In this week’s edition of Option Flows, Tony Stewart is commenting on the Markets respond to the recent CPI release.

February 15

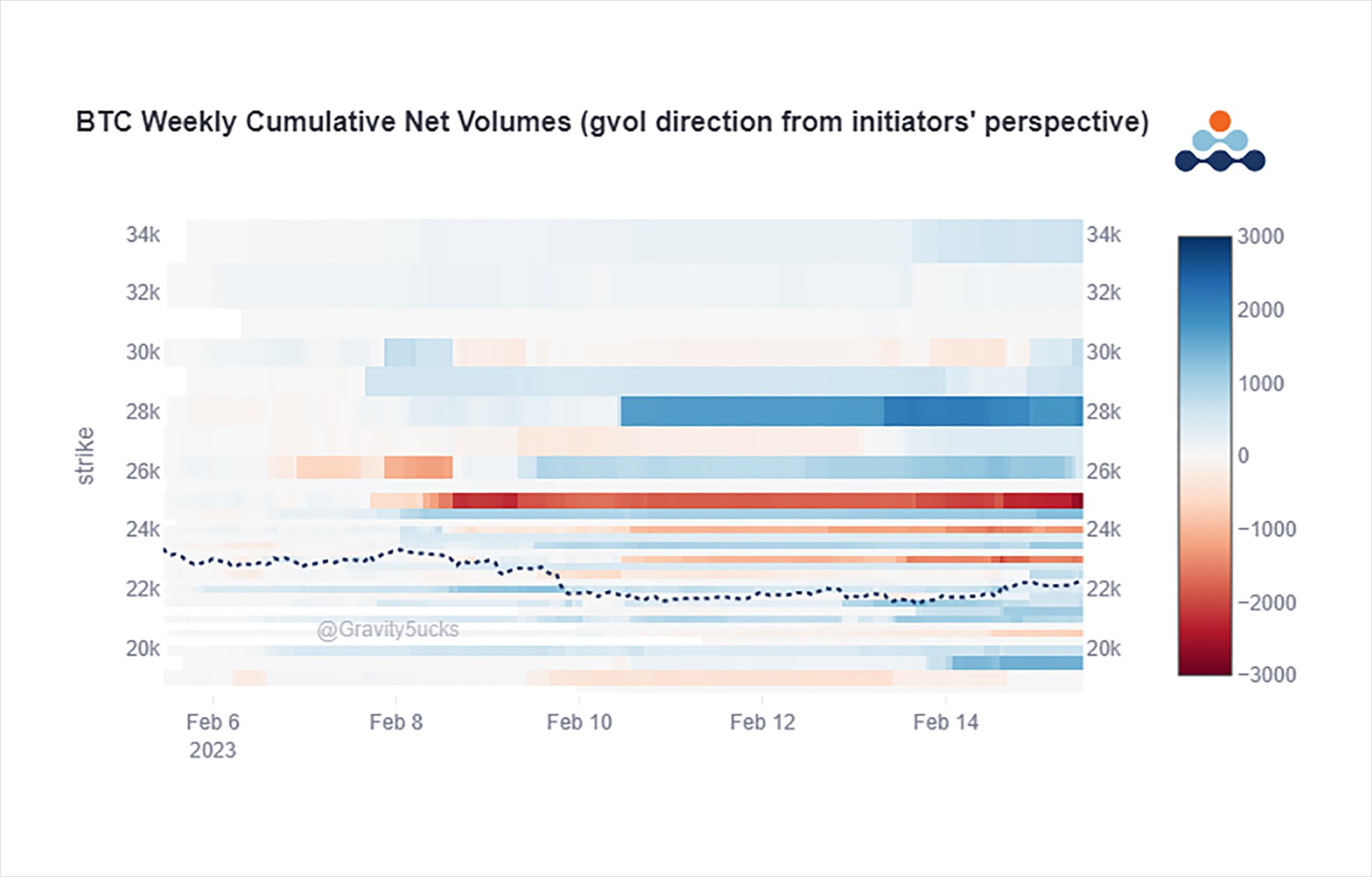

CPI release helps lift core Crypto away from recent lows as regulatory FUD simmers.

Fast money focussed more on low premium punts.

Whilst an entity continues to sell March 25-35 Delta Calls on DSOB into Spot rallies, dampening Call Skew and suffocating IV in quiet conditions.

2) Activity in the wings continues as a combination of punts, risk exposure and convexity plays.

But the flows that impact IV the most are based near-ATM.

We’ve seen this/similar entity before that deposits resting orders on DSOB; this time selling 2k 24-25k March Calls mid-40%.

3) Combined with an underperforming RV, this quite limited selling flow, but in a quiet market, scuppers any real squeeze in IV.

Longs have to be wary to profit quickly before IV is crushed once again.

The CPI squeeze and post-dump was accelerated by this despite low levels IV.

View Twitter thread.

AUTHOR(S)