The fall of FTX was one of the landmarks of the crypto market liquidity crisis that reached its peak. The overexpansion during the bull market and highly leveraged trading became a deadly noose during the liquidity crunch.

In a bear market, the fight over liquidity quotas may be one of the most significant destabilizing factors in the crypto asset market, and the “weaponization” of liquidity may further exacerbate market turmoil.

While the macroeconomic environment is showing signs of improvement, the recovery from the bear market in the crypto market may be significantly delayed by the FTX exchange incident and its aftermath.

Prelude

FTX’s history ended so abruptly. If someone had said the night after the Fed’s Nov. rate hike ended that FTX would run out of liquidity in a matter of days and users wouldn’t be able to withdraw their deposits, the vast majority of investors would have felt he should go to the doctor.

Smaller exchanges may fail in a bear market. Still, the larger ones have weathered a series of regulatory and institutional bankruptcies. They have built up a reputation as “too big to fail” – until a Coindesk reporter hit “publish” on his newly written article.

Of course, the article only generated a flurry of discussion at the time: as a major exchange in the industry, the exchange token issued by FTX, FTT, was not some “junk debt” lacking in credibility. Solana was also one of the major public chains in the industry. As such, few would doubt the value of FTT and SOL. The assets on the books of Alameda Research and FTX are still “nothing to sneeze at”. Once investors lose interest in the balance sheet and article, they are back to focusing on the October CPI data – which will influence the rate hike in December and impact the crypto market.

However, the seeds of doubt were already planted deep in the minds of investors. In May and June, Luna and 3AC Capital’s investors were thinking like the above; they were either broke or had huge losses. As a result, some institutions began preparing withdrawals, creating more market rumors. Despite FTX’s efforts to combat with these rumors, some investors and institutions were ready for a “big event”.

