In this week’s edition of Option Flows, Tony Stewart is commenting on a quiet market with FOMC and CPI coming up.

December 12

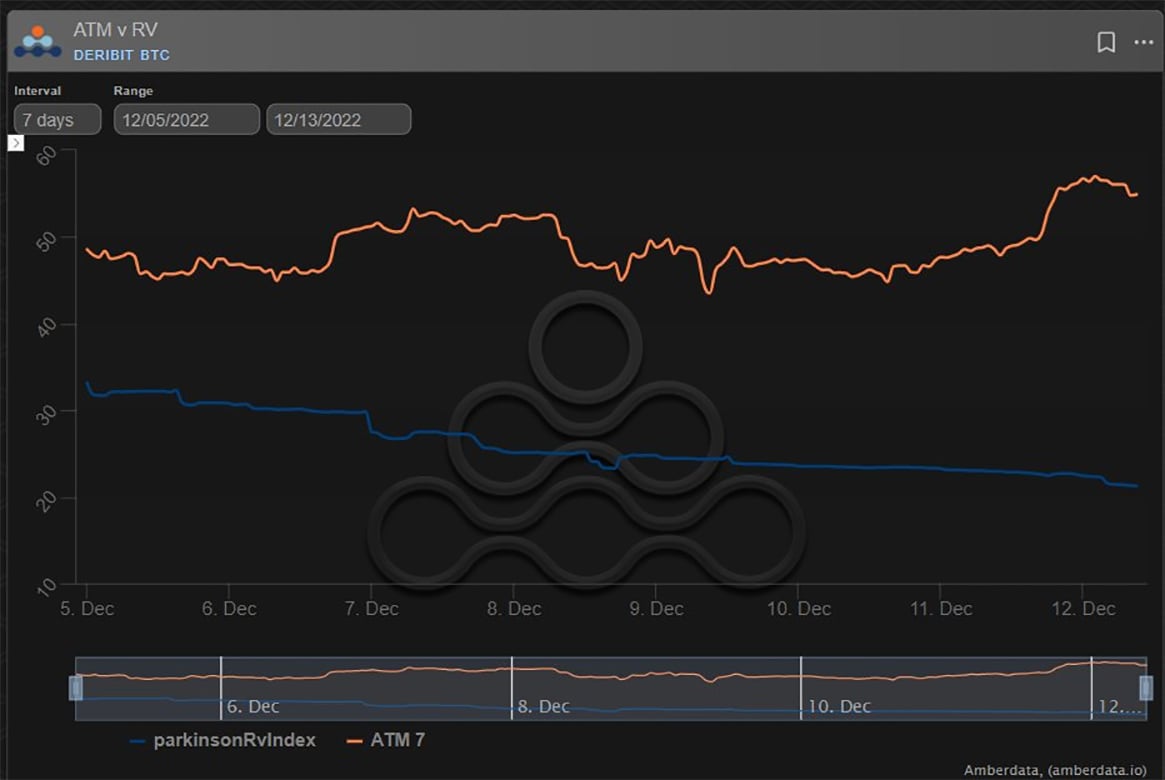

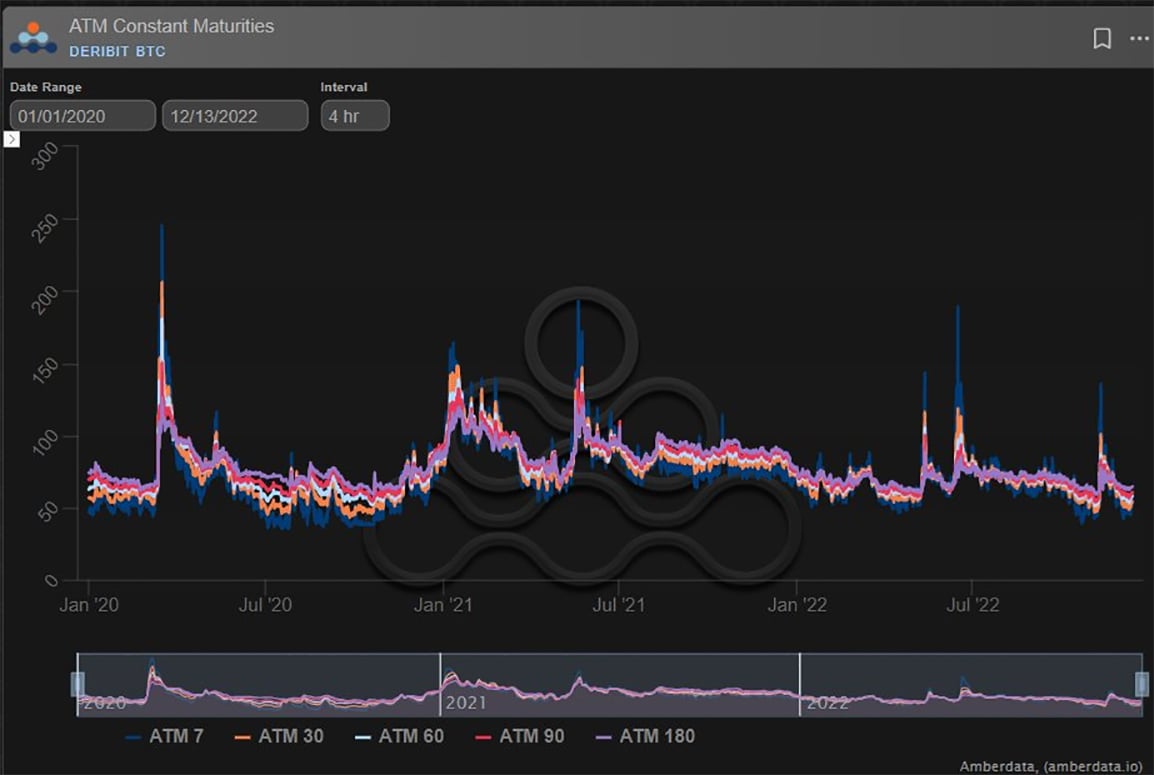

Gamma RV now <25%. 7day IV >50%.

IV holding despite premium.

Theta eating away.

Discussed dynamics last thread.

But now FOMC+CPI this week gives a new dilemma.

Option flows quiet.

Accumulation Jan+Feb 13-15k Puts 1k+

Mar 23k Calls sold 1k

Dec Puts+Calls bot, Gamma supplied.

2) No directional clarity from flows, although the limited slow accumulation of Jan+Feb downside perhaps suggests some caution after any legacy market Santa rally.

Immediate flows in Dec show a mixed bag, with 16k Put and 18k Call bot, but ATM sold too.

Dec16 bump pre CPI+FOMC.

3) Questions to be considered ahead of CPI+FOMC:

– How much current IV>RV premium is Crypto backdrop, how much CPI+FOMC priced in?

– If CPI/FOMC moves S&P will it move Crypto? Beta?

– Buying for D-neutral Gamma, or naked direction?

– How will IV react after?..if right/wrong?

4) The question is always more than is it cheap?

– If buying event Gamma, how long do you hold?

– Considered exit liquidity?; will MMs make it easy for you to sell Options back to them?

– are you expecting change in the crypto-vol environment?

– how is the market positioned?

5)

