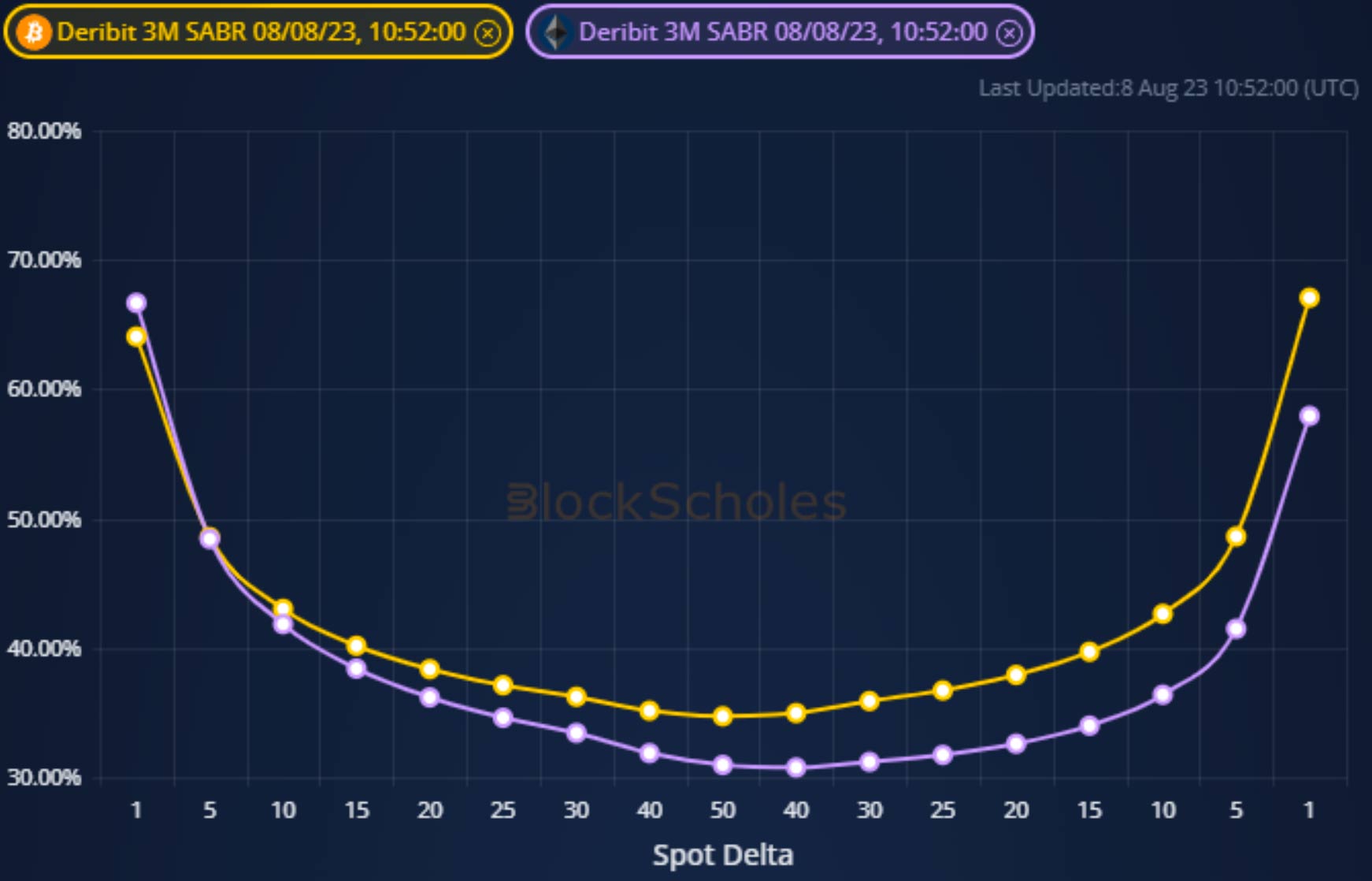

Whilst the volatility smiles of both BTC and ETH options remain slightly skewed towards OTM puts, BTC’s smile is notably less skewed than ETH’s. This effect is strongest at a 3-month tenor, but is present across the term structure. The extra skew in ETH’s smile can be explained by lower volatility implied by the prices of ATM options and OTM calls whilst OTM puts trades at similar levels to BTC’s.

Different Skews

Figure 1 Term structure of SABR Rho parameter (which controls the skew of the volatility smile towards calls or puts) for BTC (yellow) and ETH (purple) at a 10:31 UTC 8/8/23 snapshot. Source: Block Scholes

- The skew of the volatility smile towards OTM calls or OTM puts is measured by the SABR model’s rho parameter.

