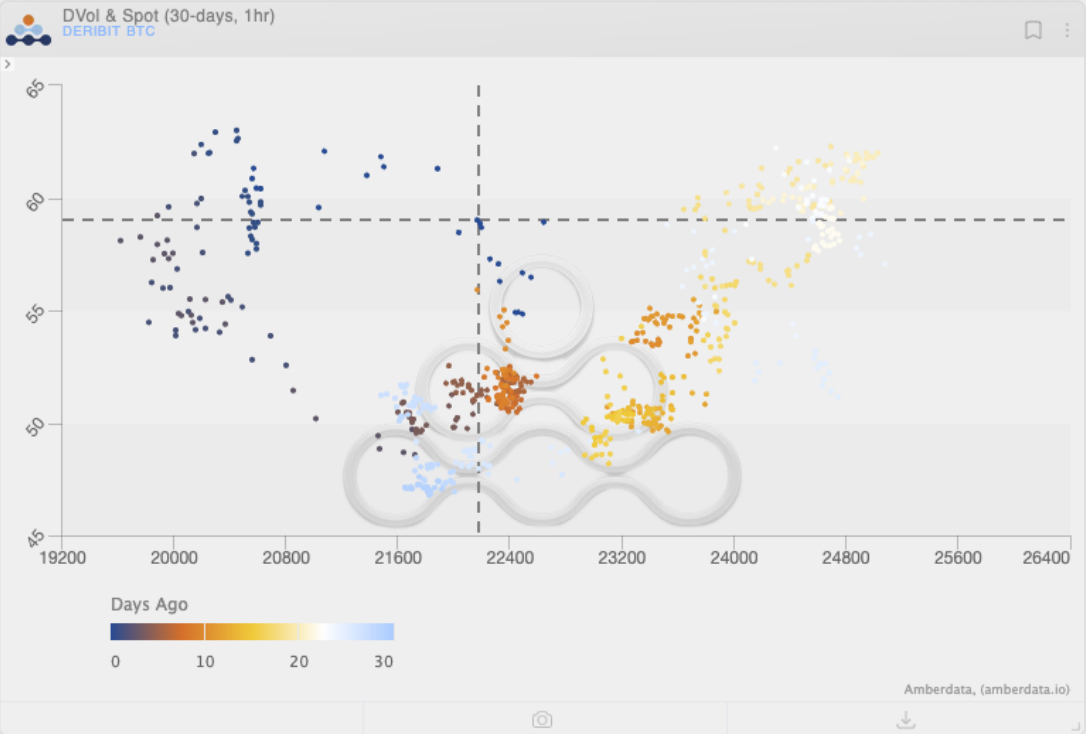

What started as a relatively calm week ended up spiraling out of control leading to a chaotic weekend as stablecoins depegged, banks failed, and the option/volatility markets saw a sign of life. Spot/Vol correlation decoupled from the recent status-quo in terms of (spot-up/vol-up) as option buyers started to become cognizant of the potential for further downside.

Put flows became rampant to end the week, and skew shifted massively across all tenors to a hefty premium in puts. With the recent rally, put skew has softened slightly, but OTM puts still trade at a premium.

Call buyers stepped in as we tested lows, and several of those bets ended up paying out with some of the 3/31 and shorter dated tenor 22K call buyers up several hundred percent after the massive Sunday rally. Term structure has become heavily backwardated on the recent fears, and overall IV has shifted higher across all tenors.