Liquidity Nuke and Run

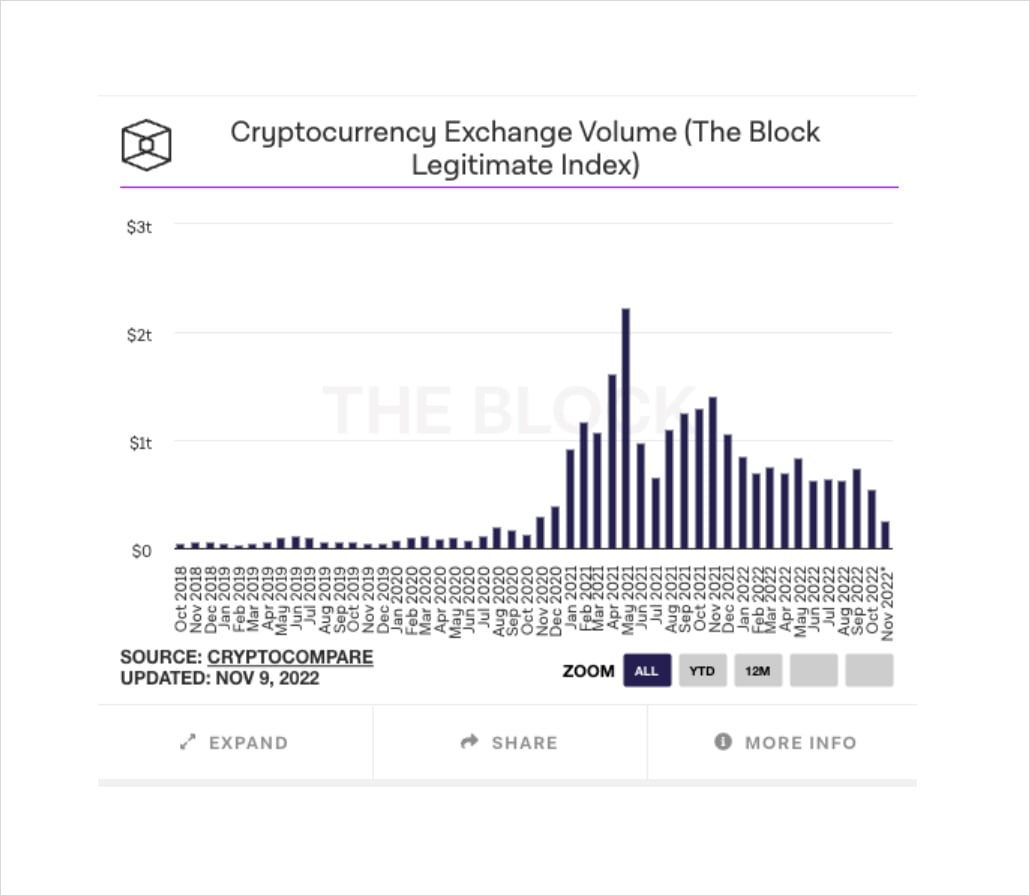

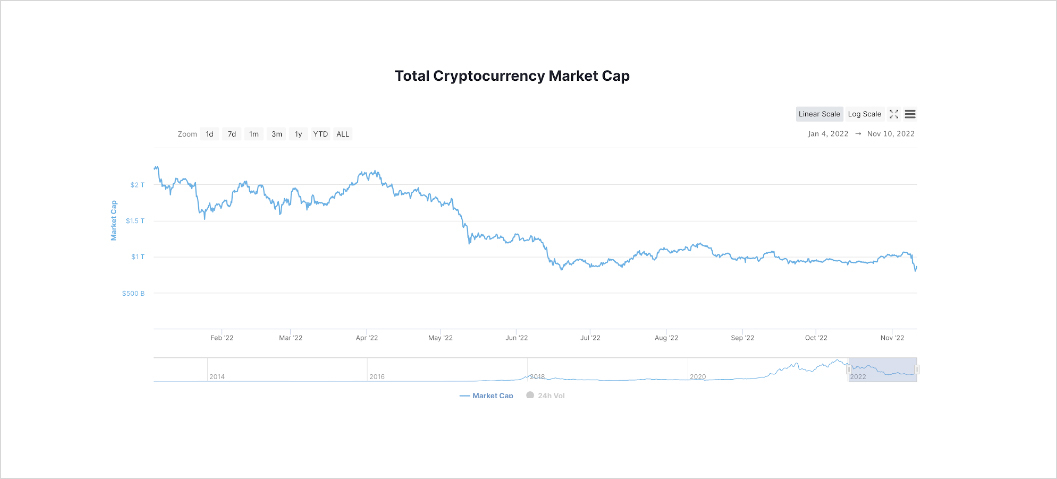

After nearly a year of a bear market, liquidity in the crypto market appears to have bottomed out. Monthly intra-exchange volume in the spot market has fallen to a new low since January 2021, with more and more investors choosing to hold their coins or trade in the derivatives market. In contrast, liquidity within the crypto market has remained relatively stable since June, propping up the total market cap of the crypto market at around $1 trillion for nearly 6 months.

Monthly trading volume movements within crypto exchanges, as of Nov. 9, 2022. Source: The Block

Crypto Market Cap Movements, as of Nov. 10, 2022. Source: coinmarketcap.com

The apparent stability does not mean that the crypto market is safe, and the events of May and June have left a large number of institutions involved, with PE/VC firms active in the primary market suffering the most significant losses. Some of them lost a lot of money in the Luna collapse; moreover, since most of their portfolios were in cryptocurrencies, and they had trouble liquidating their positions in time due to lockups, they were left with a more significant funding gap in a plummeted market due to panic and liquidity flight.

Some institutions have since disappeared, while others have been bailed out. However, the bailout for some of the funding gaps proved further to amplify the overall risk of the entire market instead.

