In this week’s edition of Option Flows, Tony Stewart is commenting on BTC postitive intraday swings, Gamma and Squeezing volume.

January 4

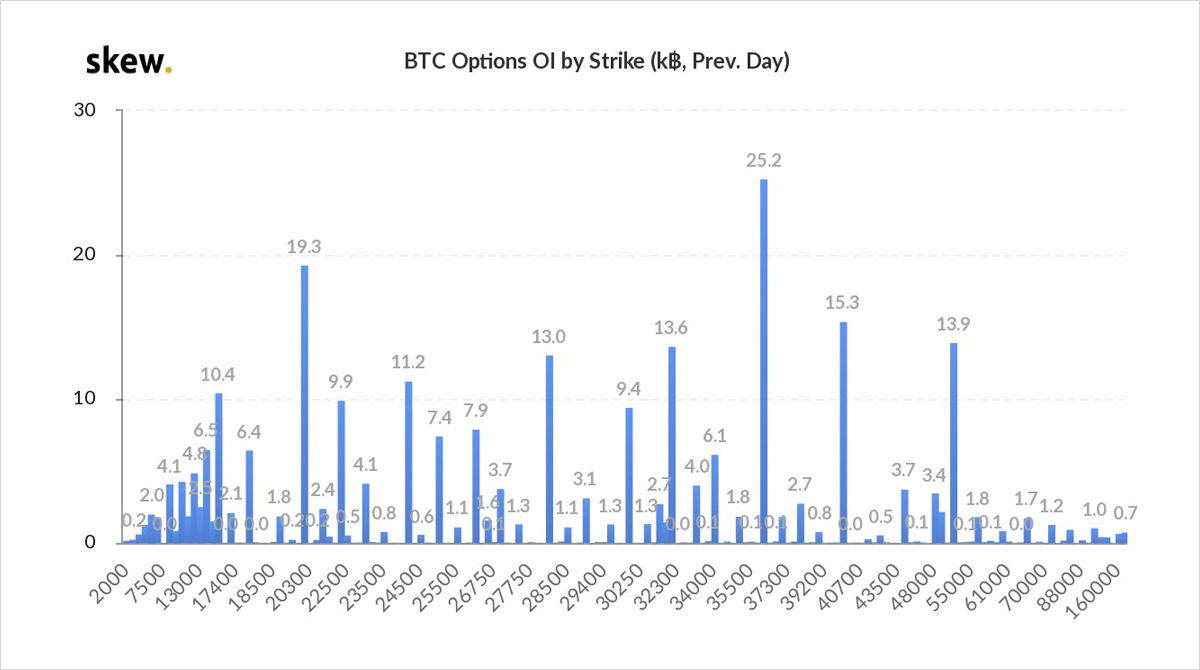

BTC 20%+ Intraday swing. Option IV >100% more than paying for moves, + long options avoiding perp/fut liquidations. Flows absent of large Insto funds, (return today), but volumes high with fast money HNW/retail. DEFCON2 Jan29 32+36k strikes, neither side displaying weakness.

2) BTC Jan29 32+36k Calls bought v 13.3k, 30th Oct.

Jan32k x4000 at 0.047BTC, $62.42

Jan36k x16000 at 0.003BTC, $39.85)

Today v32k marks.

Jan32k 0.115BTC, $3680

Jan36k 0.074BTC, $2368

#OptionsTrading

Delta equivalent of ~9k BTC. IV ~110%, exp in 25days.

3) At the boundaries of being too large to exit without the other side closing, if one side flinches, this will have massive impact on Implied Vol, perhaps spot.

So far no signs.

Suggests the short has been buying deltas and now has a short gamma position.

Unclear re the long.

4) We have hit 34.8k on 3rd Jan, 32k Calls ITM, 36k almost ATM.

If this was closer to expiry say <3days, it makes logical sense for both sides to push spot around to favour the option position depending on liquidity and trend. Around or >36k we could observe large volatility.

