CoinTelegraph’s false announcement of a spot ETF approval saw a strong spot price rally that retraced just 30 minutes later. Despite spiking during the confusion, implied volatility had begun to rise for both majors several days earlier, late on the 13th of October, and remains high following yesterday’s volatile moves. Beginning on the same date, BTC’s vol smile lead a reduction in the skew towards OTM puts as a result of an out-sized increase in the implied vols of OTM calls. This too remains following the return of spot prices to their pre-tweet levels, indicating that sentiment expressed in the last 2 days persists.

ETF Spot Spike

Figure 1 Minutely BTC (yellow) and ETH (purple) perpetual swap contract price since October 14th. Source: Block Scholes

- A now-deleted CoinTelegraph tweet incorrectly claiming the approval of Blackrock’s iShares Spot Bitcoin ETF led to a dramatic spike in spot prices that quickly retraced just 20 minutes later.

- The large gamma move reportedly saw up to $72M in liquidations of short Bitcoin positions.

- ETH has since traded sideways, while BTC has trended upwards from its pre-tweet levels.

Vol Smile Skews

Figure 2 Hourly BTC (yellow) an ETH (purple) 25-delta, 1-month risk reversals over the last 30 days. Source: Block Scholes

- BTC’s vol 1-month vol smile is near to the least skewed towards puts that we have seen in the last month.

- Meanwhile, ETH’s smile remains slightly skewed despite moving slightly more neutral in the last two days.

- Both assets began this trend before the volatility near to CoinTelegraph’s false tweet.

- The trend in skew has not changed following yesterday’s volatility, suggesting that the sentiment that caused the change has not been washed out.

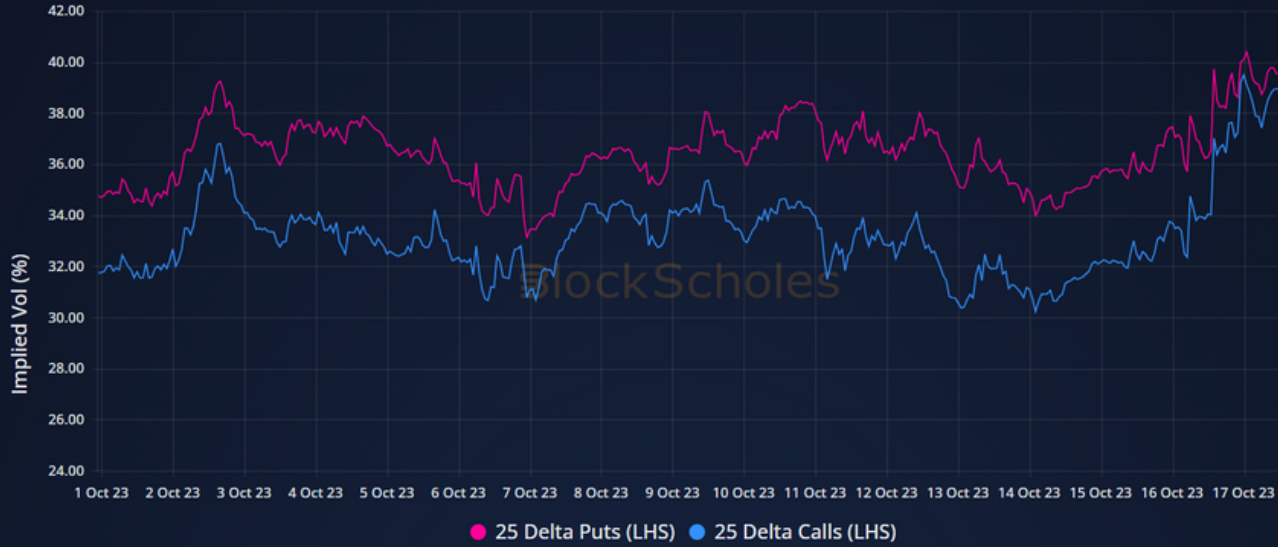

Call And Put Implied Vol

Figure 3 Hourly implied volatility of BTC 1-month tenor, 25-delta call (blue) and put (pink) since the 1st of October 2023. Source: Block Scholes

- Outright implied volatility levels has risen for both assets across the volatility surface, and remains high following yesterday’s false alarm.

- The trend in BTC’s vol smile skew has been largely driven in by an out-sized increased in the implied volatility of OTM calls, rather than an actual fall in OTM put vol levels.

AUTHOR(S)