In this week’s edition of Option Flows, Tony Stewart is commenting on BTC postitive intraday swings, Gamma and Squeezing volume.

German govt BTC sales, Nasdaq retrace, Mt Gox notifications drove Spot into a tailspin of liquidations.

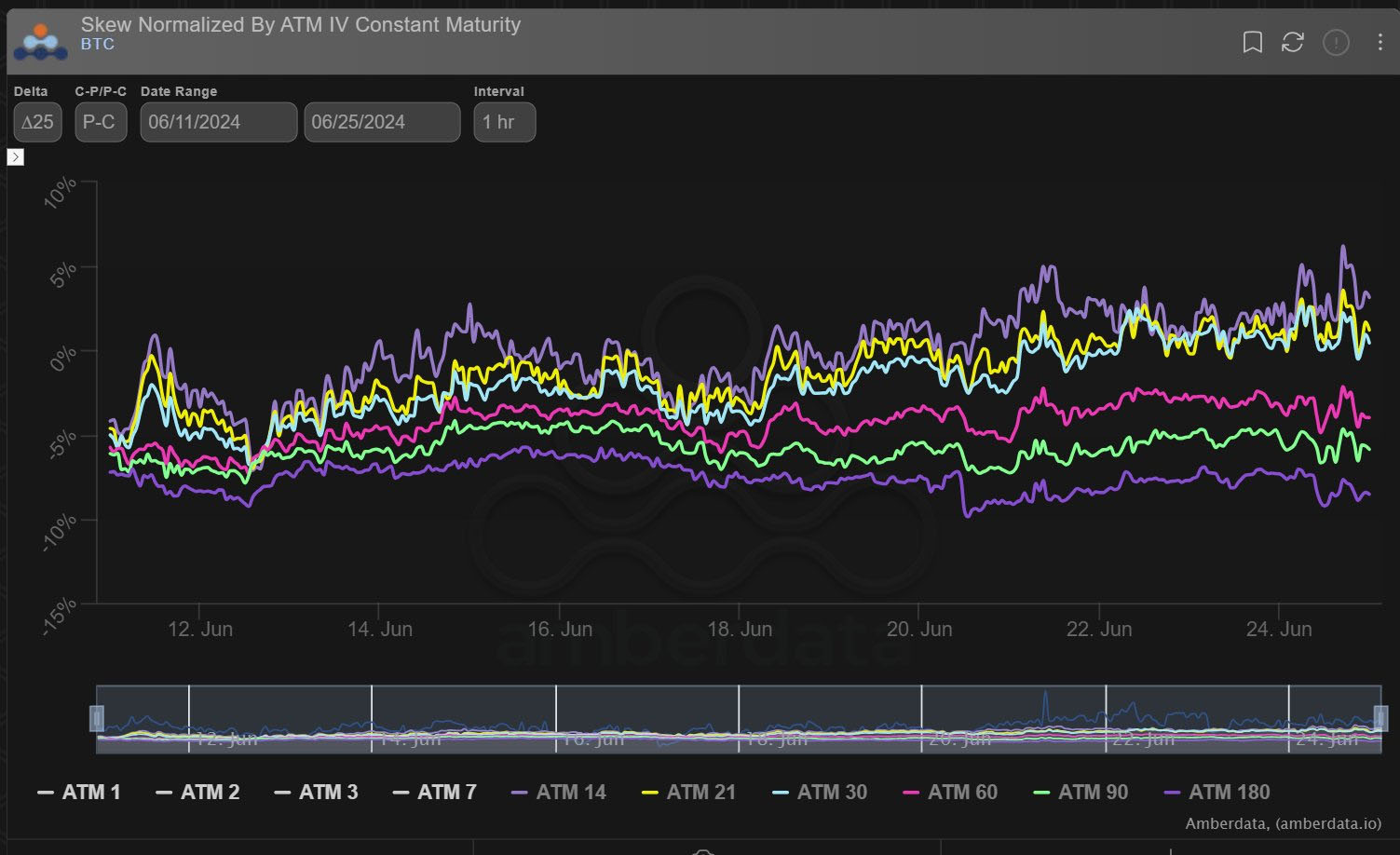

Unexpectedly Funds did not take the opportunity of low Vol, and benign Skew to protect AUM or advance bearish views.

