In this week’s edition of Option Flows, Tony Stewart is commenting on the low volume of trading ahead of the NFP, Gemini/DCG deadline.

January 5

Hopes that NY fireworks would ignite some volatility have fizzled out for the moment.

RV at sub-20%. IV 30%+ results in hesitation to buy, at absolute levels too low to sell.

Rebound from Yr-end Alts selling, providing some Call buying bias ahead of NFP, Gemini/DCG deadline.

2) Often seen at the start of a NY is a little pop in IV, which is explained by Theta collectors covering shorts and new exposure induced by inflows and revived attitude.

While there was a little Jan Call buying, the fronts reacted only fractionally. But Term Vega suffered hard.

3) The Option market is dismissing material directional reaction to the Gemini-DCG deadline, and the relatively flat Skew across Terms is not signaling strong bias.

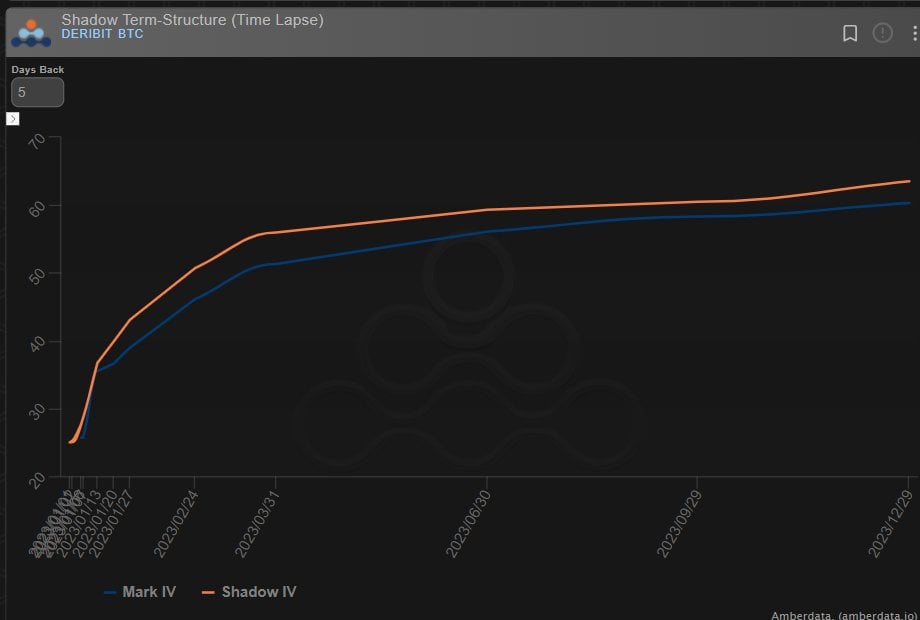

Now that the fronts are <35% IV, and the Term Structure is in steep contango, we observe conspicuous Term selling.

4) While volumes are not large, selling of Mar-Sep vol has taken IV lower by 5%.

Even structures such as the Mar 20-23 1×2 Call spread which was bought, is net selling vol.

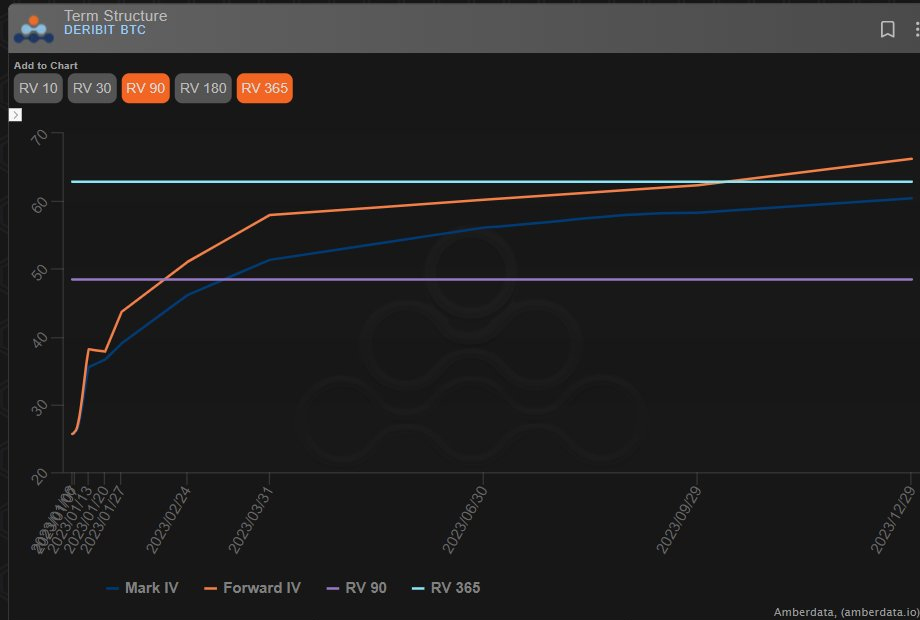

BTC IV 3m 50%, 1yr 60%

Cf to the chart below to 3m+1yr RV, which is in-line, but allows for few surprises.

5) These levels do allow for nerves to be quelled at not unreasonable prices.

As we approach events of uncertainty, buyers of Feb Puts & Mar Strangle noted.

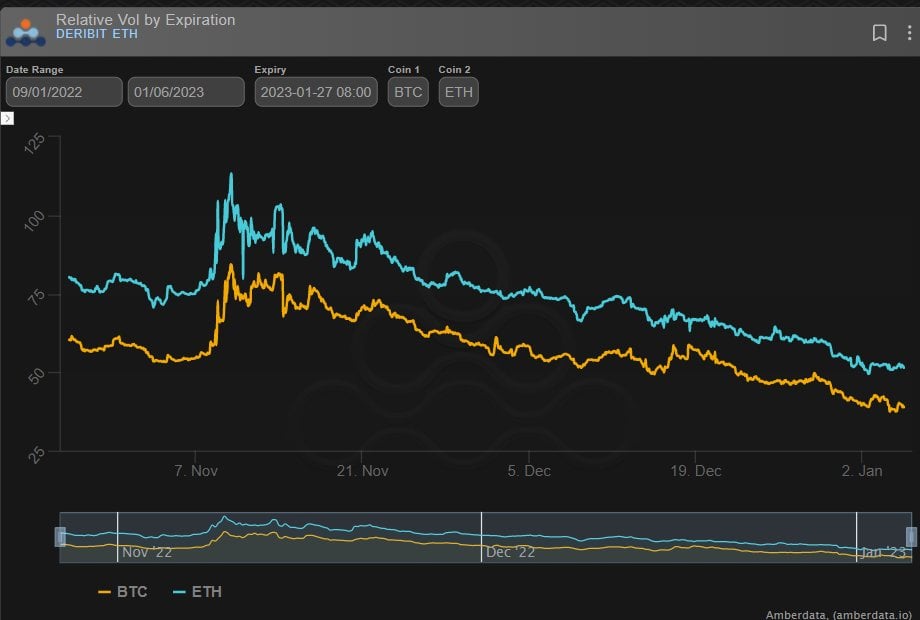

With Alts moving, ETH-BTC IV at ~10%+ attracting some.

Nervous disposition? Look away.

ETH Jun 400p unfinished buyer 50k.

View Twitter thread.

AUTHOR(S)