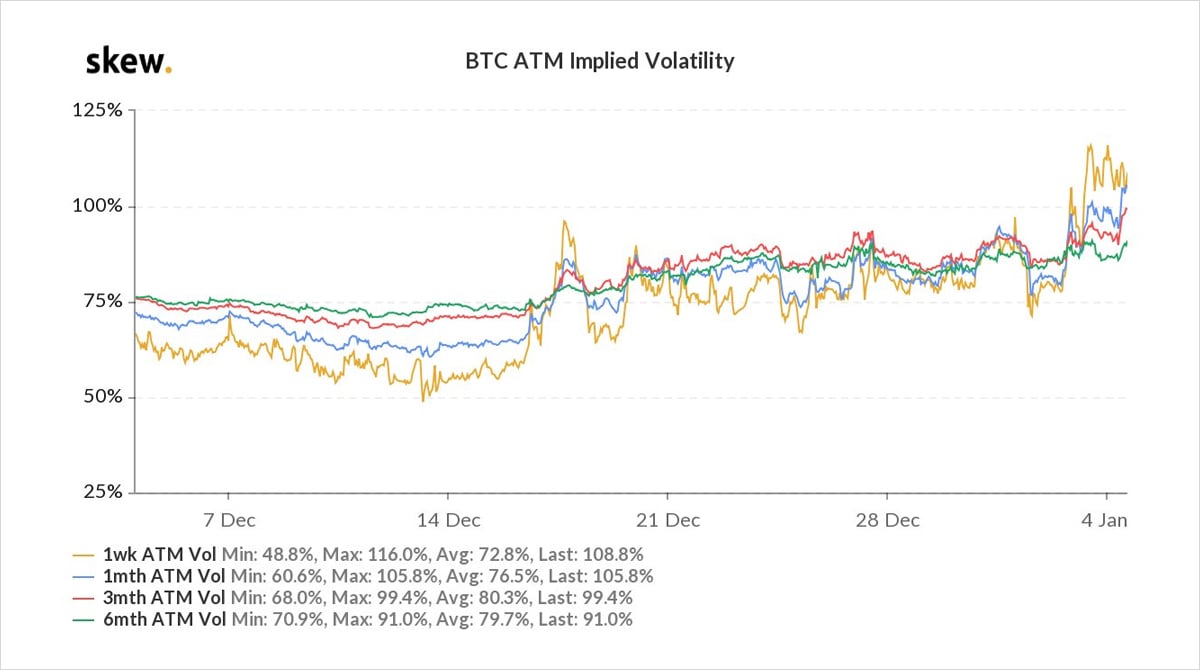

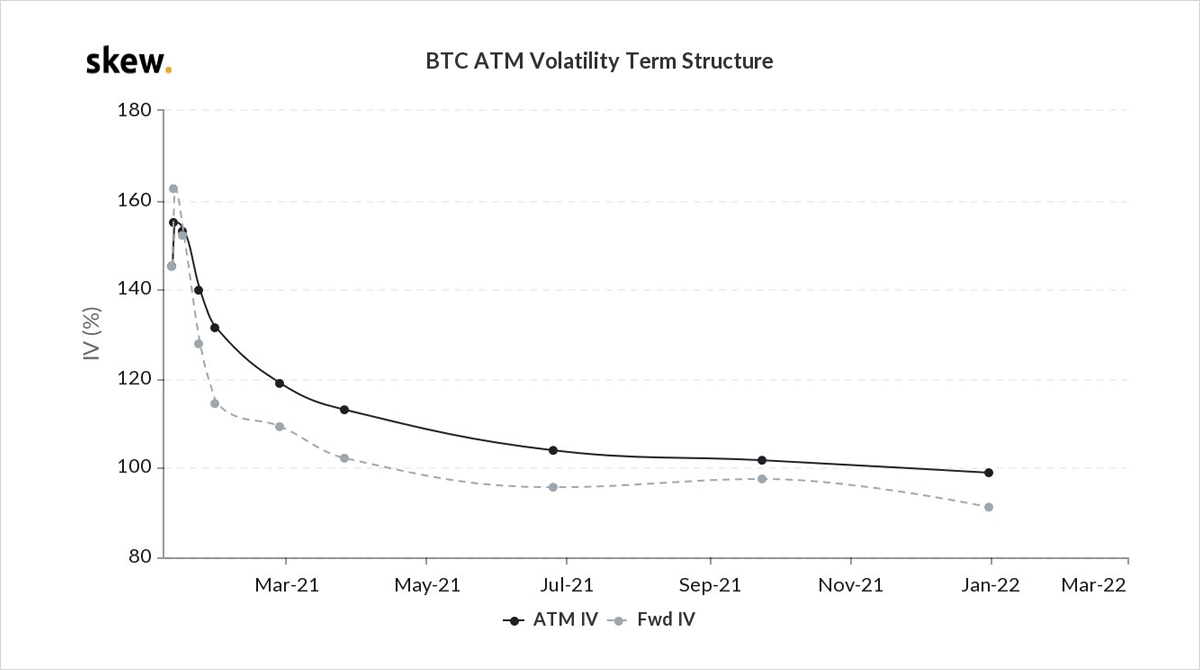

5) Current market conditions are sufficient to support high implied vols >100%. The last few days has been indicative of rising IV levels as RV increases.

The bilateral nature of the Jan 29 32+36k Call trade does not directly impact vol levels, but certainly impacts behaviour.

View Twitter thread.