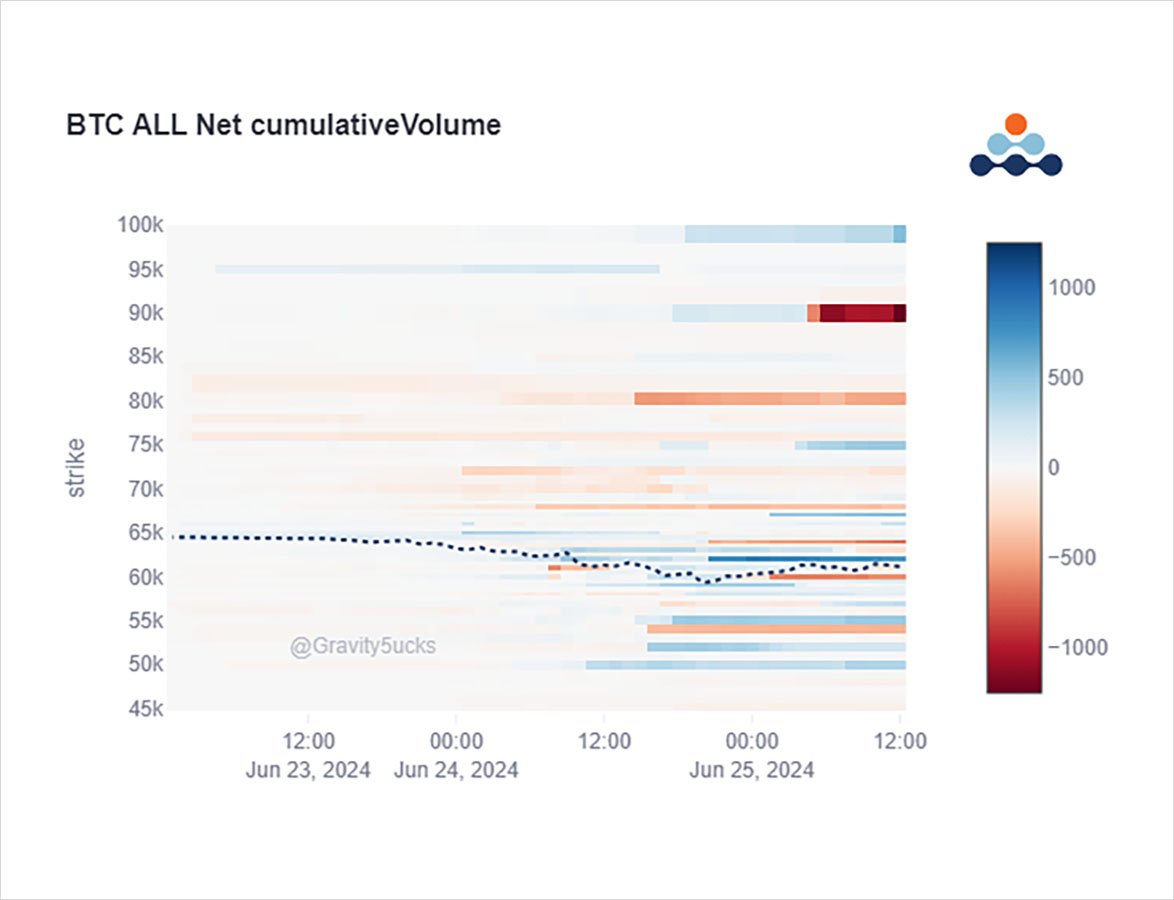

But yet again, as BTC overshot, Dec Call buyer lifted.

2) Given the vocal change of narrative on CT, coincidental pressure from German seized BTC, and imminent transfer of Mt Gox coins coming to a wallet near you in July, an expectation of drastically higher IV and Put Skew would not be unrealistic, either to protect or play bearish.

