ETH options at all tenors have seen a drop in their skew towards OTM puts, continuing to price for a more neutral smile in the wake of the FTX collapse.

However, the skew of the 1 week smile is now far more neutral than even other short-dated smiles. This could either suggest a continuation of the drift towards a neutral smile at all tenors, or that it will soon be resolved by a correction of the 1 week smile skew towards the levels priced by options at longer tenors.

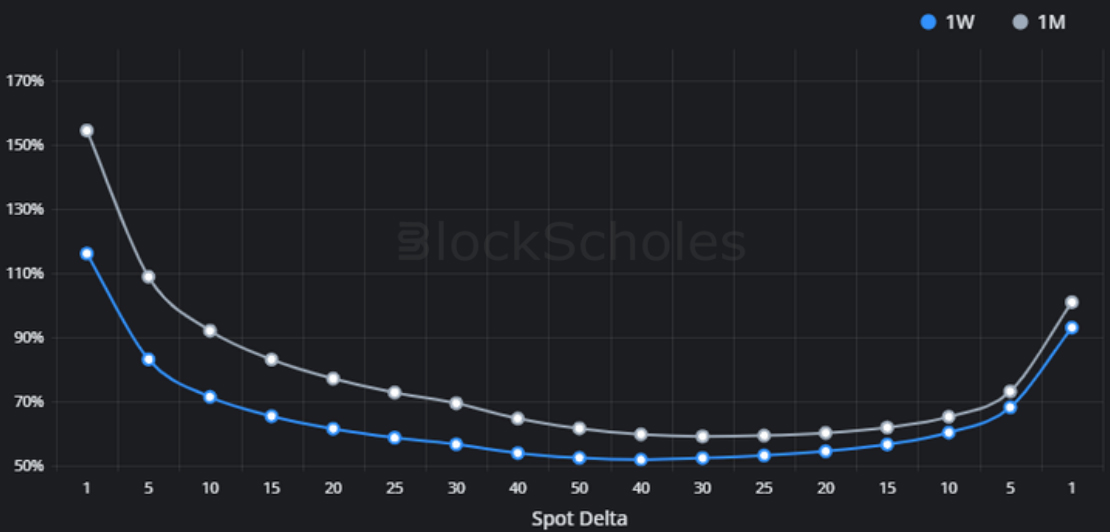

Figure 1 SABR calibrated volatility smiles at 1 week (blue) and 1 month (grey) tenors, recorded at 10:00 UTC 21st December 2022. Source: Block Scholes

- ETH’s 7-day tenor volatility smile is lower and less skewed towards OTM puts than its volatility smile at a 1 month tenor.

- This is due to a lower implied volatility for the shorter-dated OTM puts, rather than a higher volatility implied by OTM calls.

- Those 7-day OTM calls remain at similar levels to OTM calls at a 1 month tenor.

- This divergence has been observed several times over the past month.

The SABR Rho parameter corresponds to the correlation between the underlying asset and its implied volatility parameter. It also controls the skew of that calibration towards OTM puts or calls. Positive values indicate a premium assigned to OTM calls relative to puts, whilst a negative value indicates the market’s preference for OTM puts.