January 8

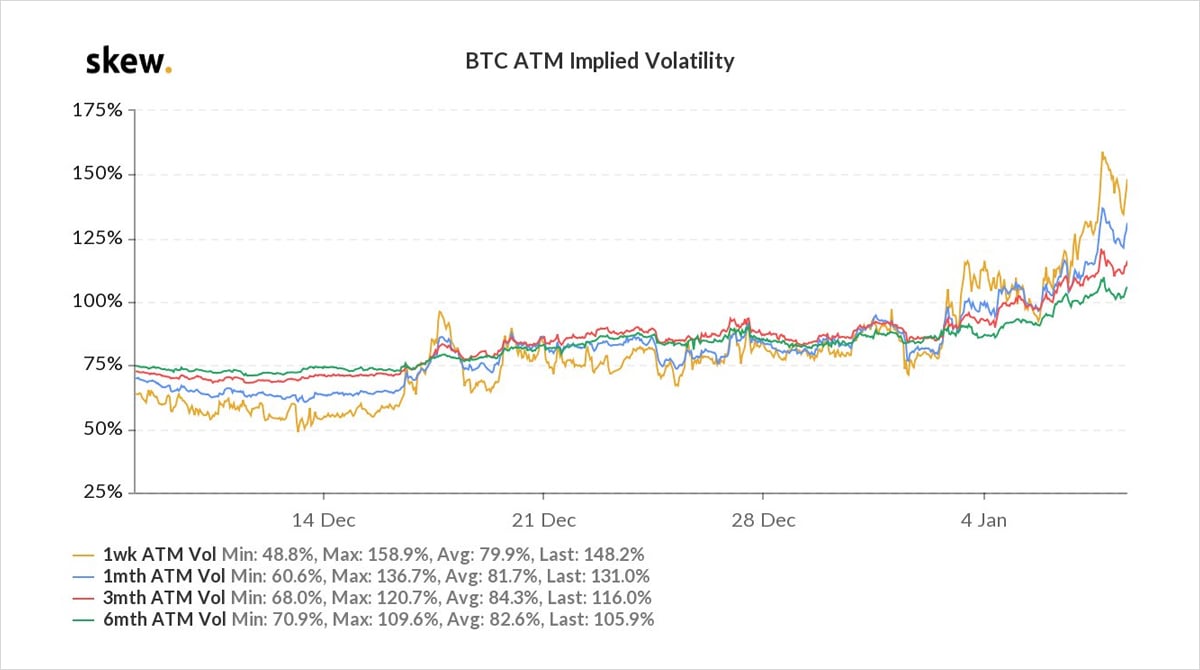

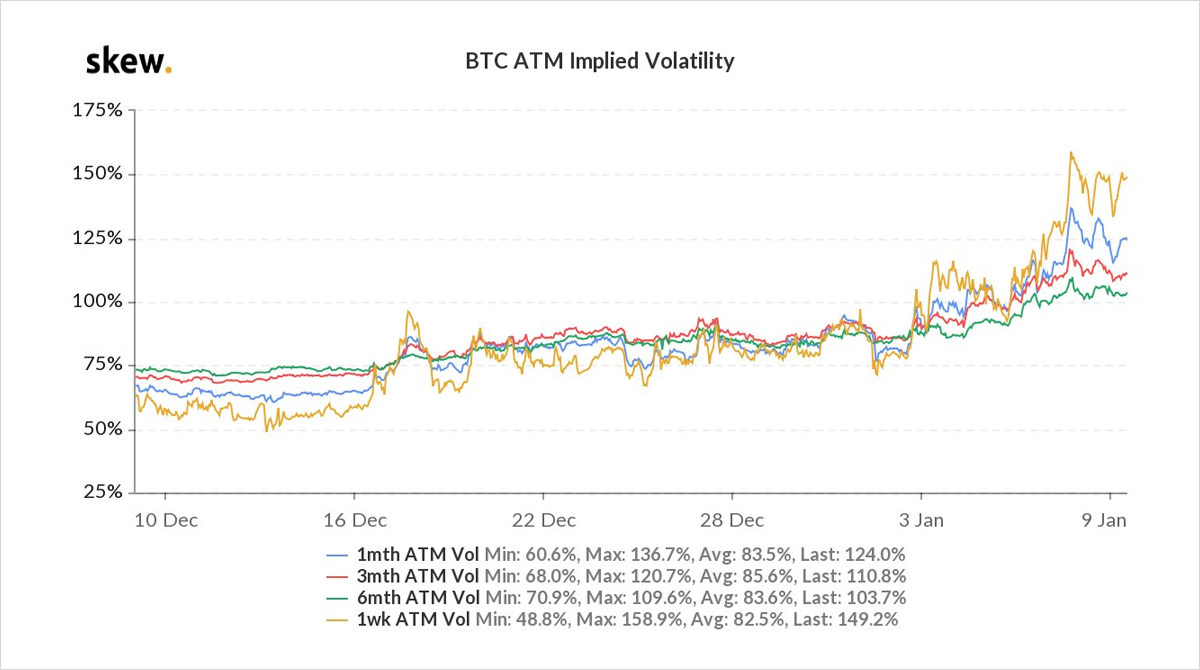

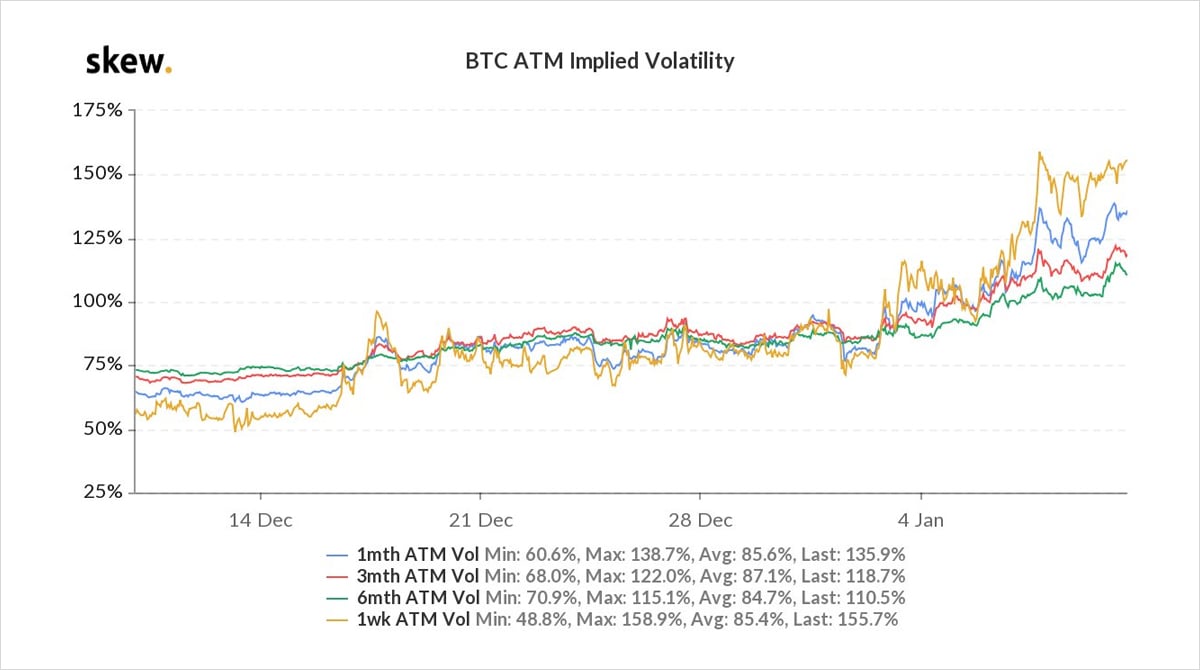

Implied Vols (price of options) surge. BTC 1week >150%. Intraday swings, pain on short option trades, anticipated BTC 40k+ spike.

Elevated IV presents opps for brave.

Jan29 40k Call sold x600 at ~$5000 (138% IV).

But huge Short covering in 23-26k Calls x2k sobering reminder.

2) The Jan29 23-26k Calls were sold on the 24th December – see Deribit Insights commentary 27th Dec – when BTC spot 23.5k.

Implied Vol action implies upside FOMO +fear of loss, but critically BTC spot, gamma and vol reaction to these ITM Calls, specifically the Jan29 36k Call.

3) Discussed Jan29 32k+36k evolution in Deribit Insights 4th Jan commentary thread.

The main impact now is Gamma.

Gamma is effectively how quickly delta changes.

As spot moves the delta moves. If hedging an options position delta neutral, need to buy/sell delta as market moves.

4) The 32k+36k Calls are ITM.

One buyer. One seller. Bilateral trade.

Publically the seller is unknown.