- The term structure of that rho parameter is negative at all tenors, indicating a preference for OTM puts.

- ETH options report a stronger skew towards OTM puts at all tenors than BTC options.

- The spread between the skew’s of each asset’s volatility smiles is strongest at a 3-month tenor.

3-Month Tenor Skew Spread

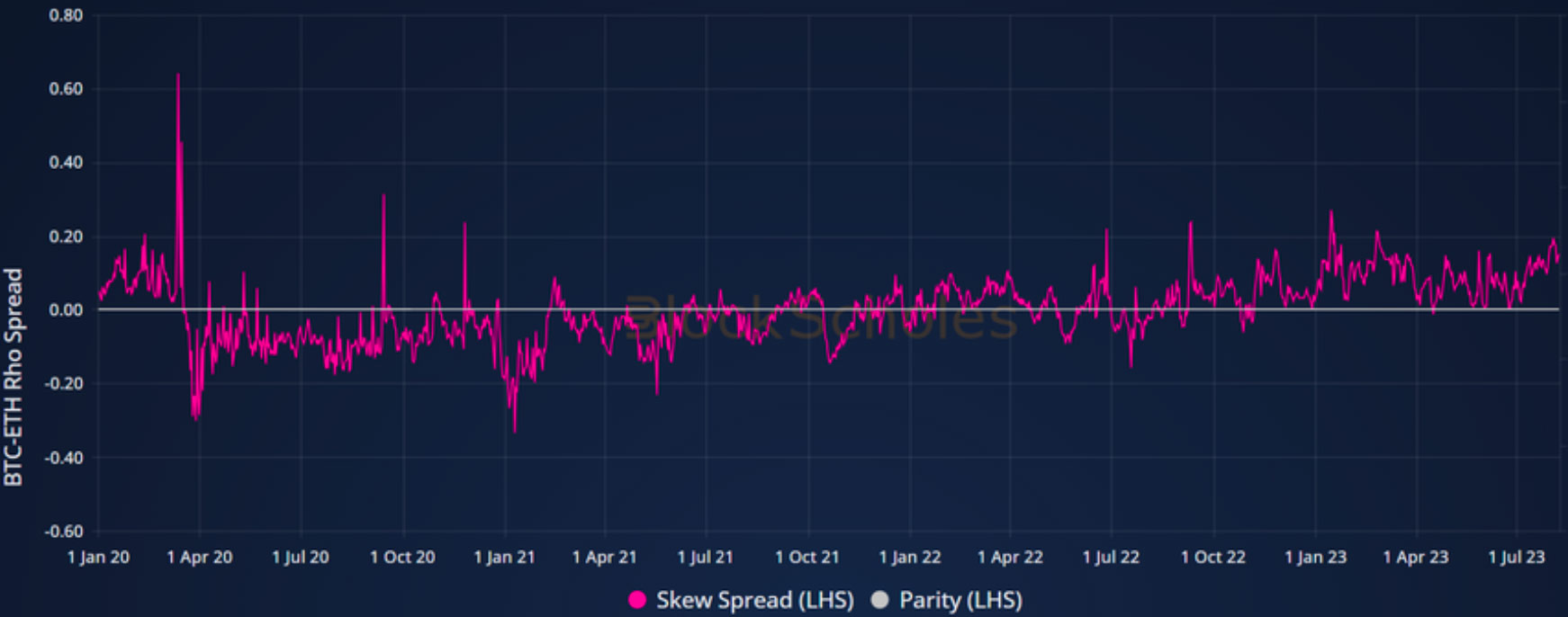

Figure 2 Daily spread of BTC’s SABR rho parameter above ETH’s SABR rho parameter on volatilty smiles calibrated at a 3-month tenor since 1st Jan 2020. Source: Block Scholes

- The spread between BTC’s and ETH’s vol smile skews has historically oscillated around 0 – parity between the pricing of each smile.

- Since the beginning of January this year, that spread has been consistently in favour of BTC, meaning that ETH’s vol smile has been more strongly skewed towards downside protection.

Vol Smile Tilts

Figure 3 SABR calibrated volatility smiles at 3-month tenor for BTC (yellow) and ETH (purple), visualised in the delta domain. Source: Block Scholes

- ETH’s ATM volatility is 3-4 vol points lower than BTC’s, resulting in a lower volatility smile across the delta domain.

- However, the spread of the implied volatility of ETH’s OTM puts to the implied volatility of BTC’s OTM puts is much tighter.

- At the same time, ETH’s OTM calls lag significantly below BTC’s, an effect that is stronger deeper into the wings.

AUTHOR(S)