In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

The derisking in the last report was not bearish but risk mitigation against ME escalation. But upon bound pacification Funds were left short Jun+Jul 108-115k Calls.

As Spot rallied 100k Puts dumped and Calls shortcovered. Jun shorts expired with no fanfare.

MM now +inventory.

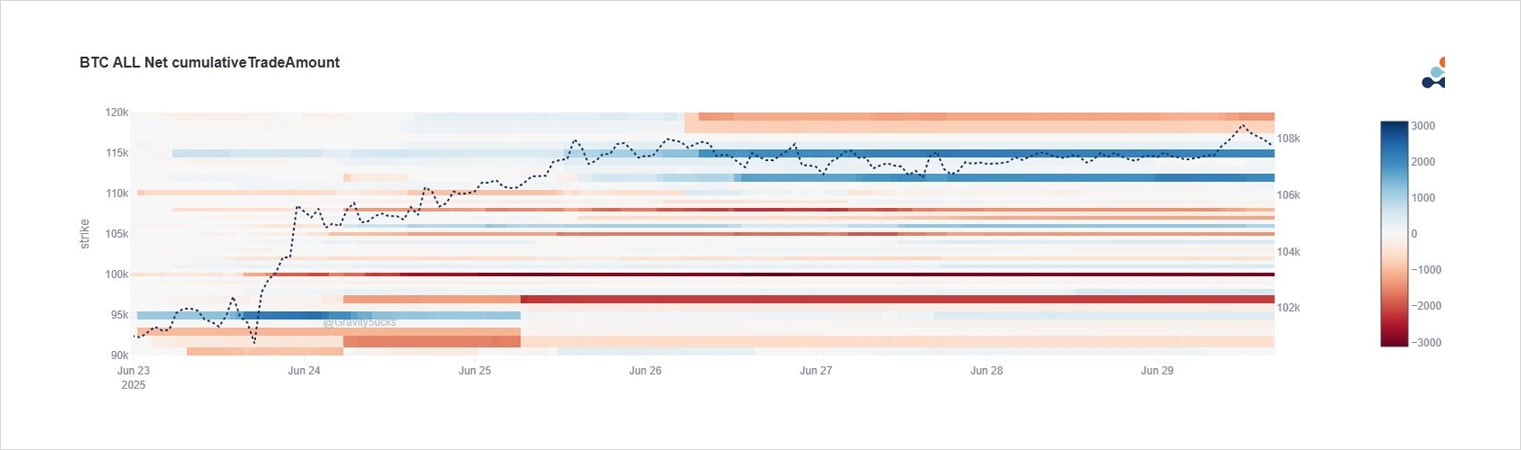

2) We observe the (red) dumping of no longer required 100k and below Puts in July and buyback (blue) of 108-115k+ Calls.

With a calmer environment and upcoming July 4th US long weekend, more inventory was sold onto dealers.

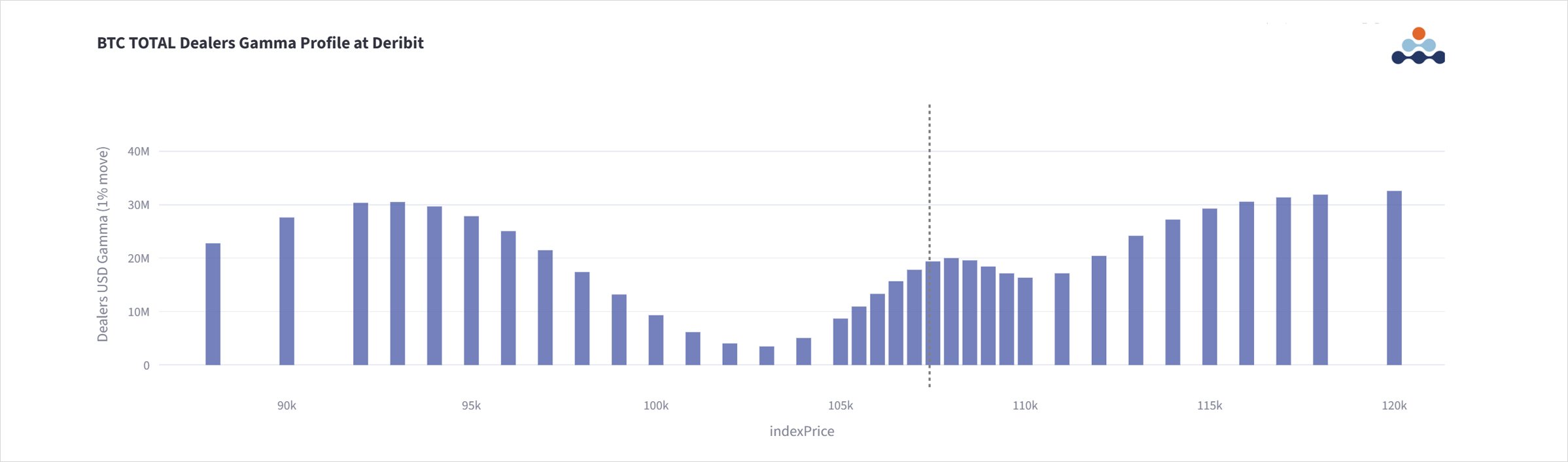

3) With June short dealer Gamma rolling off, and a continued onslaught of inventory Gamma from Funds selling Calls+Puts, MMs are now core long Gamma currently from the observed data.

This could ofc be offset by bilateral buy deals generated from several encouraging sales desks.

View X thread.

AUTHOR(S)