Some speculate a BTC miner, but short Calls do not protect downside; just limit upside. The miner would now be handcuffed, unable to sell spot BTC.

Possible but inefficient.

5) Let’s assume therefore the Short is a large institution.

At trade origination, the delta was small and a BTC 3x unexpected.

As the market rallied, the Short had to [I hope] start buying delta vs the Short Calls. There has been no indication of material listed option hedges.

6) But now deltas are 75 and 65, that’s 13.5k deltas the short needs to have accumulated for delta neutrality v the Calls.

If BTC rallies, gamma impacts delta higher, more delta to buy.

But if the market falls, the option delta drops, and therefore the Short needs to sell deltas.

7) This pain trade is termed ‘Short Gamma’.

Need to buy deltas as the market goes up, and sell when the market falls. Painful in choppy markets.

While options markets are dwarfed by spot markets, this open position is a special situation. It could have an impact on the market.

8) Theoretically the Long Call(s) is long gamma. We don’t know if he is hedging, but given the initial purchase of such far OTM Calls, it is more likely that the Calls are just being run naked – no opposing impact on delta at the moment.

As such, the Long Calls >$150m profit.

9) Of course, there is not only an impact on spot delta but also on implied Vol.

The direct impact of a forced unwind could send IV much higher, unless an agreement is managed. The indirect impact of large active short gamma positions +forced delta hedging increases Realized V.

10) The highest volatility due to short gamma would be at the 36k strike, should BTC retrace <Jan29th.

At the strike the gamma is high and option delta changes the most. To keep delta-neutral the Short option entity would violently need to adjust.

Hope the Long has taken profits

11) As the Call options move further ITM, their gamma decreases, and delta tends to 100.

At this point, the Short we assume would be forcibly delta neutral hedged, but that’s a tremendous amount of delta to have bought; 20k BTC.

Action may need to be exercised prior to this.

