In this week’s edition of Option Flows, Tony Stewart is commenting on the latest movement in the markets and how traders are approaching it.

February 27

With such heavy Call buying on the approach to 25k resistance, the retracement created a myriad of issues:

– for Funds, if Long Calls to cut/keep?

– for Funds short ATM Straddles/Strangles how to react to spot battering support.

– for MMs short upside Gamma, how to resolve?

2) One Option property is the known cost that allows an entity to allocate capital exposure without the need to potentially cut a long D1 position.

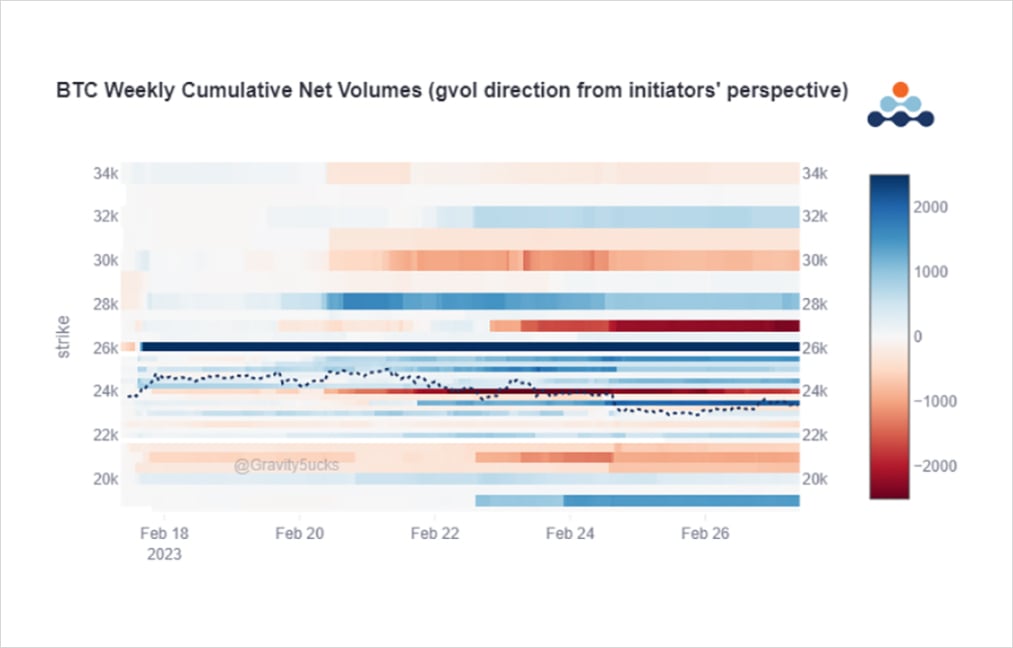

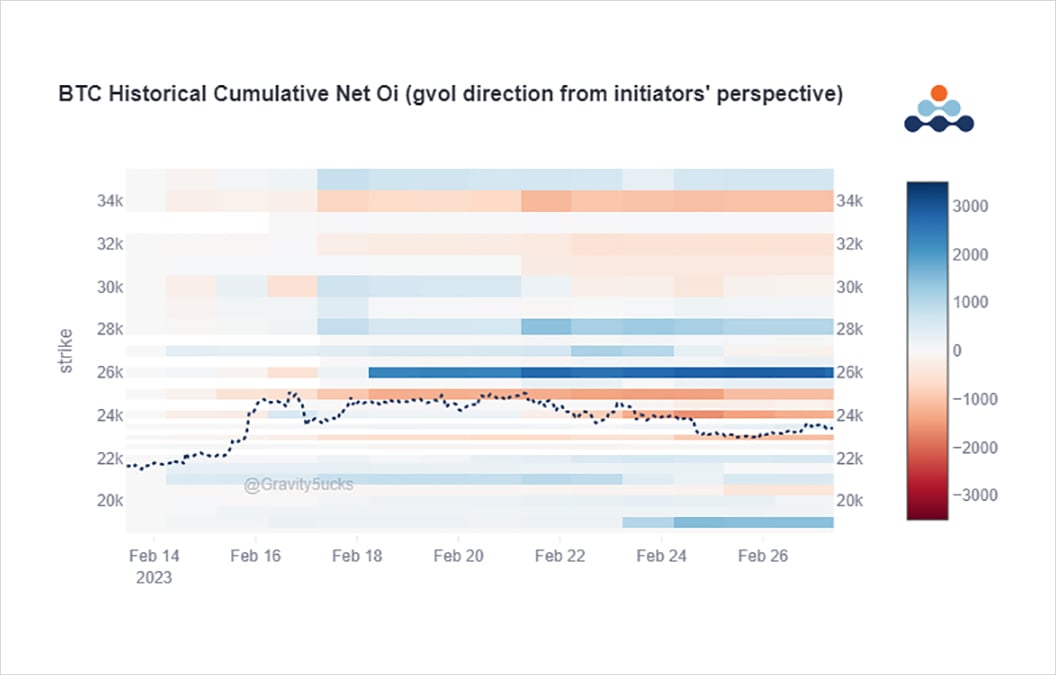

However, with 25k clearly rejected a decision can still be made to cut losses, which was evident in offloading of 25+27+28k Calls.