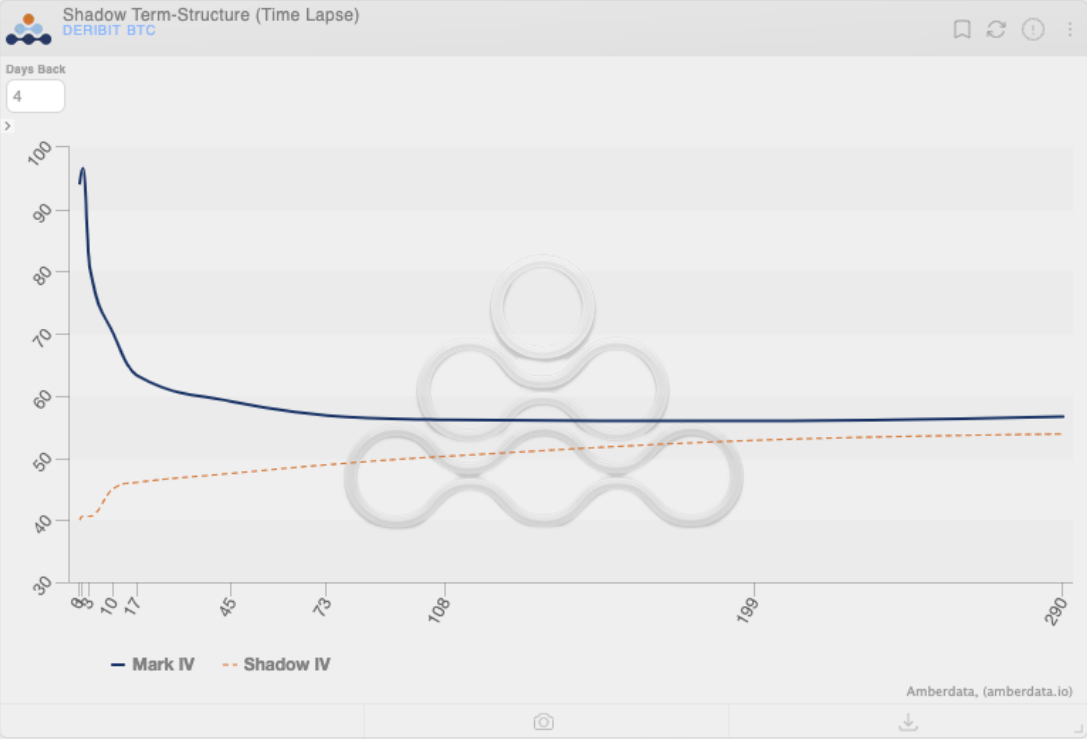

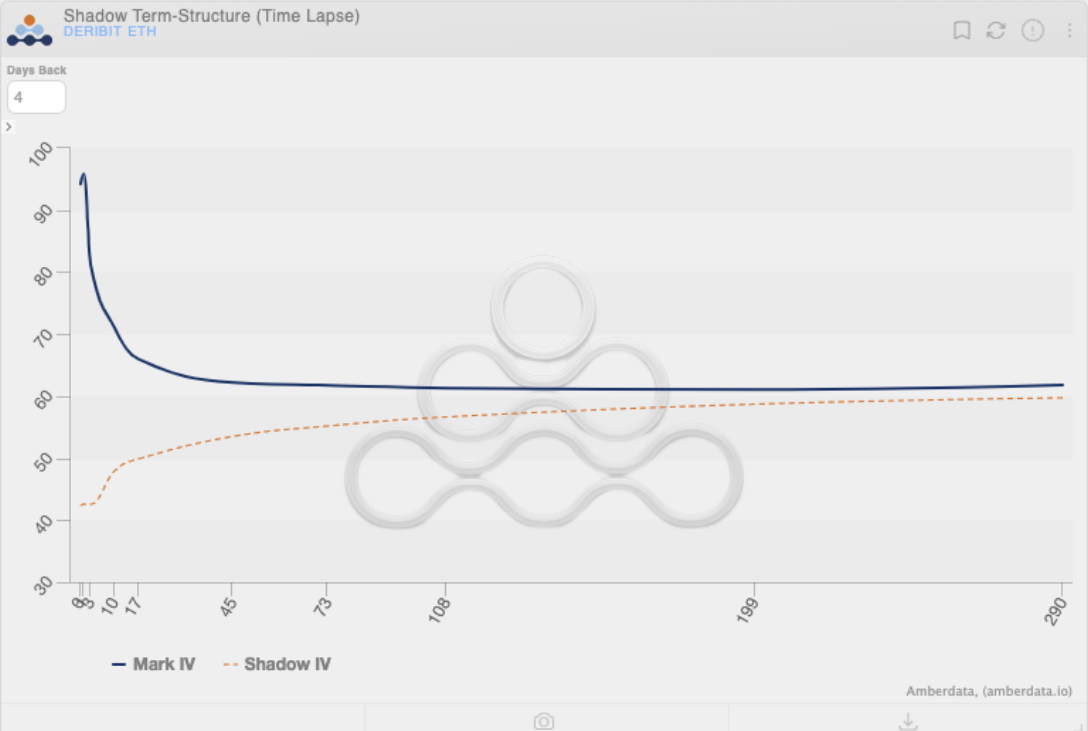

Term Structure for BTC and ETH

In both BTC and ETH, term structure has become heavily backwardated with short-dated expiries trading at significant volatility premiums compared to longer dated expiries. IV across the board has shifted up significantly after a dreadfully slow decline throughout the month of February and to start March. Longer-dated tenors in BTC shifted anywhere between 3-6 points, while the April expiry moved a whopping 12 points higher for ATM strikes.

ETH term structure shows a similar picture with sharp backwardation occurring in the front end of the curve, with a shift higher across the entire curve. Interestingly, September is slightly depressed compared to the surrounding tenors, and December has a slight kink higher than both June and September most likely caused by some of the recent flows (large calendar spreads blocked recently).