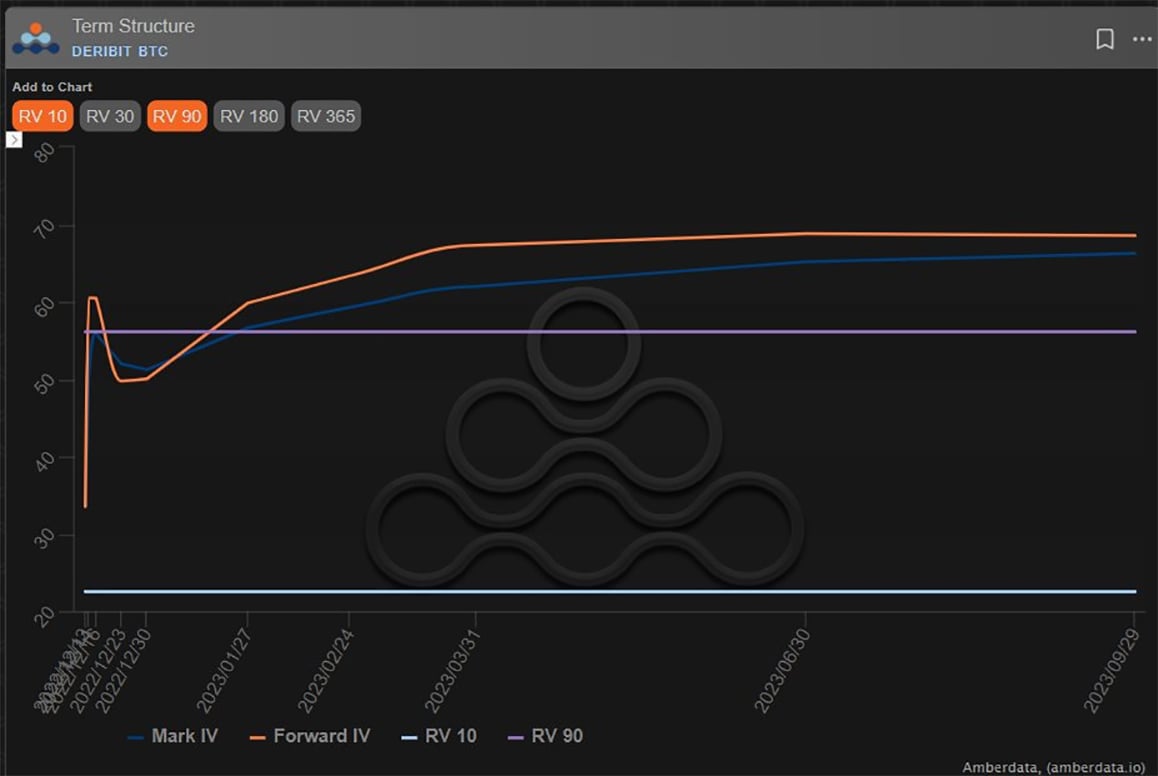

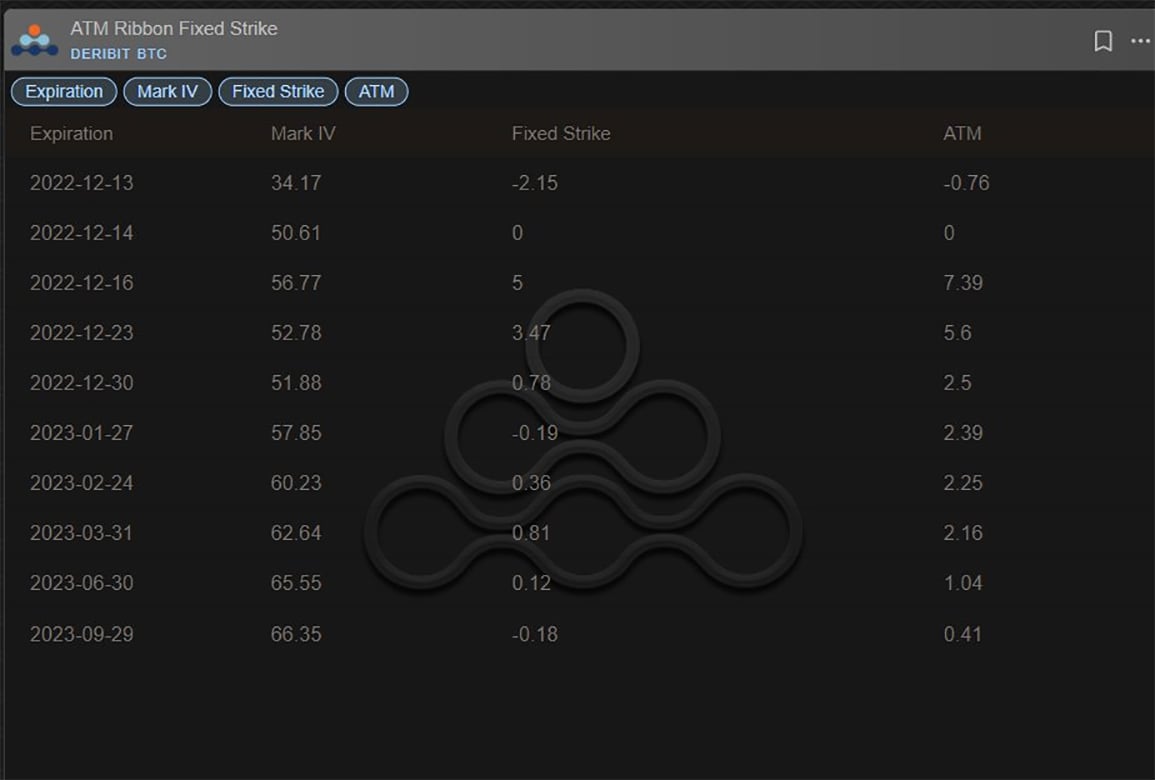

Usually these pure Gamma events bring backwardation as the desire for Gamma outpaces medium-term Vol.

Currently we see only a Dec16 expiry blip, which suggests bets ok if very low premium (unlikely to be considering IV data).

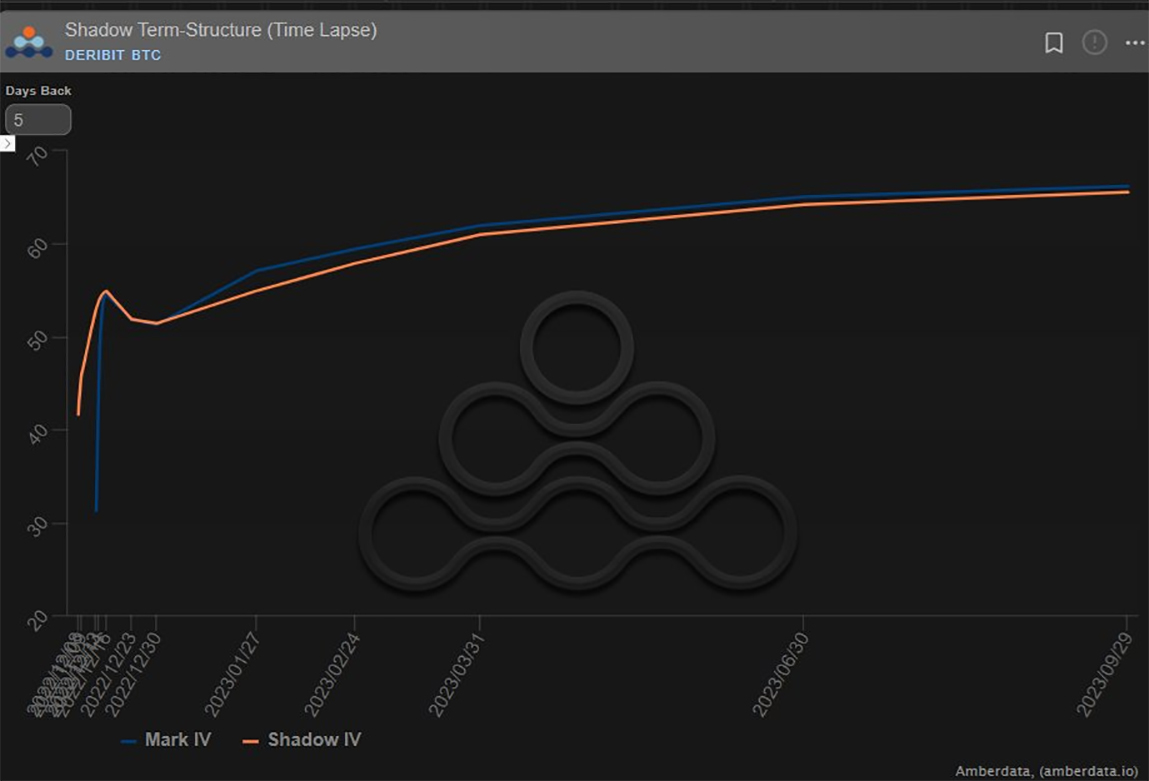

Otherwise the curve in Contango.

RV10+RV90 drawn.

6) To limit exposure to vol, if you want exposure to the event, then Call/Put spreads or Collars are simple possibilities.

If looking to sell into the event given IV>RV by 25%+, the question is timing. Will Dec16 IV squeeze, will MMs buy offsetting supply across term-structure?

View Twitter thread.

AUTHOR(S)