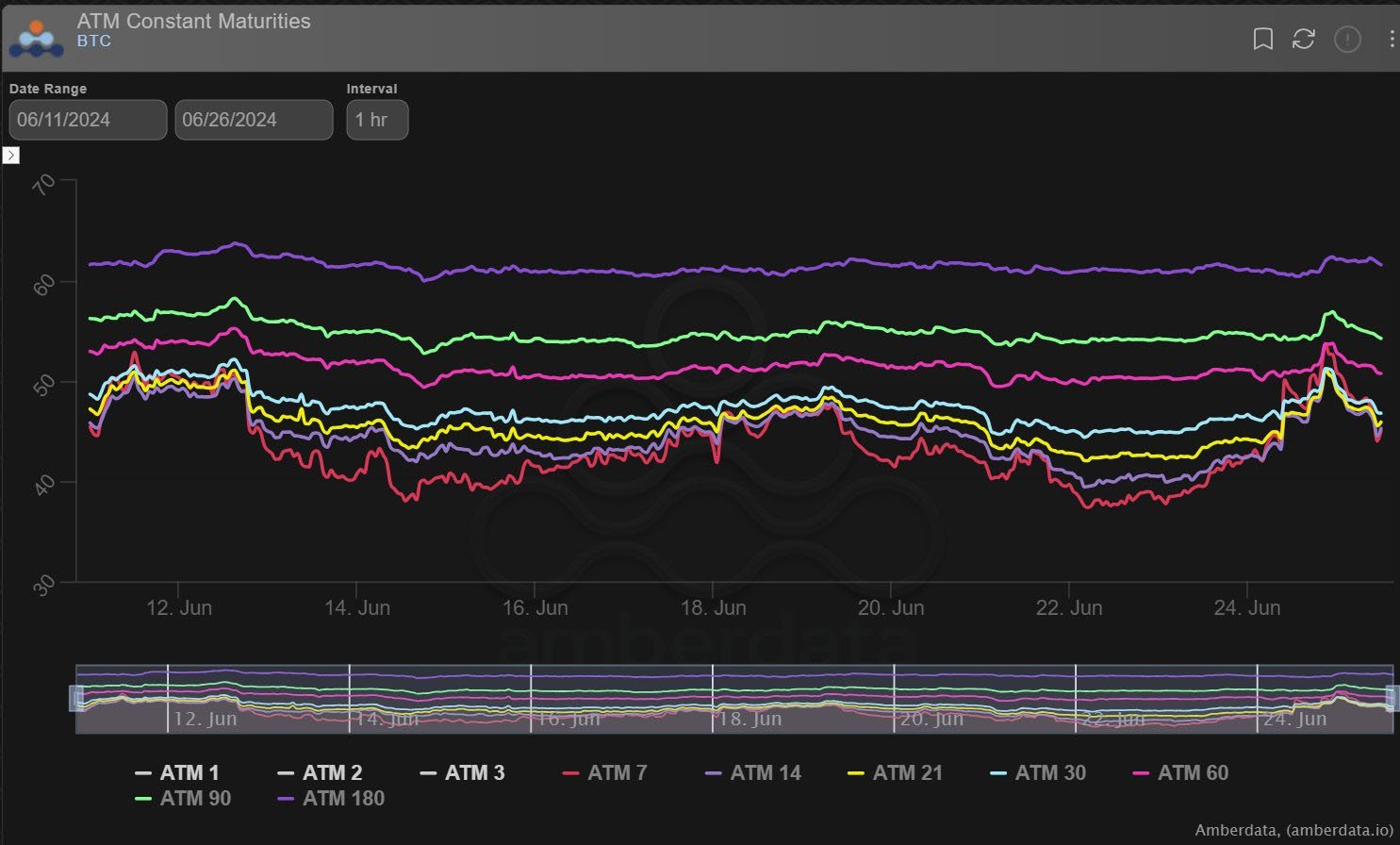

3) But IVs moved only a little higher outside the front 10days, BTC Dvol moving from 48-52%, and Put Skew also was not driven materially higher by Funds, but by Fast money calling for deep dislocations on the downside. Skew moved from flat to +5% (25delta), rather than exploding.

4) What was observed was selling of aspirational Calls (Sep 80k x500 as an example), and then more interestingly as BTC re-surfaced >60k from the 58.5k lows, the large mid-term Bull restructured again, selling Jun+Sep upside to accumulate more Dec 75k-150k Calls, Calls (+spread).