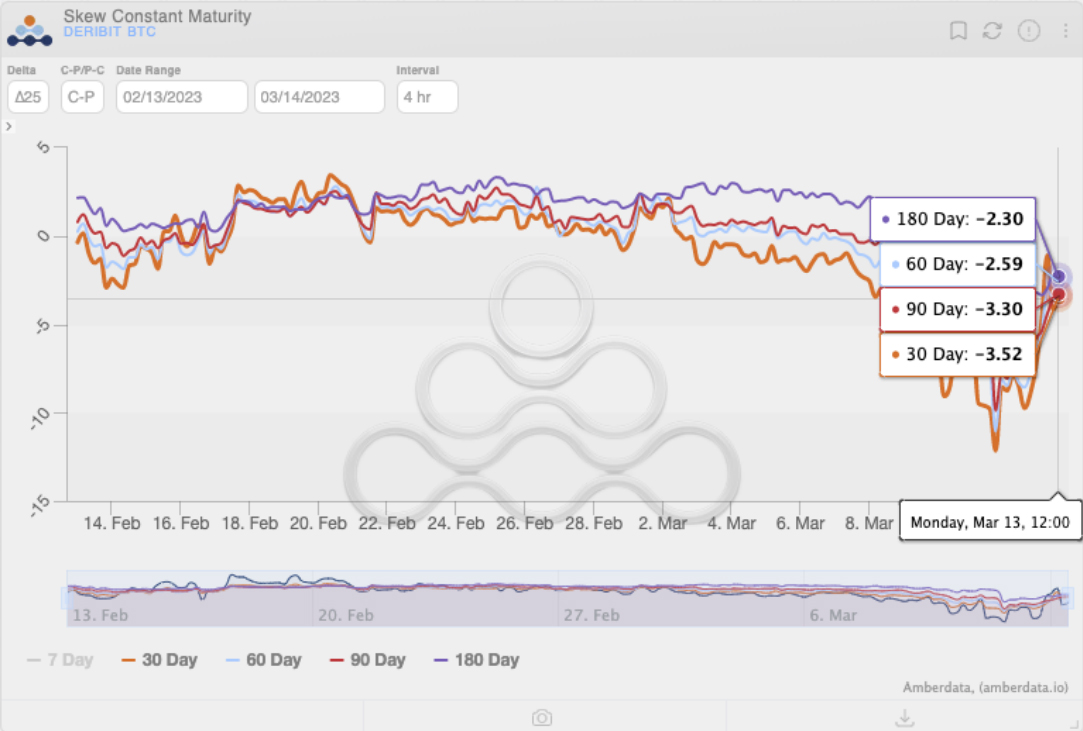

Skew for BTC and ETH

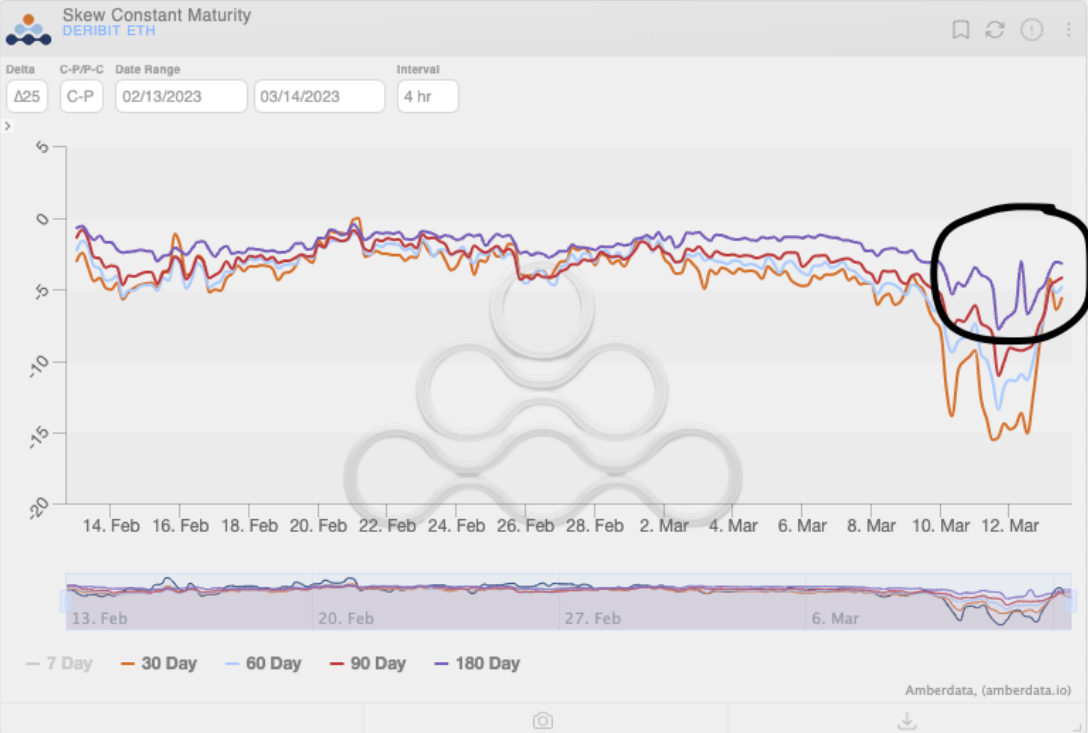

Skew has stayed relatively firm over the past few weeks but with structural fear starting to build up and the frantic worries around stablecoins over the weekend, skew across all tenors drifted heavily towards favoring puts as flows for downside protection became prevalent prior to the rally on Sunday. At the peak, put skew had shown 25 delta puts trading at 6 point premium before slowly reverting to around a 2.5 point premium in the 180 day tenor, with the 90 day tenor trading at a 10 point premium before slowly reverting to 3.3.

In ETH, short dated skew reacted much more negatively than in BTC while longer dated skew had an interesting spike higher that quickly faded at the same time skew was most negative. This strong demand for puts slowly faded with weekly skew shifting from a 15 IV premium to 5.5.

Liquidations

March 8th saw the largest number of longs liquidated over the past 3 months according to Coinglass. Quickly thereafter however, shorts saw a large number of liquidations popping up as well as short-term solutions to the recent USDC depegging and bank fears slowly started to materialize.

