Crypto-asset spot prices have once again increased their correlation to US equities, recording a 0.5 correlation coefficient over the past 30 days with the returns of the S&P 500. Whilst both asset classes also reported higher realised volatility at the end of August, crypto-asset derivative markets continue to price for a higher level of volatility. However, the implied-to-realised volatility ratio is highest in equities, even after the recent choppy moves in spot prices caused the ratio to fall for each asset.

A Return to Equity Correlation?

Figure 1 Rolling 30-day estimate of correlation of BTC returns with the returns of gold (yellow, represented by the GLD index), the Nasdaq index (grey, NDX), and the US equity market (red, SPX) since July 2022. Source: Yahoo Finance, Block Scholes

- Crypto-assets have increased their correlation to equities as well as to gold since recording zero statistical relationship to either in July.

- The 30-day correlation of the returns of gold and US equities (represented by the GLD index and NDX and SPX indices respectively) has risen strongly to levels last seen at the beginning of this year.

- Equitiy prices have moved upwards almost monotonically in that time, buoyed by positive economic data, hopes of a soft landed, and the fading of recession bets.

Realised Yet?

Figure 2 Realised volatility with a look-back of 30 days of daily returns of BTC (yellow) ETH (purple) and the SPX (red) since July 2022. Source: Yahoo Finance, Block Scholes

- The realised volatility of both BTC and ETH has been trending lower throughout 2023.

- At the same time the realised volatility of the SPX has also trended lower, continuing crypto-asset’s notoriously higher volatility over other asset classes.

- Since the end of August we have observed noticeable increase in the volatility of both equities and crypto-assets.

What Are You Impying?

Figure 3 Estimate of 30-day, at-the-money implied volatility for BTC (yellow) and ETH (purple), plotting alongside the VIX (red) since Jul 2022. Source: Yahoo Finance, Block Scholes

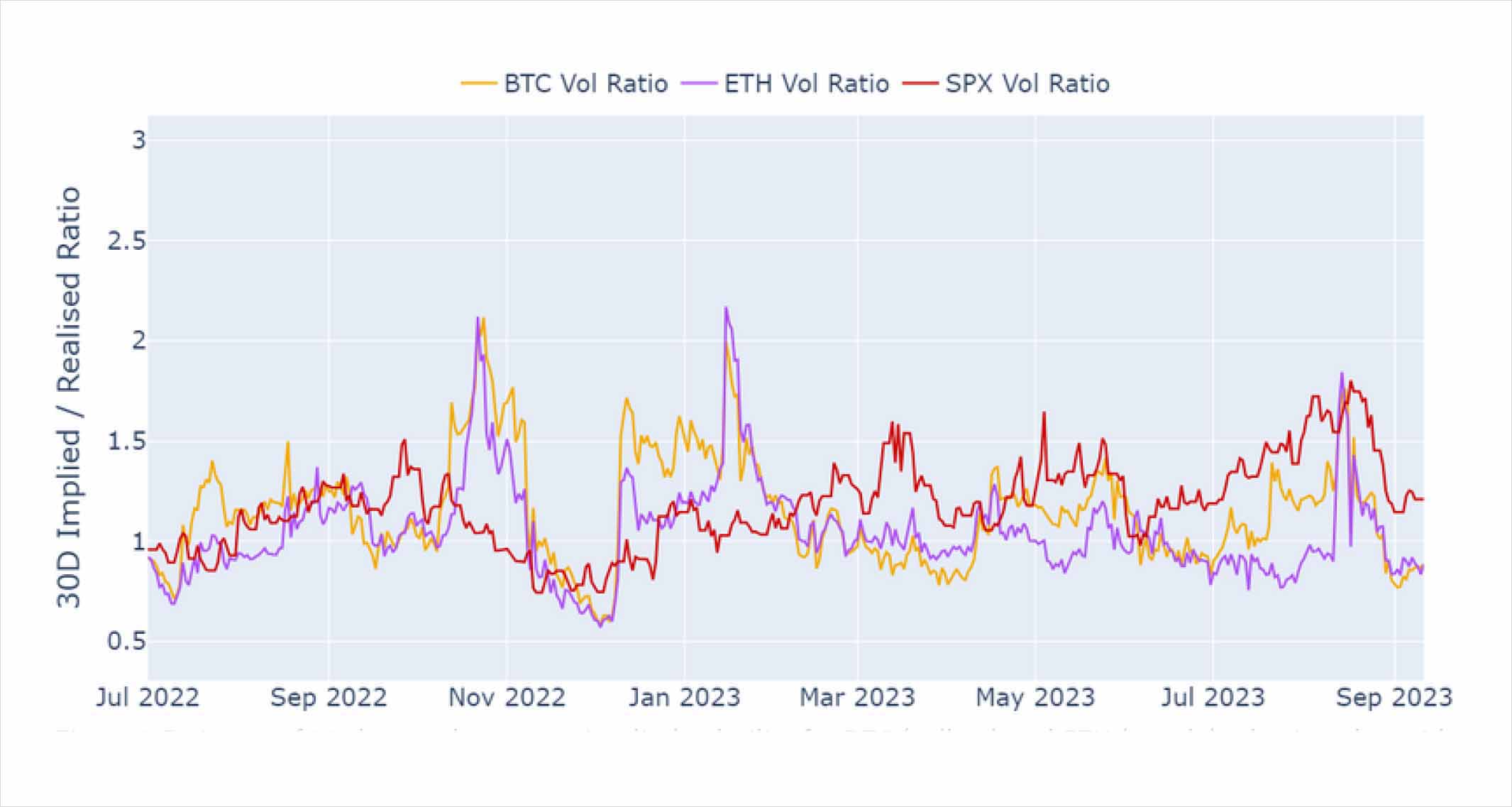

- BTC options priced for higher volatility than had previously been delivered throughout July and August, whilst ETHʼs ratio spiked above 1 only during the selloff in spot prices.

- Equities maintained a higher volatility premium during this period, as traders looked to hedge against a reversal to the recent strong performance.

- Realised volatility rose at the end of August for each asset, whilst implied volatility remained at broadly similar levels, causing the ratio to fall sharply.

- However, we observe a volatility ratio above one in options on US equities (as measured by the VIX), whilst crypto-asset derivatives markets now report a lower implied volatility than has recently been observed.

AUTHOR(S)