Larry Fink’s recent comments are reminiscent of a oft- revisited Bitcoin narrative – one that paints BTC as a “safe-haven” asset or a store-of value. Whilst we do find some indication that BTC increased its correlation to Gold in the second half of 2022, a traditional hedge against inflation, this correlation was nearly always lower than its correlation to equities. June’s rally in BTC spot prices saw a significant drop in its link with Gold, leaving BTC with no more of a statistical relationship than it has with most other benchmark financial assets.

Digital Gold

Figure 1 Daily spot price of BTC (orange) and Gold (yellow) as represented by the GLD index since January 2015. Source: Yahoo Finance, Block Scholes.

- The brief US banking crisis in the early part of this year coincided with a strong performance of crypto-assets and caused claims that Bitcoin is a store-of-value asset to resurface.

- More recently, BlackRock CEO Larry Fink praised Bitcoin for “digitising gold”, despite having once claimed that its price was simply an indicator of money laundering.

- The asset did noticeably increase its correlation to Gold beginning in the second half of 2022, with both recovering losses sustained in the first past of last year.

- But this correlation was nearly always lower than its correlation to US equities.

Gold Correlated

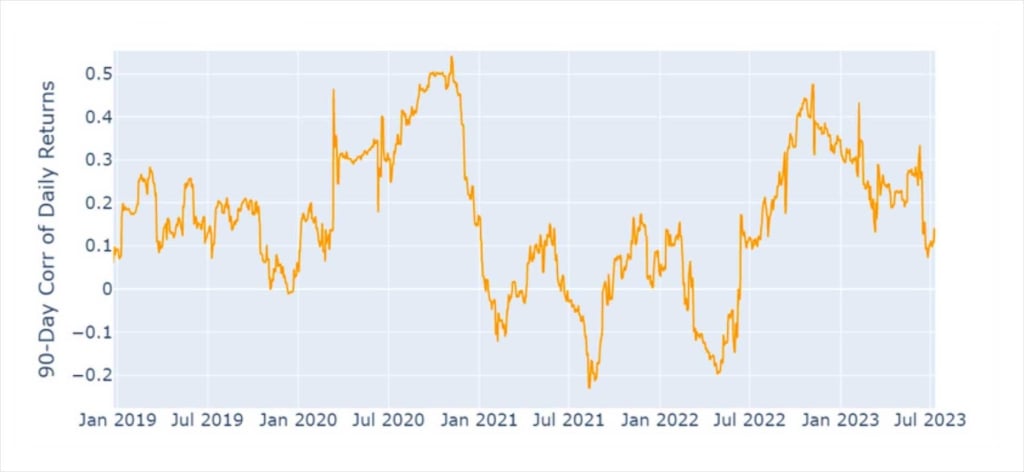

Figure 2 Rolling 90-day correlation of BTC returns to GLD index returns since January 2019 . Source: Yahoo Finance, Block Scholes.

- The last time that we saw a high correlation of BTC returns to those of to Gold’s was in 2020 during the COVID-19 pandemic, which caused a selloff and recovery in almost all investment assets.

- However, the most recent spot price movements indicate that this relationship has once again broken down.

Inflation and Inversion

Figure 3 BTC spot price (orange), US CPI inflation (grey), and the 10Y-2M spread of US Treasury notes (green) since 2015. Source: Yahoo Finance, BLS, Block Scholes.

- BTC began to move closer to the returns of Gold beginning in late July 2022.

- This is around the same time that inflation in the US was peaking and soon after the US Treasury yield curve began to move swiftly towards an inversion (as measured by the spread between the 2M and 10Y yield).

- BTC rallied in early June following the BlackRock ETF application whilst Gold continue to drift downwards.

- This resulted in a swift drop in the correlation of their returns, meaning that BTC is currently as correlated to Gold as it is to bonds or equities.

AUTHOR(S)