Post CPI Update

After giving the markets about 30 minutes to digest the news, vols across the board have come in after the CPI result YoY was hotter than expected (6.4% vs 6.2% exp.). This CPI result, however, had a relatively low impact on price. The wick down seen directly after the event was quickly bid and resulted in current prices trading relatively unchanged compared to prices before the event.

Block sellers of strangles and straddles started to flow in through Paradigm and Deribit as a supply of short-dated vol crushed implied vols in the weeklies. Longer dated expiries took a slight hit as well 30 minutes after the event. A similar trend is forming in ETH, comparing current IV’s to those 24 hours ago. Some had speculated we’d be trading below $21K or above $23K in BTC after this event given the gap up on January 20th, however, current price action suggests we may continue consolidating at these levels as volume starts to build up at these prices and a new, tighter range starts to form.

Weekend Recap

Recent regulatory concerns have been the primary crypto-native narrative impacting price-action recently, with a macro event (CPI) also looming around the corner. Last CPI catalyzed price action that led to massive rallies in BTC and ETH. Although those rallies were predominantly BTC driven, ETH had started to catch up in February as the ETH/BTC ratio started to steadily rise up until Wednesday. This relative strength in ETH during the last week quickly has faded, and firming ETH vols saw a bit of weakness over the weekend in-line with BTC.

Skew, BTC

Short-dated skew in BTC had touched positive levels as an exuberant market relentlessly pursued upside on rallies before slowly drifting lower throughout the next two weeks. Skew across all tenors is heavily depressed, and although a short-term flip to positive happened around 04:00 UTC on Monday to the weekly skew, the premium was short-lived as skew currently shows 25 delta puts at around a 2 IV premium to calls. Longer dated skew in tenors longer than 90 days is still slightly positive and this has persisted ever since the January CPI print and subsequent rally.

Skew, ETH

In ETH, a very noticeable shift in skew has occurred with short-dated 25 delta puts trading around a 7 point premium and even in the longer dated tenors skew is negative. Seeing such a sharp dropoff in call skew, especially prior to this event, signals to me a fear of some short-term downside or skepticism of any upside rallies. After testing $1,700 about 4 times before this sharp rejection we’re now around 15% away from even being close to a test of the upper range we’ve traded in, and thus this decline in demand for OTM calls certainly makes sense. With the supply of upside short-dated calls also coming back into the market as long positions closed out, another weight on upside implied volatility has become apparent.

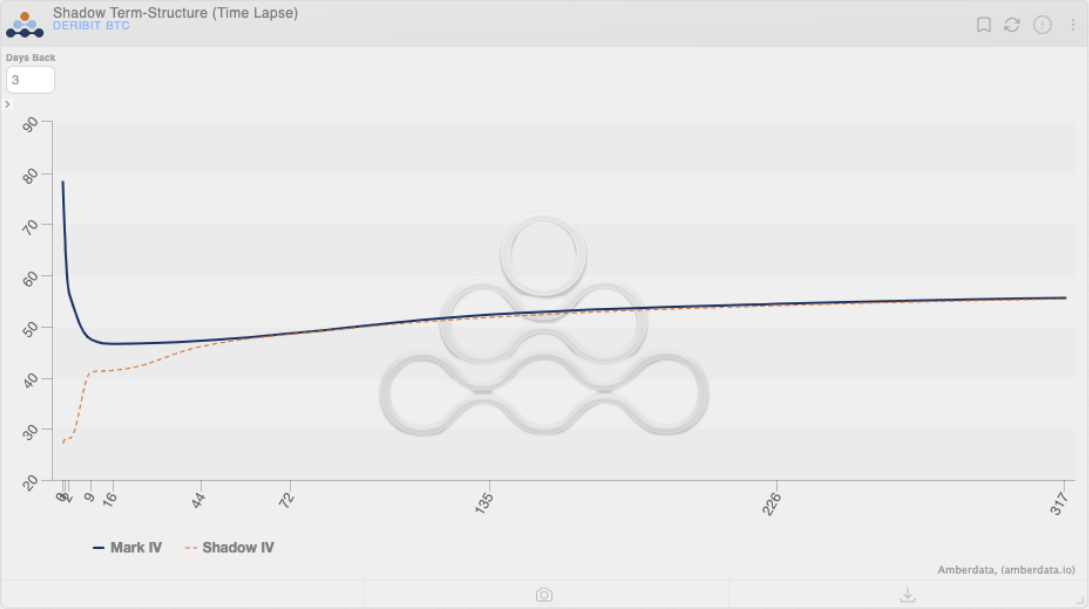

Term Structure, BTC

With the recent price-action driven in the short-term by some of the regulatory concerns and CPI speculation, the front end of the term-structure in both BTC and ETH is currently in sharp backwardation – primarily due to traders positioning themselves around CPI. The longer-dated end of the term-structure has been relatively stable compared to three days ago.