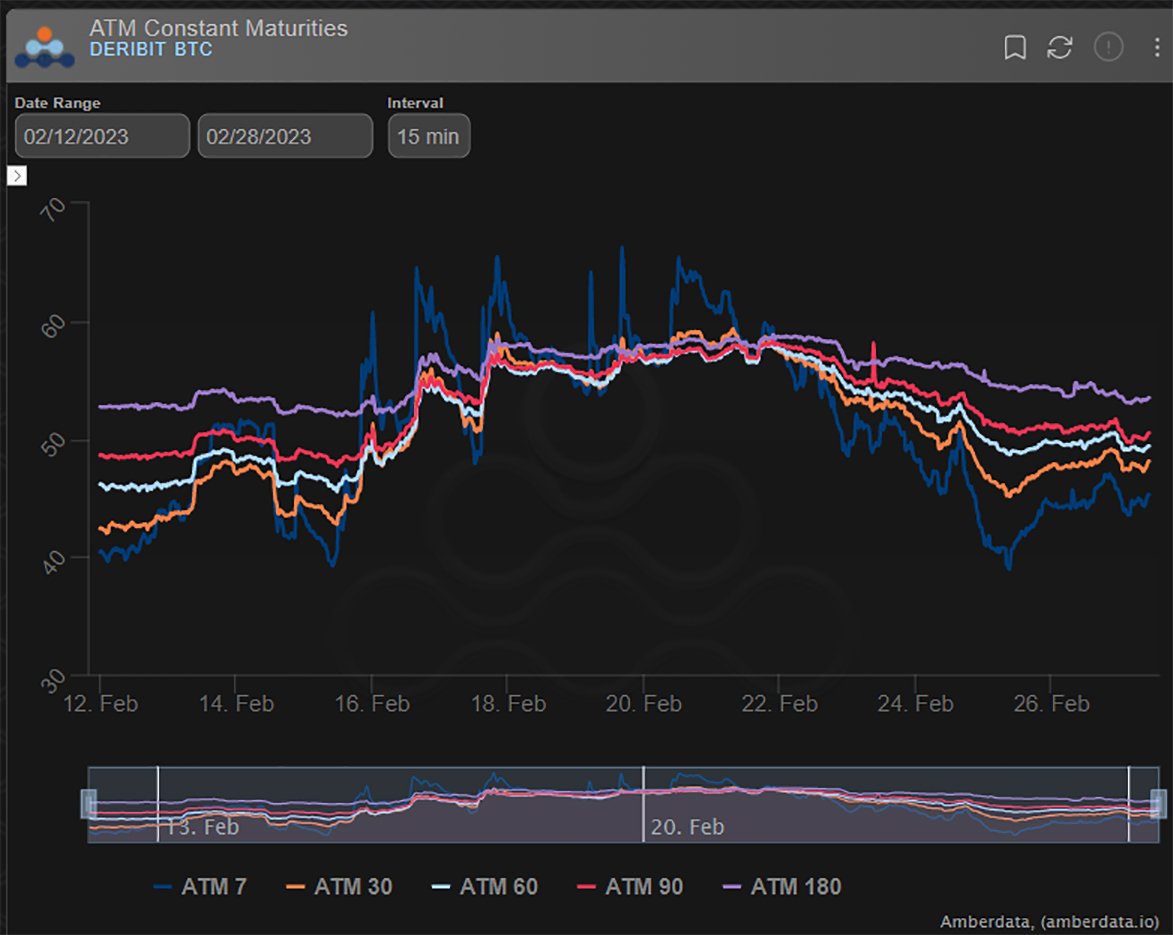

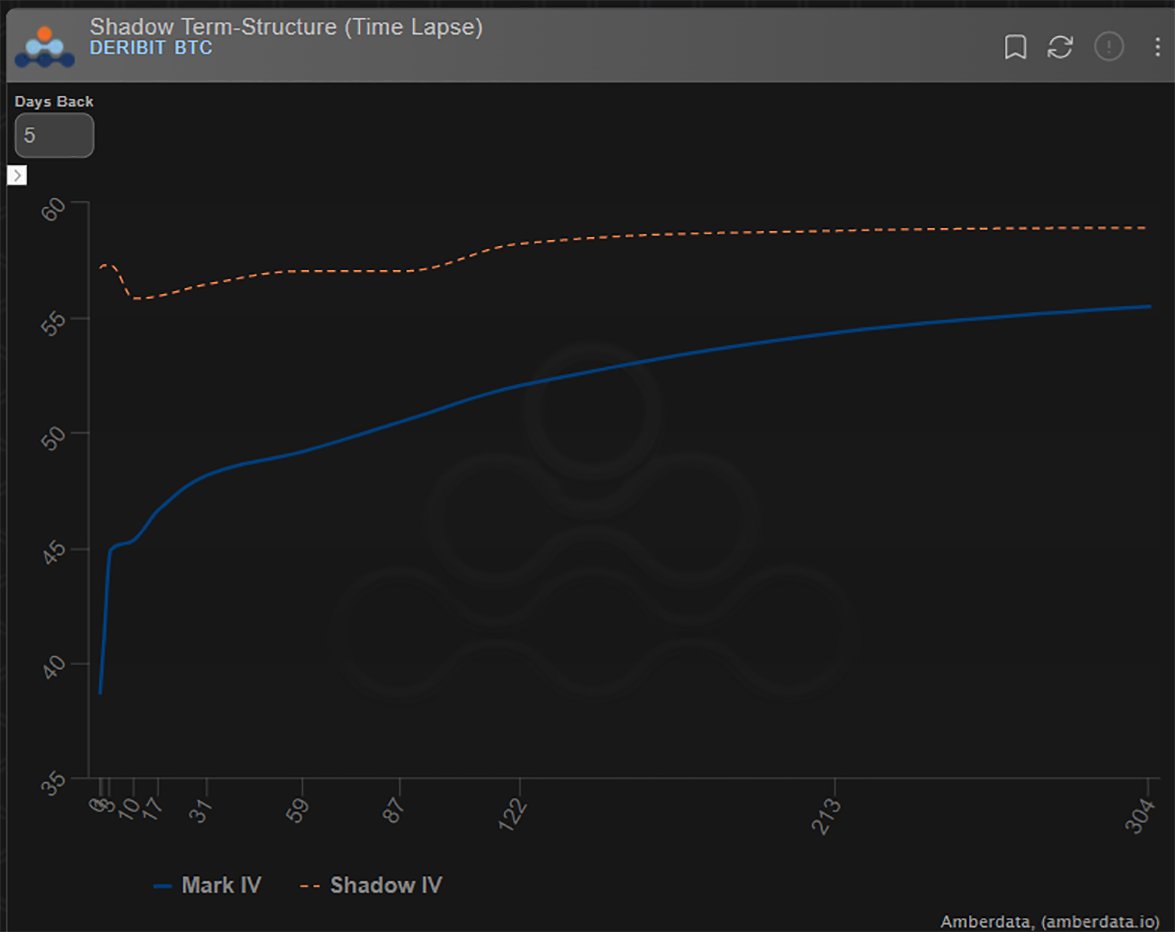

3) while Long Call positions still dominate the upside, this offloading of some exposure dumped Gamma and hit IV hard into the end of the week, in addition to the ubiquitous expiry-related selling flow.

