In this week’s edition of Option Flows, Tony Stewart is commenting on the market after a week with major global tensions.

Global tensions subside. VIX falls from 20% to <16% and risk assets rally. BTC with extra strength.

Protection <60k Puts unwound. Calls TPd.

Now sitting mid-60-74k range: chop, IV drift.

Jun Calls moved out to Sep-Mar.

ETH flows light; conspicuous: not seeing usual Call sales.

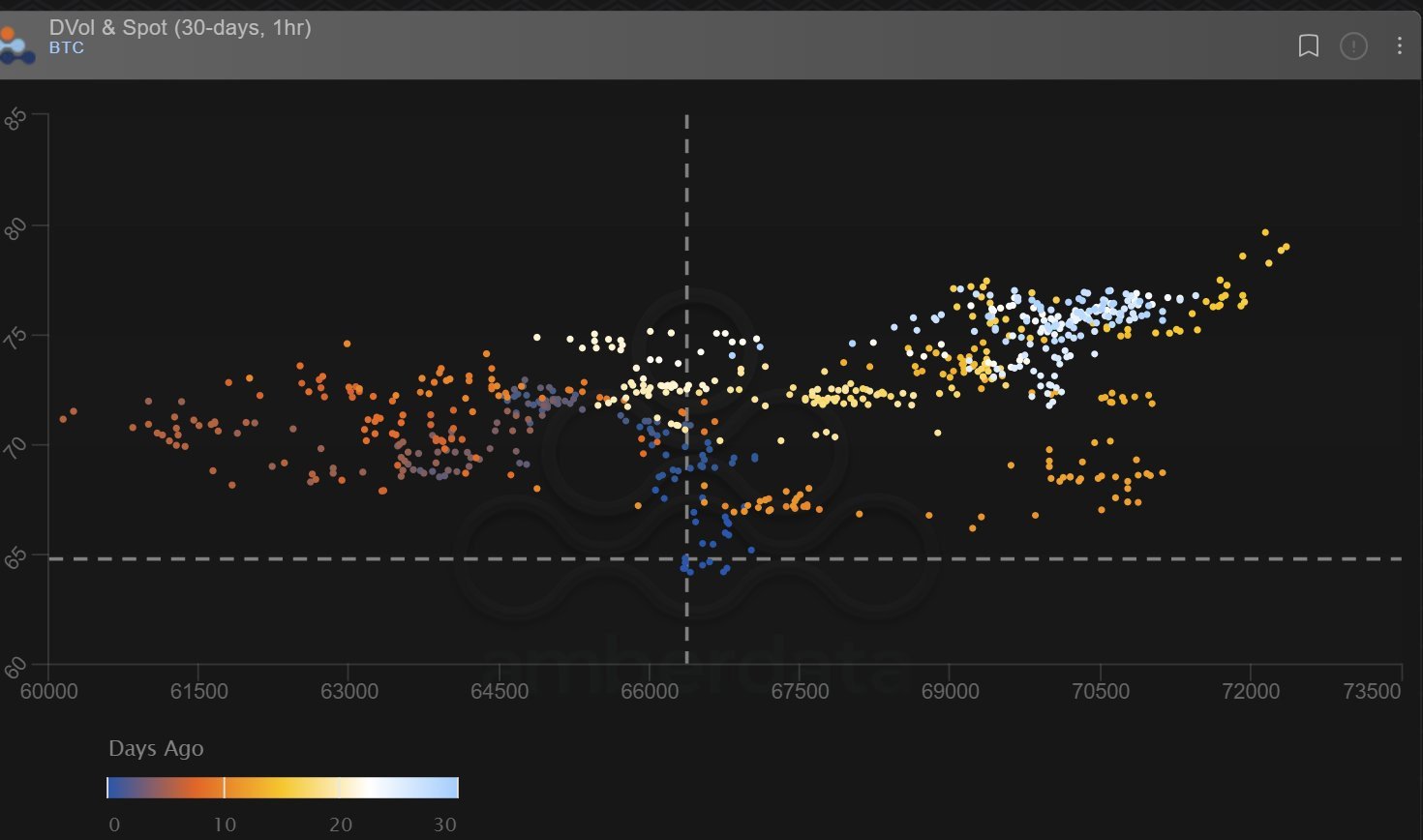

2) BTC strength off the lows triggered quick sales of protective <60k Put (+spreads) in Apr+May expiries.