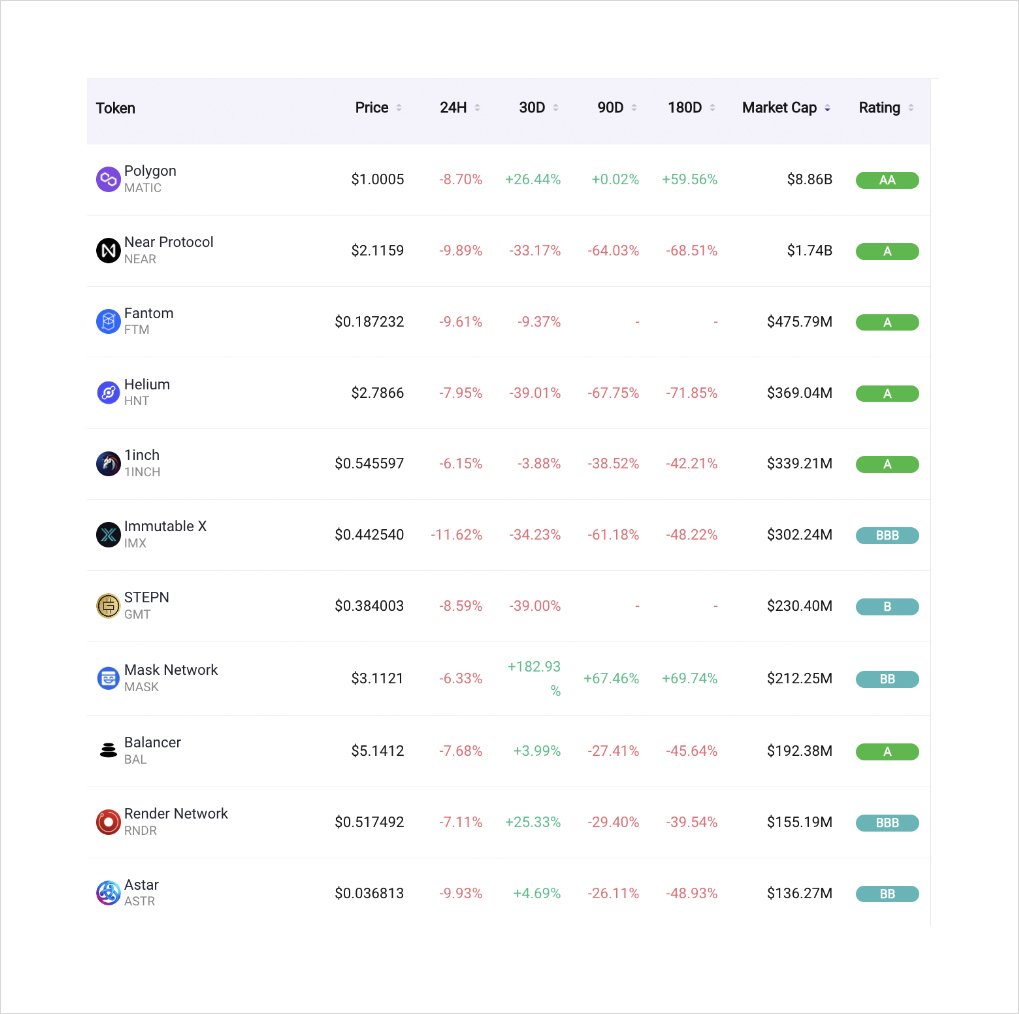

Let’s look at one of the protagonists of this event, Alameda Research, a Tier0 venture capital firm in the crypto market. It has only 11 projects in its portfolio that have maintained a total market cap of $100 million or more around Nov. 10. Considering that each investment was not launched independently, it is understandable how much the value of the tokens in their hands has devalued. In this case, a bailout seems to be the only option if you don’t want to declare bankruptcy.

Portfolio of Alameda Research, as of Nov. 10, 2022. Source: TokenInsight.com

FTX bailed out Alameda Research, making the latter one of the “lucky guys” to survive the May-June wave of institutional failures, with FTX providing a loan to Alameda, which likely used FTT and SOL as collateral. FTT and SOL are widely accepted collateral during the 2021 bull market; the bailout appears to be “no problem”.

This is the crux of the matter: FTT issuance is controlled by the exchange and is, in a way, the exchange’s “bank notes”, with the exchange providing the credit guarantee. But if the exchange has any problems, FTTs will become worthless. Something like this has happened many times in history.

