ETH’s volatility surface reflects a higher preference for downside protection than BTC options do at all tenors except 1-3 months. This divergence has moved closer along the term structure over the last week, suggesting that derivatives markets could be targeting the Shapella upgrade, planned for April 12th. In addition, the outright level of that skew has reduced at the shortest tenors, indicating increased confidence in the Ethereum foundation to reach the April 12th date without further setbacks.

Term Structure of Skew

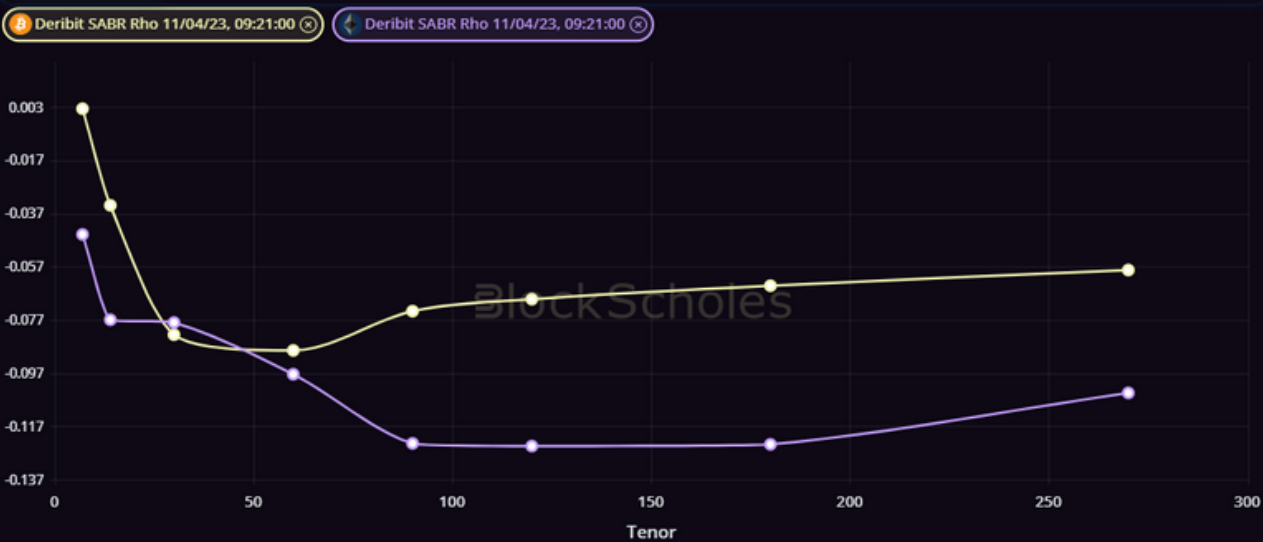

Figure 1 Term structure of BTC (pale yellow) and ETH (pale purple)SABR rho (skew)parameter at a 09:21 UTC 11/4/23 snapshot. Source: Block Scholes

- Both BTC and ETH volatility smiles are skewed towards OTM puts at all tenors.

- ETH’s volatility smile is, in general, more skewed towards OTM puts than BTC’s across the term structure.

- A kink in ETH’s term structure of skew means that vol smiles at a 1M to 2M tenor are similarly skewed for both assets.

