We observe a noticeable “kink” in the term structure of the skew of ETH’s volatility smile at a 1-month tenor. This dislocation is noticeable compared to the shape of its own term structure, as well as compared the same point on the term structure of BTC’s vol smile skew. The divergence has grown over the last 24 hours as a result of an out-performance in ETH’s OTM calls. The skews of both majors have traced each other closely over the last 30 days, with such dislocations typically resolving over several days.

A Kink In The Skew Term Structure

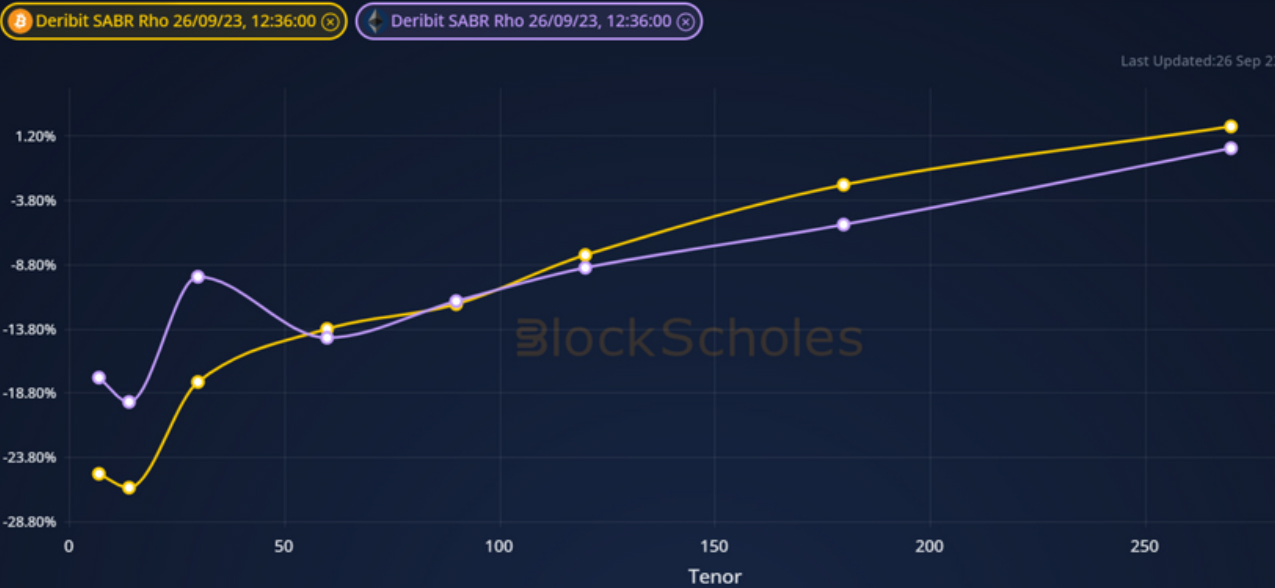

Figure 1 Term structures of SABR Rho parameter for BTC (yellow) and ETH (purple) options at a 10:18 UTC 2023-09- 26 snapshot. Source: Block Scholes

- We observe a dislocation in the term structure of ETH’s volatility smile skew at a 1-month tenor.

- The SABR rho parameter measures the skew of the volatility smile towards puts (negative values) or calls (positive values).

- ETH’s rho parameter is more strongly skewed towards OTM puts at the adjacent 1-week or 2-month tenors, resulting in a distinct kink in the shape of its term structure.

A Comparison With BTC

Figure 2 Hourly 25-delta, 1-month tenor risk-reversal for BTC (yellow) and ETH (purple) over the past 30 days. Source: Block Scholes

- The skew of ETH’s 1-month tenor skew has grown relative to BTC’s over the past 24 hours.

- Previously the skew of the two majors had tracked each other very closely, with similar divergences resolving within several days.

Call Or Puts?

Figure 3 SABR implied volatility of 25-delta ETH calls (light purple), puts (dark purple), and at-the-money (white) over the last 7 days. Source: Block Scholes

- Outright volatility expectations have risen steadily over the past 7 days.

- The implied volatility of ETH’s OTM calls has outperformed that of it’s OTM puts over the last 24 hours.

- This has led to the noticeable reduction in skew at the 1-month tenor.

- However, the vol of OTM puts remains above the vol of calls, meaning that the vol smile is still skewed towards downside protection.

- The skew at this tenor is distinct from its own term structure as well as from the same point on the term structure of BTC’s skew, which it has tracked closely historically.

AUTHOR(S)