In this week’s edition of Option Flows, Tony Stewart is commenting on the market movement, and the sudden ETH interest after Blackrock’s ETH ETF filing.

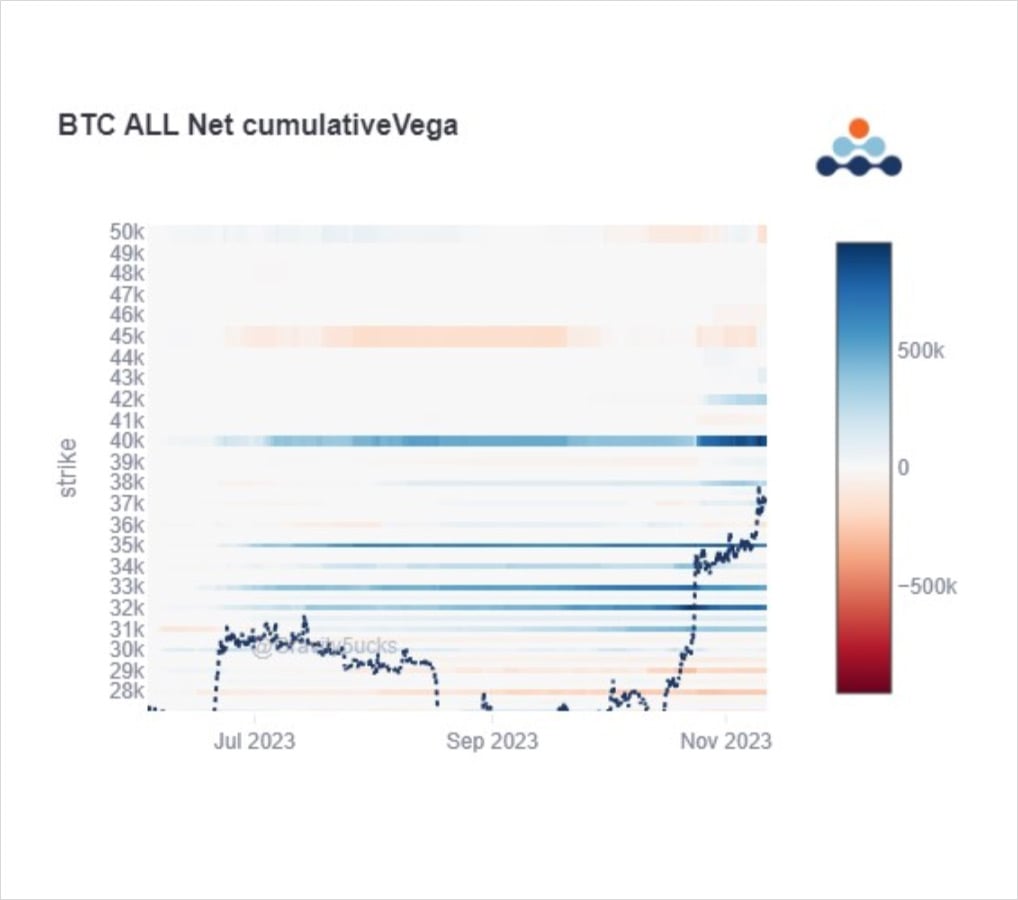

Some impatience in the last report from Call sellers was punished as BTC surged to 38k on the back of strong Spot buying. But an almost simultaneous registration by Blackrock of an ETH Trust caught the market offside and a huge rotation ignited.

Allocators spoilt for choice!

2) BTC+Alts were on fire, ETH lagged.

Blackrock’s ETH Trust registration suggests an ETH Spot ETF application sooner than the market had expected.

A huge rotation created a cascade of over-leveraged Alts, a large BTC Spot seller, ITM+ATM BTC Call sellers.

ETH Spot + IV pumped.

