In this week’s edition of Option Flows, Tony Stewart comments on a brief and short-lived buying spree as BTC+ETH subsequently fell.

December 8

Brief action in Options as BTC+ETH drops <17k/1.25k.

Dec30 12-10k Put spread bot, Dec30 15-12 ratio Put spread sold, suggesting 12k is a focal level on the downside.

Countering, Dec30 18k +ETH 1.9+2k Calls bot, plus a large DSOB buyer of Mar 23k Calls.

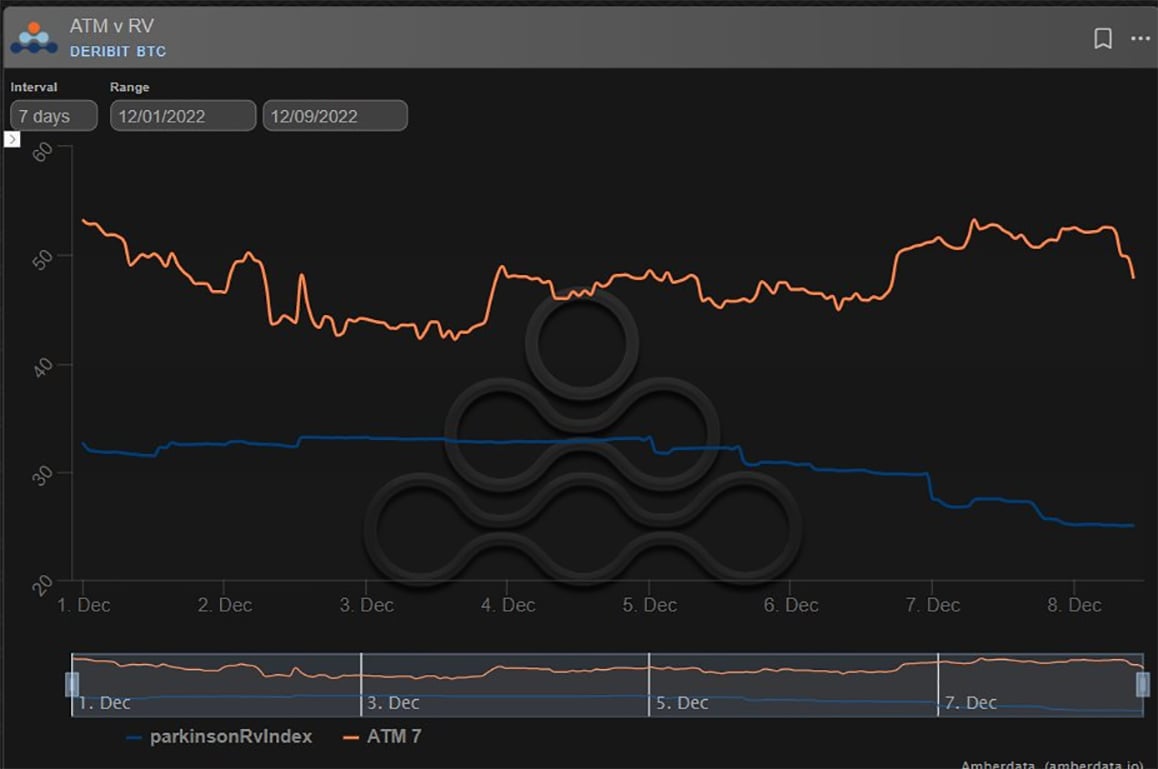

MMs happy to sell IV>RV.

2) This buying flurry momentarily pushed IV a couple points higher at the front end, but interestingly in March (where the DSOB buyer set a resting non-aggressive bid), sellers used the bid to spread off other Stikes and ultimately sold, IV unchanged, suggesting long vols exits.

3) 120d (~March) ATM IV currently trades at a small premium to 120day historic RV.

30d (~Dec) IV trades at a 15% premium to 30d RV.

10d IV trades at a 25% premium to 10d RV.

So MM happy to sell IV, even in the background environment.

A Fund this morning sold Dec16 ATM IV at <50%.

4) IV generally trades at a premium to RV, but this current Gamma premium an illustration of buyers willing to pay above the odds in uncertain times, and also an unwillingness to plunge IV in an environment that could present large shocks. MMs happy to sell, but keep risk tight.

View Twitter thread.

AUTHOR(S)