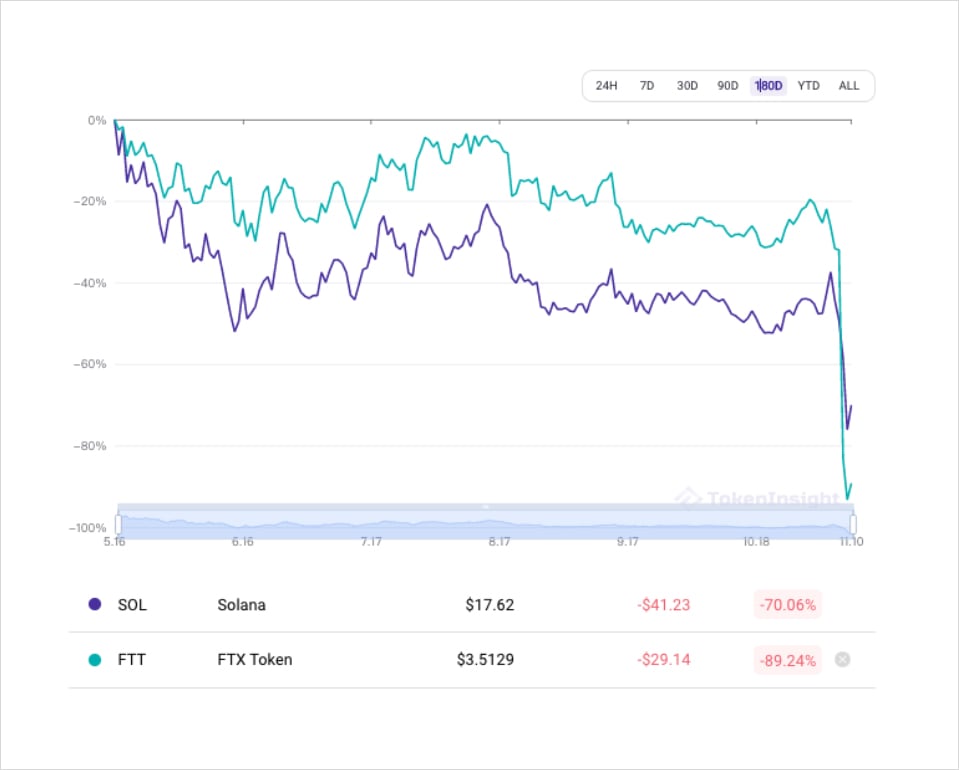

Moreover, the collateral’s value has been shrinking: in mid-to-late May, SOL was priced at about $50, while FTT was priced at about $30. Before the Nov. incident, the value of both of them had dropped by 30–40%. Usually, the margin call should have been sent to the desk of Alameda Research. However, the news of the margin call did not appear in the press until the incident.

SOL and FTT price movements over the last 180 days, as of Nov. 10, 2022. Source: TokenInsight.com

As one of the main holders of FTT, Binance seems to have discovered that things didn’t seem right only after the Nov. story became public. Perhaps they had known something earlier, but it didn’t matter; CZ felt it was time to do something. So, in a public Twitter thread, he announced that Binance would sell its FTT holdings.

As one of the central figures in the crypto market, CZ has put the fuse on the “liquidity nuke” himself. But even at this point, FTX’s SBF isn’t feeling nervous. Existing deposits are sufficient to meet withdrawal needs, and as the market picks up, Alameda’s debt will be steadily converted back to dollars through FTT and SOL. Everything is still under control; the price of FTT and SOL has not fallen and has even risen slightly.

Chain Reaction

Institutions are always the quickest to react when they realize the severity of the problem. Institutions represented by Nexo, Circle, and Jump Trading were the first to withdraw their assets from within the FTX exchange (Link). After the painful lessons learned in May and June, crypto institutions realized nothing is reliable or impossible during a bear market except their own wallets.

Some of the individual investors who heard the news also started withdrawals. But until Nov. 6, there were no significant problems with withdrawals; FTT and SOL prices were stable at around $24 and $30, respectively. As long as the CPI data for October is released, the market will rebound further, and FTX and Alameda may have a chance to survive this crisis. However, Alameda’s CEO released two statements that personally pushed the explode button for the “liquidity nuke”.