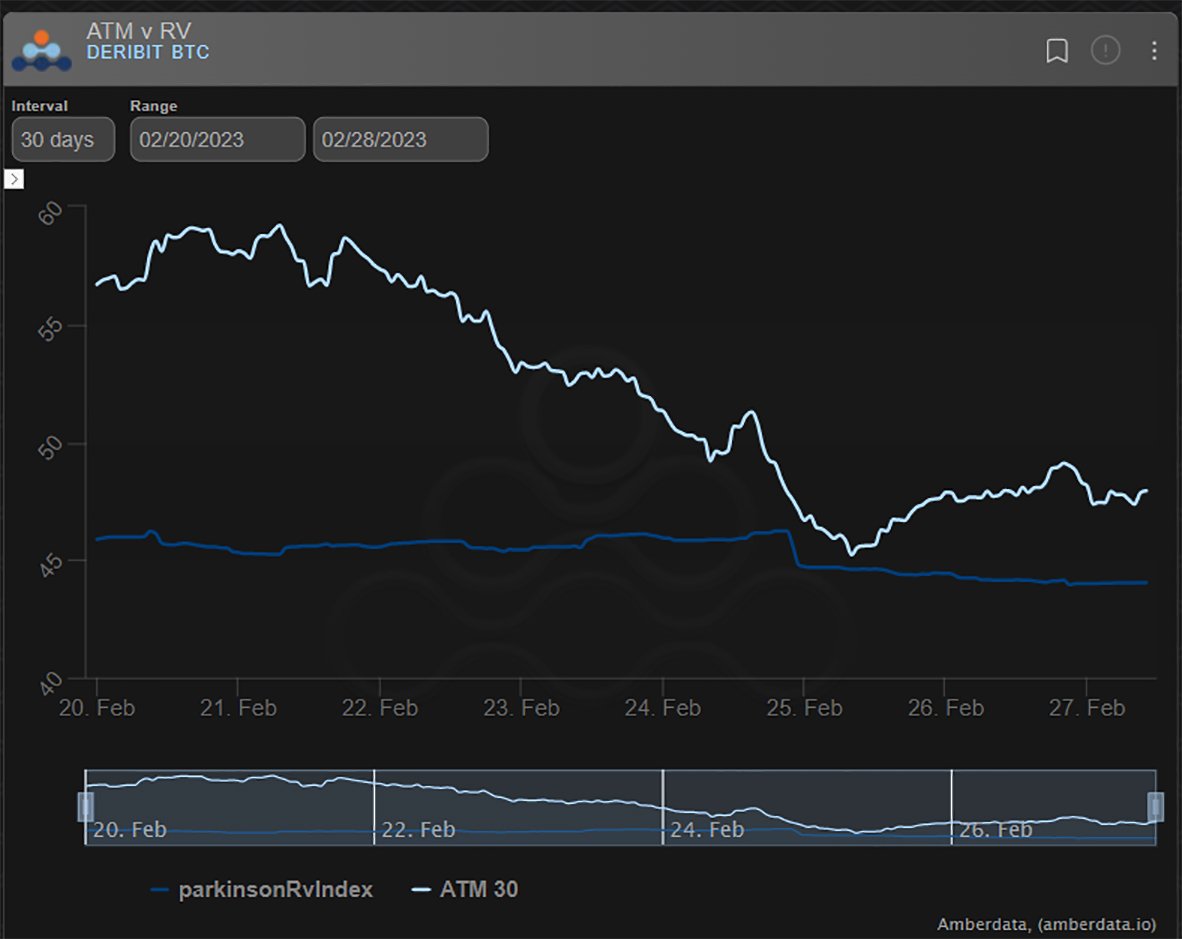

4) As discussed previously, while Calls were being bought by some Funds, other Funds took advantage of the raised IV and sold ATM Straddles and Strangles. The Spot retrace and IV impact from Call selling was welcomed, but Spot then continued lower testing support and conviction.

5) Strangle+Straddle sellers wanted a gentle retrace from resistance and to maintain Spot within the 23-25.5k range where they could continue to benefit from IV>RV, collect Theta+IV rolldown.

With 25.5k+ no longer a threat, was <23k, the lower bound of the range? Cover shorts?

6) Some did cover, took profits, and reduced Gamma exposure via closing OI in the specific Strikes they were short; some bought Calls that were being offloaded.

