In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

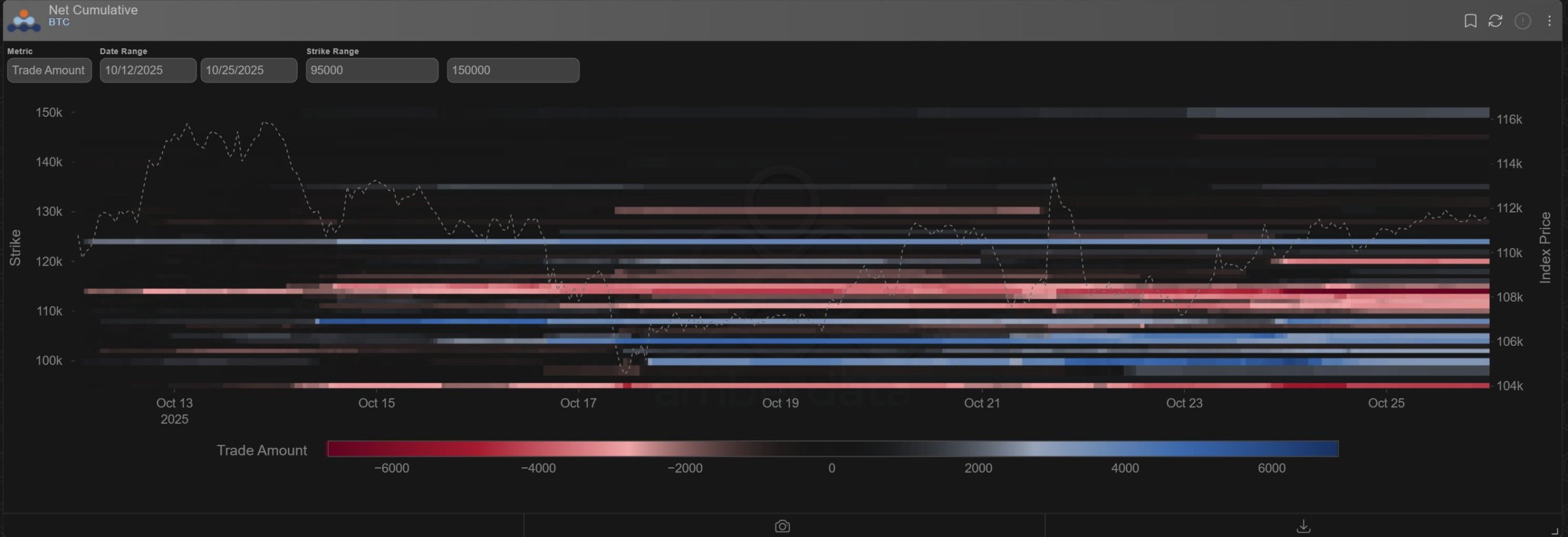

Since 10/10, Options positioning heavily cautious; Funds protecting with 100-107k primary strikes via outright Puts+spreads. The Overwrite Fund continues to select & rotate aggressive Call Strikes.

OG whales supplied Spot. Preliminary consensus on Trade deal may free upside.

Understandable 10/10 PTSD led to large downside protection positioning into the weekends:

– 14-17th: (BTC105-108k)

– Nov7 100k Puts x2k, Oct31 102-Dec 90 PS, Oct31 105-Dec 09 PS, Oct31 107-100 PS, standout, all bought.

– 20-22nd: (BTC110+)

– Nov7 100k, Nov28 108k, Nov7 105+106-95 PS.