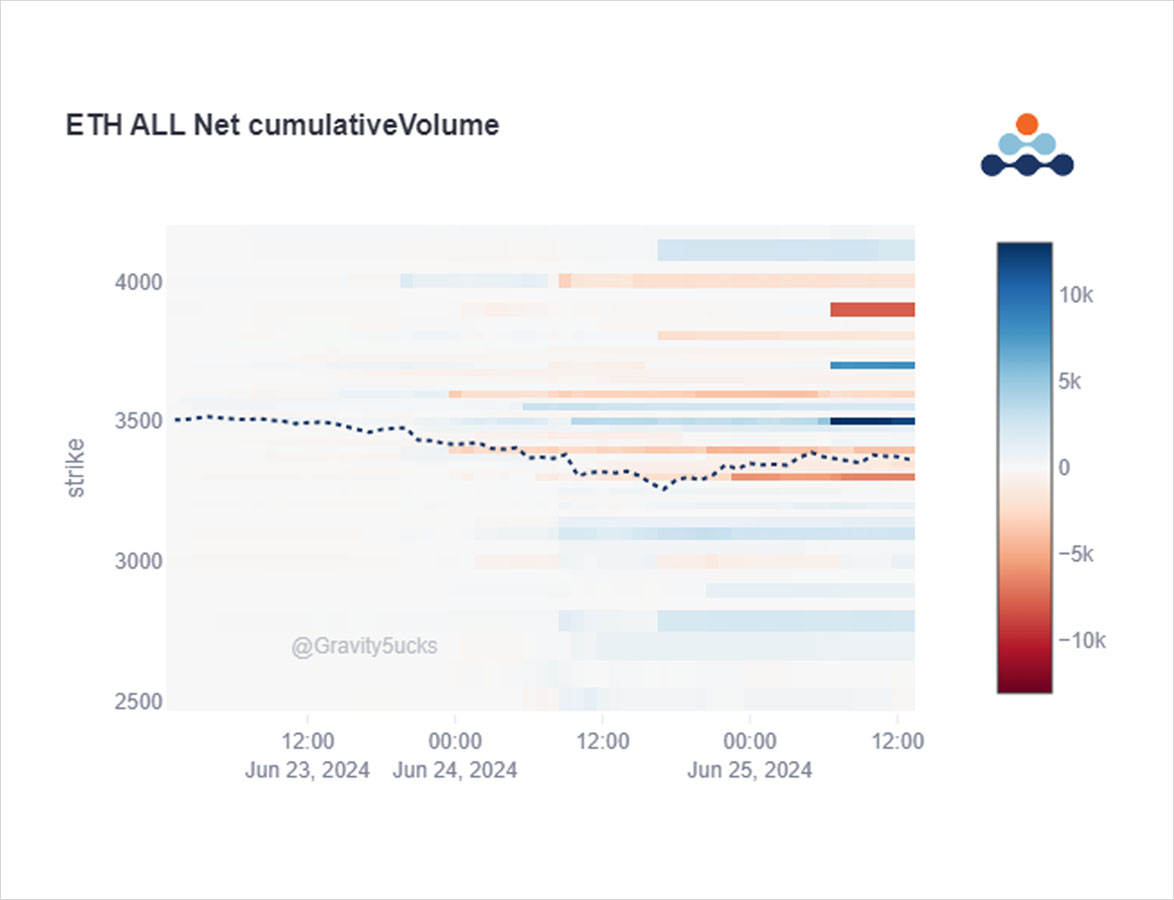

5) All this ahead of SEC responses to ETH ETF S1 amendments and comments, and upcoming trading expected also early July. But ETH Spot was also hit hard as narratives were vocalized expressing concerns over the ETF flow success. Here too, very little Fund action, only Fast money.

6) With BTC Dvol back to 48%, ETH Dvol also retracing a few % back to 62%, the Options market feels as if it is afraid or cautious of a summer lull. And yet the newsfeed and opinions within the community could not be more actively passionate and diverse.

View Twitter thread.

AUTHOR(S)