To help add to the buying pressure, with confidence in stablecoins waning, a potential shift in allocation from stables to majors also seems to be in the cards as spot buys flow in (although difficult to pinpoint reasoning).

Noticeable Flows Throughout the Week

Large flows into puts as recent events started to become primary trading narratives, with large blocks of OTM puts in BTC and ETH both purchased. Popular strikes and expiries were the 18/19K strikes expiring 17MAR and 31MAR in BTC. In ETH, 1.2/1.3K strikes expiring 31MAR were prevalent.

Buy-The-Dip-esque trading started to flow in toward the end of the week after the large selloff and liquidations, which (as of now) seemed to have paid off quite nicely after the Sunday rally. Large blocks of vega selling after this rally in vols have been noticed in ETH as well.

For further detail on some of the block flows traded through Paradigm, check out their recent tweet.

A Look Ahead

A spike in implieds across the board has been warranted given the recent events and some of the potential longer term implications and short-term fallout. However, it seems like the market is both happy with some of the short-term solutions, as well as some of the longer-term implications on rates.

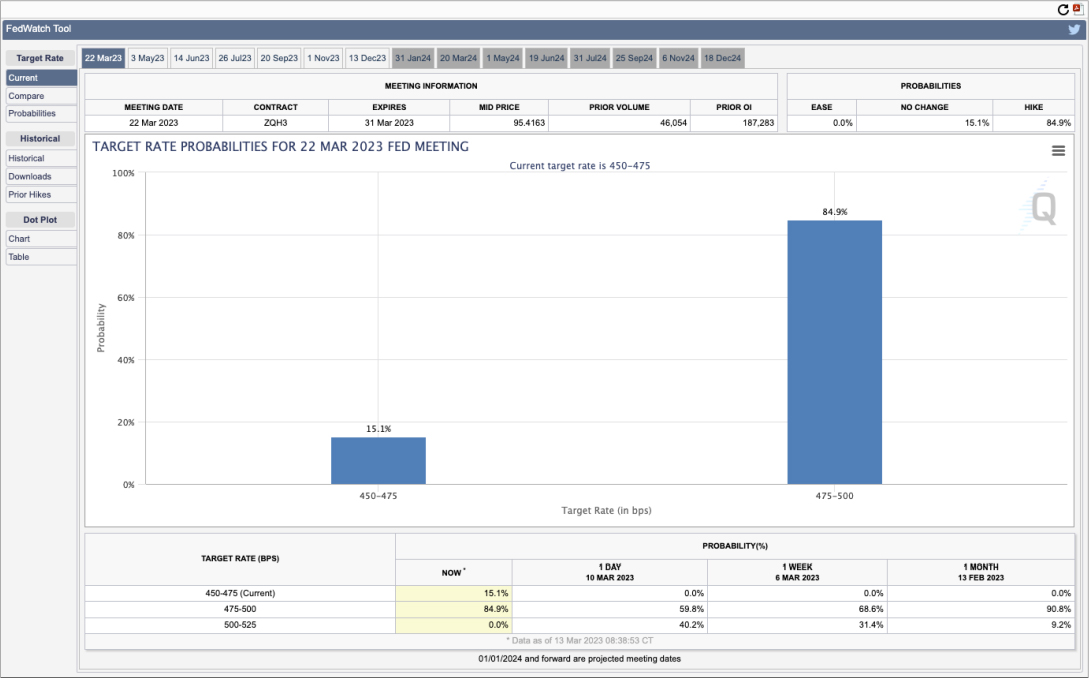

Interestingly enough, a week ago predictions showed a 0% chance for a no-hike FOMC, and a 31.4% chance of a 50 bp hike. Now, predictions are estimating a 15.1% chance for no hike, and a 0% chance of a 50 bp hike.

AUTHOR(S)