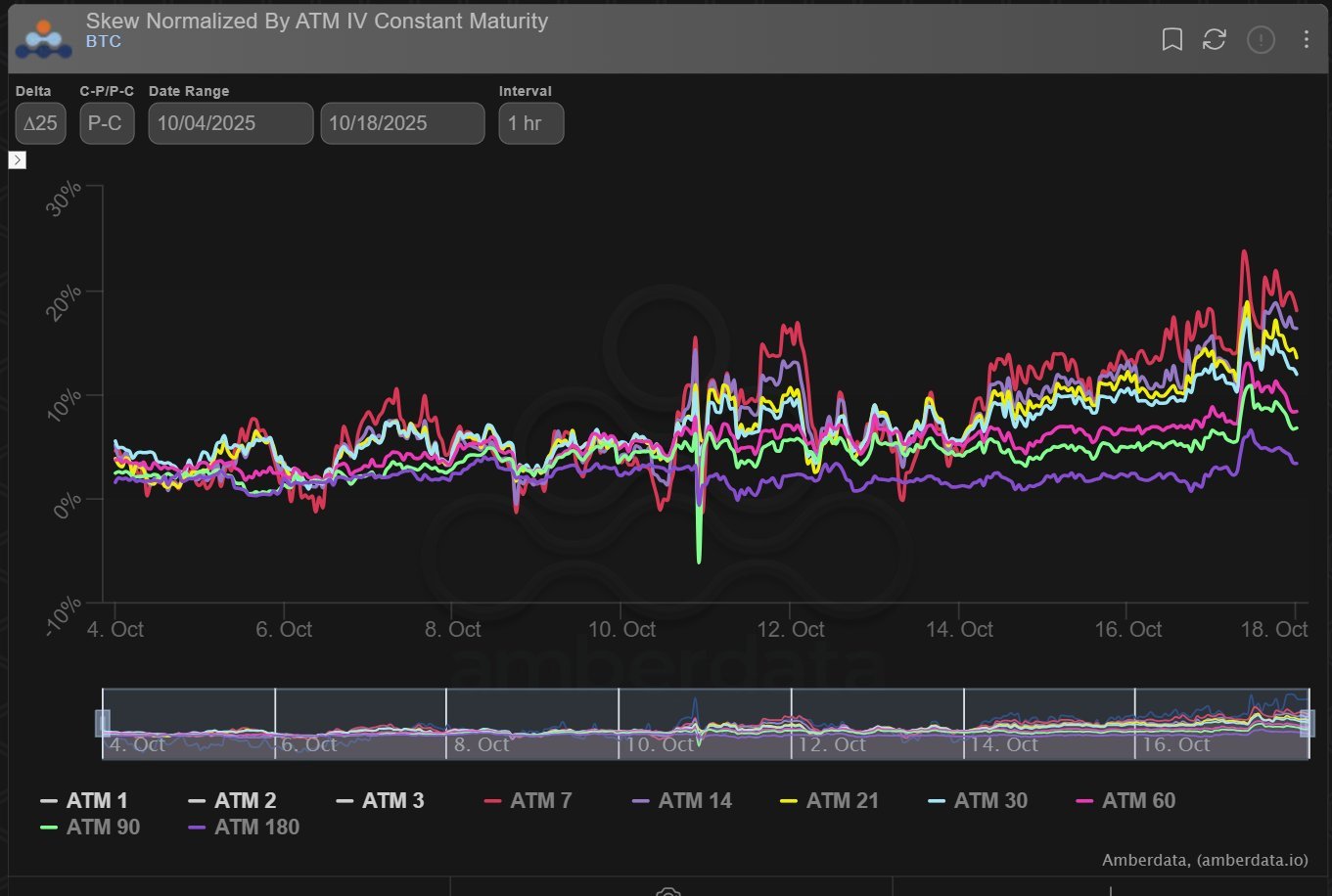

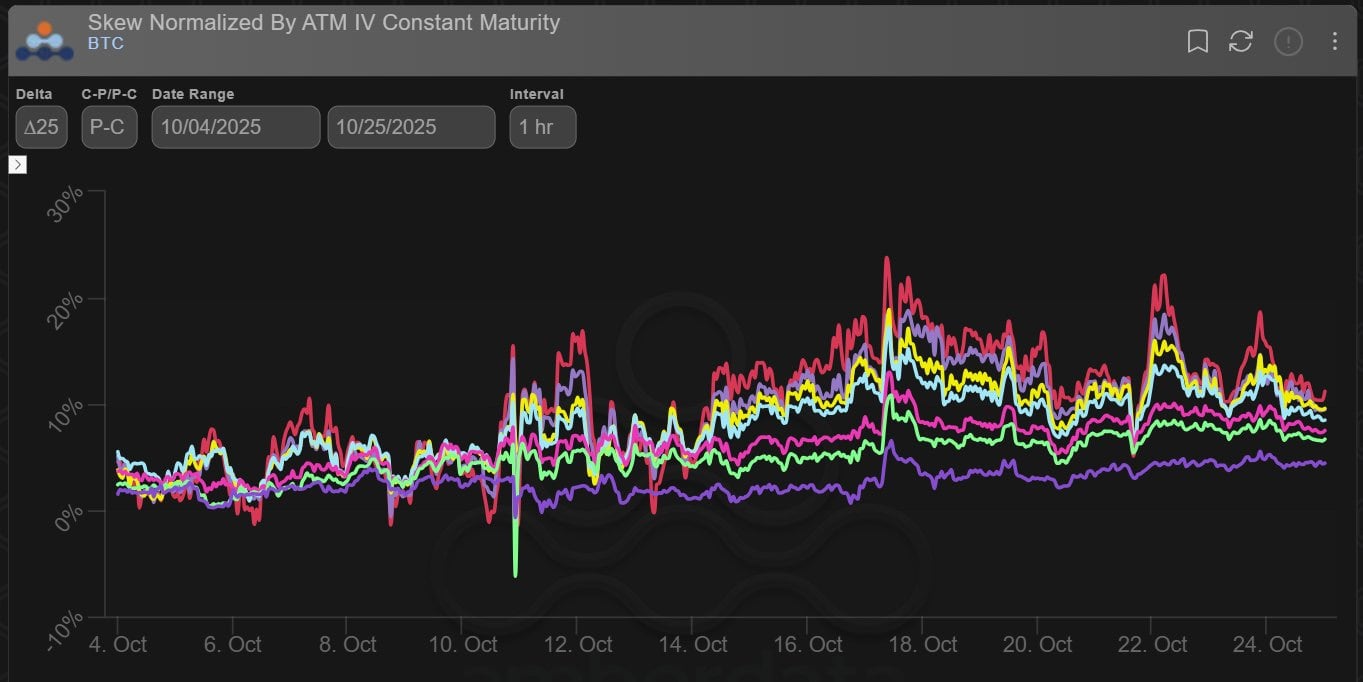

As seen, Skew (P>C) was higher on 17/10 than on 10/10, from measurable data.

But this didn’t just come from Puts being bought, but also, materially, the Call Overwrite Fund plunging aggressive upside Strikes.

Oct110-115k Calls now mostly rolled to Nov7+Nov28 114+120k Calls.

While the above chart looks messy without my forensic breakdown, it is clearer as a picture if you separate the 110-120 Strikes we see Funds selling (red) Calls, and within the 100-110 Strikes we see Funds buying (blue) Puts.

In the shadows is a large exit of Dec 150k Calls.