But the buying did little to materially slow the momentum of IV falling, even with a 4%+ Spot dump on Friday.

Dvol 50%

7) This caused unexpected issues for MMs.

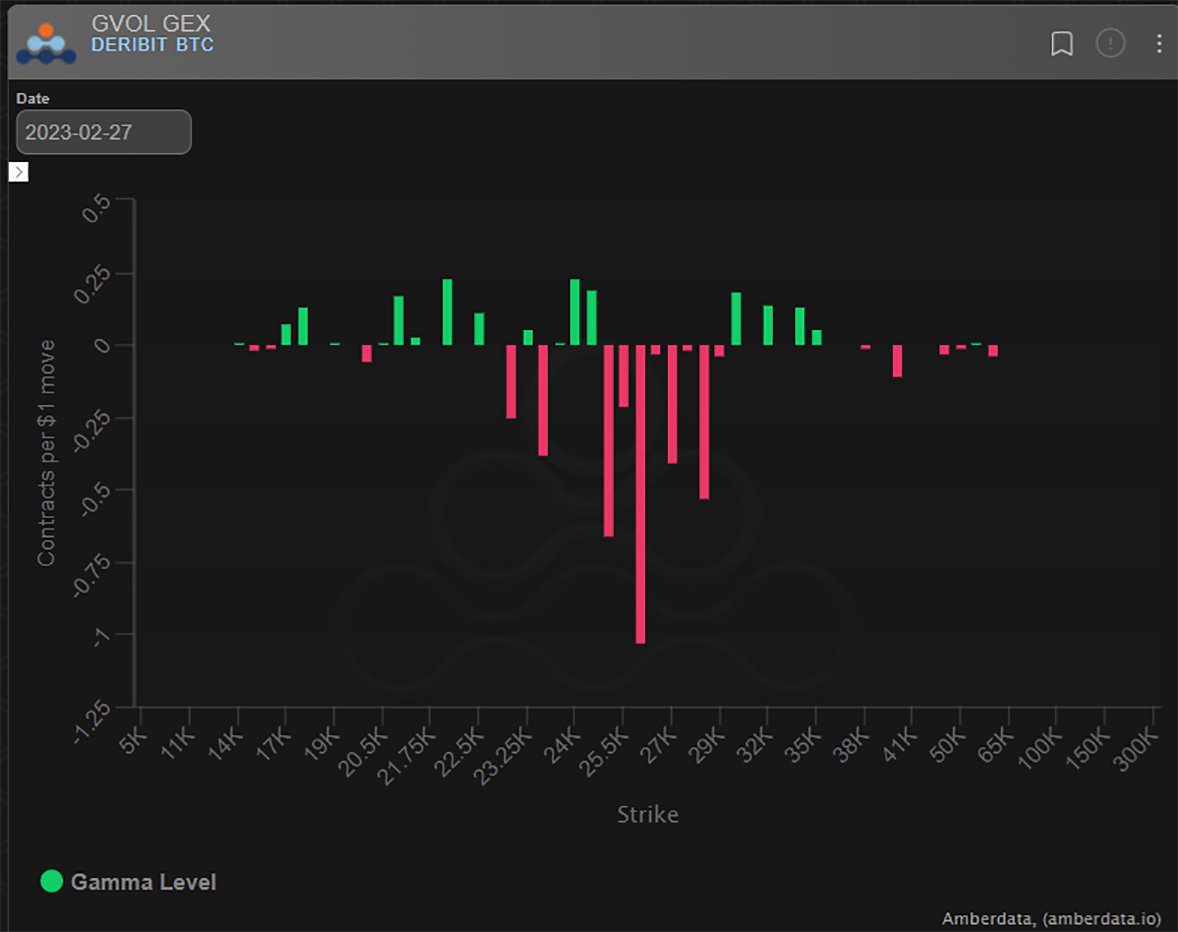

On a simplistic level, the chart below shows short Gamma exposure above 25k. MMs were likely long ATM Straddles/Strangles 23+24k Strikes.

Moving away from Hedged Shorts to Longs is Pain, more so when IV falls into the Longs.

8) At first, the Spot move Gamma paid for the pain.

MMs wanted to buy the discounted Calls [a)] being offloaded, but needed to sell out their Long basket Strikes.

