The failure of Silicon Valley Bank, who hold $3.3B of USDC’s $40B reserves, caused a sustained and significant depeg of the stablecoin’s value from the dollar. This caused options that settle in the stablecoin to be valued at a discount to options that settle in the underlying asset, such as those traded on Deribit. Despite recovering its peg to the dollar on Monday, the implied vol spread between exchanges persists, suggesting that the market is pricing for a continued risk of a further depeg.

Implied Volatility rose sharply

Figure 1 Hourly BTC, 1W, ATM volatility as implied by options traded on Deribit (green) and ByBit (orange) from the 12th Feb 23 to 14th Mar 23. Source: Block Scholes

- BTC’s at-the-money implied volatility rose sharply across all exchanges, beginning on the 10th March.

- This followed the reversal of the early 2023 rally in response to news of SVB’s collapse.

- The crypto-friendly bank was also revealed to hold $3.3B of USDC reserves, causing a $0.10 depeg in one of the largest stablecoins on the market.

Vol Spread shows USDC risk

Figure 2 Hourly spread of a 1W option struck ATM on Deribit, settled in the underlying asset (BTC) to an equivalent option (tenor and strike) traded on ByBit, settled in USDC, from 1st Mar 23 to 14th Mar 23. Source: Block Scholes

- Whilst the payoffs of Deribit and ByBit derivatives are both calculated with reference to the USD value of the underlying, the settlement, premia, margins are paid in BTC and USDC respectively.

- This means that a ByBit option is fundamentally different to a Deribit option, despite sharing a common strike, tenor, and underlying asset.

- The brief depeg of USDC tokens to $0.90 meant that options on ByBit would be settled at around 90% of their stated payoff in dollar terms.

- The market was slow to price for this difference, briefly continuing to price both option-types at the same level of implied volatility.

- This pricing failed to account for the risk that USDC could depeg completely, rendering USDCsettled options worthless.

Persistent Spread

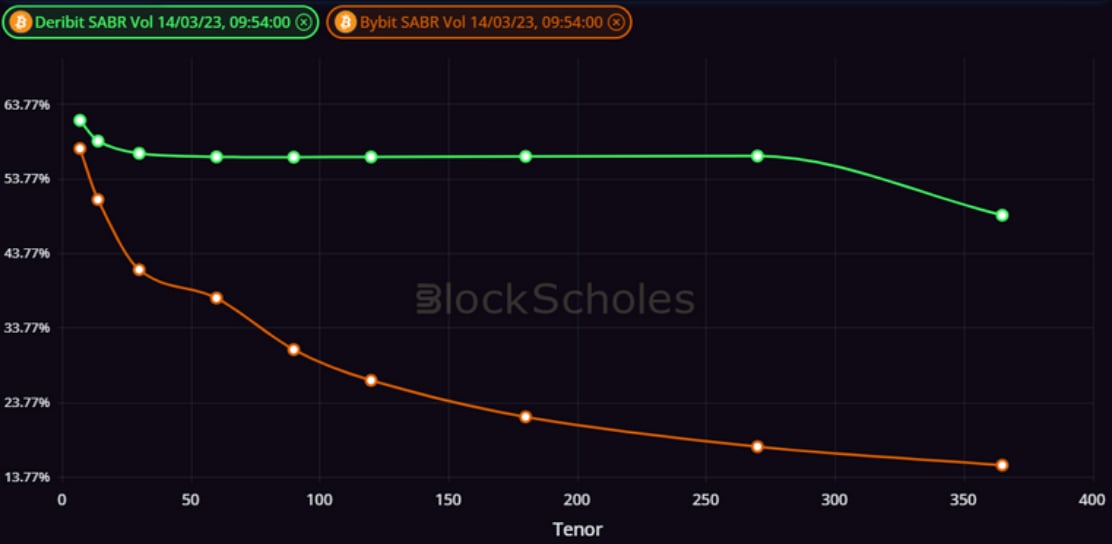

Figure 3 Term structure of ATM implied volatility for options traded on Deribit (green) and ByBit (orange) at a 09:54 14/03/23 UTC timestamp. Source: Block Scholes

- Whilst USDC has now recovered its peg to trade at $0.99, the spread of Deribit option- to ByBit option-implied volatility persists.

- The discrepancy is present across the term structure and is most dramatic at longer tenors.

- This suggests that the market is still valuing options that settle in the underlying (rather than USDC) at a relative premium due to a continued concern of a further depeg.

AUTHOR(S)