ETH Skew Term Structure 1 week ago

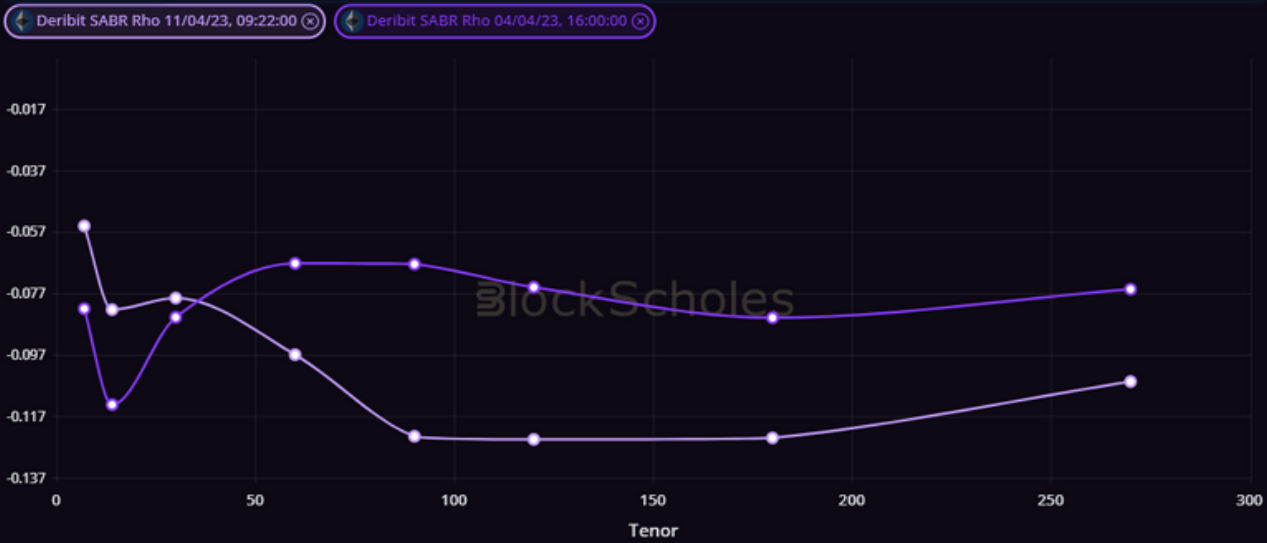

Figure 2 Term structure of ETH SABR rho parameter at 16:00 UTC 4/4/23 (dark purple) and 09:22 UTC 11/4/23 (pale purple) snapshots. Source: Block Scholes

The SABR Rho parameter corresponds to the correlation between the underlying asset and its implied volatility parameter in the SABR calibration used to model the volatility smile. It also controls the skew of that calibration towards OTM puts or calls. Positive values indicate a premium of OTM calls relative to puts, whilst a negative value indicates the market’s preference for OTM puts.

- The positive kink in ETH’s skew has moved along the term structure over the last week, further indicating that this is the result of positioning for the Shapella upgrade, scheduled for 22:27 UTC on Apr. 12.

- That positioning assigns a slightly higher preference for downside protection at both a 2W tenor and tenors longer than 1M, whilst now showing a more neutral smile at tenors between 2W and 1M.

The 2 week Smile Skew

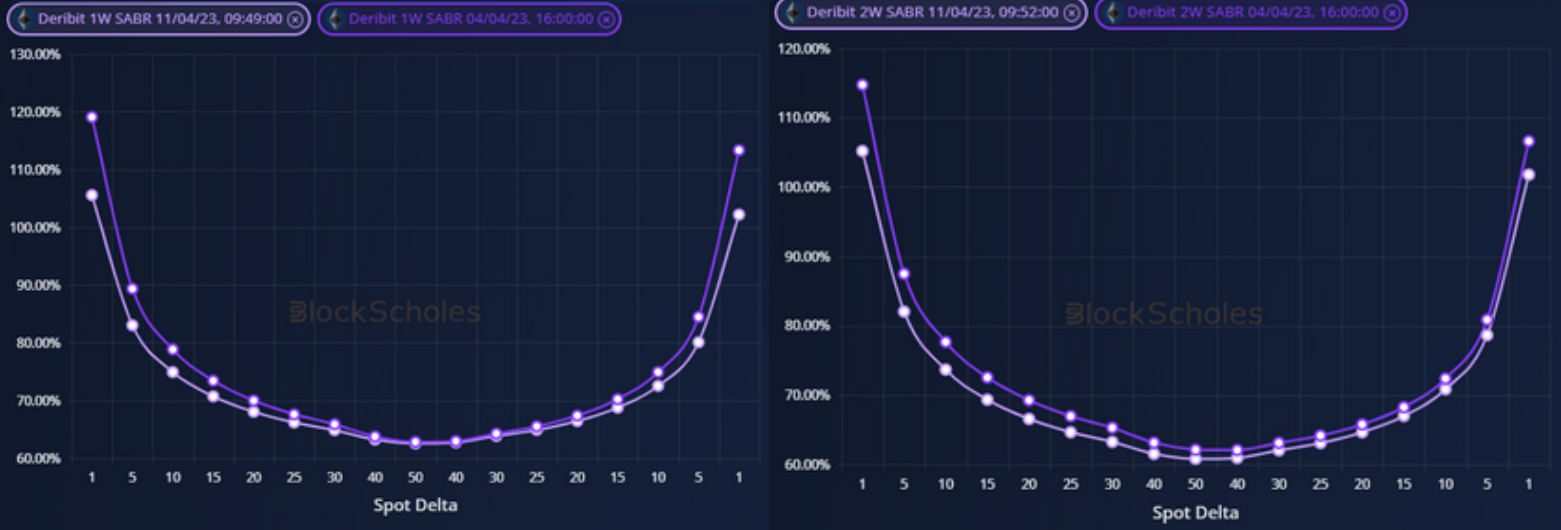

Figure 3 (a) ETH volatility smile at a 1 week tenor at 09:49 UTC 11/4/23 (dark purple) and 16:00 UTC 4/4/23 (pale purple) snapshots. (b) ETH volatility smile at a 2 week tenor at 09:52 UTC 11/4/23 (dark purple) and 16:00 UTC 4/4/23 (pale purple) snapshots.Source: Block Scholes

- The changes in skew leave the 1 and 2 week ETH vol smiles with slightly lower outright volatility than 1 week ago.

- However, a sharper drop (from dark to pale purple) in the implied volatility of OTM puts relative to OTM calls at both tenors sees them move away from favouring downside protection, which is more dramatic in the 1M tenor.

AUTHOR(S)