These two statements appear to respond to investors’ questions and Binance’s “provocative” behavior, showing that it is well-funded and well-run – “We are still strong like before”. However, investors interpreted Caroline’s words as below:

- More than $10 billion in assets have disappeared from the balance sheet and gone elsewhere. Where are they now?

- The FTT buyout price given by Caroline was significantly lower than the market price when CZ tweeted its challenge ($24). Traders don’t usually show their floor prices on Twitter, so Caroline’s floor price is uncertain, but it may be lower than $22. The above means that Alameda and FTT may no longer have enough cash flow to stabilize asset prices.

So, even as a hedge, a large number of investors began selling FTT and pulling money from the FTX exchange. The “liquidity nuke” was detonated. Just 48 hours later, the FTX exchange ran out of liquidity and announced a withdrawal halt. The sell-off spread market-wide, triggering the greatest market volatility of the second half of 2022. In the derivatives market, futures and options reacted dramatically due to the steep increase in risk. In the futures market, the BTC futures basis, which had been slowly recovering around the time of the Fed rate hike, quickly turned negative, indicating that investors’ forward implied expectations had become significantly more pessimistic.

BTC futures term structure as of Nov. 14, 2022. Source: Laevitas

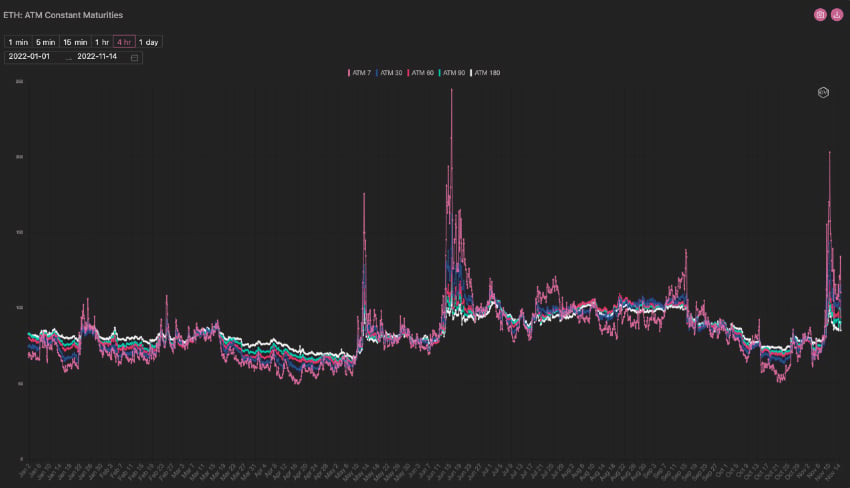

In the options market, the volatility surface for BTC once again saw a reversal similar to that of May and June, with short-term risk aversion again rising to a peak. While BTC volatility rose slightly less than in May and June, ETH volatility rose significantly more than in May, second only to the volatility triggered by the 3AC Capital event.

BTC vs. ETH YTD implied volatility movements, as of Nov. 14, 2022. Source: Amberdata Derivatives (formerly gvol.io)

Under the joint blow of many factors, such as the collapse of tokens and the run of investors, the ending of FTX is almost doomed. Although SBF has repeatedly stated that “he will try his best to raise funds” and intends to sell FTX to Binance, because Binance gave up the acquisition, other institutions in the market also gave up the bailout due to the poor state of FTX itself. On Nov. 11, FTX declared bankruptcy, officially becoming a page in the history of the crypto market.

However, the fall of FTX was only the beginning of a chain reaction. Due to the “compliance” and “reliability” image that FTX had built, it had accumulated a lot of popularity in the crypto market from retail investors and institutions. They see FTX as a reliable source of financial products and income and an excellent place to store their money without any doubt. In Taiwan, Hong Kong, Singapore, South Korea, and other sites, FTX is very popular. International first-tier PE/VC, such as Sequoia, also had investments in FTX.

