Last week’s bullish momentum has continued into this week, with both major assets enjoying significant spot price rallies. This goes against a recent trend of notable ETH under-performance, a trend we have also seen reversed in its perpetual swap contract funding rate. However, the spread between their respective future-implied spot-yields has grown to near 10% at an annualised rate for the 1-month tenors, despite a moderate pickup in ETH yields in the last 24 hours.

Spot Rally

Figure 1 Minutely BTC (yellow) and ETH (purple) perpetual swap contract price since October 14th. Source: Block Scholes

- Spot prices of both majors have continued the bullish momentum that began early last week.

- Further signs that a Bitcoin spot ETF approval is possible, macro-economic uncertainty, and some $391M in short positions liquidated all added to long demand for the headline crypto-asset.

- Against its recent trend of under-performance, we have seen a similar performance in ETH as BTC.

High Funding Rates

Figure 2 Hourly BTC (yellow) and ETH (purple) perpetual swap contract funding rate as traded on Deribit since October 2021. Source: Block Scholes

- Funding rates have climbed to their highest values since October 2021, one month before BTC’s all- time high the following November.

- The high funding rates paid by long positions to shorts is likely driven by both speculation and hedging activity, with market makers reportedly hedging net-short volatility positions at strikes above $30K.

- ETH’s funding rate has recently under-performed that of BTC’s – often trading negative when bullish spot price action in BTC has driven its rate positive.

Futures Under-Performance

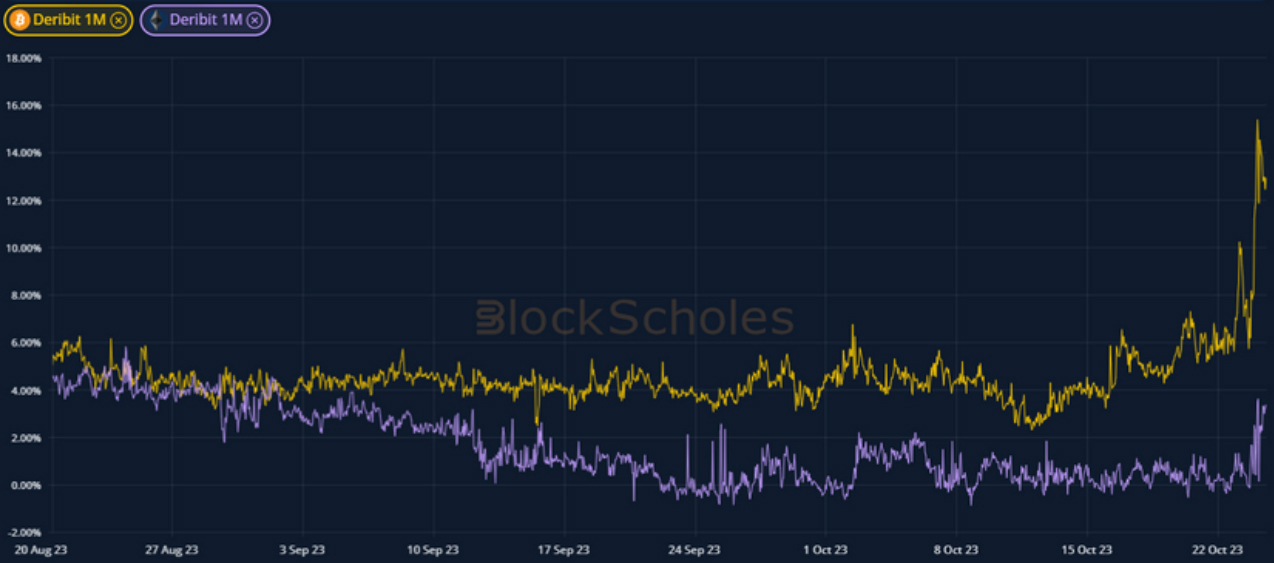

Figure 3 Hourly 1-month tenor futures-implied spot-yields for BTC (yellow) and ETH (purple) since 20th Aug 23. Source: Block Scholes

- While ETH’s strong funding rate and concurrent rally could signal a return to its correlation to BTC’s, we note that ETH’s futures markets imply yields that continue to strongly under-perform those of BTC futures.

- This trend began at the beginning of September, and has seen ETH yields stick close to zero.

- The modest recoveries in spot performance and funding rate levels leave ETH’s futures market looking underwhelming in comparison.

AUTHOR(S)