12) These notional numbers are so huge, a speculative alternative is that there is a bilateral arrangement in place to close the position at a specified $ profit/loss.

This could still lead to both sides delta hedging and interesting games near the ‘Touch’ spot/BTC or $ barrier.

View Twitter thread.

January 9

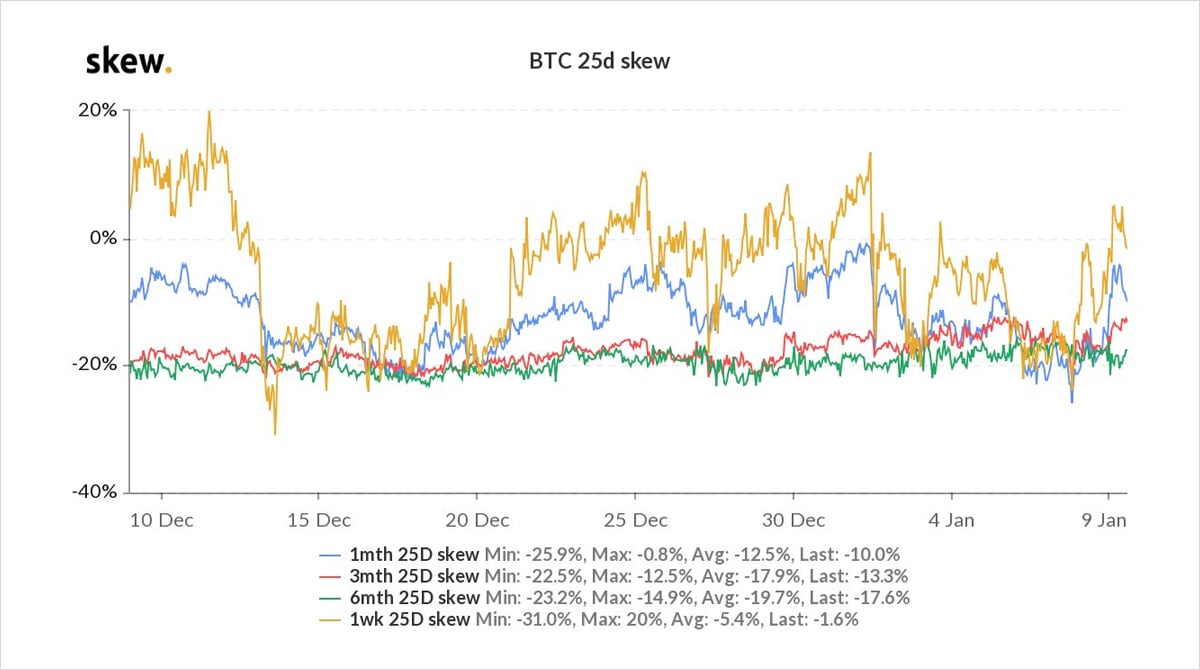

Further short-closure BTC Jan29 25+26k Calls x2k. BTC>41k profit-taking ITM Mar26 20+24+28k Calls x2k, vol+delta pressure preceding BTC retrace and Mar 12+16k Puts bought x2k. BTC<41k tests 40k, panic unwinds Jan 40-64k Calls x1k+, BTC 39k holds, bounce 41k. Gamma +skew firms.

2) BTC looked to be losing momentum – spot dump +unwinds of ITM Calls (note Calls not rolled up higher) + panic unwinds of OTM Calls a sentiment shift.

But continued institutional narrative supporting BTD mentality as 39k tested twice.

Crash protection Mar+Jan Puts. Put Skew up.

3) Pressure from Mar ITM Calls +Jan OTM Calls pre-weekend theta slapped IV down 20% at the front end, but the underlying intraday+overnight Realized moves, have reversed half of that drop on little option volume.

Realized Vol continues to squeeze Implied Vol on every dip to date.