In this incident, users in Taiwan and South Korea lost a lot of money: in Taiwan, deposits of more than 500,000 people (more than 2% of the total local population) were swept away, and countless people lost most of their savings. For institutions that trusted FTX, the assets they had deposited within FTX ceased to exist, and once top-tier custodians such as BlockFi have since passed into history.

“The Catastrophe”

The impact of the FTX event on the crypto market has been devastating. Since May, investors have experienced loss after loss and eventually discovered that project owners and institutions are unreliable. Even large exchanges with good reputations in the market are no longer reliable. The institutions and exchanges advertised as “top” may also conspire to profit from betting against investors. At this point, “hedge and wait” has become the choice of most people.

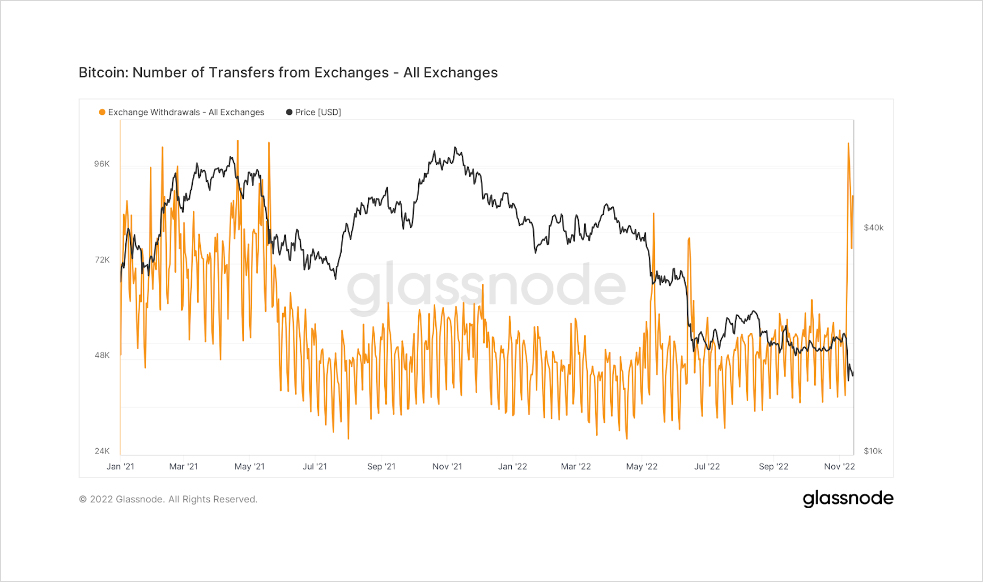

Several signals reflect accelerating liquidity outflows: according to on-chain data from Glassnode, BTC outflows from exchanges have reached a new high since 2021, even surpassing the peak of the bull market, and there are no signs of an end to the significant outflows. The already tight liquidity on the exchanges has become even more stretched in a bear market.

Exchange BTC outflows from 2021 to date, as of Nov. 14, 2022. Source: Glassnode

However, the “weaponized” liquidity had a more profound negative impact than the above.

- A run can instantly destroy an exchange or custodian platform with millions or even tens of millions of users but insufficient reserves.

- SBF’s misappropriation of subscriber funds led to the collapse and bankruptcy of FTX, which ultimately had its own consequences. But even for an exchange with 100% reserve, a run would still devastate the exchange’s operations and reputation and would be difficult to recover from in the short term.

- The cost of using a liquidity weapon is not very high: a few KOLs with enough followers can trigger investor fears about the target exchange/capitalization platform and lead to a run; the cost of calming investors down is obviously much higher.

- In the case of asset management platforms, the crisis caused by a run could be even worse. Many of the high-yield products on platforms are built on options, and in the crypto market, which is dominated by European-style options, investors’ money cannot be paid out until the expiration. Once investors start to run, led by emotions, the liquidity of the platforms will be drained in a short period. Even if the products can be redeemed at maturity, the short-term “liquidity void” is fatal.