A crowded position that was relieved by [b)] ATM buying, but insufficient to fully unwind while aware of wknd Theta.

9) The result is a reduced Fund Call exposure, but still upside dominated, combined with a reduced ATM short, but still maintaining a view the range will hold.

Downside plays, despite the drop, were limited with some buying of 23+23.5k Puts and rolling Mar Puts down in ratios.

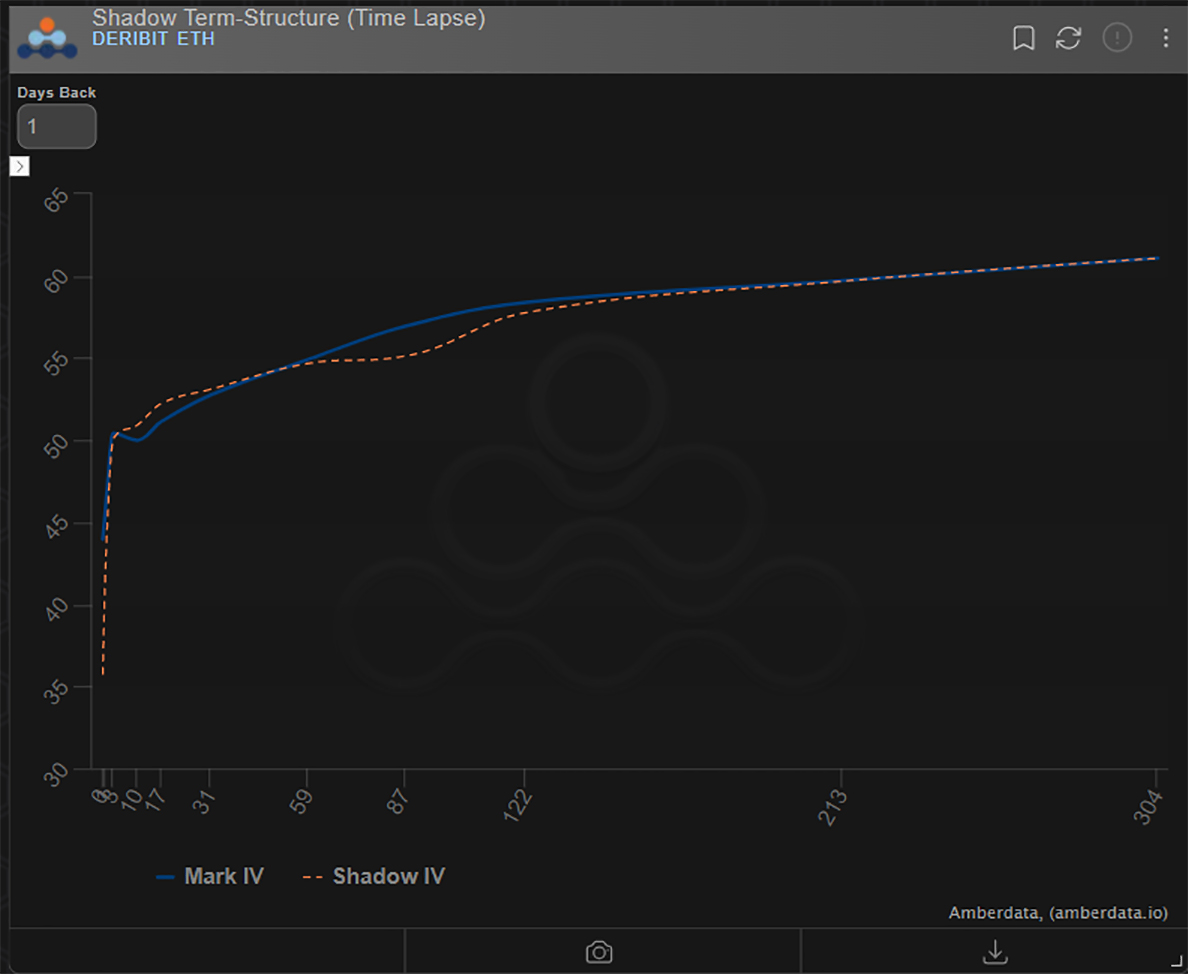

10) ETH Option flows still remain subdued with little evidence of interest in the Shanghai upgrade.