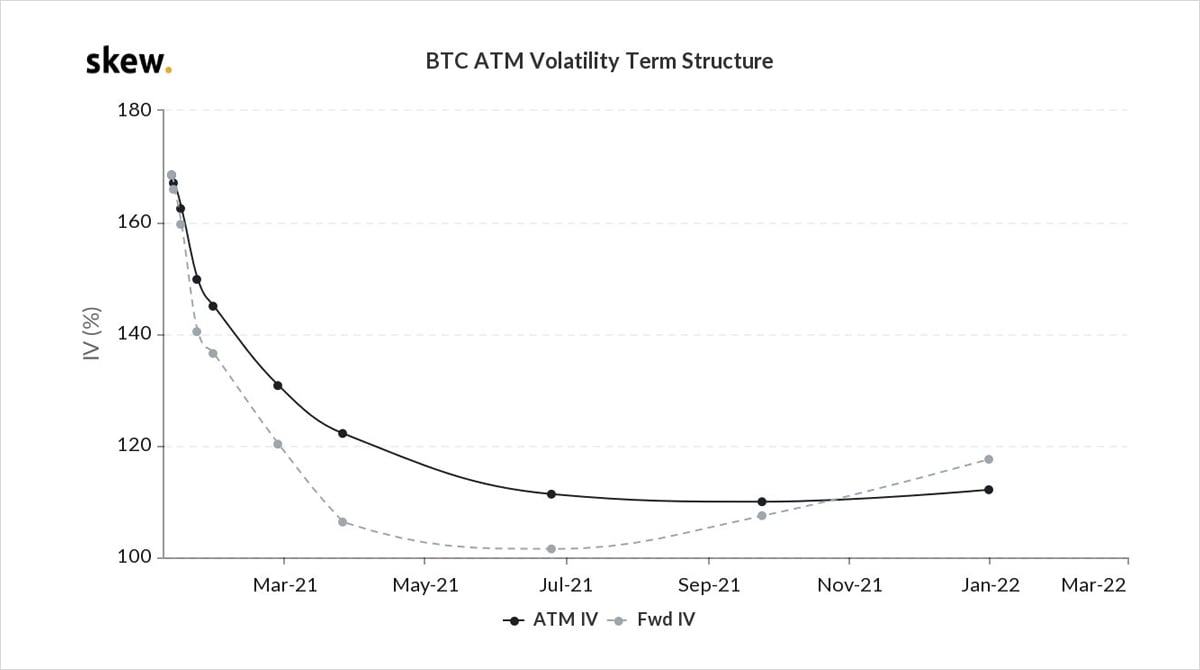

4) Realized moves continue to keep term-structure in Contango, front gamma very firm.

Funds often unwind options pre-weekend to reduce option theta decay, which may not be as actively managed, but crypto does not seem to allow welcome breaks.

Growing preference to own convexity.

View Twitter thread.

January 10

Short-closing Jan29 ITM Calls now up to 28k-32K strikes x1k+, squeezing vol up 20% at the front.

But the trade of interest printed in Dec21 100k+ Calls, net x2k of which was buying interest, initially via Jun64k-Dec100k+ CS, then outright Dec21 100k Call.

Several explanations:

2) The most exciting is that this originated from a large bullish OTC trade where the initiator bought large amounts of bullish long-term 100k+ Calls.

The listed trade that printed was covering that risk.

Weekend timing is perplexing but not a precedent.

3) The prints started with spreads: Dec100k+ Calls bought, Jun64k Calls sold. With inventory low in Dec21, often a good way to get exposure is by a spread, cover the illiquid leg first, then cover more liquid Jun (or close maturities), or spreading off existing long inventory.

4) Other explanations could be:

-Buyer is pricing a large OTC trade, knows will happen

-Buyer is covering a long-dated 100k+ Call legacy trade.

-Buyer likes long-term vol v medium-term vol

-Buyer likes Dec upside skew vol levels relative to ATM,

-Buyer likes 1yr forwards

etc.etc

5) How long-dated extreme wing Calls + skew should be priced is contentious. Expect to see continued arguments.

The result of all this near-dated short-covering + reticence to aggressively sell convexity+ long-dated Call buying has been to pump Implied Vols back to their highs.

View Twitter thread.

AUTHOR(S)