- In addition, the liquidity weapon may become another type of “nuclear deterrent” for small institutions by large platforms or big institutions. A “liquidity nuke” could quickly destroy a large exchange, while small and medium-sized exchanges and asset management platforms would find it too hard to deal with such attacks. Even if withdrawals are entirely smooth, the liquidity that leaves will likely not choose to return to the original platform – deadly for a niche platform with limited clients.

Indeed, exchanges that are not robust enough to operate are naturally eliminated by the crypto market, which objectively benefits the market’s stability. However, when some market participants realize that “liquidity can be used as a weapon”, it is likely that those who are eliminated will not be the ones who violate the rules but the ones who have fewer chips and are less popular. The possible condition above will not promote the crypto market’s development but rather create monopolies and encourage each party to develop and even use various “weapons” that can destroy each other’s liquidity to ensure their safety in the crypto market. When the crypto market turns into a dark forest, investors will not choose the ultimate winner; they will decide to leave.

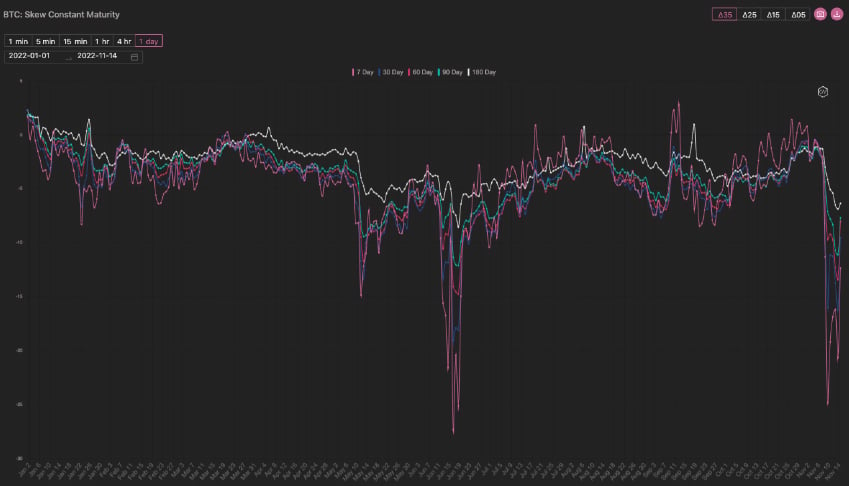

Let’s look at the impact of the FTX event: the collapse of FTX led to the bankruptcy of a large number of institutions, and the failure of FTX did not restore investor confidence but instead caused an even more severe liquidity crisis. The market capitalization of the crypto market has fallen to its lowest point since the beginning of 2021, and the forward bearish expectations for crypto assets in the options market, which professional investors dominate, have also fallen to their lowest point since the beginning of 2022. Even the Luna collapse in May and the bankruptcy of 3AC Capital in June did not make professional investors’ expectations so pessimistic; this is the “Catastrophe” of the crypto market.

Crypto Market Cap Movements, as of Nov. 14, 2022. Source: coinmarketcap.com

BTC option skew movements as of Nov. 14, 2022. Source: Amberdata Derivatives (formerly gvol.io)

The recovery of the crypto market has been delayed. The Fed is gradually slowing down the pace of interest rate hikes and approaching the peak of interest rates, while the dollar has also begun to fall after hitting a record high. Everything looks good for a recovery of the crypto market. However, until the internal problems of the crypto market are resolved, it isn’t easy to see any signs of market recovery. FTX has become history, and the ensuing institutional bankruptcy, exchange closures, and possible regulatory storms may further impact the crypto market in the near and medium term, which will continue to depress investors’ expectations.

“Liquidity nukes” help one giant defeat another. But from the perspective of the crypto market, this may only be the beginning of the crisis. In a catastrophe, there are only survivors, not winners. The same could happen to those who started it.

Let’s be a little more optimistic. There have been catastrophes many times in Earth’s history, and so has the crypto market. When a calamity occurs, there is no “too big to fail” existence. On the contrary, the giants tend to fall first, and those lucky and cautious enough will survive and evolve stronger. It is difficult for us to judge who can successfully survive this round of bear market. Still, the crypto market will always recover from various blows and show the vitality tested much since 2010.

AUTHOR(S)