vol over the weekend.

In ETH, short-dated weekly term-structure has seen the same structural development, although from an IV magnitude, ETH has shifted slightly less – 4.5 IVs higher in the front-end while longer dated tenors have been pushed up around 2 IVs.

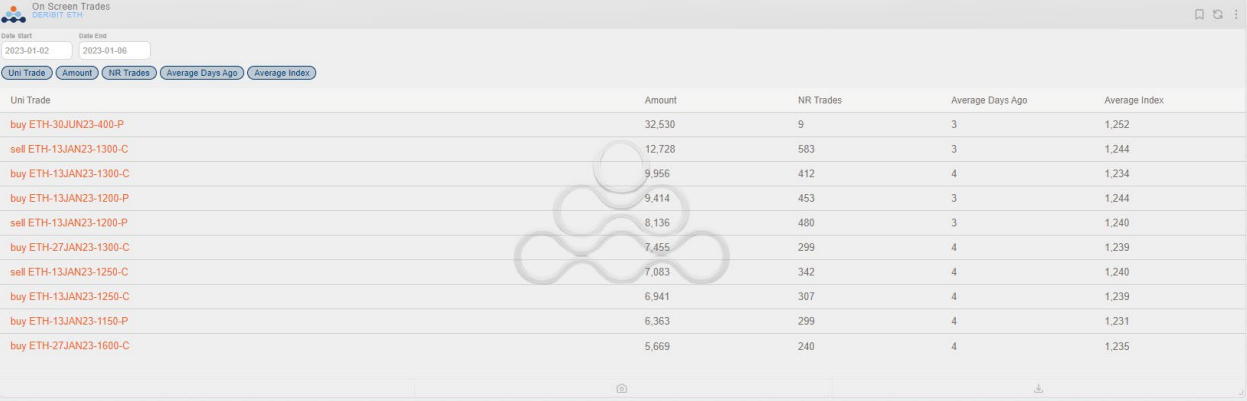

Interesting Trades Throughout the Week

We start to see some size come back into the ETH options market with a big chunk of ETH 400 puts being traded on DSOB in the June 30th tenor – being one of the largest trades to start off the year and done around 00:03 UTC on January 5th at an IV of 104.47 with around 10,000 lots still resting on the orderbook as of 00:26 UTC January 9th.

Over the weekend, flows were relatively light other than around $35K in premium blocked on a risk reversal in the March 31st tenor with 1.6K strike ETH calls bought and 900 strike ETH puts sold.

Liquidations

January 3rd started the year with one of the largest amounts of short liquidations with around $55m ETH and $11m BTC liquidated as BTC made a push to the $16,800 region and attempted a test of $17,000.

At this point, ETH had significantly outperformed the move in BTC potentially driven by the larger number of liquidations in the derivatives markets.

Saturday also saw liquidations with $31m ETH and $14m BTC being liquidated on the move above $17,000 in BTC while ETH appeared prime to test $1,300 to close out Sunday night EST.

A week ahead

We’re heading into a new week with curiosity on any impact the DCG January 8th deadline may have had on vol and now looking forward at a potential new range of trading after the previous stagnation in a $600 range for BTC.

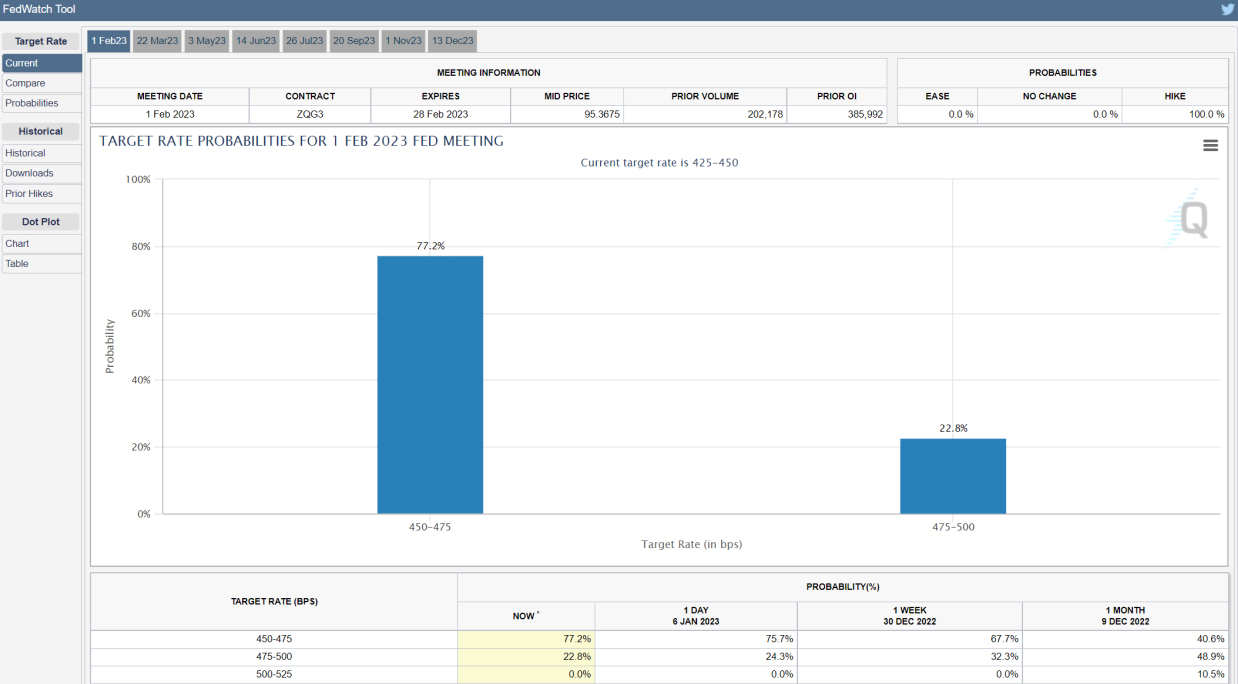

Looking into events for this upcoming week, US CPI remains the major macro catalyst to watch out for as it will also have an impact on the likelihood of more hawkish hikes in the upcoming fed meeting. The market seems to imply around a 75% chance for a 25bp hike, and 25% chance for a 50bp hike. Shortterm price sentiment as seen by the current price action and call skews does appear slightly bullish.

AUTHOR(S)