The volatility smiles of both BTC and ETH have reacted to the recent uncertainty in near identical ways.

Whilst the ATM volatility of BTC options remains consistently 20 vol points lower than ETH’s, both assets have reported smiles that are near the steepest and most skewed recorded YTD. This co-movement was punctuated in the last week by a brief divergence that appears to have been partially resolved.

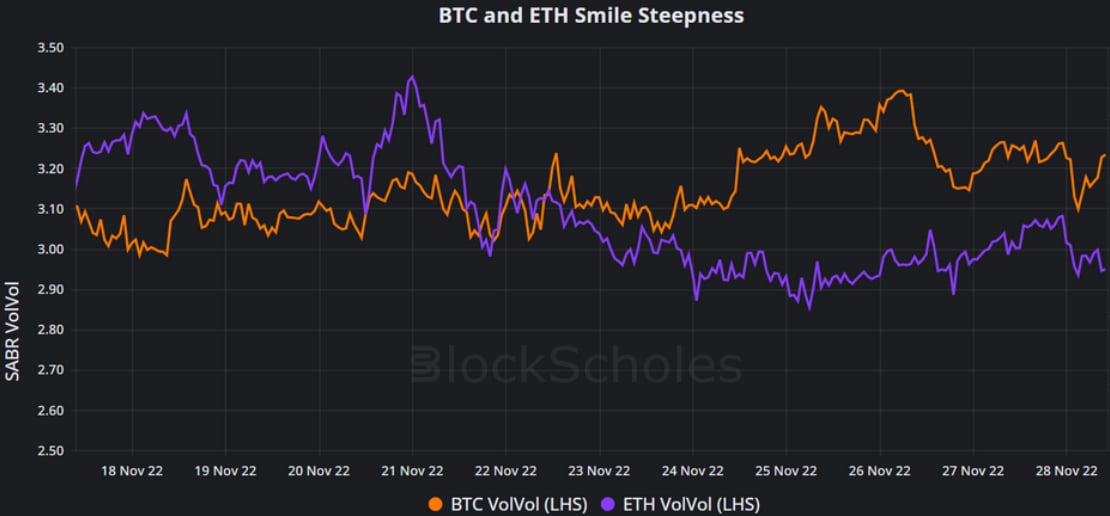

SABR Volatility of Volatility

Figure 1 Hourly BTC (orange) and ETH (purple) SABR calibration Volatility of Volatility parameter at a 30-day tenor from 17th Nov 2022. Source: Block Scholes

The SABR Vol of Vol parameter corresponds to the volatility of volatility used to model the volatility smile. The higher the volatility of volatility, the steeper the smile and the more expensive deep OTM puts and calls are when compared to options struck ATM.

- BTC’s Vol of Vol rose slightly in early last week, trading near the top of its range YTD.

- That marks a divergence from the behaviour of the Vol of Vol of ETH’s volatility smile, which has decreased since peaking on the 20th Nov.

- The divergence has since resolved somewhat following a drop in BTC’s Vol of Vol over the weekend.

- But a similar drop in ETH’s Vol of Vol means that, whilst both smiles remain near their steepest levels, ETH’s smile is now implying a slightly lower premium to volatility in the wings than BTC’s.

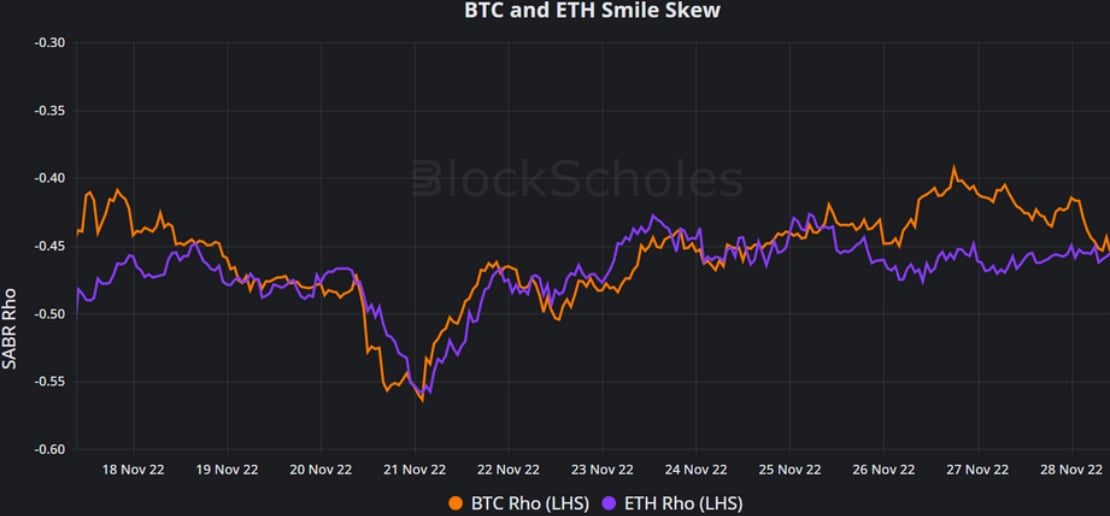

SABR RHO

Figure 2 Hourly BTC (orange) and ETH (purple) SABR calibration Rho parameter at a 30-day tenor from 17th Nov 2022. Source: Block Scholes

The SABR Rho parameter corresponds to the correlation between the underlying asset and its implied volatility parameter in the SABR calibration used to model the volatility smile. It also controls the skew of that calibration towards OTM puts or calls. Positive values indicate a premium of OTM calls relative to puts, whilst a negative value indicates the market’s preference for OTM puts.

- The SABR Rho parameters of BTC and ETH have responded almost identically to the collapse of FTX and resulting contagion risk.

- However, this was punctuated by a short-lived divergence between the smiles of the two assets at the beginning of this week.

- That divergence has since resolved, with both smiles still assigning a significant premia to OTM puts despite a moderate recovery from the most pessimistic pricing following the collapse and subsequent hack on the FTX exchange.

AUTHOR(S)