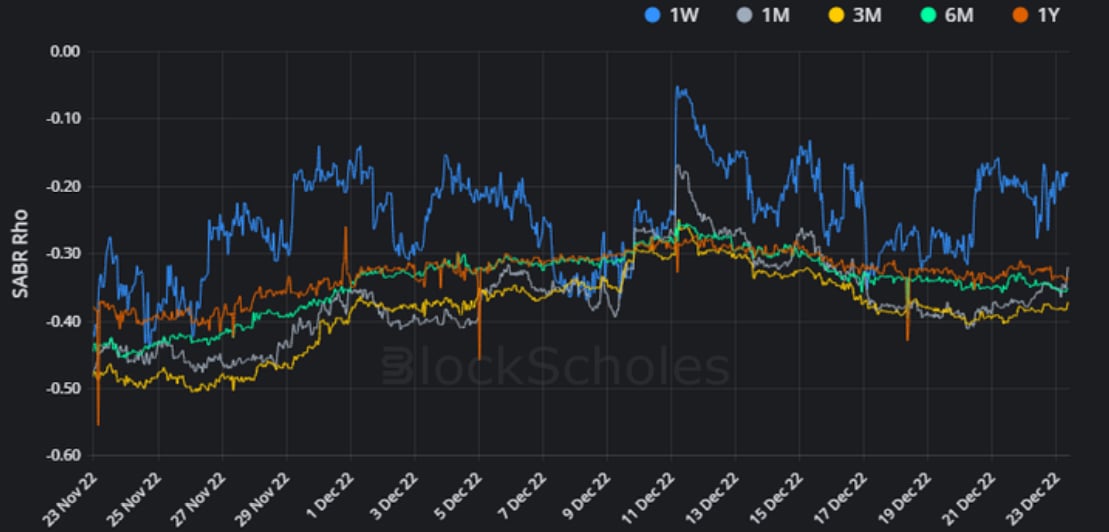

Figure 2 Hourly ETH SABR Rho parameter at several constant tenors from 23rd Nov 2022. Source: Block Scholes

- Longer-dated tenors have been observed to price a sharper skew towards OTM puts since mid-July, as the volatility smile for shorter-dated tenors has recorded a consistently less-negative Rho parameter.

- However, that divergence has grown further, with the 7-day tenor volatility smile now far more neutral than even the 1M or 3M smiles.

- A similar divergence observed at the end of November led to a drop in the skew towards OTM puts at longer-dated tenors.

- However, this dislocation could also indicate that the 7-day skew is too neutral in comparison to the rest of the term structure.

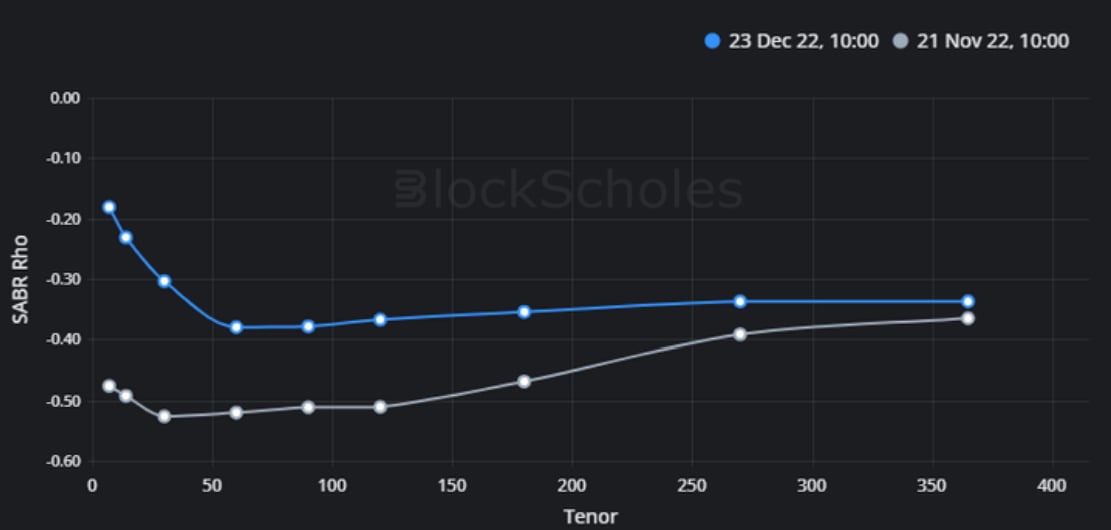

Figure 3 Term structure of ETH’s SABR Rho parameter for 23rd December and 21st November shows a significant drop in skew at shorter-dated tenors. Source: Block Scholes

- Figure 3 highlights the extremity of the drop in the 1 week put-skew compared to the rest of the term structure.

- This chart also shows that the skew of all tenors has dropped over the past 30 days.

- That drop is consistent with the slow drop in pessimistic pricing by the market since the collapse of FTX undid a recovery from negative sentiment.

- That recovery saw the 1 week tenor volatility smile price a neutral skew, without a clear preference for OTM puts or OTM calls.

ETH options at all tenors have seen a drop in their skew towards OTM puts, continuing to price for a more neutral smile in the wake of the FTX collapse. However, the skew of the 1 week smile is now far more neutral than even other short-dated smiles. This could either suggest a continuation of the drift towards a neutral smile at all tenors, or that it will soon be resolved by a correction of the 1 week smile skew towards the levels priced by options at longer tenors.

AUTHOR(S)