The volatility implied by ETH options has been higher and more skewed towards OTM puts than BTC’s for several weeks.

ETH’s volatility smile at a one month tenor has also grown much steeper than BTC’s, reflecting a relative demand for OTM optionality when compared to BTC options at strikes far away from its spot price.

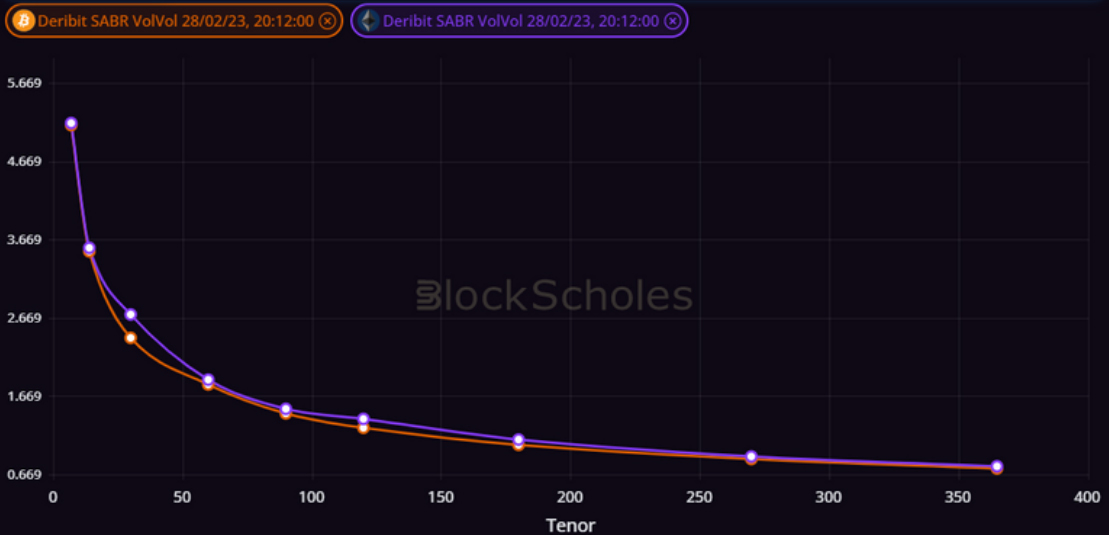

ETH Vol of Vol Term Structure

Figure 1 Term structure of BTC (orange) and ETH (purple) SABR volatility of volatility at a 18:53 28th Feb 23 UTC snapshot. Source: Block Scholes

The SABR Vol of Vol parameter corresponds to the volatility of volatility used to model the volatility smile. The higher the volatility of volatility, the steeper the smile and the more expensive deep OTM puts and calls are when compared to options struck ATM.

- Shorter tenor options in both BTC and ETH are pricing for a much steeper smile than longer tenors.

- This reflects the market’s demand for protection against further sharp swings in spot price.

- ETH’s volatility smile is steeper than BTC’s near to a 1 month tenor, despite matching BTC’s term structure at most other tenors.

Vol of Vol Discrepency Grows

Figure 2 Hourly BTC (orange) and ETH (purple) SABR volatility of volatility at a 1 month constant tenor from 30th Jan 23 to 28th Feb 23. Source: Block Scholes

- The divergence between the two asset’s vol smiles has widened since the beginning of February.

- ETH’s smile has oscillated at similar and higher levels to that date, whilst BTC’s has trended flatter.

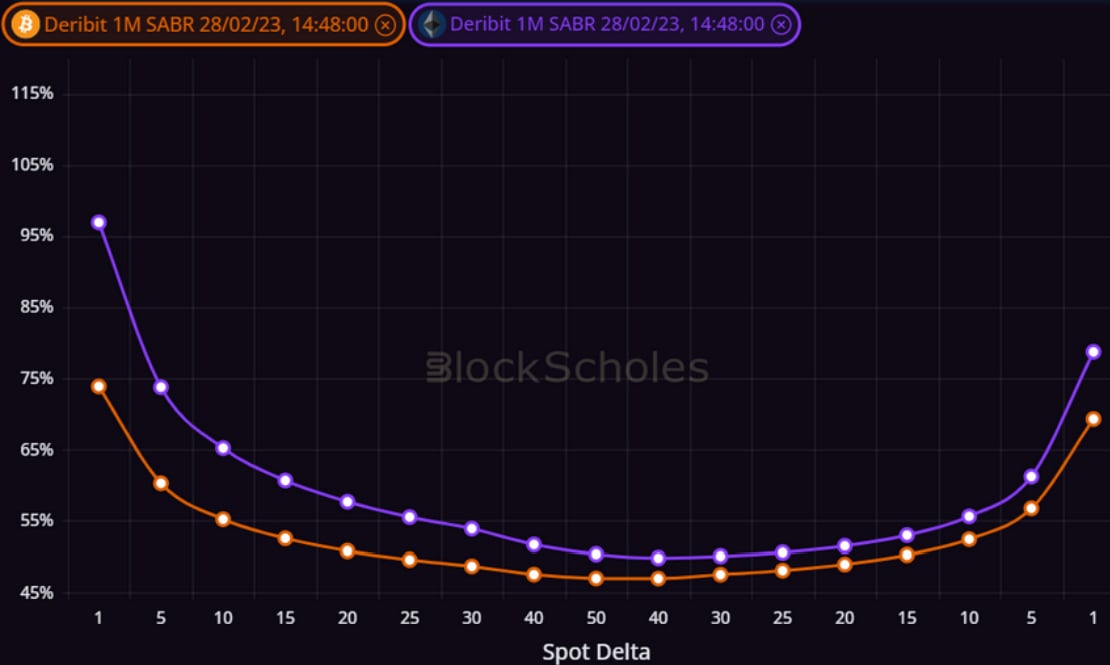

Volatility Smiles

Figure 3 Volatility smiles at a 1 month tenor for BTC (orange) and ETH (purple) at a 14:48 28th Feb 23 UTC. Source: Block Scholes

- The steepness of ETH’s volatility smile at a 1 month tenor is in addition to its higher ATM level and sharper skew towards OTM puts than BTC’s, both of which are present across the term structure.

- This means that ETH’s volatility market is primed for a more volatility, with a higher concern for downside swings in the short term.

AUTHOR(S)