But Calls were mixed, as exposure was wanted and needed as Spot rallied hard, but when BTC bounced +10%, BTC Call sellers emerged eg May 80k Calls.

Net sales. Spot chop. IV

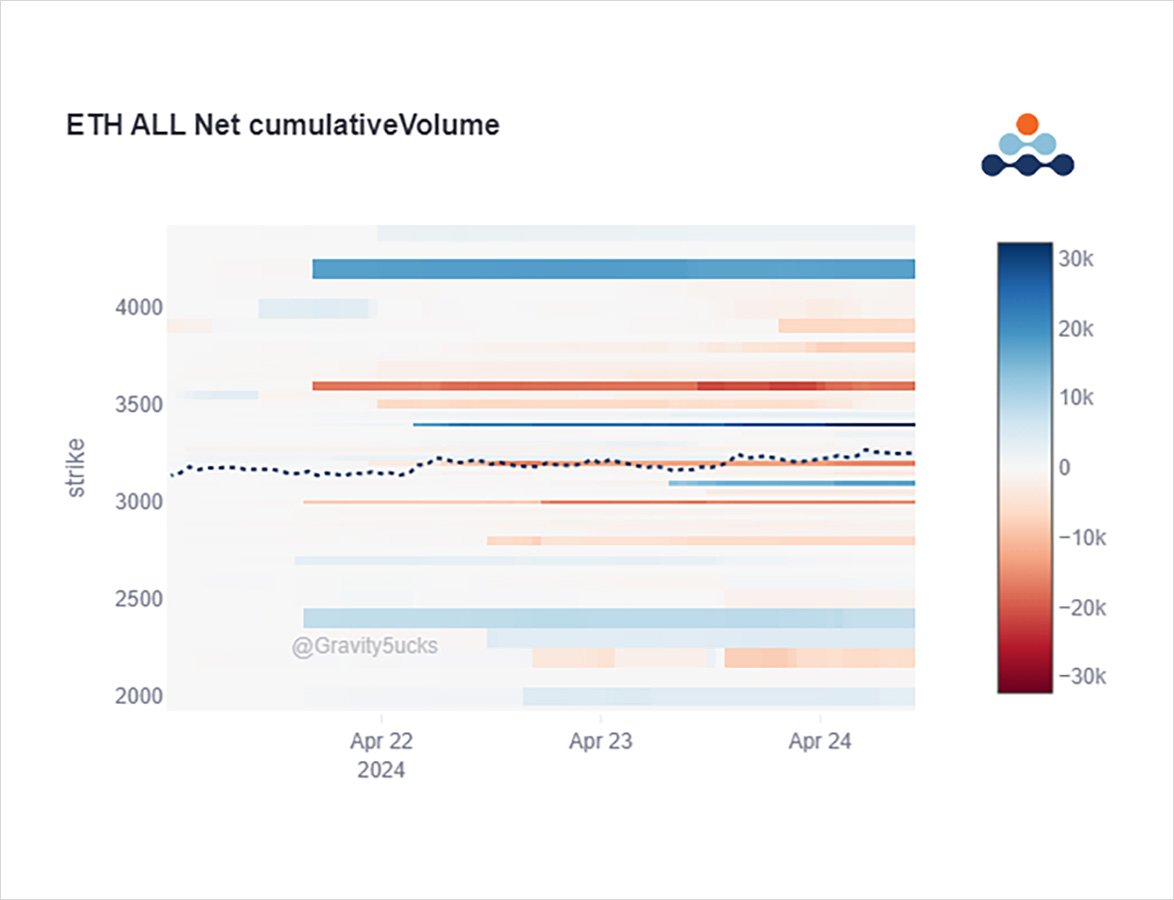

3) The large ETH Jun Put spread remains to hedge a portfolio.

ETH Option flows were similarly 2-way with Apr 3.4k Calls and 3.1k Puts bought separately, Apr 3.6k Call sold, May3 4.2k Call bought.

But the fact that previously constant Call overwriting did not occur is revealing.

4) Put Skew has softened with less demand and unwinds. Realized Vol over the last few days has started to drift.

This has occurred in US equities, many risk assets, and Core Crypto.

We now trade mid-range, as markets consolidate what has happened over recent weeks.

IV purge.

View Twitter thread.

AUTHOR(S)