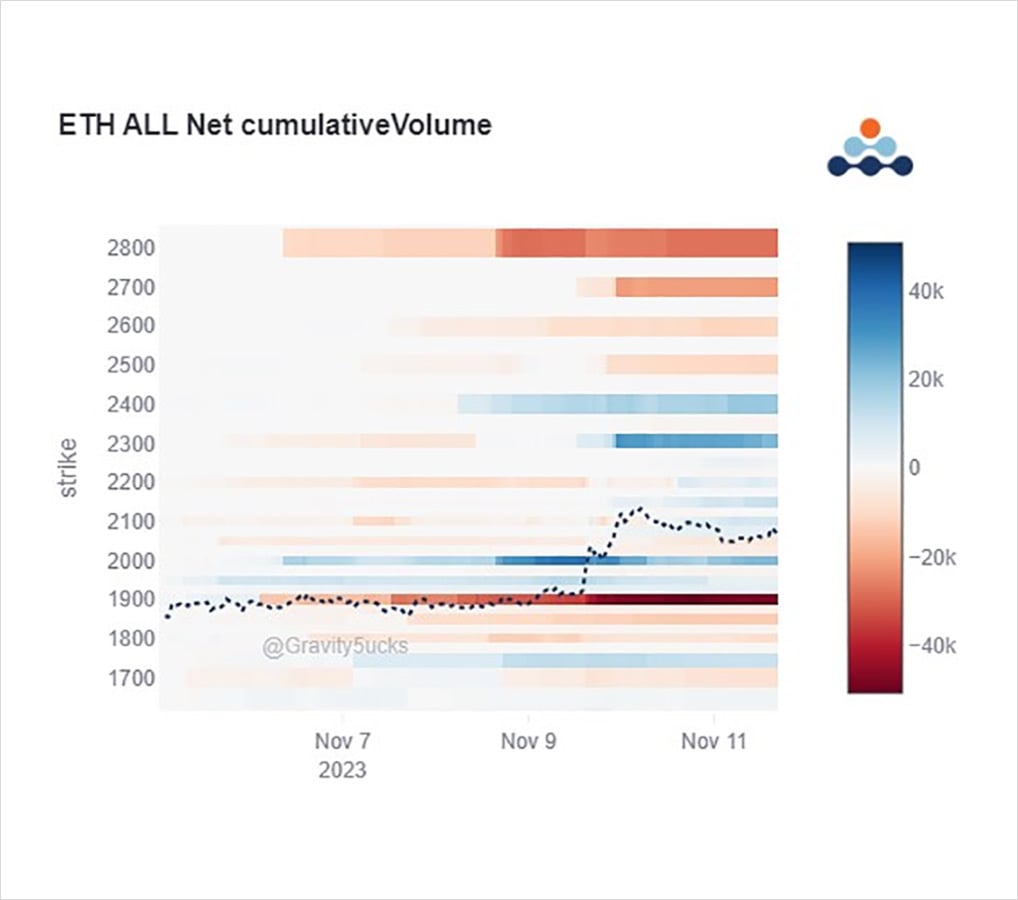

3) Note how in the above trade summary, shorts covered, fresh longs initiated in the 2-2.4k Strikes.

At the same time, Funds TPd on BTC Calls and shifted over to ETH.

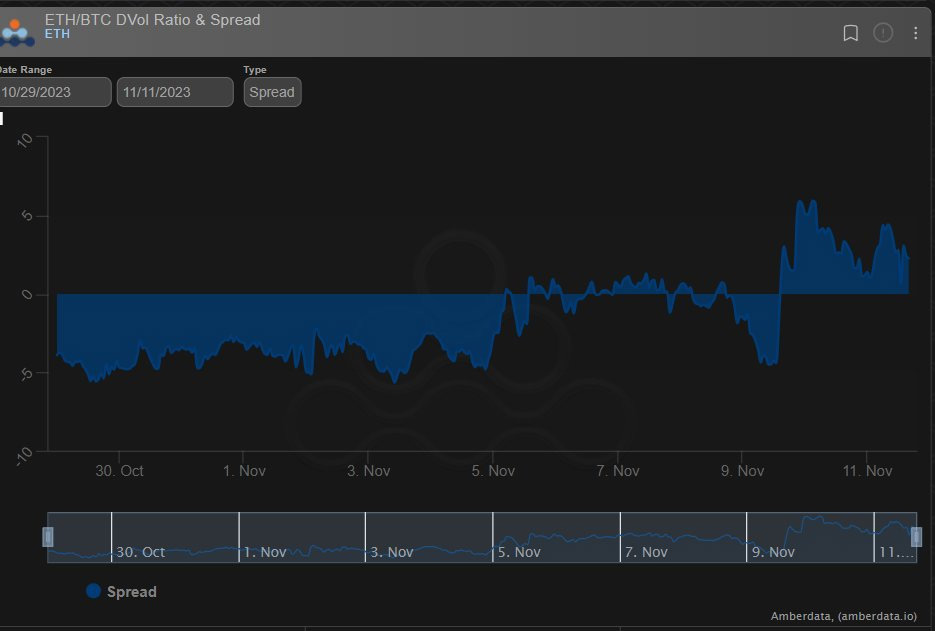

This caused a large supply of BTC Vol+Delta; DVol flipped from +ve BTC, to +ve ETH.

ETH broke above the horizon.

4) BTC dropped <36k briefly, Alts had a leverage cascade.

But both have now recovered strongly, and ETH lost a little of its shine, retracing on a relative basis.

BTC upside still continues to look well positioned for upside via Options.

Now BTC, ETH, Alts all have narrative.

View Twitter thread.

AUTHOR(S)