Term-structure in Contango, with no clear blips and ETH Dvol only 7vols premium to BTC Dvol, the lower end of the recent range.

Jun 1.6-2.1/2.2 Call spreads bot but not outsized.

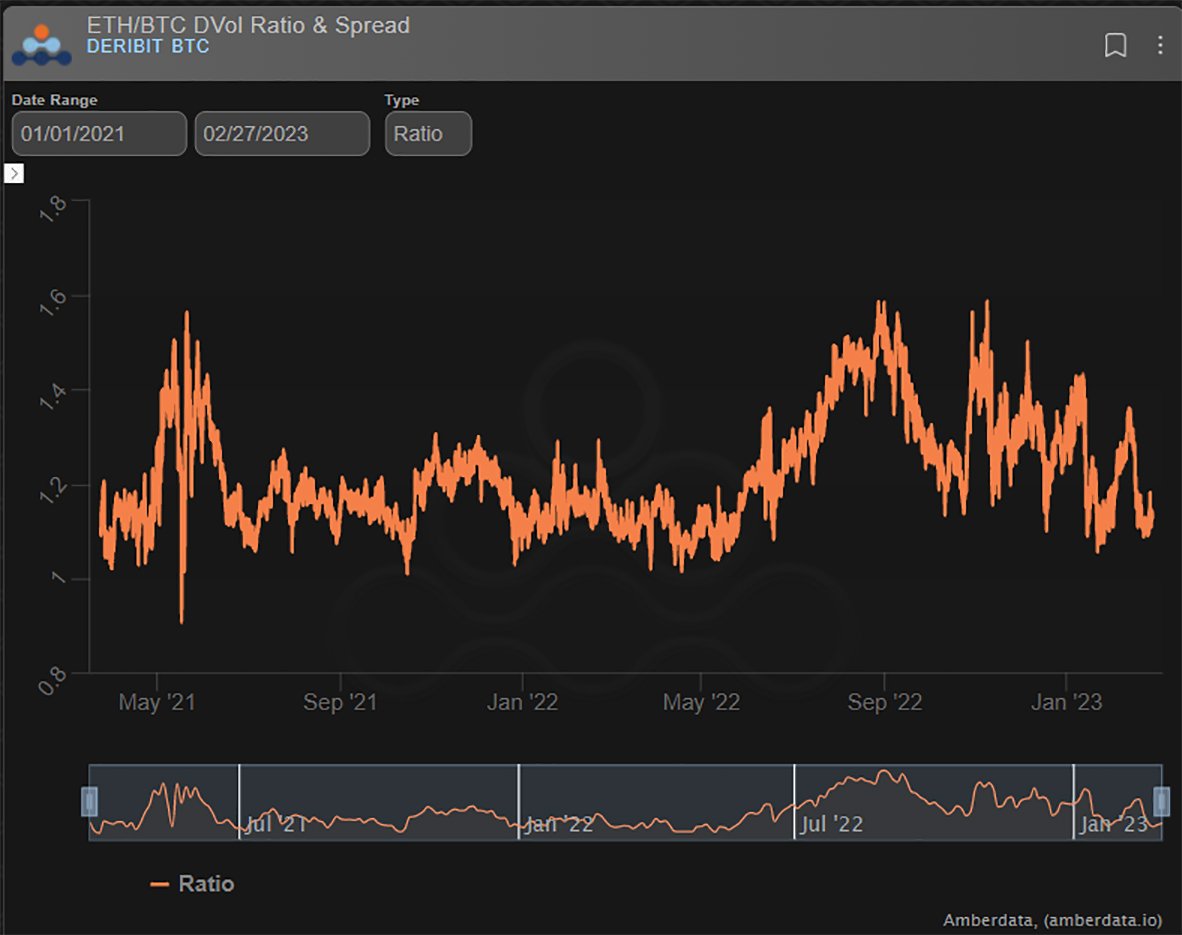

11) The Dvol ETH/BTC ratio suggests an opportunity if the ETH upgrade is a relative market pair play.

Or with the ratio low and IV low, outright ETH Options are the other obvious alternative.

But narrative seems more focussed on the Staking consequences than ETH movement itself.

View Twitter thread.

AUTHOR(S)