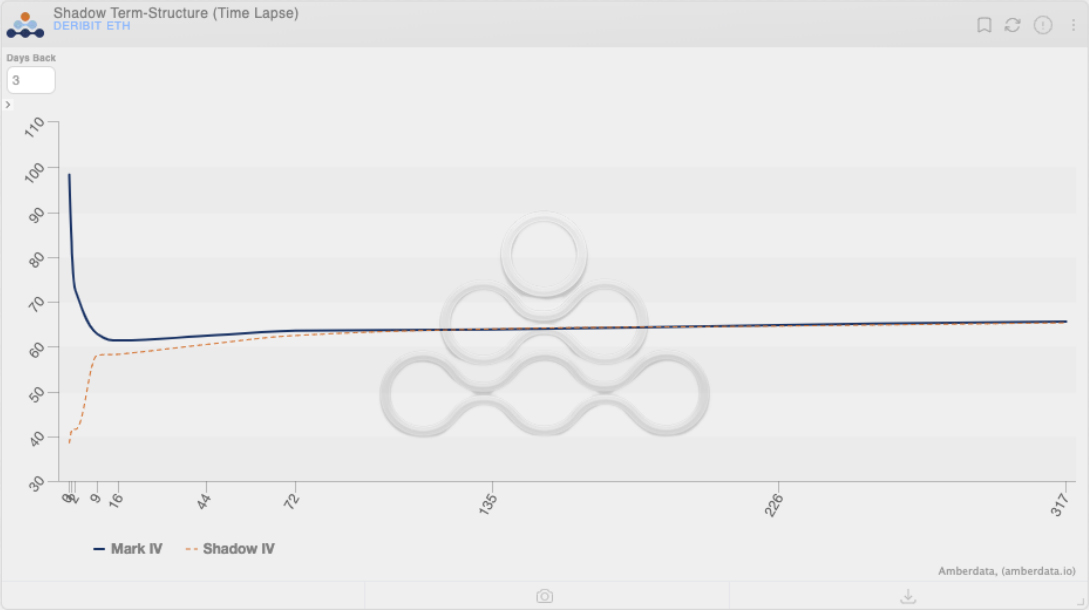

Term Structure, ETH

In ETH, a similar picture has been painted compared to BTC with sharp backwardation in the front end of the term-structure, especially after a bullish reversal overnight pushing us back above $1,500. Term structure in ETH remains relatively flat across the board, with no noticeable spike in March even though a speculated ETH Shanghai upgrade may be happening during this expiry.

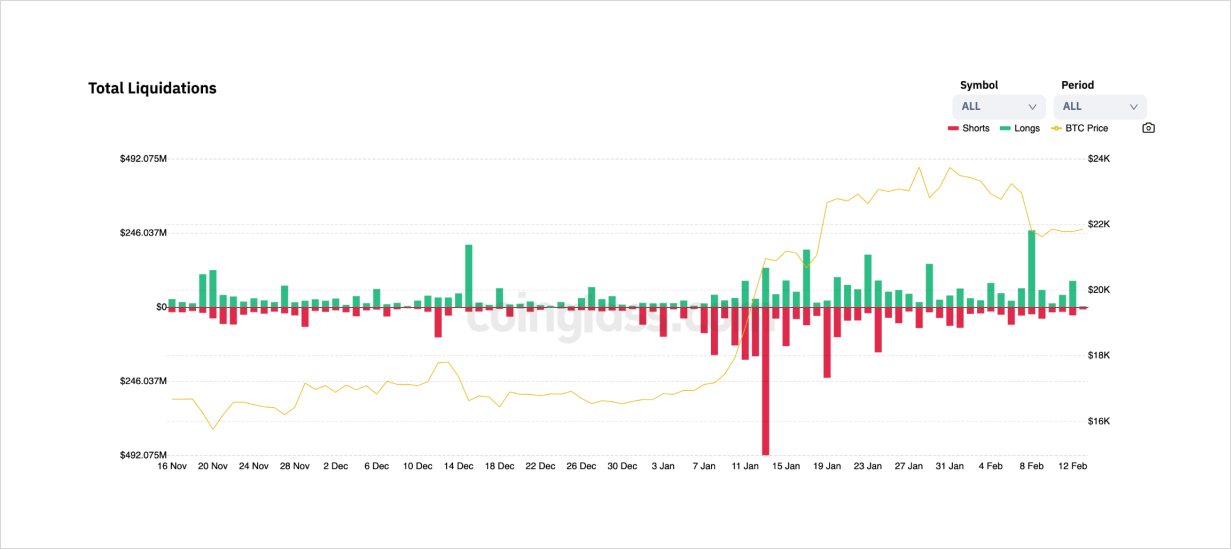

Liquidations

With positive price action closing January out, there has been an accumulation of leveraged longs across the crypto majors. Last week on the 7th, during the move from $23,000 to below $22,000, we saw one of the largest amounts of long liquidations happen. This flush of long leverage out of the system is healthy for price-action in the long term, but had noticeably increased volatility – both realized and implied – during and after this flush.

Noticeable Flows

Last week, mixed flows had come in for BTC with size blocked in certain call spreads followed by the closure of previous outright upside. In ETH, bullish sentiment was the predominant narrative being expressed to start the week off but we closed the week with some increased demand in downside protection as outright short-dated puts scattered across the Feb 17th and Feb 24th expiries started to flow in.

Day-of positioning for CPI in ETH blocked through Paradigm shows sellers of the bull risk reversal, outright puts purchased for longer dated expiries, and a demand for short-dated puts as well. In BTC, some longer dated expiries such as June 30th and April 28th saw some outright call demand, whereas in the short term mixed views had been expressed.

For more detailed insight into block trades executed through Paradigm, take a look at their recent tweet.

A Look Ahead

It will be interesting to see how the longer term implications of any sort of regulatory concerns around staking and stablecoins are either negated or exacerbated by the CPI print we saw today. Short-dated demand for upside after the last CPI print was quite popular, however, this demand for upside was after and during a massive rally which came in the wake of a very quiet previous month of range-bound trading. With the options markets also showing a large supply of the $25K calls sold, this acts as an upper range to watch out for. Additionally, with most of the longs being liquidated recently, perhaps there are a few shorts resting at previous levels of resistance that could possibly be squeezed out and push us back into or out of our previous range.

AUTHOR(S)