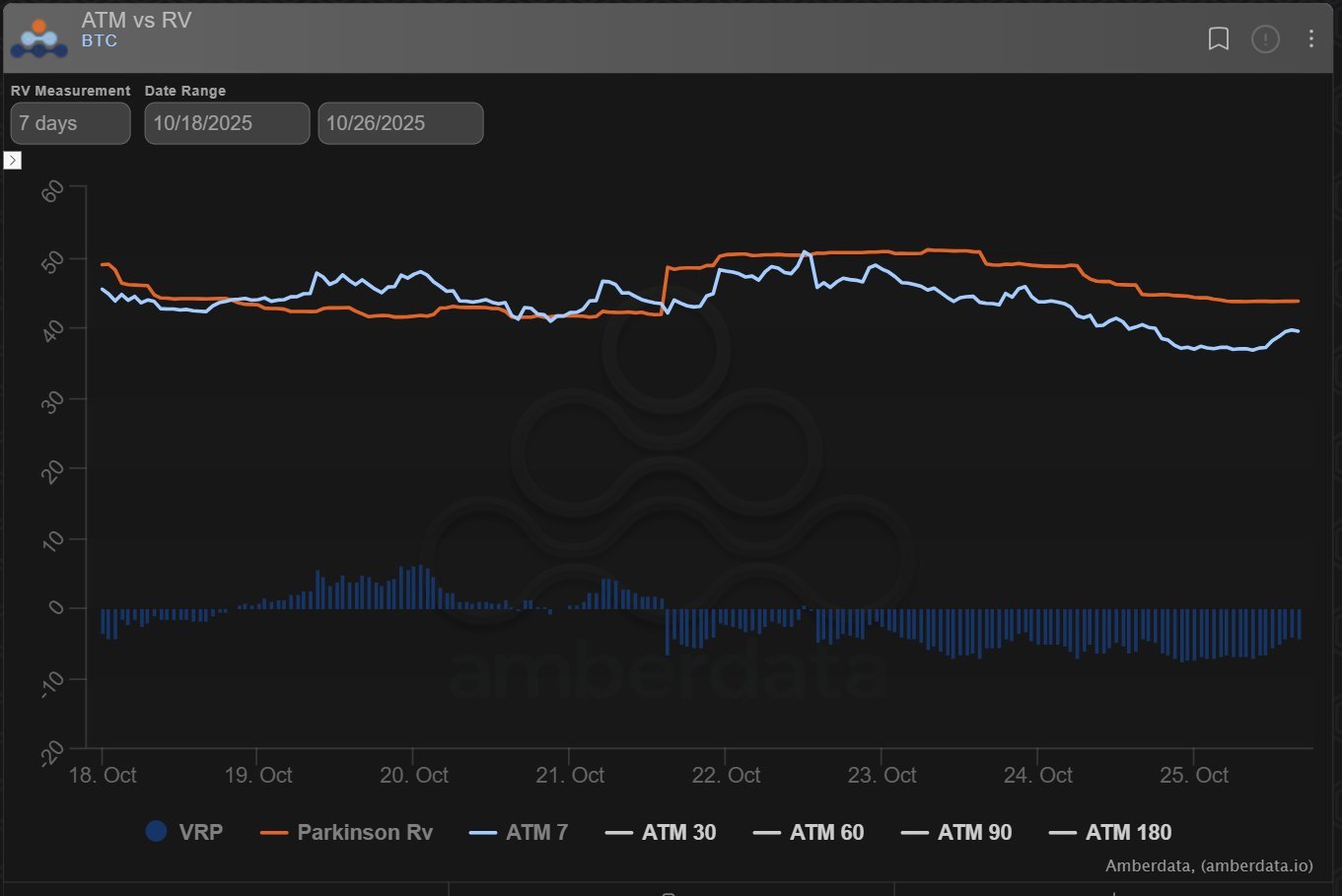

On a 7day measure, Realized Vol sustained a premium to Implied-V, which led to strong MM absorption of selling from the Dec 150k Calls and the Fund Overwriter entity.

Some bullish play Funds looking to buy delta, took the opportunity to buy (in particular) Nov 125-135k Calls.

As such, after the calm preceding 10/10 and the large spike of 10/10, vol of vol, looking at Dvol as a proxy has been higher.

The Overwrite fund would offload gamma/vol, dipping the curve structure, then Put buyers and increased RV days would lift the curve back up.

As Vol is starting to settle down, we’ve seen a drift lower across the curve in the last few days, but Put Skew remains elevated.

Preliminary consensus may have been found, but Funds are being cautious of the details, ratification, and unknowns between Trump+Xi b4 the Summit.

Even if the trade deal is done, which would be a huge wall broken down to potential upside, the recent BTC OG selling and Alt liquidity holes have been disturbing.

On the other hand, CEX+DEX transparency has allowed large instos+Funds to sweep sellers + attempts at <106-107k.

See original post on X here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)